metamorworks/iStock via Getty Images

Investment Thesis

The Trade Desk (NASDAQ:TTD) is leading the charge in a world of advertising that is increasingly looking for transparency. The company has grown into a true ad tech leader, and as digital advertising (and in particular connected TV) continues to take up more share of global advertising dollars, I think The Trade Desk is positioned to benefit immensely.

But does that make it a good investment right now? I put it through my framework to try and find out.

Industry Overview

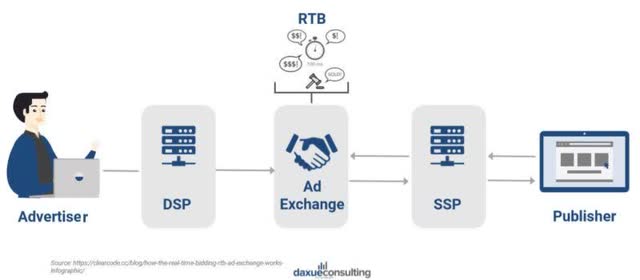

Before diving into the company itself, I want to take a moment to explain the industry as a whole, because there is a lot going on that isn’t necessarily intuitive. I’ll start with a few key terms that will be used throughout this article

- Programmatic Advertising: The use of automated technology to buy advertising space.

- Demand-Side Platform (or DSP): A platform that allows advertisers and ad agencies to automatically bid for advertising space.

- Supply-Side Platform (or SSP): A platform that allows digital media owners and publishers to automatically sell their advertising space.

- Walled-Garden: Refers to a company that operates a closed platform, where these companies have complete control over the entire advertising process, often with reduced transparency.

I’ll start with an example of how the programmatic advertising industry works, just to help anyone new to the industry wrap their head around exactly where The Trade Desk sits. Let’s imagine that Coca-Cola (KO) decide to advertise on The Roku Channel. (ROKU) Let’s also assume that Coca-Cola use an advertising agency – the following steps would happen:

- The Roku Channel has some advertising inventory space

- Roku’s SSP partners will send the individual advertising slot to a central ad exchange

- DSPs can now see this advertising slot on the ad exchange

- DSPs will host real-time auctions where advertisers can ‘bid’ for the impressions

- Coca-Cola’s advertising agency will bid for this advertising slot

- If Coca-Cola is the highest bidder, then the slot will be sold, and Coca-Cola will place that advert on The Roku Channel

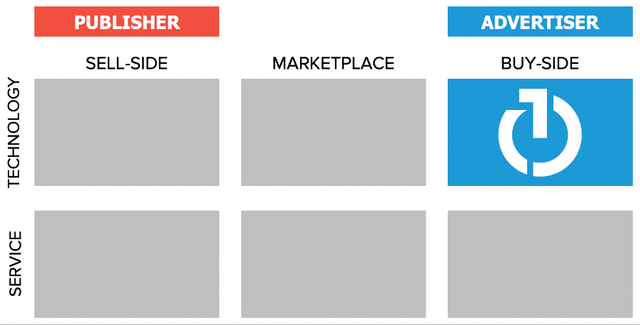

The Trade Desk is a demand side platform, and so it sits between the advertisers and the ad exchanges.

The Trade Desk Q1’22 Investor Presentation

Business Overview

The Trade Desk is a global technology company, with a demand-side programmatic advertising platform that ad buyers can use to get the most out of their advertising dollars. Through this self-service, cloud-based platform, ad buyers can create, manage, and optimize their digital campaigns across a variety of channels and devices, including computers, mobile phones, and connected TVs.

The company focuses exclusively on the demand side of advertising for two reasons. Firstly, the supply of digital advertising inventory exceeds demand, making it much more of a buyer’s market. Secondly, it prevents any conflict of interest that exist when platforms sell both the demand-side and supply-side. It has allowed The Trade Desk to build trust with their clients, and as a result many advertisers use their own data on The Trade Desk’s platform which enables them to achieve better results.

