Justin Sullivan

This is the OASIS. It’s a place where the limits of reality are your own imagination. You can do anything, go anywhere.

(Wade Watts — Ready Player One, 2018)

From the movie Ready Player One, the OASIS (Ontologically Anthropocentric Sensory Immersive Simulation) is a massive multiplayer online simulation game that takes place in a virtual reality world, or as we call it, the metaverse.

I was skeptical of the metaverse — I’m not a gamer nor a tech enthusiast. But when I watched this movie, it gave me a perspective of what the future of gaming may look like.

Then one day, I tried Meta’s VR headset — it completely changed my perception of virtual reality.

In this article, I dive deep into Meta’s (NASDAQ:META) business, financials, opportunities, challenges, and more. Enjoy!

Investment Thesis

Today, investors get to buy Meta’s advertising business on the cheap. In addition, they get to piggyback Meta’s emerging virtual reality unit, which could be a massive opportunity for the company if executed well.

Shares of Meta are down big. Macro headwinds, rising competition, iOS changes, weakening profitability, and metaverse uncertainty are to blame here.

But these headwinds are temporary — it’s only a matter of time before things change for the better.

And when they do, investors would’ve missed most of the gains.

As such, it pays to be a contrarian today.

Value Proposition

In 2003, Harvard sophomore Mark Zuckerberg launched a website called Facemash. He wrote a piece of software that hacked into the university’s servers, downloading and uploading photos of students — without consent — into his newly-built website. In turn, Facemash visitors could see two student photos side-by-side with the prompt “Who’s Hotter? Click to Choose.”

Word of the new website spread like wildfire as people began rating who’s hot and who’s not. This caught the attention of the Harvard administration who, a few days later, shut down Facemash. Zuckerberg, on the other hand, faced charges for hacking campus security and violating individual privacy. He also faced expulsion.

Fortunately, all charges against him were dropped.

Not long later, Zuckerberg launched Facebook on February 2004.

Facebook was allegedly an idea stolen from three Harvard seniors who wanted to launch a social networking website called HarvardConnection. A lawsuit was filed against Zuckerberg. But again, he dodged another bullet and eventually walked off scot-free.

To grow the website, Zuckerberg turned to fellow students Eduardo Saverin, Dustin Moskovitz, Andrew McCollum, and Chris Hughes. The 5 co-founders expanded the site to additional universities, to employees, to other countries, and eventually made the social networking website available to anyone 13 years or older with a valid email address.

By end of 2004, Facebook had 1 million active users. By 2010, the number blew up to 500 million, becoming the world’s largest social networking service.

In essence, Facebook enables people to share life’s moments, connect with others, and build communities. It was intended for social networking purposes but has now grown into a platform for news, shopping, dating, and more.

Facebook

In 2011, the company launched Messenger, a simple, instant messaging app and platform for consumers and businesses. Today, users can also make audio and video calls.

The following year, the company acquired photo-sharing startup Instagram for $1 billion — a hefty amount for a company with only 13 employees. However, Instagram, arguably, turned out to be the company’s most successful acquisition to date.

With Instagram, users can share photos and videos through different formats: regular posts through Feed; temporary content through Stories; short-form videos through Reels; and livestream through Live. Users can also chat and shop through the app.

Not long after the Instagram acquisition, Facebook went public in May 2012.

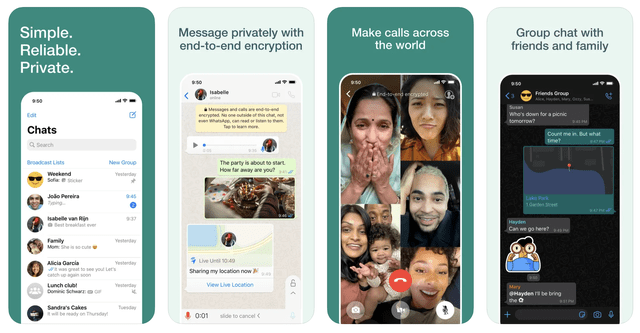

Two years later, Facebook made another acquisition — a blockbuster one to say the least. In 2014, WhatsApp joined the Facebook family… at a price tag of $19 billion.

WhatsApp is a simple and secure messaging app that allows people to communicate through the internet, rather than through a traditional cellphone messaging platform and network.

Facebook, Instagram, Messenger, and WhatsApp make up Meta’s Family of Apps, or FoA. These are the social media/communication platforms that billions of everyday consumers have come to love and appreciate.

These apps are also mediums for businesses, both small and large, to grow their communities. In simple terms, FoA provides companies with the:

- platform to showcase content outside of their native websites.

- communication tools to engage with consumers.

- ad space to reach relevant customers.

- opportunity to grow online sales.

Meta is also moving beyond 2D screens toward immersive experiences provided by augmented reality [AR] and virtual reality [VR].

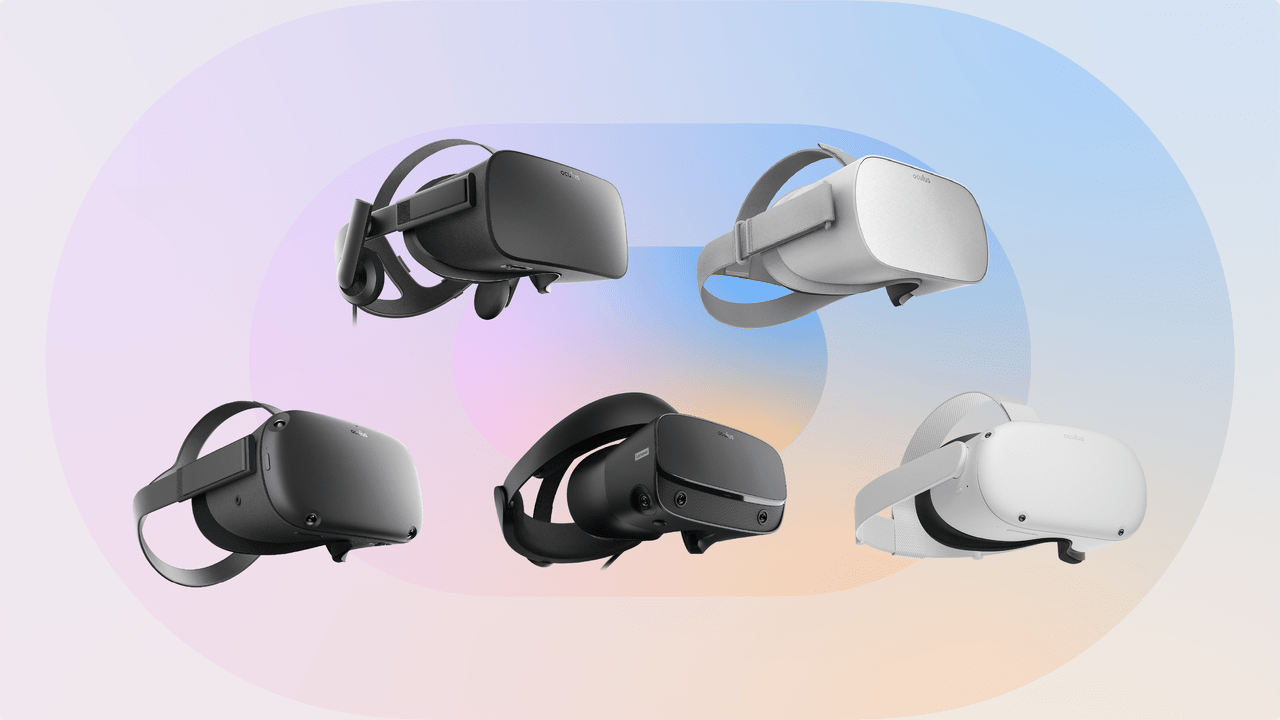

A month after its WhatsApp acquisition, Facebook acquired Oculus — a leader in VR technology and headsets — for $2 billion. Zuckerberg believes that VR technology will be important in next-generation social and communications platforms.

At that time (2014), the acquisition left many scratching their heads, wondering why would a software-enabled social media ad giant acquire a hardware company that seemed to be completely unrelated to FoA.

Meta

Fast forward to 2022, Wall St and Main St are starting to see what Zuckerberg sees. In recent years, it’s normal to hear people conversing about AR, VR, and the metaverse. According to Investopedia:

The metaverse is a digital reality that combines aspects of social media, online gaming, augmented reality, virtual reality, and cryptocurrencies to allow users to interact virtually.

Not surprisingly, Meta is one of the only few companies making bold investments into the space, offering consumers cutting-edge VR hardware, software, and content through their Reality Labs [RL] division.

