Vertigo3d

Thesis

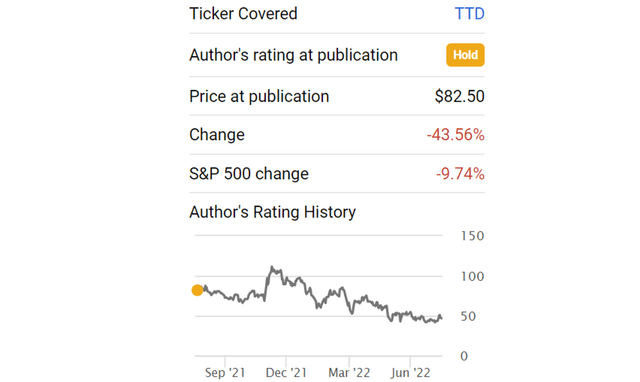

My last article on The Trade Desk (NASDAQ:TTD) was published when the stock was trading at a price of $82.5 and a P/S ratio of 44x! The title of the article, Valuation Will Take Years Of Growth To Catch Up, probably already totally gave away the thesis. The stock has lost more than 43% of its price since against the backdrop of a 10% correction of the overall market.

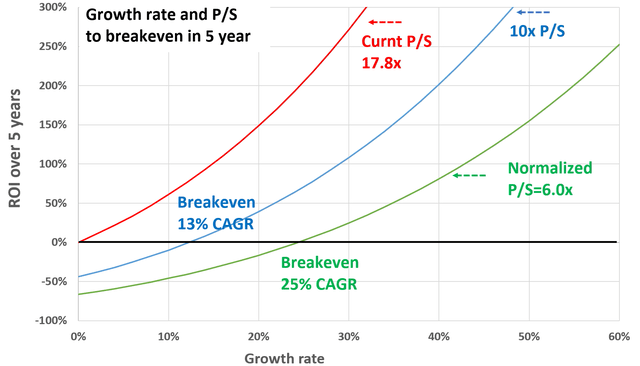

Combined with its sales growth since then, now the stock is at a much lower valuation with a P/S ratio of around 17.8x. So I decided to take another look, and my conclusion is that it’s still priced for perfection. A simple back-of-the-envelope projection shows that investment at this point still requires a consistent 25% CAGR for the next 5 years or so to just break even. Not entirely impossible. But I consider a 25% CAGR over 5 years to be a perfect growth trajectory. To put things into perspective, its sales growth has been averaging 29% CAGR for the past 5 years.

The near-term prospects are mixed. The company posted a first-quarter net loss of $0.03 a share, while the topline jumped 43% YoY, the strong growth in the past 4 years. The customer retention rate remains high and the new trading platform Solimar is enjoying successful adoption. However, margins are under pressure and the business is dealing with significant increases in operating expenses, as we will see next.

Margin pressure and operating expenses

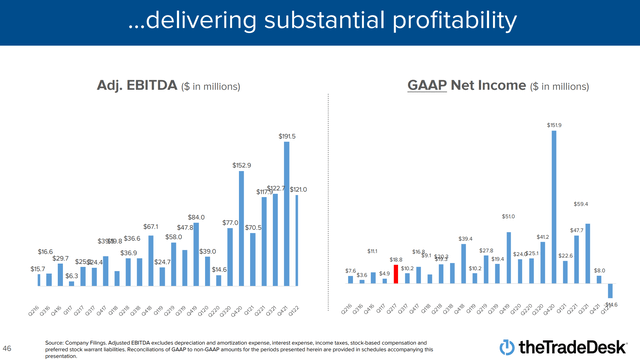

As can be seen from the following chart, adjusted EBITDA dialed in at $121 million in the last quarter. It is about $70 million lower than the previous quarter, but about $50 million above a year ago, a quite remarkable YoY growth. However, the net profit turned red. Its GAAP net income came in at -$14.6 million, compared to a small positive $8 million profit in the previous quarter and $152 million a year ago.

The business is dealing with higher operating expenses. Even with the benefits of the virtual environment, operating expenses went up 30% YoY as commented by CFO Blake Grayson (abridged and emphases added by me):

With the durable top line performance in Q1, we generated $121 million in adjusted EBITDA or about 38% of revenue. The $121 million in adjusted EBITDA represents a 72% increase from a year ago. In Q1, we continued to benefit from temporarily lower-than-expected operating expenses, partly driven by the virtual environment. Turning now to expenses. Excluding stock-based compensation, operating expenses were $207 million in Q1, up 30% year-over-year. We continued to see significant operating leverage as we scale the business and improve our efficiency.

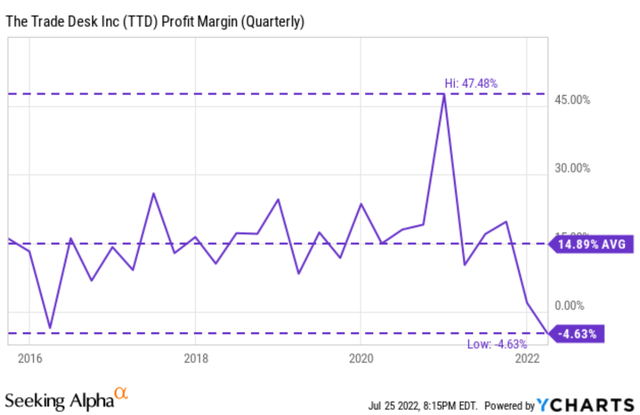

Due to the combination of the considerable increase in operating expenses and the decrease in EBITDA earnings, the profit margin plunged in recent quarters as you can see from the following chart. Its net profit margin has been fluctuating around an average of 15% over the past few years (and the peak level last year around 48% is an exception). Currently, the net profit margin is in the negative, about- 4.6%.

