Vertigo3d

Key Takeaway

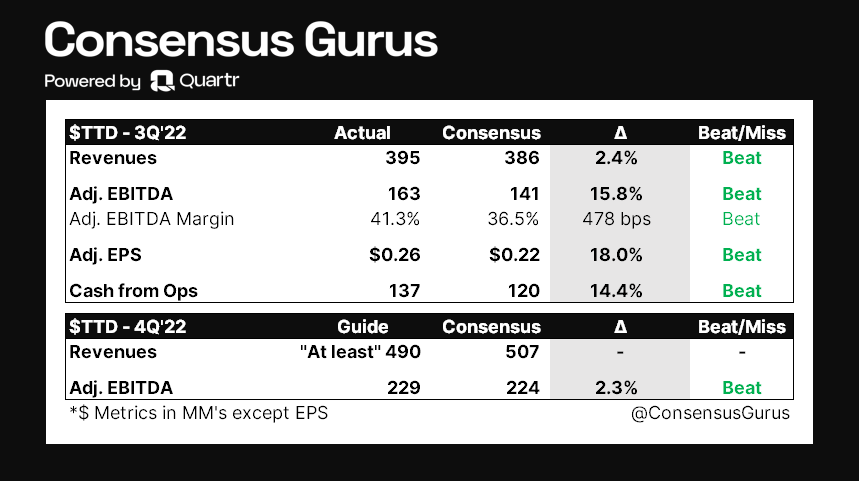

The Trade Desk, Inc. (NASDAQ:TTD) reported Q3 2022 revenue of $395 million that beat the $386 million consensus, while adj. EBITDA of $163 million was above previous guidance of $140 million. For 4Q22, the company guided revenue of at least $490 million vs. $507 million consensus, with adj. EBITDA of $229 million vs. $224 million consensus.

Overall, Q3 was again a strong quarter for Trade Desk given: (1) broad-based growth across all industry verticals, (2) solid customer retention (95%) and (3) “very robust” CTV spend. This is contrary to the results of most digital ad players and Roku’s (ROKU) recent commentary that “big advertisers are not spending with anyone.” Although Trade Desk’s Q4 top-line guidance was ~3% below consensus which indicates some macro pressure, estimated Q4 growth of 24% YoY still compares favorably to a very strong 4Q21 comp (+24% YoY) in a challenging environment. That said, shares remain expensive at ~11x 2023 revenue, I, therefore, maintain a neutral rating on the stock, considering valuation still poses downside risks.

ConsensusGuru

CTV

CTV continued to be the biggest top-line driver in Q3, where Video (incl. CTV) accounted for low 40%’s of platform ad spend, followed by Mobile at high 30%’s, Display at low teens, and Audio at 5%. Per management, CTV spend growth in North America remained healthy, while Europe and Southeast Asia were growing particularly fast, with 11 international markets outperforming the U.S. to be exact. As an independent platform without any proprietary content that competes against other CTV channels, The Trade Desk is able to benefit from streaming content fragmentation and has been able to form partnerships with CTV providers worldwide.

The same trend was noted during PubMatic’s (PUBM) Q3 earnings call, where management highlighted that the 45% growth in its omni-channel video business was driven primarily by CTV which grew 150% YoY, the 6th consecutive quarter of 100%+ growth.

Speaking of the outlook for 2023, Trade Desk believes CTV will again be the largest driver for platform ad spend, as new CTV inventories are expected to be available with Disney+ (DIS) and Netflix (NFLX) both introducing ad-supported tiers towards the end of 2022.

UID2

UID2 continues to gain traction as an industry alternative for 3rd party cookies. Recent updates for the new identity solution include:

- P&G (PG) announced in September that it’ll be adopting UID2.

- MediaMath (a DSP with >3,500 advertisers) began allowing advertisers to match UID2 to 1P data in ad targeting and measurement.

- Data commerce platform Narrative adopted UID2 to enable the matching of clients’ 1P data to UID2 to perform audience segmentation.

- fuboTV Inc. (FUBO) was the first CTV player to join UID2 in February 2021. The company has seen platform ad spend increase by 61% over the past year.

- UID2 is also available across cloud service providers including AWS (AMZN), Snowflake (SNOW), Salesforce (CRM), and Adobe (ADBE), which house data for advertisers worldwide.

- UID2 now has over 600 partners.

- CEO Jeff Green believes over 50% of data inventory will be transacted in UID2 in 2023.

Retail Media

Q3 marks the 3rd full quarter of Trade Desk’s retail media effort, which has seen spend grow 3x from Q2. Besides CTV, retail media is the second most valuable growth driver as retailers continue to look for ways to leverage their 1P data in a cookie-less world. Amazon is a prime example of this, as consumers are literally standing in front of its online store when looking to make a purchase. In Q3, Amazon saw its advertising business grow 25% YoY (30% ex-FX), which was relatively robust even against Google’s (GOOG, GOOGL) search business (+4% YoY /+10% ex-FX).

Trade Desk highlighted it is working with 80% of the largest retailers in the U.S., including Walmart (WMT), Walgreens (WBA), and Albertsons (ACI). The retail media trend is likely to remain structural vs. secular as retailers increasingly try to close the loop.

Expenses

Trade Desk noted that expenses are likely to see some upward pressure in 2023, as travel and live events are expected to return to pre-Covid levels (2016-2019). In Q3, the company recognized $121 million in stock-based compensation (“SBC”), which represented >30% of revenue due to the ongoing recognition of Jeff Green’s CEO Performance Option. In Q4, however, SBC is expected to decline YoY, but will likely still stay at an elevated level.

Final Thoughts

There’s no question that Trade Desk is outgrowing the advertising industry by a wide margin as GroupM forecasts just 8.4% YoY growth in 2022. Should Trade Desk deliver revenue of $490 million in 4Q22 (+24% YoY), full year revenue will come in at $1.58 billion, up 32% against a very strong 2021 which grew 43% YoY. Unfortunately, the stock isn’t quite working, as markets are highly sensitive to the valuation side of the equation. At 11x 2023 revenue, multiples remain at risk of further contraction under the current macro narrative. As a result, sit back, relax, and wait for a better entry point.

Be the first to comment