Without going too much into detail, RL consists of three device groups:

- Virtual Reality: people can enjoy 3D games like Beat Saber, powered by Meta Quest headsets, which start from $399 a piece. Meta is also working on Horizon Worlds, a shared virtual 3D space for all, and Horizon Workrooms, a shared virtual office for workers to collaborate and interact with one another.

Meta Horizon Workrooms

- Smart Glasses: Meta has partnered with Ray-Ban to develop smart glasses with features such as built-in cameras, open-ear audio, and social sharing capabilities, to name a few. Though VR features are still limited, these smart glasses are a less intimidating option than the bulky VR headsets offered by Meta.

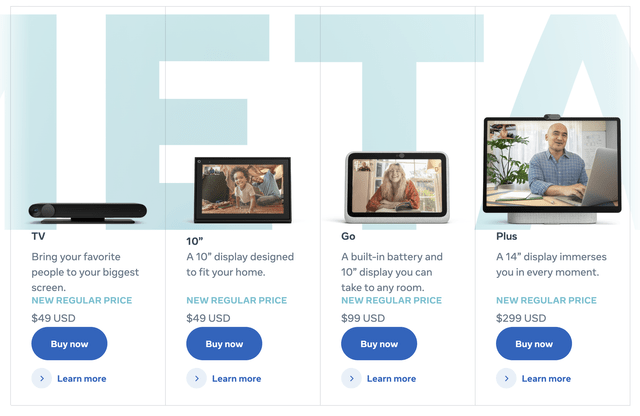

- Meta Portal: These are a family of video calling devices with built-in virtual assistant technology, smart cameras, and compatibility with apps like Zoom (ZM), Messenger, and WhatsApp. These devices are probably the ones that left me with the most question marks as it seems to be a redundant component of Meta’s entire product line. Plus, consumers are better off buying an iPad, which offers more functionality.

The concepts of AR, VR, and the metaverse are still new. But they’re gaining more acceptance and adoption by the day, as envisioned by Zuckerberg. At the same time, they’re still speculations — we don’t know whether the metaverse is a thing of the future or just a fad.

But one thing’s for sure: Zuckerberg is going all in on this venture, as stated by the company’s updated mission statement:

Our mission is to give people the power to build community and bring the world closer together.

All of our products, including our apps, share the vision of helping to bring the metaverse to life.

The company went as far as changing its company name and ticker symbol.

Ultimately, Meta’s RL venture could redefine the way people work, play, and interact with one another, through virtual worlds. Combined with Meta’s FoA, we could see a whole new social networking experience come to fruition in the coming years.

Market Opportunity

Meta operates in two separate industries: advertising and the metaverse. I’ll address the market opportunity for each, starting with the ad market.

Advertising

I believe there are a few levers that drive the social media ad industry:

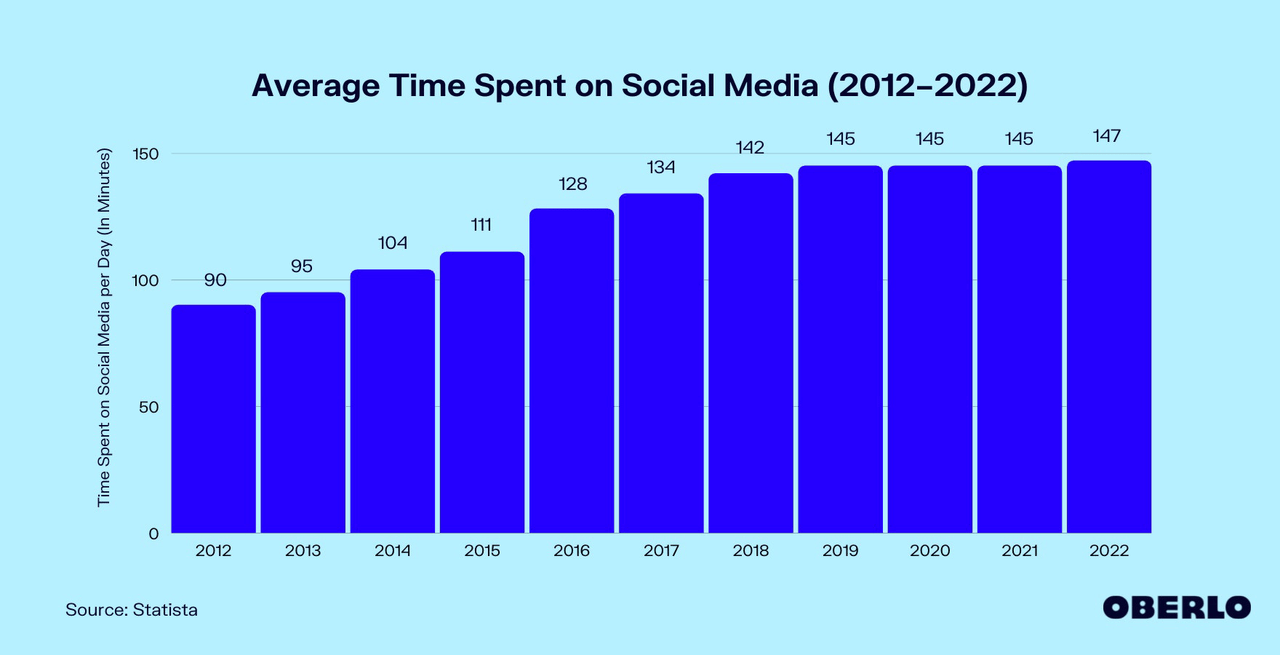

- Average time spent on social media platforms.

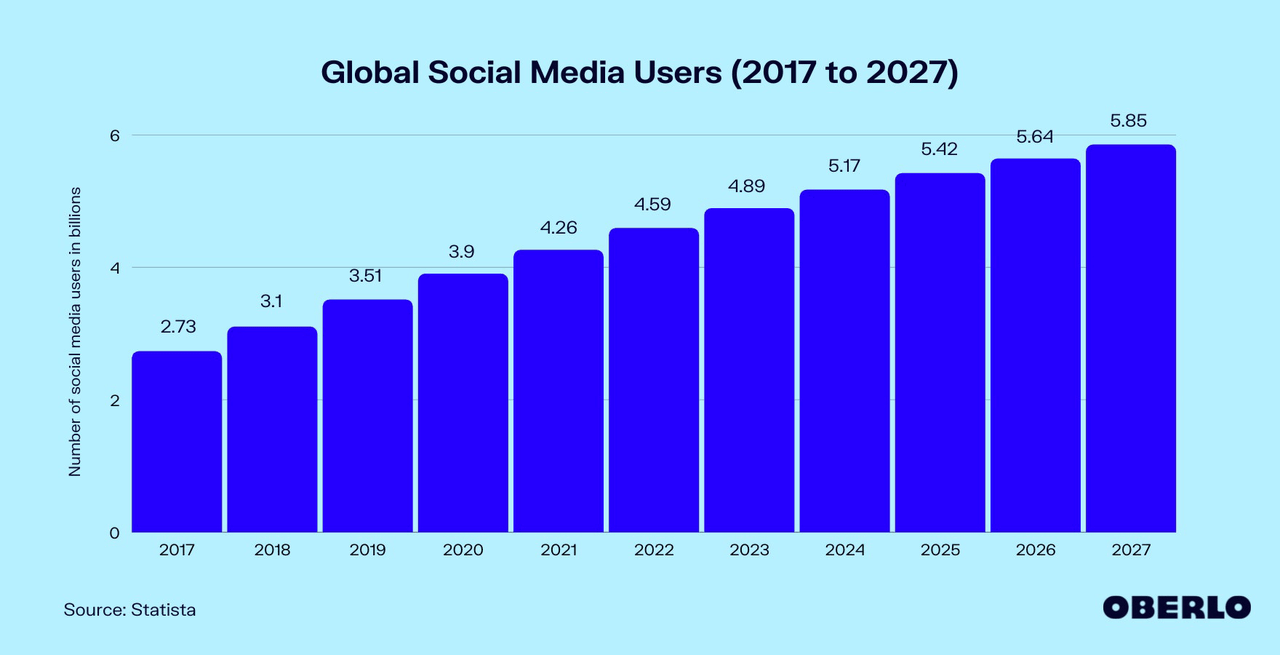

- The number of social media users.

- E-commerce market share.

As we all know, the early days of the pandemic led to governments all over the world exercising social distancing and stay-at-home policies. In addition, corporations globally passed work-from-home policies, leaving billions of people stuck at home. As such, many people turned to the internet to alleviate their boredom. This includes scrolling through social media such as Facebook, Instagram, and TikTok. As shown by Oberlo, the Average Time Spent on Social Media was 145+ minutes in 2020 and beyond.

Oberlo

While the figure seemed to have plateaued, we can see that Global Social Media Users continued to grow, and are expected to reach 4.59 billion by the end of 2022. So, on a gross basis, Time Spent on Social Media platforms actually increased.

