PixelCatchers

What is more melancholy and more profound than to see a thousand objects for the first and the last time? To travel is to be born and to die at every instant…”― Victor Hugo, Les Misérables

Today, we take an in-depth look at a new name that popped up onto my radar thanks to recent insider buying, a substantial decline in the stock price, and because the company is opening and will operated a brand new hotel a stone’s throw from my loft in Delray Beach. A full analysis follows below.

Company Overview:

Pebblebrook Hotel Trust (NYSE:PEB) is a Bethesda, Maryland based hotel real estate investment trust [REIT] with 54 soft-branded and independent full-service properties in the upper-upscale segment of the lodging industry, boasting 13,415 rooms across nine states and Washington, D.C. Its properties are generally hotels located in major urban centers or resorts in leisure-centric markets. Pebblebrook was formed in October 2009 and went public two months later, raising net proceeds of $379.6 million at $20 per share. The stock trades around $19.50 a share, translating to a market cap of $2.5 billion.

In addition to its common shares, Pebblebrook is capitalized by four series of preferred stock, which cumulatively entitle its shareholders to annual dividends totaling $45.4 million.

The REIT’s strategy has been to invest in smaller high-end hotels primarily located within major U.S. cities, but that approach has shifted towards resorts in more leisure-focused markets since the pandemic. Pebblebrook’s properties generally have one or more restaurants, lounges, and meeting facilities, complemented by high levels of customer service. Owing to the smaller size of its properties, the REIT – in normal/good times – typically enjoys higher margins than its full-service peers. Its most significant transaction was its $5.2 billion purchase of LaSalle Hotel Properties in 2018, which increased its portfolio from 28 properties to 66, mostly in California and Washington, D.C. Pebblebrook then became a net shedder of assets until the pandemic. The REIT turned buyer in 2021 and has been active in 2022, purchasing the Inn on Fifth in Naples, Florida and Gurney’s Newport & Marina in Newport, Rhode Island, while selling The Marker San Francisco. The net effect of this year’s transactions was to add 168 rooms at a cost of $253 million.

Pandemic Effects

It can be properly surmised that no industry was more negatively impacted by the pandemic than lodging. Not only was it immediately and dramatically affected by the shutdown of the economy, but it has also been very slow to recover to pre-pandemic activity, with leisure travel achieving some version of normalcy in the summer of 2021. On the other hand, business travel was still severely truncated throughout 2021, as Zoom (ZM) meetings continued to replace spendy conventions and face-to-face client interaction.

Prior to the pandemic, Pebblebrook enjoyed 82+% occupancy rates in FY18 and FY19 as well as same-property revenue per available room (RevPAR) of $252.76 and $256.17 and same-property total RevPAR of $302.28 and $308.01 (respectively). Those metrics plummeted to 26.5% occupancy, $61.72 RevPAR, and $95.15 total RevPAR in FY20 and only improved marginally, to 40.4%, $104.12, and $157.69 (respectively) in FY21.

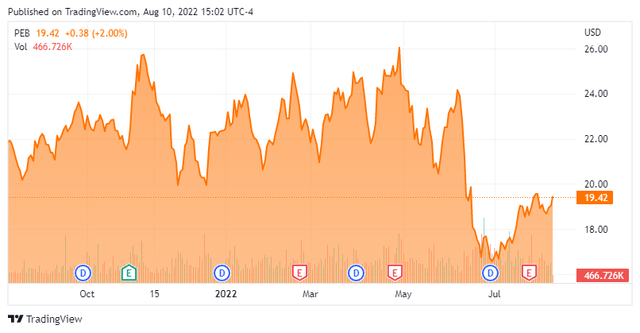

Shares of PEB reflected this new reality. Trading in the mid-20s before the pandemic, Pebblebrook stock briefly fell below $6 a share in the throes of the March-April 2020 selloff as the REIT temporarily suspended operations at 47 of its hotels and resorts with business bottoming out in mid-April 2020. But as can be gleaned from the above statistics, its rebound off the low was extremely tepid. While activity was stunted, management was compelled to amend agreements governing all its debt. In exchange for leniency regarding covenants, Pebblebrook agreed to slash its quarterly dividend from $0.38 a share to $0.01, suspend share repurchases, sell some properties at losses, and embark on a cost mitigation program.

As the economy emerged from the pandemic, expectations abounded that business travel would return and Pebblebrook’s occupancy rates would achieve pre-pandemic levels. As such, the market bid its stock above $26 in November 2021 and again in late-April 2022, but it has retreated 35% since.

The reasons for the backslide are manifold, including fears of a recession due to the Federal Reserve’s response to the upward spike in inflation. There are also company-specific reasons, such as the company’s exposure to business travel. Results are robust at the 11 properties comprising the resort portion of its portfolio. However, the majority of its ownership is tied up in urban hotels, which are still a long way from returning to pre-pandemic levels. Furthermore, its common dividend will not return to normal, even as its covenant waiver period (presumably) expired on June 30, 2022. Considering the REIT generated FY21 funds from operations (FFO) of negative $12.4 million on revenue of $733.0 million after generating FFO of $347.5 million on revenue of $1.6 billion in FY19 – still a huge improvement over FFO of negative $211.3 million on revenue of $442.9 million in FY20 – it appears that it will have little room to return capital to shareholders for now.

