marchmeena29

Introduction

On November 9, The Trade Desk (NASDAQ:TTD) reported its Q3 2022 earnings. The company did again much better than other players in the ad tech market and chalked another 30%+ growth quarter. We look at the numbers in more detail and the reason why The Trade Desk does so much better than Alphabet’s Google & YouTube (GOOG) (GOOGL) and Meta Platform’s (META) Family of Apps, Facebook, WhatsApp, Instagram and Messenger. The Trade Desk’s founder and CEO Jeff Green gave clear hints.

The numbers

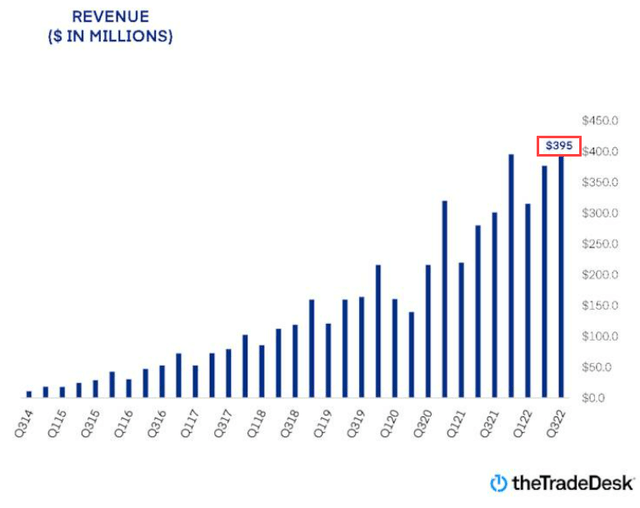

The Trade Desk grew its revenue to $394.77 million, up 31.1% year-over-year, beating the estimate by $8.24 million or 2.1%.

TTD’s Q3 earnings call slides

As with all ad-based companies, The Trade Desk’s quarters are always a bit different, with, of course, the fourth quarter as the biggest quarter by far because of Christmas shopping. But if you zoom out a bit, you can see the reliability of the company’s revenue growth. It has a 2-year CAGR, or compound annual growth rate, of 35% and a 3-year CAGR of 34%. With 31.1%, the company is not materially slowing down, despite the higher dollar base to start from and the quite tough comps of 40% growth in the same quarter last year.

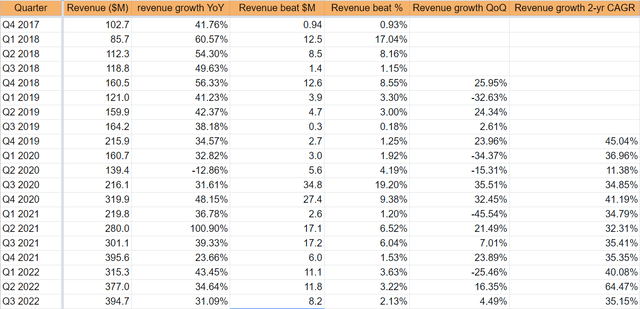

This is an overview I have made for you.

Made by the author

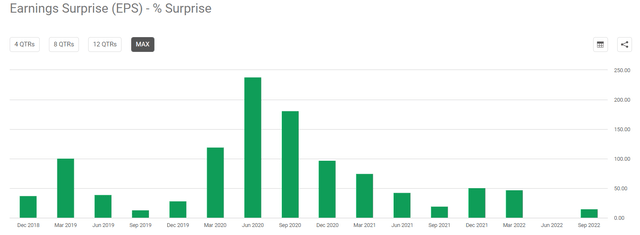

The non-GAAP EPS came in at $0.26, beating the consensus by $0.03 or 13%. The Trade Desk has a very consistent pattern of beating EPS expectations as well.

Seeking Alpha Premium

For adjusted EBITDA, the company posted $163 million, 15.8% better than the consensus of $141 million. That’s quite an impressive beat. Cash from operations came in at $137 million, 14.4% higher than the consensus of $120 million. Overall, another strong quarter!

Since the pandemic, The Trade Desk changed how it guides. It now does this with ‘at least’. The company guides for ‘at least’ $490 million, 3.3% below the consensus, but don’t forget the ‘at least’ addition. For adjusted EBITDA, the company guided $229 million, 2.3% higher than the consensus of $224 million.

Some good news summarized quickly:

- For the eighth consecutive year, customer retention was over 95%.