Oberlo

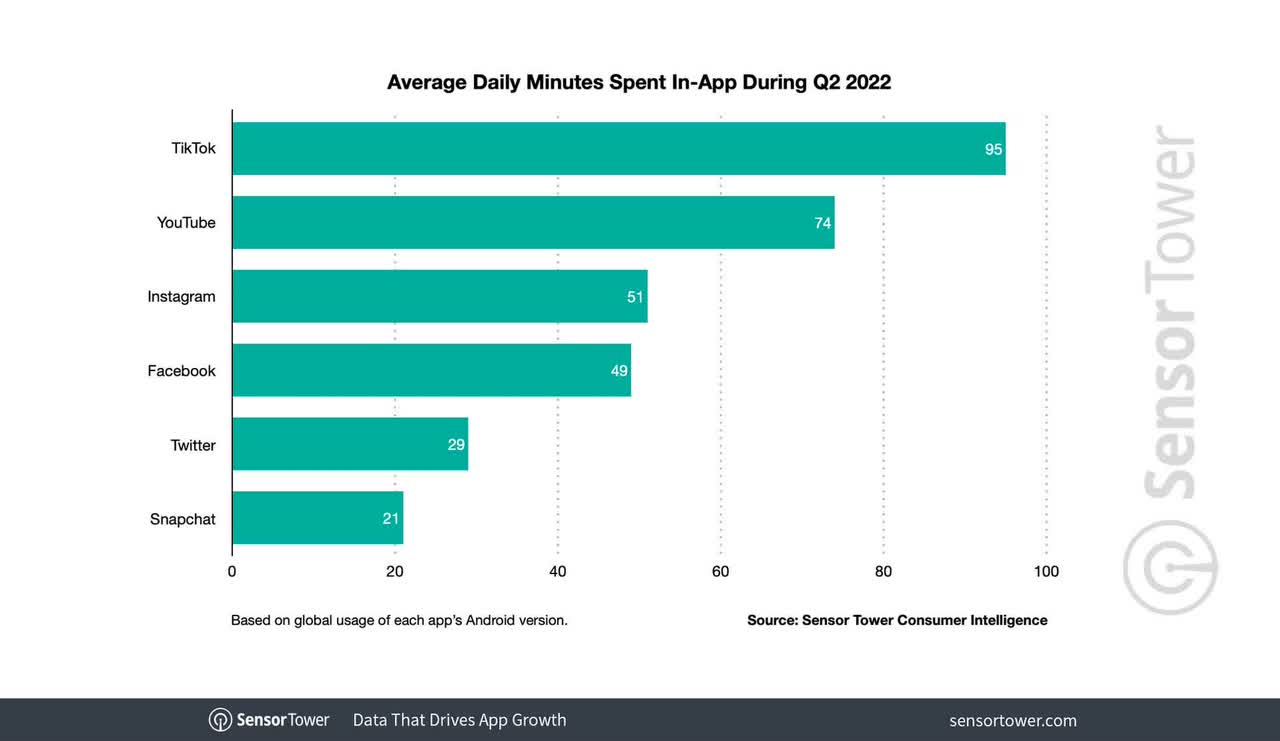

As more users spend more time online, they naturally spend more money online. According to Insider Intelligence, Retail Ecommerce Sales Worldwide grew by 26% in 2020, an acceleration of 21% in 2019, to $4.2 trillion. That number is expected to continue its growth trajectory, reaching $8.1 trillion by 2026. Robust growth in the Ecommerce sector is a prime reason why companies globally are allocating more budget for digital ad marketing, including ads on social media platforms. The Statista graph below shows Social Media Advertising Spending Worldwide over the years, and we can see that it has been growing rapidly.

As long as these three major trends persist, they should be a tailwind for social media ad platforms like TikTok and Instagram. And since Meta is predominantly an ad business, these trends should benefit Meta in the long run.

That’s the boring, old ad industry.

Now let’s turn to the more exciting industry: the metaverse.

Metaverse

There are several key players that would eventually contribute to the growth of the metaverse:

- Hardware: In order for people to immerse themselves into the metaverse, they need VR hardware, and presently, the VR headset offered by Meta Quest is the most readily available. Chip manufacturers also play a role in this category as it requires exceptional processing power to achieve optimal experience — companies like Nvidia (NVDA) and AMD (AMD) come to mind. Data center REITs — such as Digital Realty Trust (DLR) and Equinix (EQIX) — also play a crucial role as data centers are required to support the growth of the metaverse. Even 3D space capture and virtual touring companies like Matterport (MTTR) could be a part of the metaverse as physical real estate turns increasingly virtual.

- Software: There needs to be a software stack for developers to build and support 3D worlds, games, spaces, items, etc. One particular company is Unity Software (U).

- Virtual Real Estate: Unlike the real world, the metaverse could be limitless. But just like all real estate, location, location, location matters — the company that can provide the most desirable shared virtual space should prevail. Meta is already working on this with the launch of Horizon Worlds. Another prominent player in the space is Roblox (RBLX) which already has companies like Walmart (WMT) and Gucci buying its digital real estate. The more users and businesses populate a particular virtual space, the more valuable that real estate gets, thus allowing the virtual landlord to charge higher “rent”.

Walmart

- Digital Currency: Although the current crypto winter might be scaring some consumers away, we all know that crypto is gaining more acceptance and adoption by the day — crypto could be the currency of choice for transactions in the metaverse. Crypto exchanges like Binance and Coinbase (COIN) could provide the infrastructure to process these transactions.

- Digital Items: Buying and selling items in the virtual world is already common, especially in blockbuster games such as Fortnite and Warcraft. In the metaverse, participants can buy and sell NFTs — NFT marketplaces like Opensea could provide the infrastructure for people to exchange these digital items.

So these are several investment vehicles investors can partake in the speculative growth of the metaverse. Meta seems to be focusing on the software and virtual real estate components of the metaverse, though they may expand to other areas to offer consumers a full ecosystem experience.

Nevertheless, the metaverse is still a nascent category so it’s incredibly difficult to predict the trajectory, let alone quantify the potential size, of the industry. But here are a few estimates by several industry analysts:

- $825 billion by 2030 (Verified Market Research)

- $679 billion by 2030 (Grand View Research)

- $1,607 billion by 2030 (Precedence Research)

Suffice to say, market research firms expect the metaverse to make up a larger part of our lives over time.

If Meta executes well on its RL venture, we could see a metaverse giant in the making. Subsequently, Meta could start running ads in the metaverse, which becomes yet another growth catalyst for its ad segment.

Business Model

Meta operates two segments: FoA and RL.

Family of Apps

- Advertising Revenue: Meta generates revenue by selling ad placements. Marketers pay for ad products based on the number of impressions or actions (such as clicks, conversion, etc.). Revenue is recognized once the impressions are delivered or when a user takes the action specified in the contract.

- Other Revenue: This consists of net fees received from developers and Revenue from other sources.

Reality Labs

Meta generates RL Revenue from the sale of hardware products such as Meta Quest and Meta Portal, as well as other related software and content.

For both segments, Revenue is typically the strongest in Q4 due to strong demand during the holiday season.

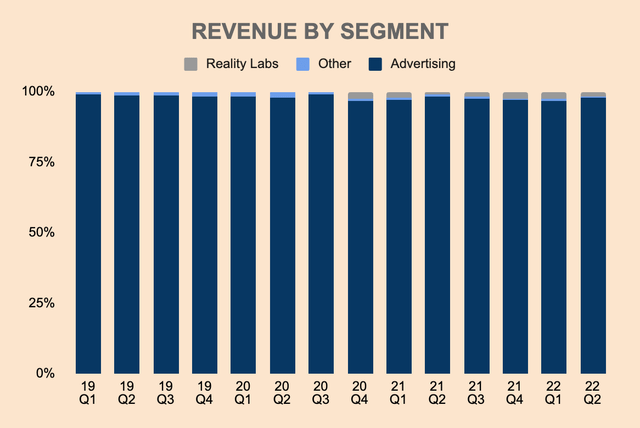

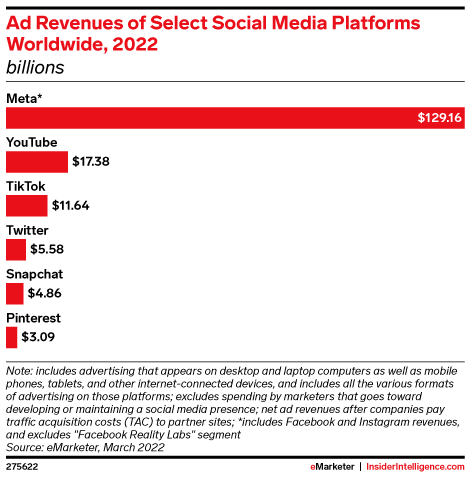

As shown below, Meta’s Advertising component still makes up the bulk of the entire business, at 98% of Total Revenue.