The company generates revenue by charging clients a platform fee based on a percentage of a client’s total spend on advertising. It also generates revenue from providing data and other services and features.

The platform offers several key features for advertisers, including:

- Auto-Optimization that allows buyers to automate their campaigns and support them with modelling and decision making

- Advanced Reporting and Analytics Tools offer robust reporting of performance insights across multiple various, resulting in better learning for advertisers and improved campaign optimization and outcomes

- Data Management and Measurement Tools enables advertisers to select data from multiple third-party vendors, allowing them to further optimize campaigns

- Koa Artificial Intelligence is a predictive engine that helps advertisers make data-driven decisions and recommends optimizations for advertising campaigns, without advertisers having to sacrifice control or transparency

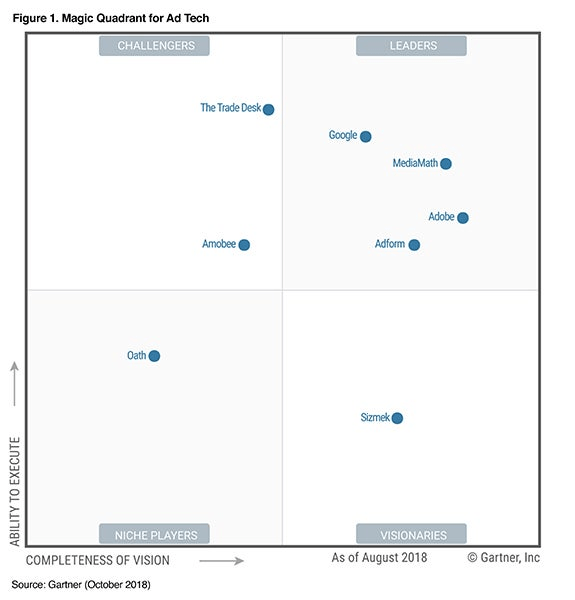

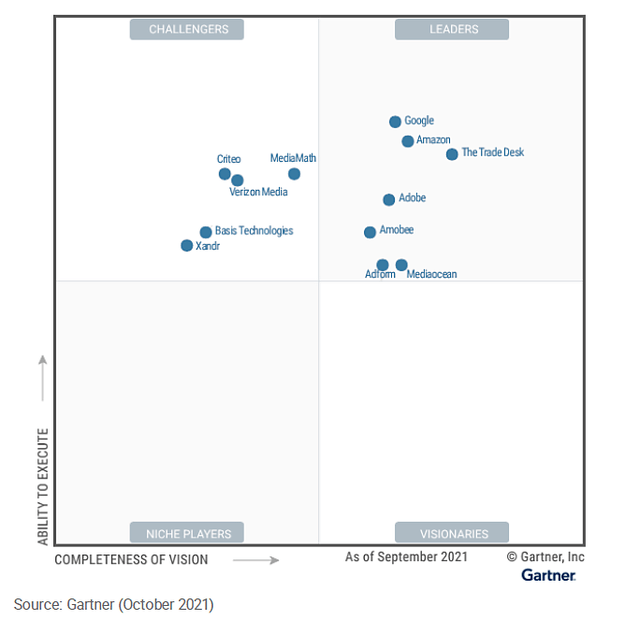

Through its transparent, independent, open approach, The Trade Desk has successfully built a strong reputation in this industry. And, the platform has been continually improving to become a real industry leader. Just take a look at the change in Gartner’s Magic Quadrant for ad-tech from 2018 through to 2021.

2018 Magic Quadrant (Gartner) 2021 Magic Quadrant (Gartner)

The biggest concern for The Trade Desk has always been its ability to compete with the huge walled gardens of Google (GOOG) (GOOGL) and Meta (META), so how can it protect itself from these competitive pressures?

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

Arguably the most powerful economic moat possessed by The Trade Desk relates to counter-position, which is when a company’s business model would actually harm competitors if they were to adopt it. We’ll start with the question most asked: how does it compete with Google?