Looking forward, I see mixed prospects in the near future. On the one hand, I think the surge in operating expenses is likely due to the recent rollout of Solimar and the launch of OpenPath. On the other hand, these new platforms are enjoying good adoption rates and the incoming mid-term election may provide a strong catalyst, as detailed next.

Business outlook and Solimar

Customer retention remains high (remarkably higher actually) with over 95% retention rates in the past few years. Customers are sticky with its unique capabilities such as the connected TV and self-service omnichannel software platform. Looking forward, the company will keep focusing on its CTV capability and the rollout of new platforms. Solimar and OpenPath are two of the highlights. Solimar is its new trading platform and OpenPath will allow advertisers direct access to their inventory too. The incoming midterm election could serve as a strong catalyst for both its existing and new products.

Management is reporting encouraging results as reflected in the following Q&A exchange during the Q1 earnings report (abridged and emphases added by me). And they are aiming for a 100% adoption rate in one year.

Questions from Shyam Patil (SIG): … when we look at your results and your outlook, they look a lot better than what we’ve seen from a lot of other ad-funded companies during earnings. Can you just talk about what you think is driving your outperformance? And then second question, can you talk a little bit about how you see the rest of the year shaping up?

Answers from Jeff Green (CEO of TTD): And then, of course, in the second half of the year, we’re also going to have a midterm election… And we think it’s – we’re very well positioned to have it be our biggest political year ever. Solimar is now over 80% adoption. So we’ll finish that by the end of the year. So in other words, we’ll move everything over to Solimar, the platform that we shipped on July 7 last year. To go from launch to 100% adoption the following year is something that we were aiming for, but now we’re extremely confident that we’ll hit.

Valuation and expected returns

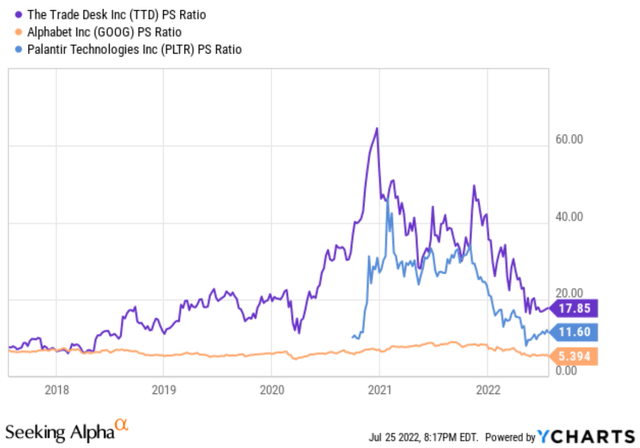

As aforementioned, my last TTD article was published when the stock was trading at a P/S ratio of 44x. As you can see from the following chart, the stock is now trading at 17.8x. In other words, the stock has lost 60% of its valuations in terms of P/S multiple (and BTW, a 60% loss will take a 250% expansion to break even). Although when we broaden our view a little bit, the stock is still trading at a significant premium relative to other peers. For example, Palantir Technologies (PLTR) is trading at an 11.6x P/S ratio and Alphabet (GOOG) (GOOGL) is trading at 5.4x.

Because of such a premium valuation, the market is still expecting a perfect growth trajectory ahead, as you can from my following back-of-the-envelope calculations. This is what I call a reality check or a commonsense test. It is an estimate of the growth rate required to deliver a target ROI in the next five years. Sometimes, we are so focused on operation details (which are very important) that we forget to run a simple test just based on our common sense.

The red line shows the returns if its valuation remains constant at 17.8x. This is obviously the dream case for growth investors. The growth continues and keeps justifying the premium valuation. As a result, every percent of growth translates to investment returns.

However, it is very possible for its growth to slow down and valuation to further contract. After all, the basic law of growth is that the larger you become, the harder it becomes to grow further. If its P/S contracts to 10x, the level that PLTR is currently valued at and still a premium valuation, its return scenario is represented by the blue line. As seen, should this contraction occur, the business has to sustainably grow at ~13% CAGR for the investment to break even in 5 years – a quite reasonable growth rate. However, if the P/S normalizes to 6x (mind you, still 20% above GOOG and about 2x of the overall market), then the business has to sustainably grow at ~25% CAGR for the investment to break even in 5 years. To put things into perspective, its sales growth has been averaging 29% CAGR for the past 5 years and I see the past 5 years as its exponential growth stage.

Final thoughts and other risks

After a shrinkage from a 44+ P/S ratio to the current ~18 level, TTD’s valuation bubble has largely deflated. Its financial position is a plus too. It has no debt and has more than $1.1 billion of cash on its ledger as of the March quarter.

However, under the current conditions, the investment has a reasonable chance of breaking even or even delivering a positive return if growth slows and valuation contraction happens (say to 10x P/S). Although 17.8x valuation is still lofty. To me, such a valuation still implies a perfect growth trajectory of around 25% CAGR for the next few years.

Besides the valuation risk, there are a few other risks worth mentioning. As aforementioned, I anticipate issues with margin and operating costs to persist into the near future. There are considerable macroeconomic uncertainties too. Based on the earnings from other bellwether stocks like JPMorgan Chase (JPM), there is a good chance for a recession. TTD stock price could be especially sensitive given its historical valuation volatility and the nature of its business.

Be the first to comment