META Investor Relations and Author’s Analysis

Growth

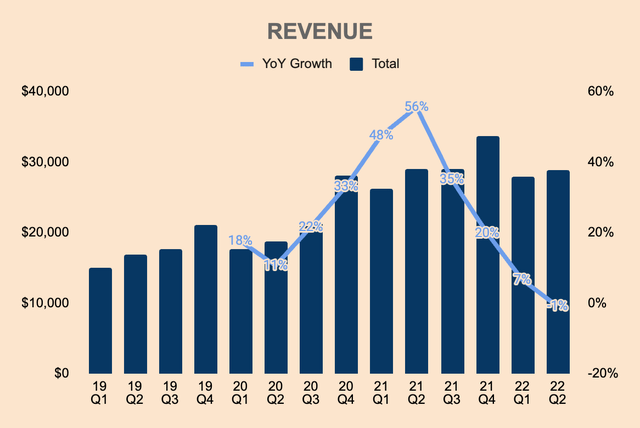

For the first time in its history, Meta reported a YoY decline in Revenue in Q2, which dropped by 1% to $28.8 billion. In the chart below, we can see how Revenue growth rates accelerated during the early days of the pandemic, peaking at 56% in 21Q2. Since then, Revenue decelerated substantially due to a number of headwinds which we’ll discuss further below. That said, the sharp drop in growth has led many to conclude that Meta’s growth story is finally over.

META Investor Relations and Author’s Analysis

During the Q2 earnings call, management highlighted a few headwinds to Revenue:

- Currency Exchange Pressure: Strong US dollar is putting pressure on Meta’s business outside of the US. On a constant currency basis, Revenue would have grown by 3% YoY.

- Apple iOS Changes: Management estimated a $10 billion impact for the year due to Apple’s new privacy policy, which limits in-app data tracking.

- Reels Growth: Reels is still in its early stages and therefore, has not been monetized at the same rate as Feed or Stories. As users turn their attention to short-form video content, higher-monetizing surfaces naturally take a hit. But management’s priority is to drive engagement and user growth — that means sacrificing near-term topline growth.

- Macro Uncertainty: Amidst a challenging macro environment, marketers are lowering ad spending.

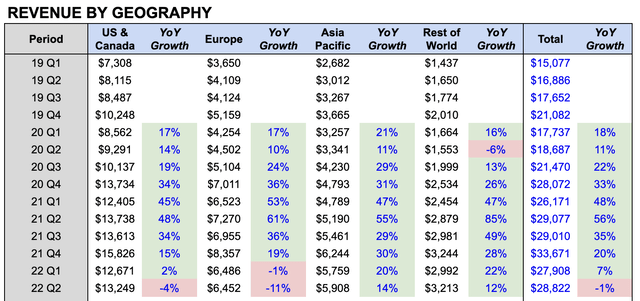

The table below shows Revenue by geography. We can see that North America and Europe — Meta’s most mature markets — saw YoY declines in Q2. The drop in Europe is also due to the Russia-Ukraine war. On the other hand, Asia Pacific and Rest of World are still experiencing growth of 14% and 12%, respectively, primarily due to strong growth in click-to-messaging ads.

META Investor Relations and Author’s Analysis

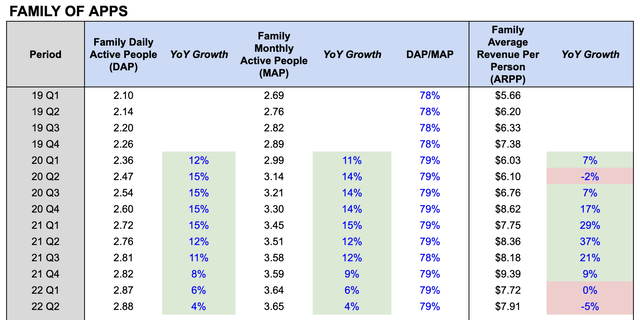

The total number of ad impressions in Q2 increased 15% YoY. The increase in ad impressions was due to a higher number of ads displayed across a larger user base. As shown below, Family Daily Active People [DAP] and Family Monthly Active People [MAP] both grew by 4% in Q2, to 2.88 billion and 3.65 billion, respectively.

On the other side, the average price per ad dropped by 14% YoY as a result of softening advertiser demand, a mix shift towards lower monetizing services, and currency pressures. As such Family Average Revenue Per Person [ARPP] dropped 5% YoY, to $7.91.

META Investor Relations and Author’s Analysis

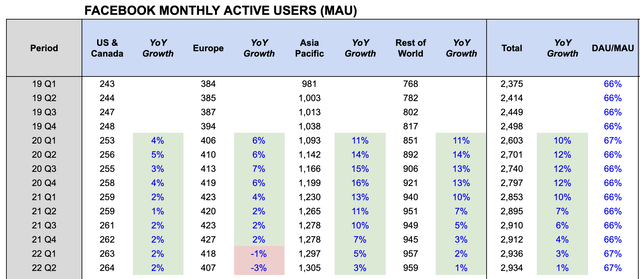

Facebook Monthly Active Users [MAU] grew by 1% YoY. This is in spite of the loss of users in Russia and Ukraine, as seen by a 3% drop in Europe. Nonetheless, we could potentially see the first YoY drop in Facebook MAU in Q3 or Q4 this year.

META Investor Relations and Author’s Analysis

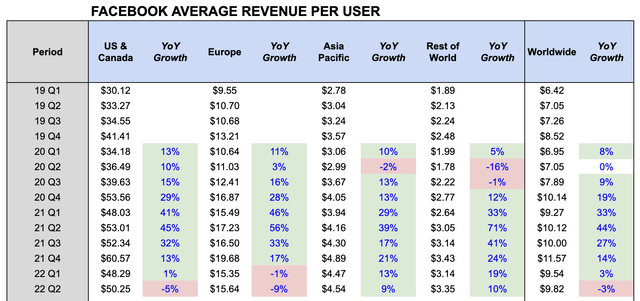

For Facebook Average Revenue Per User [ARPU], observe how large of a variance there is on a geographic basis. For example, North America has an ARPU of $50.25 while Asia has an ARPU of $4.54. I brought this up because there lies an opportunity for Meta to increase monetization rates in regions outside of North America. That could be a significant Revenue driver for Meta.

That aside, Worldwide ARPU decreased 3% YoY to $9.82 as global advertising demand weakens.

META Investor Relations and Author’s Analysis

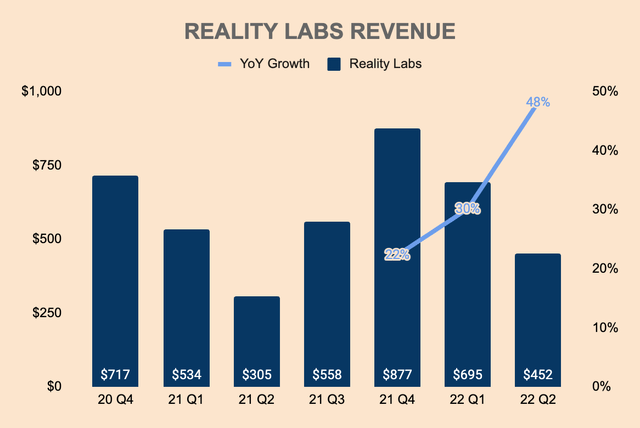

We’ve covered the advertising side of Meta’s business. As for RL, Revenue in the segment accelerated in Q2, growing by 48% YoY to $452 million. All eyes are on the holiday quarters to see if demand remains robust. The recent price increases in Meta Quest 2 (that took effect on August 1st) could also be a Revenue booster for the segment.

META Investor Relations and Author’s Analysis

To summarize, Meta’s advertising unit is facing headwinds as the company navigates through a tough macro environment. Growth is decelerating as advertising demand softens, which got many investors scared about the near-term outlook of the company. On the bright side, it is encouraging to see momentum in the RL segment, though it’s still a very small part of Meta’s overall business.