1Q22 Earnings & Outlook

And despite solid improvement in 1Q22, management offered little hope that the dividend outlook would change. On April 26, 2022, Pebblebrook reported 1Q22 Adj. FFO of $0.11 a share and Adj. EBITDA (for real estate) of $46.5 million on same-property total revenue of $258.0 million versus 1Q19 Adj. FFO of $0.48 a share and Adj. EBITDA (for real estate) of $92.3 million on same-property total revenue of $336.1 million. Although the Adj. FFO and revenue figures bested Street estimates, they were still glaringly short versus 2019 – and this is with nine of its properties in Los Angeles aided by the 2022 Super Bowl. These deficiencies were further highlighted by the REIT’s key metrics. Same-property occupancy in the quarter was 48% versus 75% during 1Q19 and although same-property average daily rate was up 19% over 1Q19 to $297, same-property RevPAR was $144, down 23% versus $188 in 1Q19.

On the bright side, management projected 2Q22 Adj. FFO of $0.60 a share and Adj. EBITDA of $112.5 million with RevPAR down 9% versus 2Q19 to $213. All of these projections are based on range midpoints. Given the still adverse operating environment for lodging, it is not providing full year projections. However, on the 1Q22 earnings conference call, CEO Jon Bortz expected, “getting back to ’19…somewhere in the third quarter.” As to what specific metric he was referring to was not elucidated but assumed to be Adj. EBITDA, which was $136.9 million in 3Q19.

Returning to the dividend, management stated investors, “should not expect a complete normalization of the dividend [after the covenant waiver period ends on June 30th]…in 2022. That’s more likely a 2023 decision….”

Second Quarter Results:

Pebblebrook reported second quarter numbers on July 26th. They were notably better than in the first quarter. The company had positive adjusted FFO of 72 cents a share, up from a negative 10 cents in the same period a year. Revenues rose over 145% from 2Q2021 to $397.5 million. This is approximately 97% of the company’s revenue from the second quarter of 2019, prior to the pandemic. Taking into account inflation, sales would be significantly less “recovered,” but the REIT is doing a solid job getting back to its pre-Covid-19 self. Adjusted FFO was 87 cents a share in 2Q2019.

|

2022 Monthly Results |

||||||||||||

|

Same-Property Portfolio Highlights(2) |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

||||||

|

($ in millions except ADR and RevPAR data) |

||||||||||||

|

Occupancy |

34% |

50% |

62% |

68% |

67% |

73% |

||||||

|

ADR |

$269 |

$308 |

$305 |

$319 |

$314 |

$323 |

||||||

|

RevPAR |

$91 |

$153 |

$188 |

$218 |

$210 |

$236 |

||||||

|

Total Revenues |

$57.0 |

$84.9 |

$116.2 |

$128.3 |

$129.4 |

$138.1 |

||||||

|

Total Revenues growth rate (‘22 vs. ‘19) |

(44%) |

(21%) |

(9%) |

(3%) |

(6%) |

(1%) |

||||||

|

Hotel EBITDA |

($3.1) |

$20.5 |

$38.8 |

$46.6 |

$42.9 |

$49.3 |

||||||

|

Hotel EBITDA growth rate (’22 vs. ’19) |

(115%) |

(29%) |

(9%) |

1% |

(11%) |

(6%) |

||||||

During the quarter, the REIT acquired the 119-room Inn on Fifth in Naples, Florida for $156 million as well as the 257-room Gurney’s Newport Resort & Marina in Newport, Rhode Island for $174 million. Pebblebrook also disposed of the 208-room The Marker San Francisco for $77. million.

Balance Sheet & Analyst Commentary:

When Pebblebrook presented at Nareit’s REITweek 2002 Investor Conference (June 7-9th), it indicated that its liquidity stood at $600 million as of May 30. The was updated to $561.2 million at the end of the second quarter. This was against debt of $2.5 billion with no meaningful maturities until November 2023 ($636 million). Even though it has since exited the covenant grace period, the quarterly dividend remains $0.01 a share until further notice. Management did hint at the possibility of a share repurchase program.

Since the end of June, five analyst firms including Citigroup and Robert W. Baird have maintained Hold ratings on the stock. Price targets proffered ranged from $19.00 to $23.25 a share. BMO Capital seems the lone optimist on the shares at the moment as it reissued its Buy rating and $24 price target after second quarter numbers hit the wires. Approximately nine percent of the outstanding float is currently held short.

Bucking the Street’s pessimism are CEO Bortz and board member Ron Jackson, who purchased 26,000 and 5,900 shares of PEB (respectively) over the final two days of June.

Verdict:

Although the 35% backslide from its 22YTD high began shortly after the company reported its 1Q21 quarter when it offered no concrete guidance on its dividend, the preponderance of the downdraft began after the REIT presented at Nareit’s conference, where – and this is conjecture – attendees picked up on a loss of momentum in 2Q22. On June 17, 2022, Pebblebrook more or less confirmed this speculation when it revealed that its May occupancy rate was 66%, sequentially lower than the 68% posted it in April. Actual second quarter results have buoyed the shares a bit, and June occupancy was 73%, the highest since the pandemic began and boosted occupancy for the quarter to 69%

With a murky economic outlook for the country, no change in dividend policy – at least for now – and leadership still unable to give full year guidance due to the ongoing pandemic, it is probably best to practice prudence here. With “normalization of the dividend” not even on the table until 2023, its stock has further downside risk, at least that seems to be the view of the analyst community at the moment.

Pebblebrook will be a better catch once it has established some momentum and potential investors in the REIT are content with its yet-to-be-announced “new” dividend. As such, we will recommend staying on the sidelines for now.

Some journeys can only be traveled alone.”― Ken Poirot

Be the first to comment