Firstly, go back to The Trade Desk’s consistent focus on transparency. Its platform is completely open and transparent, with advertisers being able to gain access to a plethora of data about their advertising campaigns, enabling them to improve the effectiveness of these campaigns in future. In fact, clients can even build their own features on top of The Trade Desk’s platforms.

By comparison, walled gardens such as Google or Meta Platforms are notoriously less transparent when it comes to the data they provide to advertisers – but that is, in part, due to the conflict of interest. The Trade Desk doesn’t care about the results of an advert placed on The Roku Channel; they have no incentive to provide anything other than accurate results for the effectiveness. But imagine that Coca-Cola instead places an advert on Meta-owned Instagram, or Google-owned YouTube. Both Meta and Google have an incentive to charge as much as possible for the ad placement on their platforms, and the less data an advertiser like Coca-Cola has, the less accurate they are able to price their ad placements. This gives Google and Meta a greater ability to charge higher prices, but unsurprisingly advertisers are not happy about this – which gives The Trade Desk an advantage outside of the walled garden ecosystems.

So I think this is a substantial economic moat against the big players, with the bonus that the likes of Google and Meta are more at risk from regulation. The EU recently announced their Digital Markets Act targeting “Big Tech’s Walled Gardens”, and in a future where walled gardens are shunned, The Trade Desk will succeed.

There is also a counter-positioning moat against traditional models, wherein a company would buy large amounts of advertising supply from publishers well in advance. They would then sell this to advertisers over time, and make a ‘spread’ on the buy and sell price. The problem now is that there is no telling what the future value of these advertising spaces will be – they are forced to sell at an elevated price to make this spread, whereas The Trade Desk offers a real-time appropriate price and generates revenue through platform fees, rather than by trying to take a spread.

The Trade Desk also benefits from switching costs, as shown by the following line being present on their quarterly reports for the past 32 quarters:

Strong Customer Retention: Customer retention remained over 95% during the first quarter, as it has for the past eight consecutive years.

Given that The Trade Desk is one of the biggest players in this industry outside the walled gardens, it should be no surprise that any advertiser wants to work on their platform. The ability to build additional features on top of this platform is another way in which The Trade Desk can increase switching costs, by having their partners even more embedded with their platform.

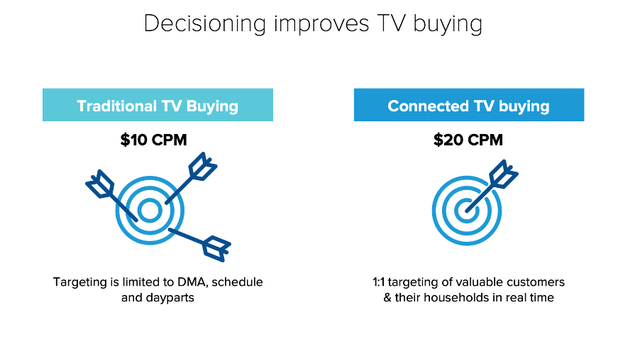

It also benefits from network effects, and this specifically relates to data. Advertisers share their data with The Trade Desk when they join the platform, and The Trade Desk can use this data to make more informed decisions about the targeted ad spend, and they can learn from this data, making their return on advertising spend greater, leading to more customers, who share more data, that The Trade Desk can continue learning from. A quick example below shows the power of data driven, targeted advertising – and how The Trade Desk is about to charge twice as much compared with traditional TV buying.

The Trade Desk Q1’22 Investor Presentation

So a lot of positive economic moats here for The Trade Desk which should help them continue to grow whilst fending off the competition.