Profitability

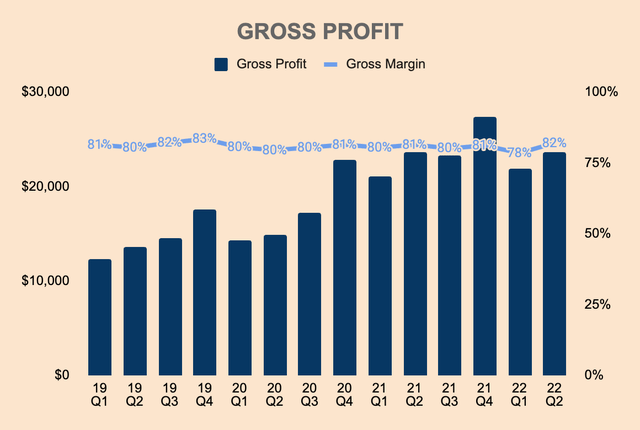

Q2 Gross Profit was $23.6 billion, unchanged from last year. Meta boasts a high Gross Margin of 82% in the latest quarter. Gross Margin has been relatively stable at 80%+, showing high, consistent earnings potential.

META Investor Relations and Author’s Analysis

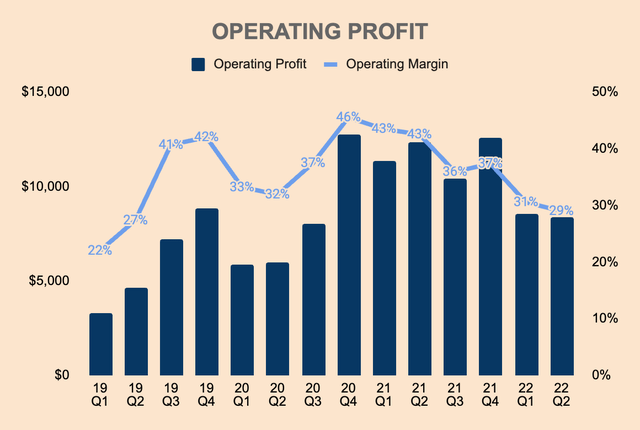

Operating Profit, on the other hand, is seeing some pressure, with Operating Margin trending downwards over the last few quarters. Overhiring is one reason to blame here, which is why the company has recently announced layoffs in an attempt to reduce costs.

META Investor Relations and Author’s Analysis

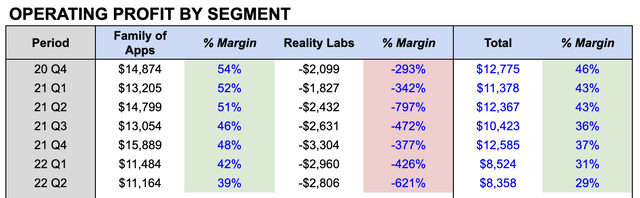

Continued investments in product innovation, particularly in the RL segment, are also pressuring margins. The table below breaks down Operating Profit by segment — note that Meta began reporting RL separately starting from 20Q4.

As you can see, FoA Operating Margin, though in a downtrend, is still high at 39%. On the flip side, the RL segment is still chronically unprofitable, with high, negative triple-digit Operating Margins. But fear not, the income-producing FoA business more than covers the cash burn from its RL venture.

META Investor Relations and Author’s Analysis

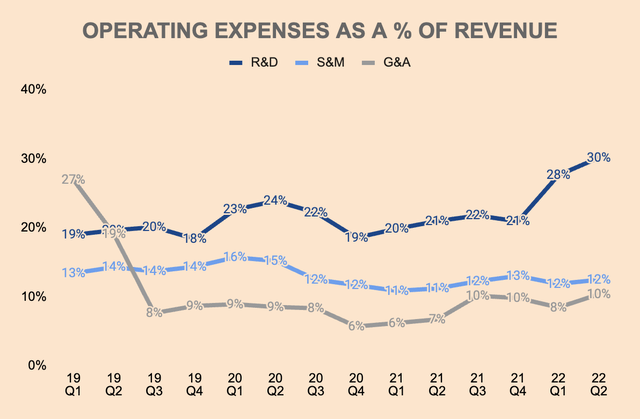

Management clearly stated that they’re investing heavily in the metaverse, which explained why R&D remains the highest component of Operating Expenses, as shown below. The metaverse is Meta’s next big bet, as management believes that it would eventually “unlock hundreds of billions of dollars, if not trillions, over time.”

This is obviously a very expensive undertaking over the next several years. But as the metaverse becomes more important in every part of how we live from our social platforms and entertainment to work and education and commerce, I’m confident that we’re going to be glad that we played an important role in building this.

(CEO Mark Zuckerberg — Q2 Earnings Call)

It’s only a matter of time before Reality Labs takes off.

META Investor Relations and Author’s Analysis

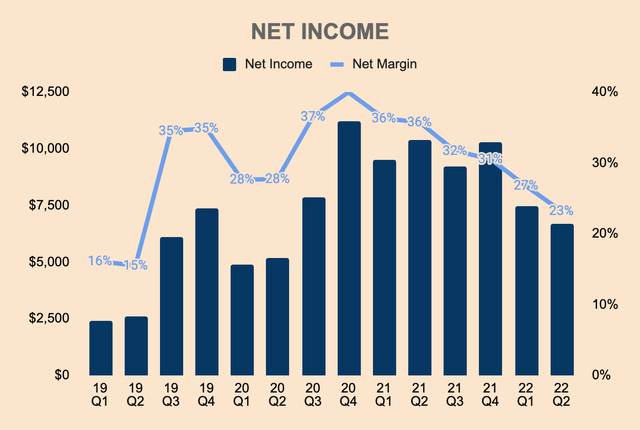

Despite ongoing RL investments and macro headwinds, Meta is still a highly profitable business with Net Income Margins of 20%+.

META Investor Relations and Author’s Analysis

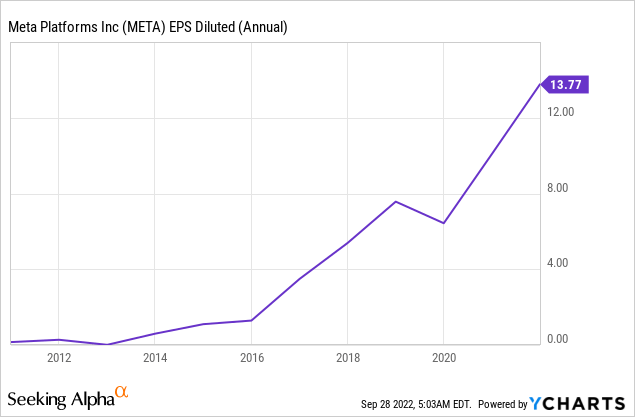

More importantly, Meta has grown Earnings Per Share from a mere $0.01 per share in 2012 to $13.77 per share in 2021.

Just like many businesses, Meta is facing a gloomy economic backdrop, causing profitability to deteriorate. Furthermore, investments in the metaverse — which may not turn out as big and bright as Zuckerberg envisioned — are also pressuring the company’s bottom line.

In essence, Meta is sacrificing short-term profitability for long-term growth.

But zooming out, Meta did not disappoint — it is a high-quality business with strong fundamentals and improving earnings per share, characteristics that have historically produced market-beating shareholder value.

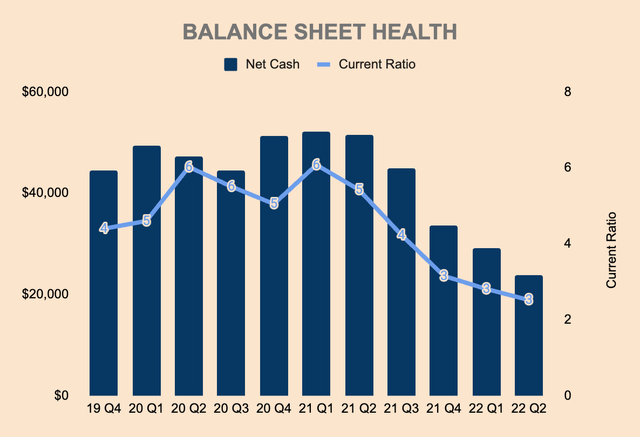

Financial Health

Meta has a fortress balance sheet with $40.5 billion of Cash and Short-term Investments. Total Debt stands at about $16.7 billion, which brings its Net Cash position to $23.8 billion. Its balance sheet is also quite liquid, with a Current Ratio of about 3x.

META Investor Relations and Author’s Analysis

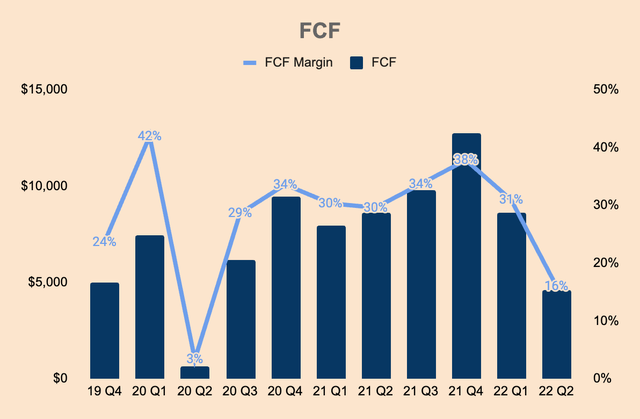

Meta is also Free Cash Flow [FCF] positive. FCF for the last 12 months was $35.8 billion at an FCF margin of 30%.