- Continued support for UID 2.0, the alternative to 3rd-party cookies The Trade Desk developed and then gave to an independent consortium. In this quarter, big names like Procter & Gamble, fuboTV and MediaMath, a DSP with over 3,500 advertisers, adopted UID 2.0.

- Many industry recognitions, from Gartner (Customers’ Choice for Ad Tech’), BIG Innovation Award for Technology Product for Solimar, for the 9th consecutive year in Crain’s 100 Best Places to Work in NYC, Stevie Awards for Great Employers, Employer of the Year, in the category Computer Software, Chief Strategy Officer Samantha Jacobson in the Ad Age 40 under 40 and several others.

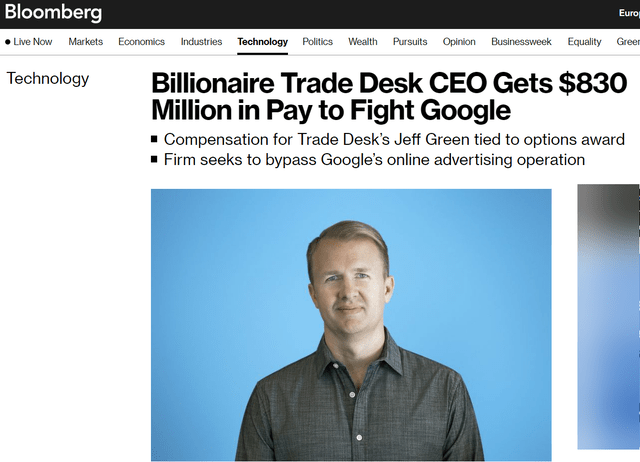

Jeff Green’s compensation is controversial

Maybe you have seen the headlines. Here’s Bloomberg.

Bloomberg

The British tabloid The Daily Mail:

The Daily Mail

You get the picture.

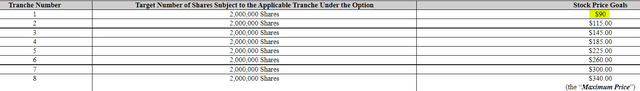

What’s going on here exactly? Last year, when these headlines were in the press, The Trade Desk issued a reward plan for Jeff Green. You can read the SEC filing here if you want. While that $830 million can be seen as exorbitant, and we have to be honest, to a certain extent it is, there are nuances. The most important one is that the compensation plan is tied to the stock price of The Trade Desk. The first milestone was $90, as you can see here.

TTD’s SEC filing

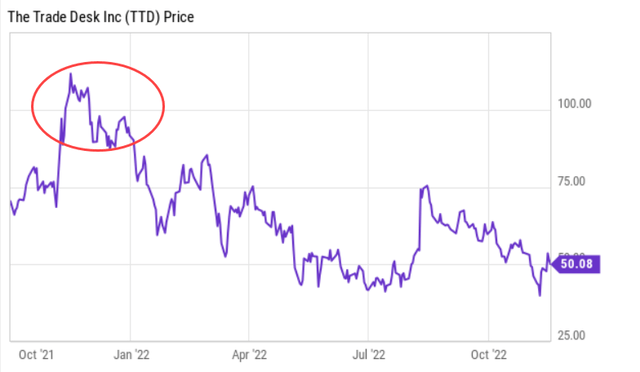

The stock price has to be above the milestone for at least 30 days, which happened for $90 in January of this year already.

Ycharts

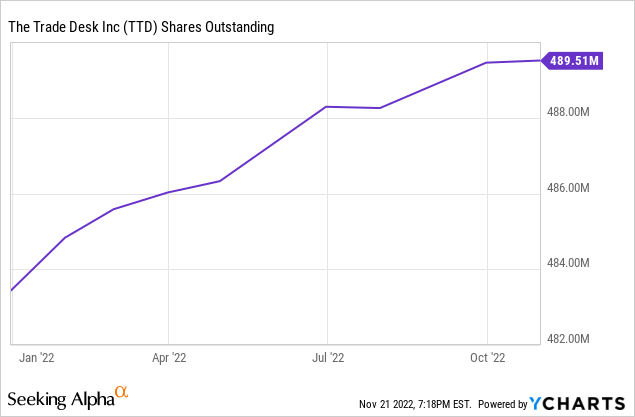

So, Green’s shares started vesting and if you look at GAAP and non-GAAP, there is a big difference in this quarter. But how much are shareholders diluted? This is the evolution of the shares outstanding.

