YinYang

The stock market just doesn’t get it.

Stocks are fighting the Fed with another rally attempt. However, it seems difficult to imagine how any rally can be sustainable given the number of headwinds facing the stock market. These are not only headwinds; but a tremendous force, with the Fed clearly stating it wants tighter financial conditions.

The tighter financial conditions get, the harder it will be for stocks to sustain a meaningful rally. Because ultimately, the Fed needs financial conditions to tighten further to cool the economy and to bring inflation rates down effectively.

Tightening financial conditions also means that risk assets, like stocks, need to fall further. The Fed needs stock prices to drop for financial conditions to become restrictive. Even Minnesota Fed Governor Neel Kashkari went as far as to say he was not thrilled to see the stock market rally following the July FOMC meeting.

“I certainly was not excited to see the stock market rallying after our last Federal Open Market Committee meeting,” he said. “Because I know how committed we all are to getting inflation down. And I somehow think the markets were misunderstanding that.”

He also noted:

“I was actually happy to see how Chair Powell’s Jackson Hole speech was received.”

Of course, this followed a sharp decline in the S&P 500 on the day of the Jackson Hole speech. Proof enough of how serious the Fed is to get inflation to drop and getting the equity market to bend to how the Fed desires.

Not Tight Enough

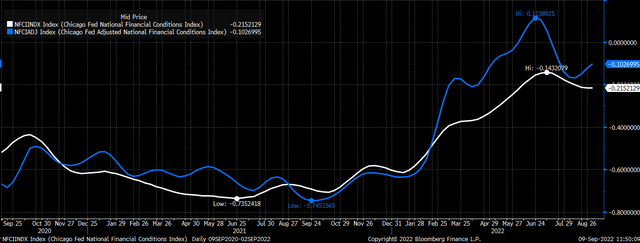

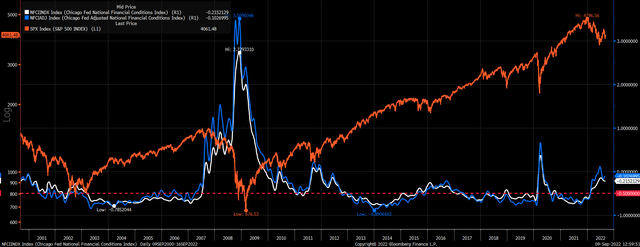

By most measures, financial conditions have tightened some following Jackson Hole, but they have not tightened nearly enough. Conditions today are still easier than at the beginning of July and need to tighten further to become sufficiently restrictive to cool the economy. That would mean that the Chicago Fed’s National Financial Conditions Index and the adjusted National Financial Conditions Index would need to rise above 0. Currently, both indexes are below zero, which suggests financial conditions are accommodative to expanding the economy.

Financial conditions are tied to stock prices; when conditions tighten, stock prices fall, and when conditions ease, stock prices rise. It’s hard to pinpoint the exact spot where stocks start to struggle or show signs of increasing volatility, but typically once financial conditions have crossed above -0.50 on the Chicago Fed Index, that has been when stock struggles really begin.

With the Fed’s desire to contain inflation and the need for financial conditions to tighten, the next leg of tightening conditions should result in the next shoe to drop in equity prices. These conditions are the overriding factor determining how the market trades from here.

Not Cheap

On top of this, considering where rates are, stocks are expensive. The NASDAQ 100 earnings yield minus the 10-Yr real yield hasn’t been this low in more than a decade. That is because the real yield has risen dramatically, a sign of tightening financial conditions. The NASDAQ hasn’t fallen enough to offset the rise in real yield and tighter financial conditions.

The higher rates rise, the tighter financial conditions get, the greater the odds the stock market makes a new low. The equity market is facing a tremendous number of headwinds that are not favorable to stocks going significantly higher or making new highs anytime soon. The Fed included.

Be the first to comment