The combination of high FCF, high Net Cash position, and plummeting valuation are why the company has been buying back shares aggressively. In 2021 alone, Meta bought back $50.1 billion worth of its own shares. As of Q2, Meta had $24.3 billion available and authorized for repurchases. With shares falling, I expect big buybacks in the coming quarters.

META Investor Relations and Author’s Analysis

All in all, Meta has a strong balance sheet. In times like these, profitability and financial health are crucial as the company sail through rough waters. It also means an opportunity for Meta to reinvest into growth and buyback shares while smaller, unprofitable competitors struggle to make ends meet.

Outlook

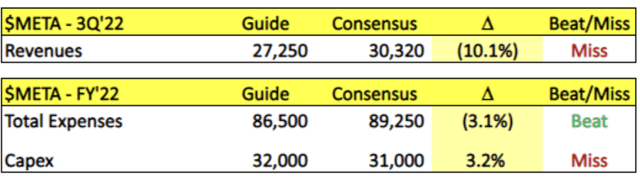

Management provided the following guidance:

- Q3 Revenue: $26 to $28.5 billion. The company anticipates continued weakness in the advertising market as well as a 6% headwind from currency exchange rates.

- Q3 RL Revenue: lower than Q2 RL Revenue.

- FY2022 Expenses: $85 to $88 billion, lower than its previous estimate of $87 to $92 billion as the company reduces hiring and growth expenses.

- FY2022 Capital Expenditures: $30 to $34 billion.

My take on the guidance is a mixed bag. For one, Meta expects a 6% YoY decline in Q3 Revenue (midpoint guidance), an acceleration from Q2’s 1% decline. It’s also 10% lower than analyst estimates, according to Consensus Gurus.

RL Revenue is also expected to drop QoQ — concerning as it also meant a YoY decline in Meta’s “fast-growing” segment.

On the bright side, Total Expenses are expected to come down so the loss of Revenue has less of an impact on the company’s bottom line.

The near-term outlook looks dismal due to macro uncertainty and tough YoY comps.

But don’t worry, economic pain does not go on forever — it’s only a matter of time before macro conditions improve.

As such, we should see Meta jumping back into growth mode in 2023 and beyond — analysts estimate 10%+ growth in the next three years.

Competitive Moats

Based on my research and analysis, I identified 4 competitive moats for Meta: technology, scale, network effects, and switching costs.

Technology

Meta pioneered social networking through Facebook. Over the past two decades, Facebook faced fierce competition from the likes of Myspace, Friendster, Snapchat (SNAP), Vine, Twitter (TWTR), TikTok, and others, but Facebook still reigned supreme. Many people think that Facebook is dead, but its latest quarter’s results said otherwise: Facebook added 39 million MAU YoY.

In addition, Meta made very strategic acquisitions including Instagram and Whatsapp which further solidifies the company’s technological prowess.

Even in the face of changing consumer preferences and digital trends, Meta was able to adapt quickly. Here are some examples:

- Facebook was initially built for desktops but it quickly developed a mobile application as smartphone adoption surged.

- Instagram launched Stories to compete with Snap.

- Instagram launched Reels to compete with TikTok.

That speaks volumes about Meta’s technology.

Not just for consumers, but for marketers as well. Meta’s vast ad formats, high engagement, and data algorithm make it the most efficient platform for social media advertising, which is why companies all over the world turn to Meta, first and foremost, to promote their products and services.

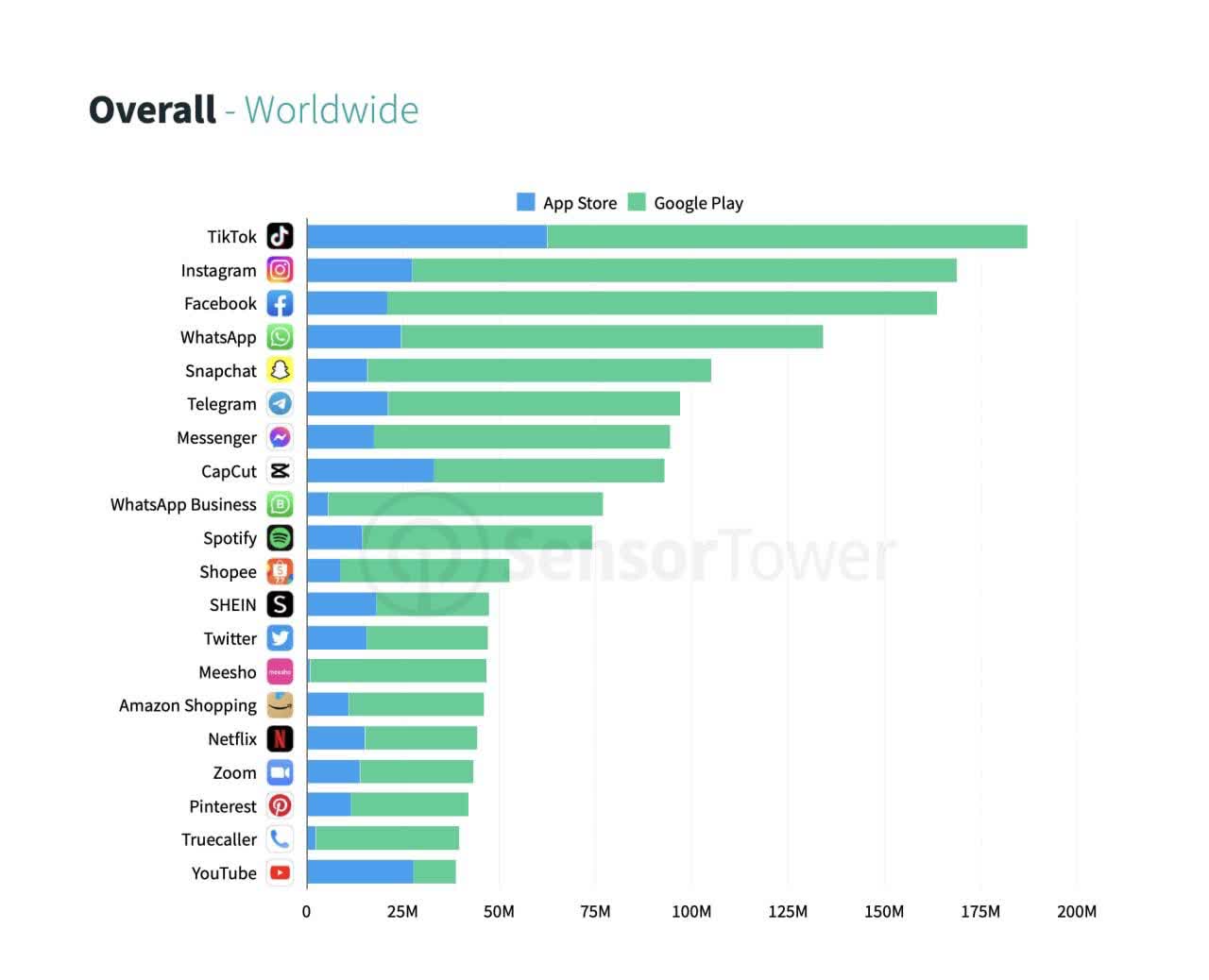

Insider Intelligence

Meta also leads the charge in VR hardware through its acquisition of Oculus in 2014. Billions of dollars have been invested into its metaverse venture, which puts Meta and Oculus far ahead of emerging players.

Scale

As standalone apps, only TikTok had more downloads than any of Meta’s apps, according to SensorTower. However, when combined together, Meta’s FoA had the most downloads globally. And these are just downloads in a given period (Q2 of 2022 to be precise).

SensorTower

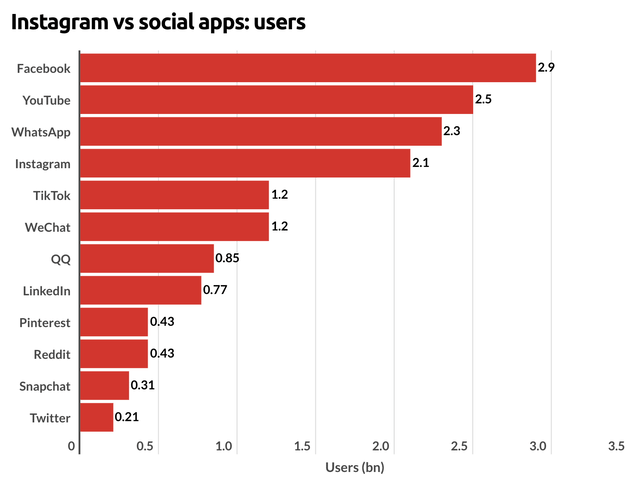

If we take a look at the total number of users, we can see that Facebook is still sitting at the number one spot, followed by WhatsApp and Instagram in third and fourth place, respectively. Without a doubt, Meta’s FoA ecosystem is the largest in the social media realm.