As you see, there are 489.5 million shares. There is a special extra condition that the vesting may be at 120%, which means 2.4 million. If you multiply by 8 for the whole period, you get 19.2 million extra shares. On 489.5 million, that’s 3.8% of shares outstanding.

While this is not ideal, Green is totally aligned with shareholders. If he really gets his company to a stock price of $340 from here, he’s worth the bonus. When the plan was made, the stock traded at $68, so $340 is a 5x at that point. The next goal, $115, is already up 130% from where the stock trades now around $50.

Also important: the plan expires in 2031, so that $340 would mean a 7x in 10 years. Not a bad return.

So, all in all, while the headlines can maybe make you angry and dilution is never something to cheer for, all in all, I would be very happy to pay Green this huge amount in shares, as it will mean that we have all done extremely well.

The headwind to GAAP numbers should mostly go away in 2023 unless Jeff Green takes his company’s stock above $115, of course, which I think is rather unlikely.

In the meantime, Jeff Green has still not exercised his options, which is not strange, as they are priced at $68, so that is another incentive for him.

Notes from the earnings call

Jeff Green is always a pleasure to listen to on earnings calls. Green doesn’t just announce results, every quarterly call is a masterclass in the new trends of ad tech. It’s a real passion for him that everybody understands as much as possible from this complicated business. That’s also why he has a series called In Human Terms on YouTube, 21 clips of 2 to 4 minutes in which he explains the most important concepts in digital advertising. His earnings calls are a masterclass in the latest trends.

But this time, I will start with a conference call quote from CFO Blake Grayson, because it’s important in this context. Unlike many other companies, The Trade Desk did not overspend, which is why the company can keep investing.

There are a lot of companies out there that might have more resources than us that are pausing or even cutting their resources because they potentially invested too aggressively. And we didn’t get ahead of ourselves the last couple of years. I think maybe like some of these companies did, and that’s paid off for us. We have the ability to stay the course and be deliberate about our investments, and that includes hiring.

Of course, having $1.2 billion in your bank account and no debt also helps a big deal.

Over to Jeff Green now, who was in Singapore for the call.

This is how he started:

We continue to gain share as advertisers embrace the precision and relevance of data-driven advertising on the open Internet via our platform. Throughout 2022 and in particular, in Q3, The Trade Desk has significantly outperformed seemingly all other forms of digital with a significant contrast to walled gardens in our ability to win advertising budgets. It is very clear that under the current operating conditions, we are significantly outpacing the market regardless of the macro environment.

This is a clear reference to ad platforms like Google and especially Meta Platforms, the walled gardens that control so much of digital advertising. And indeed, YouTube’s ad revenue was down, Meta had a really poor quarter. At the end of the prepared remarks, he was even clearer:

While I don’t often comment on competitor performance, I do think it’s worth noting again that in an environment where many of our competitors have contracted or grew in the single-digit range, we grew 31%.

Green explains where that comes from:

Nearly every single major advertiser wants a world where the open Internet thrives, where competition and price discovery thrive. They want great measurement that works across the web so that they can compare the performance of each site, app or destination to all the others. They want an Internet where relative value can be found as we have predicted CTV is a catalyst for massive change on the Internet, when possible, the power balance is shifting to the open Internet away from opaque walled gardens and systems that aren’t comparable to others.

I think many investors still underestimate the importance of the granularity of data The Trade Desk can provide. Don’t forget that it has partnerships with giant retail outlets like Walmart (WMT), Albertsons (ACI), Home Depot (HD) and many more. What this means is that The Trade Desk can measure the results of campaigns, both online, where others can do that as well, but also offline, which is very hard without the first-party data that these big stores have. Everybody flocks to The Trade Desk to unlock the power of their 1st-party data without compromising on privacy.

We believe that more than 80% of the largest retailers in the United States partner with The Trade Desk and more of the world’s leading retailers are also now following suit. The chorus of retailers making retail measurement available is furthering the power and benefits of an open competitive Internet

The result? Much faster growth than everybody else.

WPP’s GroupM predictive worldwide advertising will increase 8.4% in 2022 and we are growing at more than 3x that rate. (…)

I believe that through the first 9 months of the year, we have gained more market share, grabbed more land than at any point in our history.