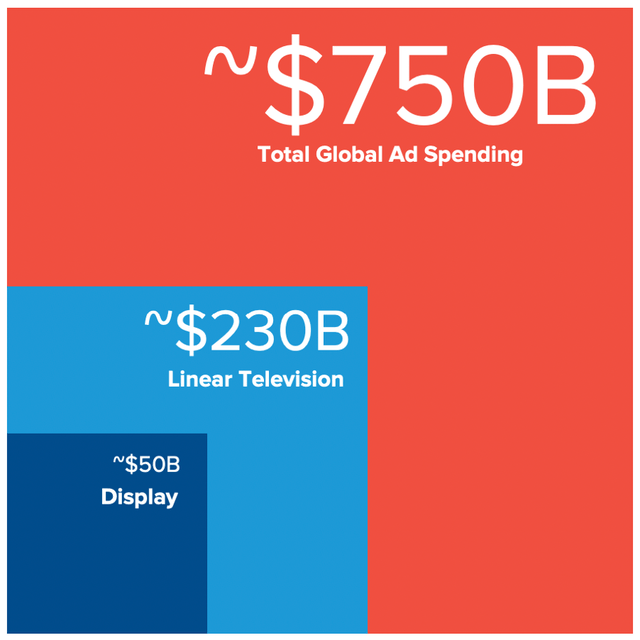

Outlook

The future looks extremely bright for The Trade Desk, both with the increased amount of advertising shifting to programmatic as well as new opportunities emerging such as connected TV. In fact, it’s likely that the future of all advertising is programmatic – and the advertising industry is huge, with a current market size of ~$750 billion.

The Trade Desk Q1’22 Investor Presentation

I’ll take a moment to speak specifically about the opportunity that The Trade Desk has in connected TV, or CTV. I’ll start by highlighting some words from CEO Jeff Green in a 2018 interview:

Green believes Netflix will follow Hulu’s lead soon enough, offering a cheaper ad-supported option alongside its existing ad-free subscriptions, because it needs to compete with the free-by-default YouTube. And he told Recode’s Peter Kafka that he’s said as much to Netflix’s departing CFO David Wells (who sits on the board of The Trade Desk) and other executives at the company.

“They’ve envied YouTube’s international reach for a very long time, where even less than two years ago, 80 percent of subscribers for Netflix were in the U.S.” Green said. “Our median household income is at $50,000-ish, roughly, a year … compare that to all the places where there’s growth in the world, which is also where advertisers are willing to pay ahead. I don’t think there’s any chance that they can catch up to YouTube, whose geographical distribution is exactly inverted, which is 80 percent comes from outside the U.S., unless they go ad-funded in the same way that YouTube is.”

Green predicted the rise of ad-supported video on demand (aka AVOD) as well as predicted that Netflix, the anti-advertising company, would eventually shift to an ad-supported offering. Well, in recent months it appears that Green has been proven right yet again, after Netflix Co-CEO Ted Sarandos confirmed at Cannes Lion advertising festival that the future of Netflix will include adverts.

Jeff Green has a habit of knowing which way the wind is blowing, but the CTV opportunity is far greater than just Netflix. According to Statista, the global TV advertising spend in 2021 was just under $170 billion – but as we saw earlier, companies such as The Trade Desk can generate twice as much value for advertising on CTV compared to linear TV.

To finish on the opportunity here, I’ll hand back to Jeff Green’s comments from the Q1’22 earnings call:

With the explosive growth of premium CTV over the last few years, especially the last year, the trend is clear. We see it clearly reflected in some of the UGC data that’s been reported out in the last few weeks, and it’s also why CTV remains by far our fastest-growing channel and why premium video in all of its forms has become the largest segment of our business.

