24K-Production

Thesis

The Trade Desk, Inc. (NASDAQ:TTD) is heading into its Q3 earnings release on November 9 after wowing investors with its Investor Day in early October. However, it didn’t wow the market as it forced TTD down further to re-test its 200-week moving average.

We cautioned investors about adding to its Q2 earnings spike in our previous article (Sell rating). Accordingly, TTD has underperformed significantly since our previous update, down nearly 27%, compared to the S&P 500 ETF’s (SPY) -9.8% return.

Under CEO Jeff Green’s remarkable leadership, The Trade Desk has established its outstanding execution credentials, becoming the Open Internet’s leading independent demand-side platform (DSP). It’s also focused on furthering its reach in the CTV ecosystem as viewers and advertisers continue to shift from Linear TV.

We think there’s no question about TTD’s immaculate execution over the years. It’s highly profitable, has tremendous influence with marketers and advertisers, and is closing ranks with publishers through its OpenPath initiative as it takes on Google (GOOGL) (GOOG).

However, TTD trades at a significant premium that suggests investors adding here need to be very cautious with hiccups in its execution. With revenue growth expected to slow further, it could hurt the company’s ability to drive significant operating leverage. We believe these are necessary conditions for TTD to maintain its substantial growth premium.

Hence, the potential risks for underperformance are increasing as the ad industry downturn puts more pressure on ad budgets and spending. As such, we postulate that the consensus estimates on TTD still look surprisingly robust heading into FY23.

We will hear more from management about its forward guidance as it reports Q3. That should give us a good indication of the significance of the ad industry’s impact over the next year.

While the market has undoubtedly de-rated TTD from its August highs in anticipation of a relatively weak outlook, we aren’t buyers at these levels.

However, TTD appears to be at a near-term bottom and also seems to be consolidating.

As such, we move to the sidelines at the current levels and revise our rating from Sell to Hold.

The Trade Desk Could Be Near Peak Profitability

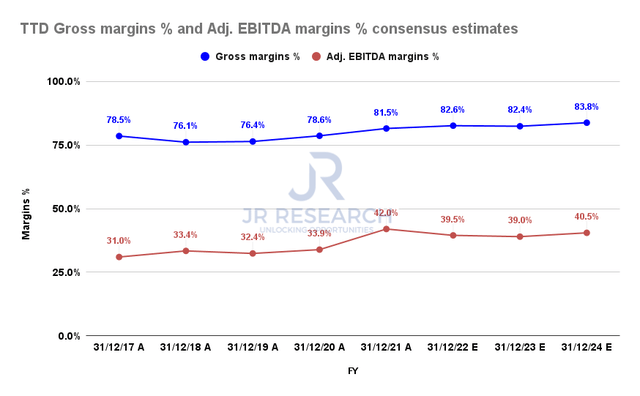

The Trade Desk Gross margins % and Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

CFO Blake Grayson updated its long-term adjusted EBITDA guidance at its recent Investor Day. Accordingly, Grayson highlighted that the company targets 40% as its long-term target.

The Trade Desk posted an adjusted EBITDA margin of 42% in FY21, well above FY20’s 33.9%. Hence, the market has gotten it absolutely spot on as it battered TTD from its November 2021 highs, postulating that the company was over-earning.

The revised consensus estimates (bullish) suggest that TTD could post a margin of 39.5% for FY22. The company’s previous guidance for Q3 indicates a margin of about 36.4%. Hence, Street analysts expect the company to post a significant Q4, which could also be lifted by the mid-term elections advertising. Investors should note that Q4 is usually a critical quarter for the company.

Accordingly, analysts’ projections indicate that The Trade Desk is expected to post an adjusted EBITDA margin of 44.6% in Q4, down from last year’s 48.4%.

Given the ad industry headwinds, we believe the consensus estimates could be overly optimistic, needing Q4’s metrics to lift its full-year projections. Hence, a worse-than-expected outlook from management could force further value compression on its expensive valuation.

Is TTD Stock A Buy, Sell, Or Hold?

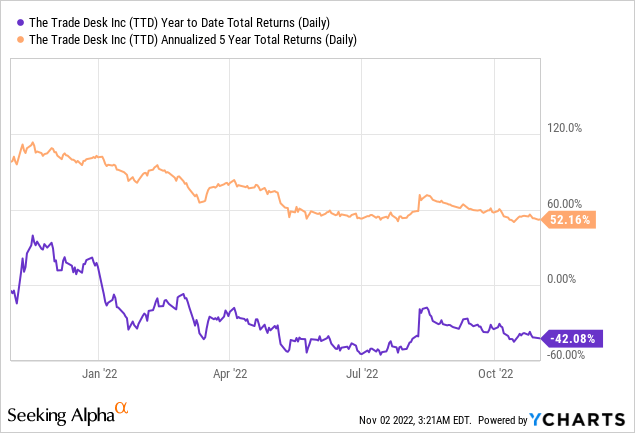

Despite its YTD total return of -42.1%, TTD has been a massive winner for investors who bought it five years ago. It delivered a total return CAGR of 52.2%, outperforming the broad market significantly.

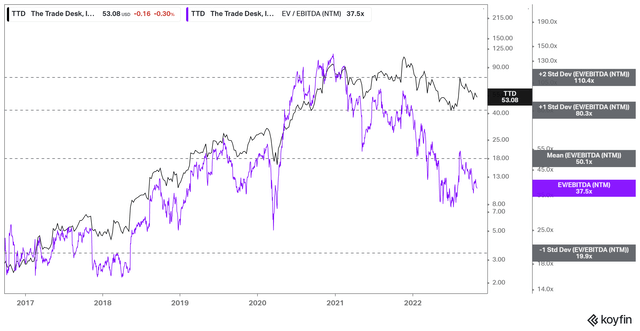

TTD NTM EBITDA multiples valuation trend (koyfin)

However, that also means its valuation is no longer cheap. Despite the YTD battering, it last traded at a NTM EBITDA multiple of 37.5x or a NTM normalized P/E of 50x.

Investors need to see significant growth in operating leverage at such valuations to justify TTD’s valuations. However, if it’s expected to be operating at peak profitability, we believe further value compression must occur to de-risk the company’s forward execution risks.

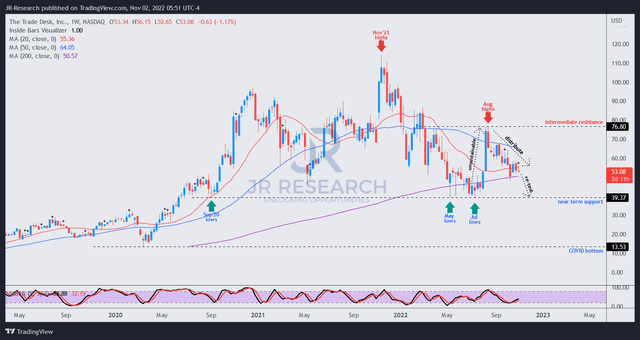

TTD price chart (weekly) (TradingView)

As seen above, the market has justifiably digested most of its unsustainable momentum spike in August.

However, there wasn’t any panic selling/capitulation from its August highs. Instead, it was the good, old classic distribution by astute investors. For high multiple stocks like TTD, we prefer to observe a significant capitulation move intended to force out weak holders before we consider entering.

For now, we view its near-term support as the likely zone where the market could force a capitulation to de-risk the entry zones for investors.

Hence, we believe it makes sense to let the market show us its near-term directional bias as we move to the sidelines after our previous Sell call.

Revising from Sell to Hold.

Be the first to comment