Procter & Gamble (PG) is one of the biggest advertisers in the world and Green was happy to quote that company’s CFO on P&G’s earnings call:

it is difficult to describe media sufficiency in dollars, especially when we are actively shifting our spending from linear non-targeted TV into programmatic and into digital spend. That is a lot more targeted and a lot more precise in terms of delivering reach and quality of reach where we need it. We now have more than 50% of our media spend in digital. We are increasing our first-party data and our digital capabilities to increase precision of reach, not only in the U.S. or in Europe, but around the world and that is allowing us to drive significant productivity while increasing reach while increasing quality of reach and while more precisely targeting our consumers.”

The macroeconomic uncertainty is even a tailwind for The Trade Desk, as Jeff Green had predicted in previous quarters. It’s hard to believe because you hear every other ad company complain about the macroeconomic headwinds. Green explains why The Trade Desk can benefit:

We provide objective transparent measurement. We provide precision and relevance. We allow advertisers to optimize based on real-time performance and we provide access to the world’s most advanced data marketplace including many of the world’s biggest retailers. CMOs and CFOs are carefully watching costs and spend at this moment. It is why we are particularly excited by the growth on our platform this quarter. This moment is also a time when advertisers have clear goals and our objective partnership is really important to them achieving those goals.

Green was very bullish on CTV or Connected TV again. In a short time, CTV has become both the biggest and the fastest-growing division for The Trade Desk. And don’t expect CTV growth to come down.

The U.S. and Australia have been great leaders and case studies for the world, both benefiting from the fragmented and competitive nature of content in their markets, but now CTV adoption is going global.

Perhaps the most bullish statement I will make this year is that our CTV spend grew in the majority of our international markets faster than it did in the United States. I have said previously that the U.S. and Australia are leading the way on CTV and that markets like the UK and France are following fast, but that pace is picking up in all corners of the world.

Green was very optimistic for 2023 and beyond and UID2.0 plays a very important role there. On CTV, there are no 3rd-party cookies, but advertisers use UID2.0 to unleash the power of their first-party data, in other words, the data they have from their customers. UID2.0 allows them to do this in a way that is completely compliant with current and probably future privacy laws, unlike 3rd-party cookies that are used on the internet.

The data of these big brands are on data aggregators such as AWS (AMZN), Snowflake (SNOW), Salesforce (CRM), Adobe (ADBE) and many others. They have all adopted UID2.0. Because of this, the data don’t even have to leave those platforms anymore. Or, as Green puts it:

With UID2, advertisers can transact on that data without it ever leaving home. Because of this progress, I predict that more than half of the data inventory flowing through our platform by early next year, will be UID2 tagged.

And that has great consequences for both parties:

With more and more of our publishers’ inventory also UID tagged, that means the value of advertiser first-party data increases exponentially on our platform, more than 10x next year compared to this year. (…)

(Our customers) will finally be able to realize the value of their first-party data to model and understand where their next generation and most loyal customers are and reach those customers with precision, and of course, do that more effectively than ever.

Here again, you see that data granularity that advertisers have been dreaming of for so long.

Green gave another example in the Q&A, when one analyst asked if shared viewing was not a problem for targeting.

The bottom line is when we are considering, targeting or customizing ads, there is an individual graph, there is a household graph. Both of those are considered when we are making the placement of ads and shared viewing doesn’t necessarily mean that it’s worth any less. And in fact, what we are competing with is an environment in linear or broadcast television that is almost always shared viewing, but it’s not measurable. So, finally, we have the ability to measure when it’s being shared and when it’s not. And of course, a lot of premium video is on personalized devices.

My thoughts about this quarter

This was another very strong quarter for The Trade Desk, especially considering the tough context. While incredibly strong companies like Google and Meta struggle, The Trade Desk chalks 31% revenue growth and that is before the tailwinds of the mid-term elections spending, which was growing a lot, according to Jeff Green, without the huge secular tailwinds of the ad-supported tiers of Disney+ (DIS) and Netflix (NFLX). As Green shared, the unlocking of the first-party data of big retail will be another boost in the upcoming year.

The very high performance package for Jeff Green is a lowlight, but if he can indeed bring the stock to $340, then I can live with that.

The Trade Desk keeps its premium growth in a very challenging environment and that alone is impressive. It’s taking more and more market share from the big boys in advertising, Google and Meta Platforms. We know how incredibly big piles of money these companies have generated. If The Trade Desk can continue its outstanding execution like this, it will take more and more market share.

In the meantime, keep growing!

Be the first to comment