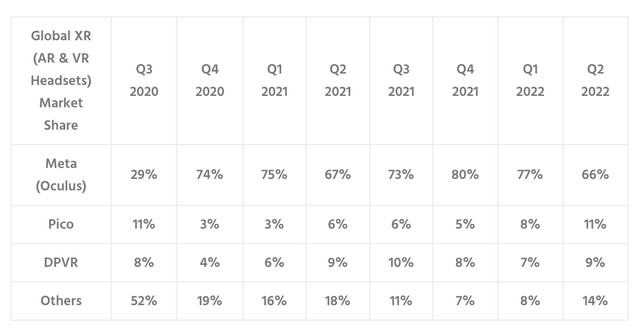

Turning to the VR space, Counterpoint claimed that Oculus had a 66% market share in 22Q2. Another source found that Oculus had a 90% market share in the VR headset market.

Being the top dog — both in the mature social media industry and the emerging VR industry — puts Meta in a favorable competitive position. Looking at the figures above, Meta seems to be running virtual monopolies in two separate industries. This type of scale presents Meta with two advantages:

- Economies of Scale: For example, Meta’s strong brand and wide adoption meant that the company could spend less on sales and marketing to acquire new customers or retain existing customers.

- High Barriers to Entry: For instance, Meta’s larger, income-producing FoA segment is able to support the huge losses incurred from its RL segment. Smaller companies in the VR space do not have the luxury of a cash cow funding their ventures.

Network Effects

As the number of users increases on Meta’s platform, the greater the value of the platform. As we all know, the Meta ecosystem is massive:

- 3.65 billion Family Monthly Active People, or ~45% of the world’s population.

- 2.93 billion Facebook Monthly Active Users, or ~37% of the world’s population.

- 200 million+ businesses use Meta’s apps.

As more users and businesses join the platform, more ads are produced. Subsequently, more data insights can be collected, which further strengthens Meta’s algorithm and AI. In turn, marketers can launch more effective ad campaigns while users get more relevant content on their feeds.

The flywheel effect rolls on.

In addition, Meta could cross-sell products across its FoA and RL users — e.g. allowing businesses who use FoA to run ads on Horizon Worlds.

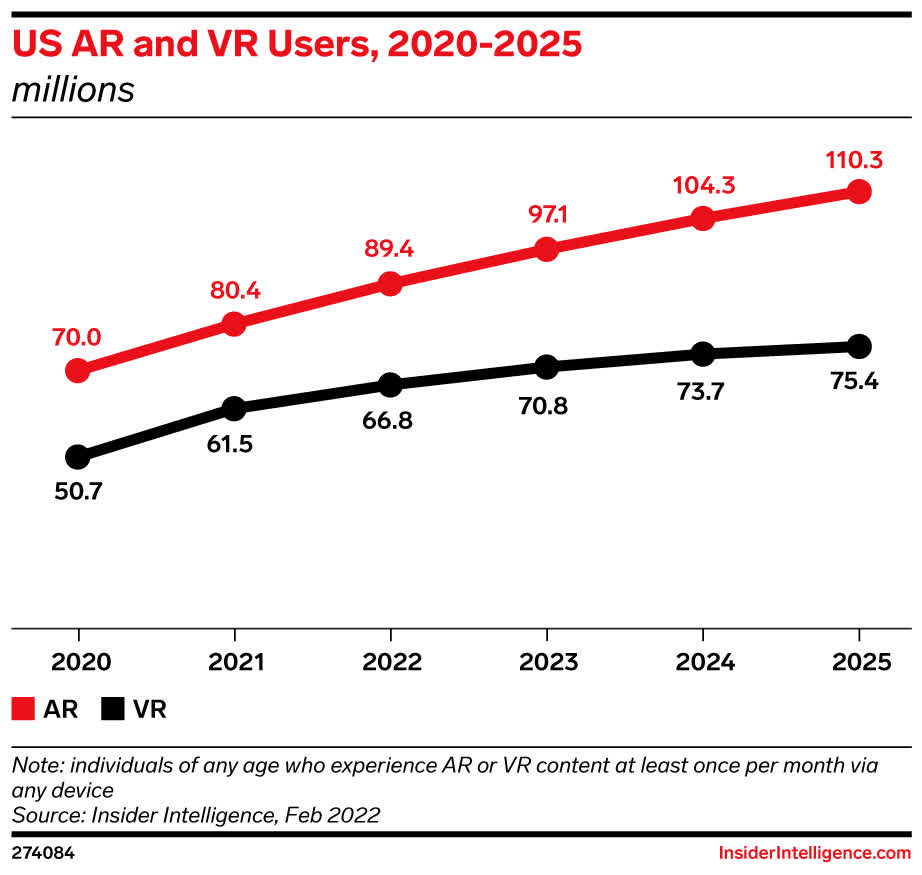

The number of users in the RL segment is not disclosed yet. But per Insider Intelligence, the number of AR and VR users in the US alone are rising by the day. As the metaverse welcomes more users, virtual real estate, digital items, and so on, the greater the network effects that Meta will eventually enjoy.

Insider Intelligence

Switching Costs

Imagine having hundreds, if not thousands, of contacts saved in your WhatsApp. Would you go to the trouble of switching to another app, which your friends or family may or may not be using?

Imagine having hundreds, if not millions, of followers on Facebook or Instagram. Would you abandon these apps and start building your following from scratch again on a new app?

Imagine already being comfortable and familiar with Meta’s FoA after spending years in those apps. Would you consider leaving those apps and learning the ins and outs of a whole new app?

Most of you would answer “no” to all three scenarios.

That’s Meta’s high switching costs moat in action — and that’s why Meta’s FoA is so sticky.

Another reason why people stay on these platforms is that they offer specific use cases, namely social networking (Facebook), chatting (Whatsapp and Messenger), and content sharing (Instagram).

Other apps do not offer such complete use cases. For example:

- TikTok is focused on short-form video entertainment.

- LinkedIn is focused on professional networking.

- Pinterest (PINS) is focused on high-intent idea discovery.

Valuation

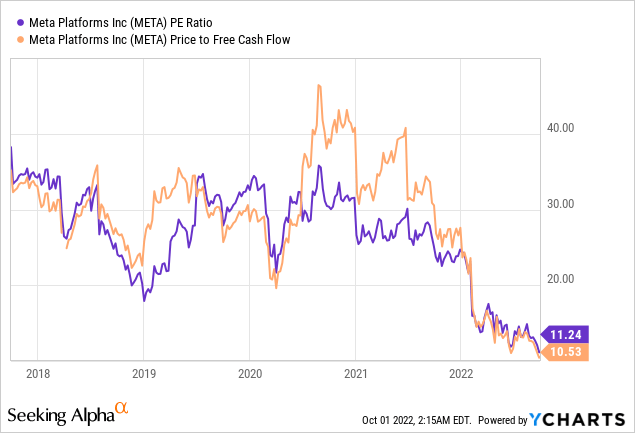

If you were to look at Meta’s recent stock price action, you might mistake it for a high-flying, unprofitable, small-cap stock — as of this writing, Meta is down 65% from its all-time highs, unheard of from a wide-moat, FCF-generative, mega-cap company.

A year ago, Meta surpassed the $1 trillion mark… for a brief moment.

Today, it is only worth ~$365 billion.

Slowing growth, rising competition, currency pressures, high inflation/interest rates, and RL speculation are to blame here.

Following the selloff, Meta’s share price is back to where it was in 2016.

But here’s what also happened in that 6 long years:

- Revenue grew ~332%.

- Earning per share grew ~246%.

As the share price collapses, valuation multiples have compressed to levels never seen before. Meta now trades at a P/E Ratio and P/FCF multiple of 10.5x and 11.2x, respectively. These multiples — which typically trade at around 30.0x — suggest that Meta is in deep value territory.

To put that into further perspective, other mega caps are trading at much more expensive P/E ratios:

- Apple (AAPL): 22.8x

- Microsoft (MSFT): 24.2x

- Alphabet (GOOG): 17.8x

- Amazon (AMZN): 101.4x

- Tesla (TSLA): 95.9x

Yes, Meta has been facing a few road bumps lately and will continue to experience headwinds in the near future. However, I believe that conditions will improve in 2023 and the company will eventually recover and return to growth mode.