Management

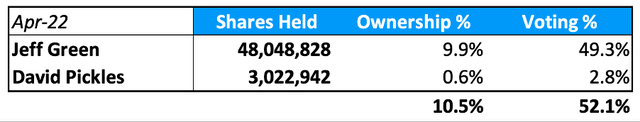

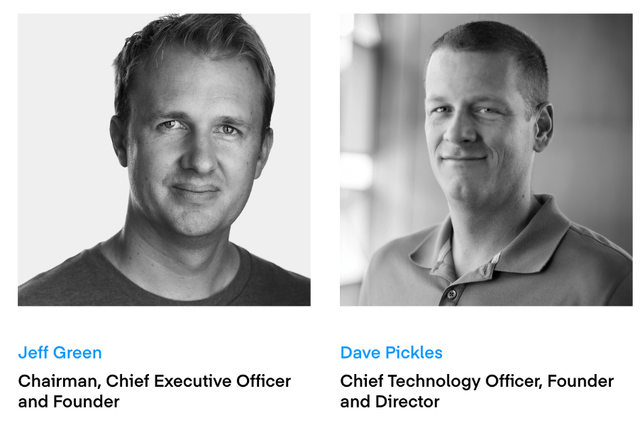

When it comes to fast-paced, innovative companies, I always aim to find founder-businesses where inside ownership is high. You can probably tell already that I am a big fan of The Trade Desk CEO Jeff Green, and I’m even happier about the fact that he is the co-founder of this business. Prior to founding The Trade Desk, Green co-founded another DSP AdECN, which was acquired by Microsoft in 2007.

It’s also worth noting that the other co-founder, Dave Pickles, is the current CTO – I do enjoy seeing multiple founders still involved!

I want to invest in companies where leadership has skin-in-the-game, and The Trade Desk also ticks this box. The two co-founders hold just over 10% of all shares in the company, and have over half the voting power, with Jeff Green holding the majority of both.

The Trade Desk 2022 Proxy Statement / Excel

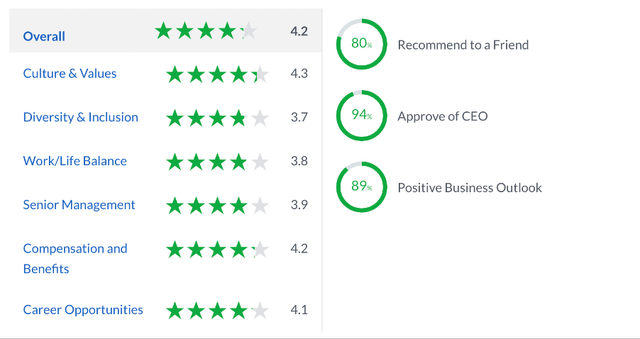

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and The Trade Desk gets some strong scores from the 333 reviews left by employees. Any score over 4.0 is impressive, and The Trade Desk manages to achieve this in Culture & Values, Compensation and Benefits, and Career Opportunities. This indicates that The Trade Desk has a great culture and employees are well compensated, meaning that they will probably be happy to work there for a long time.

The 94% CEO approval rating is also impressive, with 4 in 5 employees saying that they would recommend The Trade Desk as a workplace to their friends. Furthermore, almost 9 in 10 have a positive business outlook – this is a particularly high score, and demonstrates that employees believe in the future for The Trade Desk.

Financials

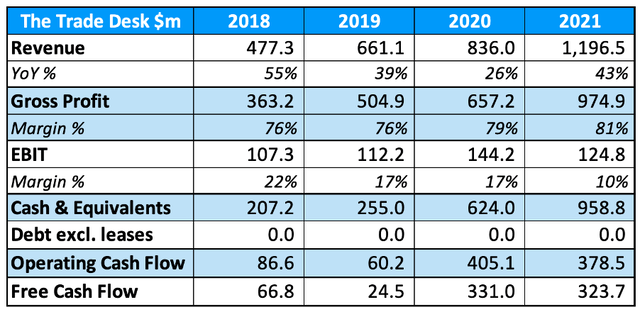

The Trade Desk has some stellar financials – it’s refreshing to see a growing technology company that is consistently profitable! It has grown top-line revenue at a ~36% CAGR over the past few years, with a 2020 that was negatively impacted by Covid-19 in the first half of the year. The Trade Desk can often have fairly lumpy quarterly revenue figures, due to seasonality of advertising as well as the fact that political ad spending is a big driver.

