SolStock/E+ via Getty Images

The central bank game seems to be dominating the world these days.

In the New York Times we read:

“Stocks nose-dived, government bond prices plummeted, the pound dipped against the dollar, oil prices slumped and cryptocurrencies wobbled on Friday as investors, already worried about rising interest rates and stubbornly high inflation, started quaking at the growing likelihood of a recession.”

“Their worries grew throughout the week as central banks around the world, from Sweden to Indonesia, once again wielded their blunt but powerful tool–interest rate increases–to combat inflation.”

“Further ones could augur a period of higher unemployment and slower economic growth.”

“Investors don’t like that prospect.”

Wow! Those darn central banks!

We Are In Bear Market Country

Guess what?

The stock market is now in “Bear Market Country.”

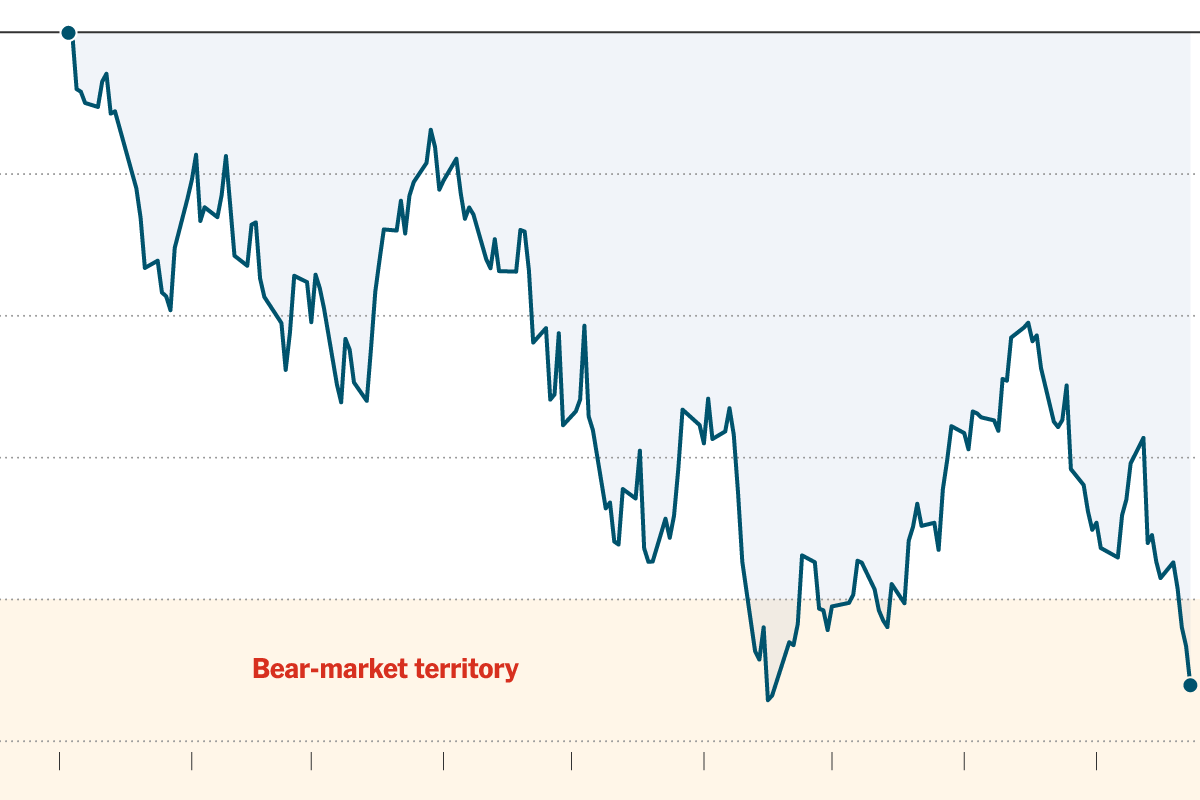

S&P 500 Stock Index

Percentage Change In S&P 500 since its peak on January 3, 2022

S&P 500 Stock Index: Percentage Change Since January 3, 2022 (New York Times)

The Bear Market kicks in with a 20 percent reduction in price.

So, the game has expanded. For most of the summer, the talk was all about the Federal Reserve, what it should do, what it shouldn’t do, what it was doing, and what it wasn’t doing.

Perhaps the biggest question had to do with whether or not Fed Chairman Jay Powell was going to put the pressure on and keep the pressure on, combatting inflation.

Investors felt that in the past, Mr. Powell always seemed to want to err on the side of monetary ease so as to not cause a market drop that would spoil his record.

But, this all took place when Mr. Powell was overseeing the Federal Reserve’s purchase of $120.0 billion in securities per month to add to the Fed’s portfolio.

Mr. Powell wanted to make sure that he was “more than covered” against such an error.

This time around, investors are concerned that Mr. Powell will again want to err on the side of monetary ease, but in this case, he would be working against making monetary policy strong enough to really break the back of inflation.

Mr. Powell made use of his August speech at the Jackson Hole conference on monetary policy to try and convince the market that he was, in fact, very serious about doing what was necessary to stop inflation.

The Fed’s movements since then, including the 75 basis point increase in the Fed’s policy rate of interest this past Wednesday, have helped to convince investors that he was actually “going to do what was necessary.”

Well, Mr. Powell has seemingly convinced U.S. investors that he is going to do the job, but he has also seemingly convinced other central banks around the world that the United States is very serious about fighting inflation.

Note the emphasis that the New York Times article mentioned above:

“The course of action wasn’t surprising to investors.”

That is, investors believed that these central banks had more than enough reason to raise their policy rates.

“Rather, it was the speed with which central banks moved this week that sent them into a frenzy.”

Ryan Detrick, chief market strategist at Carson Group, is quoted as saying,

“It’s a continuation of the worries we’ve had all week that global central banks being led by the Fed are hiking rates sooner than we thought to combat inflation and likely leaving rates higher for longer.”

And, as is well known, the Federal Reserve is expected to raise its policy rate of interest again at its November and December meetings of its Federal Open Market Committee, the group that sets the targets for the Federal Funds rate.

Now, these Federal Reserve changes are more likely to be met with further increases in the policy rates of these other central banks around the world.

Recession?

Highly likely!

Further declines in stock market prices?

Highly likely!

The Future

The present…and the future…are being dominated by what the Federal Reserve…and now, what other central banks around the world…are going to do in the future.

But, the magnitude of the response has changed.

From the earlier concern that the United States economy might drift off into a recession, now we have the prospect of much of the Western world drifting off into recessions.

This changes the picture a little bit.

Do we look into 2023 and see a worldwide recession?

We do hear talk about what is happening to oil prices. We hear talk about what might happen in Ukraine. We hear talk about what might happen in Russia. We hear talk about what might happen in China.

But, when it comes to a discussion about the future of the financial markets, talk of the Fed comes back to dominate the picture.

And, for a change, it appears as if ALL of the central banks seem to be moving in the same direction. To fight inflation.

That’s a pretty clear picture that is developing.

What kind of a picture can we draw from this for the stock market?

Be the first to comment