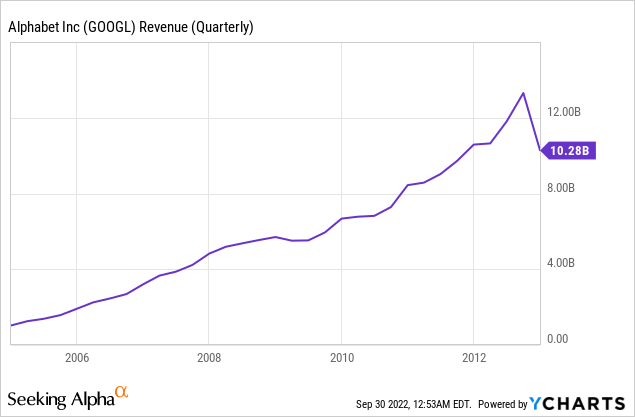

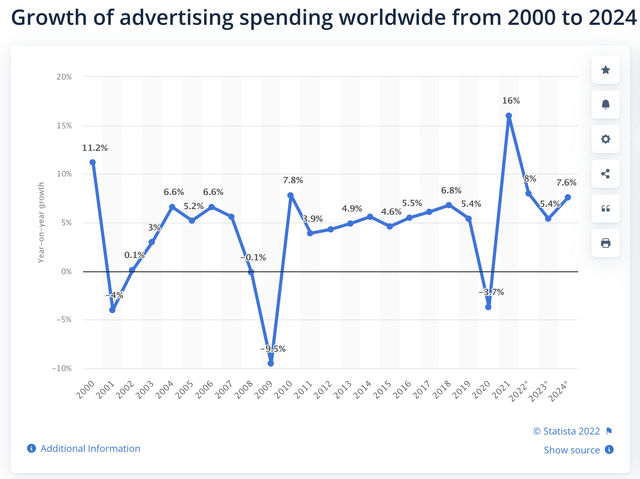

Bears may argue that Meta’s Revenue would take a massive hit as companies all over the world pull back ad spending amidst a global recession. But the advertising industry is much more resilient than many think.

Take Google — who’s also an advertising giant — for example. Revenue barely dipped during the Great Financial Crisis.

We could potentially see the same scenario for Meta — slight Revenue drop, followed by a quick recovery.

Meta’s price chart reflects a broken company with a broken stock. But fundamentally, Meta has a resilient business model with strong competitive advantages. It also has the emerging RL segment, which could be a significant Revenue driver in the years to come.

In essence, buying Meta shares today means betting on two things:

- A swift recovery in FoA and its ad business.

- RL hypergrowth and profitability.

The stock continues to fall, so much so that it’s difficult to ignore. Even Meta is scooping up its own shares at a blistering pace.

At today’s prices, investors get a large margin of safety with significant upside potential.

Catalysts

- TikTok Ban: ByteDance, the $300 billion Chinese tech giant, is the parent company of TikTok. That said, anything Chinese-related these days are under serious regulatory scrutiny. For instance, India banned TikTok in 2020 over privacy and security concerns. A few months ago, FCC member Brendan Carr urged Apple and Google to remove TikTok from their app stores over spying concerns. If TikTok is taken down, we could see a massive migration to Reels.

- Reality Labs: Of course, the biggest catalyst for Meta is for its RL segment to take off. After all, the company has poured billions into the unit. In the next few years, we should see major updates in the VR department. For example, Meta is reportedly working on releasing a higher-end VR headset, code-named Project Cambria — the higher price point also means a nice step toward profitability. Meta also plans to launch its AR Glasses with AR Wristbands in 2024. Keep in mind that hardware could be a stable revenue stream as consumers look to replace their VR headsets every 2 to 3 years, much like how people buy new iPhones every year or so. On the software side, Meta could generate substantial Revenue by charging fees on transactions that occur in the Meta Quest Store or Horizon Worlds. Rumor has it that Meta plans to take a 47.5% cut on virtual asset sales in its metaverse. With that said, RL seems to be a software/hardware powerhouse in the making.

- Reels: As discussed earlier, Reels has yet to be monetized at the same rate as Feed or Stories, and is cannibalizing sales from higher-monetized products. But with the growing popularity of short-form videos, it won’t be long before Reels overtake the other products offered by Meta. As a matter of fact, Reels has crossed the $1 billion run rate, higher than Stories did at identical times post-launch, according to management. As such, it’s only a matter of time before FoA returns to growth mode.

Reels engagement is also growing quickly. I shared last quarter that Reels already made up 20% of the time that people spend on Instagram. This quarter we saw a more than 30% increase in the time that people spent engaging with Reels across Facebook and Instagram. AI advances are driving a lot of these improvements, and one example is that after launching a new large AI model for recommendations, we saw a 15% increase in watch time in the Reels video player on Facebook alone. So I think that there are many improvements like this that we’ll continue to make.

(CEO Mark Zuckerberg — Q2 Earnings Call)

Risks

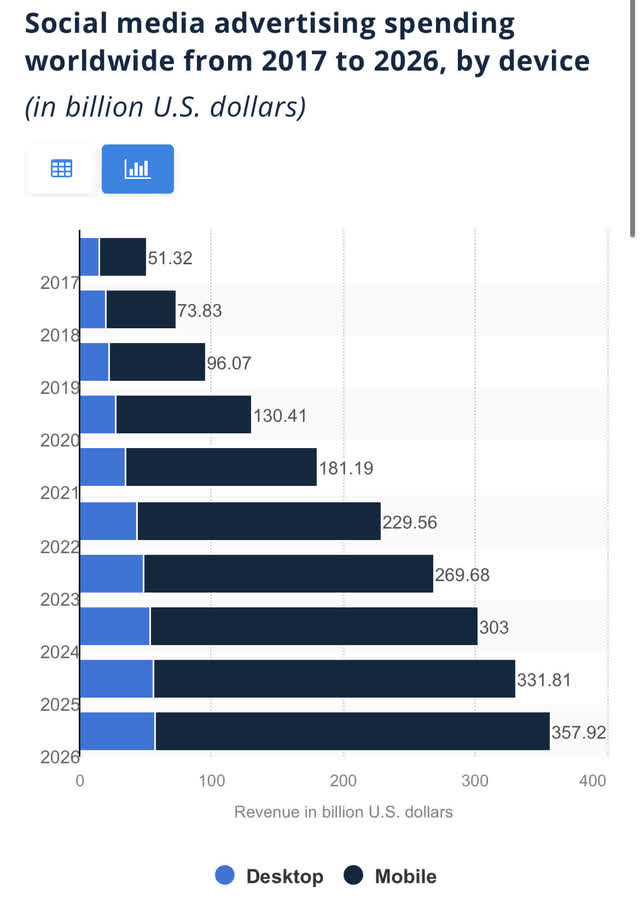

- Competition: While Meta remains the global leader in social media, we can’t completely ignore the competition. As seen below, TikTok and YouTube have higher Average Daily Minutes Spent In-App During Q2 2022 than Instagram and Facebook. Losing user time and attention to competitors meant less monetization opportunity for Meta. Apple is also expanding its ad business which may cause marketers to reevaluate their ad budget allocation strategies as there are more ad platforms to choose from. In addition, Apple is expected to unveil its AR/VR headset sometime next year, which would likely add pressure to Meta’s RL sales.

SensorTower

- Policy Changes: Data privacy changes and other regulatory developments could significantly impact Meta’s operations. For example, Apple’s 2021 iOS update allows iPhone users to opt-out of in-app data tracking, which limits digital advertisers’ ability to gain user insights. This led to an estimated $10 billion impact on Meta’s advertising business.

- Recession: As you can see in the chart below, global advertising spending fell YoY in each of the last three major recessions (2001, 2008, and 2020). With spiking interest rates and raging inflation, a looming global recession could cut advertising spending across industries.

- Sunk Cost Fallacy: This is a phenomenon whereby a company is more likely to continue with a project because they have invested heavily in it, even when it’s clear that shutting down the project would be more beneficial. Having invested billions into the metaverse, could Meta be a victim of the sunk cost fallacy? It’s too early to tell. After all, the metaverse could go bust.

Conclusion

Meta is undoubtedly going through some challenges including macro uncertainty, rising competition, Reels cannibalization, iOS privacy changes, and currency pressures.

Weakening profitability metrics, slowing growth, and the unpredictability of RL make it all the more concerning for investors.

That is why shares are down 65% from all-time highs.

At a P/E ratio of just 10x, investors get to buy a high-quality, wide-moat business at a large margin of safety.

These headwinds are temporary — it’s only a matter of time before conditions improve.

When things do get better, shares would have appreciated substantially.

Buy when there’s blood in the streets. Buy when there are dark, gloomy headlines. Buy when no one else wants to buy.

It always pays to be a contrarian.

Be the first to comment