The Trade Desk SEC Filings / Excel

Gross profit margins have consistently improved, and in 2021 The Trade Desk boasted an annual gross profit margin above 80%. This gross margin consists of costs associated with ‘platform operations’, which primarily includes costs related to internet traffic, hosting costs, and personnel costs. EBIT margins dropped significantly in 2021, but this was driven by $157.7 million related to a one-off CEO Performance Option. Whilst this option is a one off, the remaining cost of this option is $661.3 million which will be recognized over a weighted-average period of 3 years.

The company has a stellar balance sheet, with almost $1 billion in cash and zero debt. This has been achieved in part by the fact that this company loves to print out free cash flow, with over $300m in FCF achieved in both 2020 and 2021. Given the growth that lies ahead of this company, I think it could become a cash generating machine.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether The Trade Desk is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

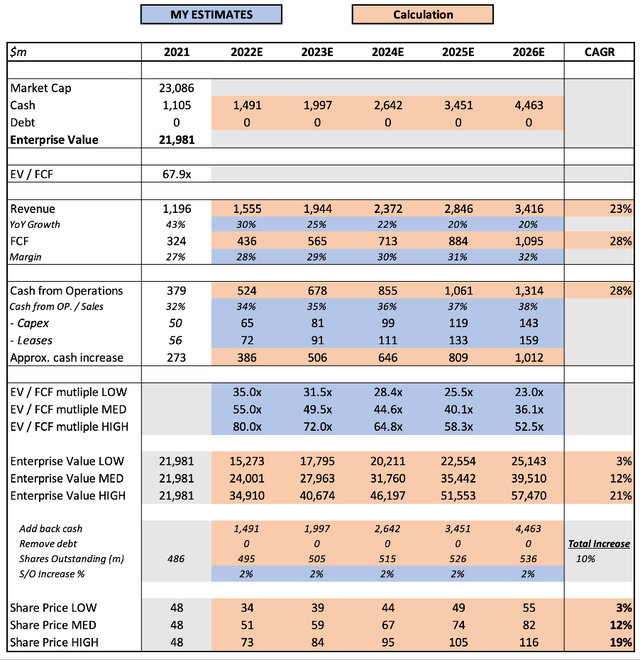

The Trade Desk SEC Filings / Excel

I have based my model on an EV / FCF multiple. In terms of revenue growth, I have assumed a gradual fall in revenue through to 2026. Despite multiple tailwinds for The Trade Desk, I felt this was prudent given the potentially difficult macroeconomic climate that we face in the upcoming years.

I have also assumed a very steady growth in the FCF margin, from 27% in 2021 up to 32% in 2026, as The Trade Desk continues to scale. I’ve also assumed that shares will be diluted at a rate of 2% annually over the period, resulting in the total shares outstanding to increase by 10%.

My mid-range scenario for 2026 uses an EV / FCF multiple of 36.1x, resulting in a forecasted share price of $82 and a 12% CAGR in share price from here onwards. I do feel like this multiple is fairly conservative, particularly if The Trade Desk’s impressive growth continues, so an alternative multiple of 52.5x in my high scenario implies a share price CAGR of 19% up to $116 per share.

Risks

The most substantial risk to The Trade Desk in the short-to-medium-term is a recession, as advertising spending is likely to be more drastically affected than, say, spending on enterprise software. That said, The Trade Desk is experiencing the secular tailwinds of programmatic advertising and CTV growth, so I believe that they will be able to continue growing – but perhaps at a slower rate if we enter a difficult recession.

There are always risks from competition, but The Trade Desk has proven itself to be the clear leader in this industry excluding walled gardens. Whereas the walled gardens are having to worry about potential regulation, The Trade Desk has made clear that it believes in transparency, so I don’t see any imminent threat from competitors – in fact, I see more threats for the competitors themselves.

Summary

All-in-all, The Trade Desk is a high-quality business with a visionary CEO in Jeff Green and a business model that is already extremely profitable. The share price is still fairly expensive, but given that this is a brilliant company with many tailwinds at its back, I’m not surprised – and it is a price that I am more than willing to pay.

Be the first to comment