whyframestudio/iStock via Getty Images

Latest inflation news:

In Europe, a new high was hit for the inflation rate for the eleventh week in a row bringing the rate of inflation in the Eurozone up to 10.0 percent, year-over-year.

In the United States, the favorite price index of the Federal Reserve System, the PCE price index, came in at 6.2 percent, year-over-year, down from 6.4 percent in July, but higher than the “experts” expected.

In England, the inflation rate came in at 7.0 percent, the highest level reached in the last 30 years.

So, what are central banks supposed to do?

The answer to this question from the investment community seems to be: central banks must tighten up their monetary policy and must stick with this tighter policy until the back of inflation is broken.

In the United States, the view is that the Federal Reserve is starting off the battle as it promised.

Translated into the stock market?

Stock prices must go down.

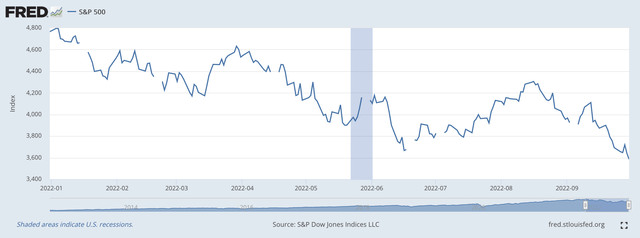

The Standard & Poor’s 500 stock index achieved its third straight weekly fall and its third straight quarterly drop.

The year-to-date loss is almost 25 percent, putting stocks in a “bear market.”

S&P 500 Stock Index (Federal Reserve)

The last time the market faced this downward pressure was in 2009 during the Great Recession.

The Federal Reserve Is Just Beginning

And, the story is that this is just the beginning of the Fed’s effort to tighten up on monetary policy.

But, the inflation scenario seems to be a global phenomenon, which means that the Bank of England, the European Central Bank, and others will also be joining the fight to contain rising prices.

In fact, this fact is a part of last week’s problem in England.

A new prime minister, last week, introduced her initial economic program to Parliament and it immediately got “shot down” with major financial market disruptions. The program was “too stimulative.”

The program would only exacerbate the inflationary situation in England.

so, worldwide, this is a very sensitive issue.

But, the Federal Reserve is just getting started.

The Fed is expected to raise its policy rate of interest…by 75 basis points…at its November meeting of the Federal Open Market Committee, and then raise the rate again at the December meeting.

This could end up with the effective Federal Funds rate exceeding 4.00 percent by the end of the year.

The Fed is also on a program to remove $95 billion in securities from its securities’ portfolio out until 2024. The reduction will be in excess of $1.0 trillion!

Questions still remain about whether the Fed will stay on this path and carry the battle out this long.

But, there are also other questions about whether or not this program is sufficient to reduce the securities portfolio sufficiently to actually contribute to constraining inflation given that the Fed has added more than $5.0 trillion to its securities portfolio since the start of the Covid-19 pandemic in early 2020.

So a lot of uncertainty still remains about what the Fed will ultimately end up doing.

For now, however, it has begun its tightening program and the investment community is reacting in a way that is consistent with the Fed’s efforts to contain inflation.

Surge In Bond Rates

In another area, we see that investors have been jolted into the current, uncertain environment.

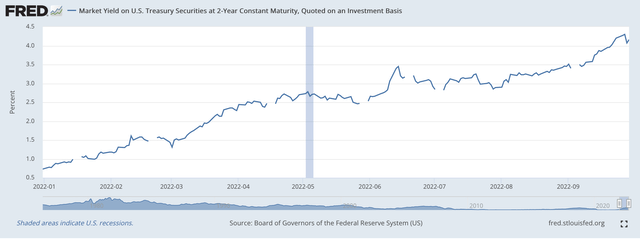

The yield on the 2-year U.S. Treasury note has risen dramatically in recent times.

Market Yield on 2-year U.S. Treasury note (Federal Reserve)

On December 31, 2021, the yield on the 2-year constant maturity U.S. Treasury note was 0.73 percent.

On September 26, 2022, the yield had risen to 4.27 percent.

This marks quite a rise.

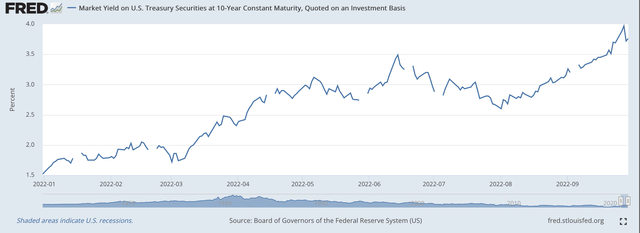

One additional point: the yield on the 10-year constant maturity U.S. Treasury note rose from 1.52 percent on December 31, 2021, to 3.89 percent on September 26.

Market Yield on 10-year U.S. Treasury Note (Federal Reserve)

The yield curve has moved from a positive slope at the end of 2021 to a negative slope at the end of September.

The interpretation of this?

Investors have now built into the term structure of interest rates the expectation that the U.S. economy will experience a recession.

In fact, some people believe that we are already in a recession.

This news is certainly not one to support a rise in stock prices.

Then There Is The Value Of The Dollar

One more thing.

The Federal Reserve has been the leader of all the central banks of the developed world in moving out to fight inflation.

This has resulted in the value of the U.S. dollar gaining a strength it has not experienced in two decades or more.

The dollar is now below parity with the Euro. It now costs around 98 cents in U.S. currency to acquire one Euro. Last week the cost of the Euro was as low as 95 cents.

In terms of the British pound, the cost of one pound is now around $1.11 and has been as low as $1.07. Will it reach parity?

Certainly, the higher U.S. interest rates have helped to improve the relative strength of the dollar. The U.S. dollar is now at its strongest level in two decades.

The Future

Laird Brainard, Vice-Chair of the Board of Governors of the Federal Reserve System, reiterated on Friday, September 30, 2022, that the Fed has got to “stay the course.”

“It will take time for the full effect of tighter financial conditions to work through different sectors and to bring inflation down. Monetary policy will need to be restrictive for some time to have confidence that inflation is moving back to target. For these reasons, we are committed to avoiding pulling back prematurely. We also recognize that risks may become more two-sided at some point. Uncertainty is currently high, and there are a range of estimates around the appropriate destination of the target range for the cycle. Proceeding deliberately and in a data-dependent manner will enable us to learn how economic activity and inflation are adjusting to the cumulative tightening and to update our assessments of the level of the policy rate that will need to be maintained for some time to bring inflation back to 2 percent.”

Are you investors listening?

Be the first to comment