mbbirdy

In the US and across the globe, there might be no news source more iconic and historic than The New York Times (NYSE:NYT). Made famous for its long-running newspaper, some investors may view the company as a relic of the past. But the fact of the matter is that while the legacy operations of the company are slowly in decline, it does have a large and rapidly growing side to it that should create value for investors in the long run. Previously, I had been bullish on the company. Long term, I remain that way. But in light of slowing growth and rising costs, I do think it would be wise for investors to take a more cautious approach to the business for now. Once these pressures ease up, if they do, then upside might still be material moving forward. But in the meantime, it may make sense to look elsewhere for attractive upside.

Read all about it

The last time I wrote an article about The New York Times was back in April of this year. In that article, I talked about the company’s continued attractive growth on the digital side of the business. This is the digital subscription that individuals and companies pay for in order to access the company’s content. I was particularly impressed with the robust cash flows of the enterprise. Even so, I did acknowledge that shares were pricey at the time and that near-term upside might be limited. But even with that being the case, I felt as though the long-term trajectory of the company was worth paying that lofty price for. This led me to reiterate my ‘buy’ rating on its stock, reflecting my belief at the time that it should generate performance that is greater than what the broader market could achieve for the foreseeable future. Since then, however, the business has under-delivered. While the S&P 500 is down 9.5%, shares of The New York Times are down double that at 19%.

Normally, when you see a return disparity of this size, it’s because the fundamental condition of the company in question is worsening. To some degree, this is the case. But in addition to that, it also relates to the fact that shares are looking rather lofty at this time. To see what I mean, we should first touch on how the company has performed during its 2022 fiscal year. After all, when I last wrote about the company, we only had data covering through the end of 2021. We now have data covering through the third quarter of 2022. According to management, revenue with the company so far this year has been $1.64 billion. That’s 10.8% higher than the $1.48 billion reported the same time last year.

The New York Times The New York Times The New York Times

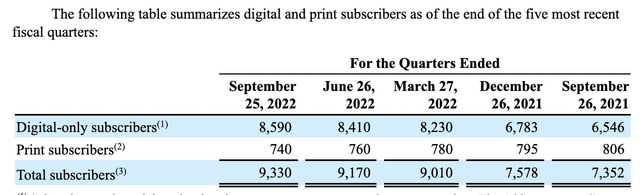

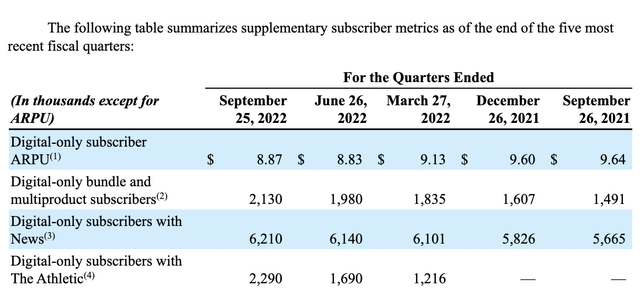

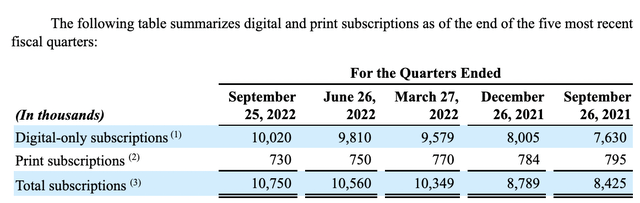

There are many working parts that make up this number. For instance, the first thing we should look at would be the total number of paid subscribers to the company’s products. As of the end of the latest quarter, this number came in at 9.33 million. This represents a significant improvement over the 7.35 million that the company reported the same time last year. Even with this number, though, we can dig deeper. It really is comprised of both digital-only and print subscribers. Over this window of time, the number of print subscribers has declined from 806,000 to 740,000. However, the number of paid digital-only subscribers shot up from 6.55 million to 8.59 million. The dark side to this increase though is that ARPU for digital-only subscribers fell from $9.64 to $8.87. It is worth noting that there’s a difference between subscribers and subscriptions. One subscriber can actually have more than one subscription. For instance, as of the end of the latest quarter, the company actually had 10.75 million subscriptions, up from the 8.43 million that it had one year earlier. On the digital-only side, this number rose from 7.63 million in the third quarter of last year to 10.02 million the same time this year. Meanwhile, the number for print subscriptions dropped from 795,000 to 730,000. Advertising revenue for the company also improved, climbing from $320.78 million to $344.12 million. Actual print advertising revenue for the company shockingly increased during this time, rising from $123.31 million to $137.53 million. Meanwhile, digital-only advertising rose more modestly from $197.47 million to $206.59 million.

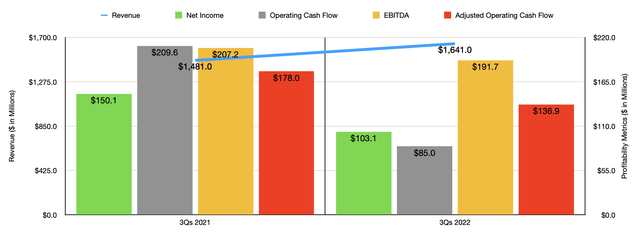

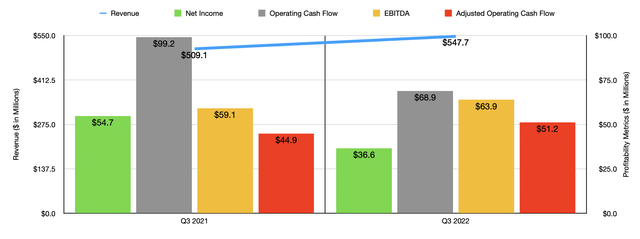

Although the revenue and subscription data for The New York Times looks impressive, there was some weakness on the bottom line. Net income fell from $150.1 million in the first three quarters of 2021 to $103.1 million the same time this year. This was driven by multiple factors. For instance, the cost of revenue for the company grew from 51.3% of sales in the first nine months of last year to 53.4% this year. This was largely due to higher journalism costs, higher subscriber servicing costs, higher print production and distribution costs, an increase in digital content delivery costs, and higher advertising servicing costs. A good portion of this increase, approximately $45.9 million, or 39.1% of the rise, was attributable to the company’s acquisition of The Atlantic. Over the same window of time, other costs for the company increased. The biggest involved a 24.7% surge in product development expenses. This increase, management said, was mostly due to growth in the number of digital product development employees that the company has in connection with its digital subscription strategic initiatives. The inclusion of product development costs from The Atlantic also contributed to this. Other profitability metrics followed a similar trajectory. Operating cash flow fell from $209.6 million to $85 million. If we adjust for changes in working capital, it still would have fallen, declining from $178 million to $136.9 million. Meanwhile, even EBITDA dropped, falling from $207.2 million to $191.7 million.

Interestingly, management has been less focused on the near term than they have been on what they call the midterm. Their current goal is to grow the number of subscribers on their platform to roughly 15 million by the end of 2027. That would imply roughly 270,000 additional subscribers each quarter, on average, between now and then. For most of the past two years, the company has easily achieved this target. But during the past two quarters, it has experienced some weakness. In the latest quarter alone, for instance, the company had net additions of only 180,000. This isn’t all that surprising when you consider the economic uncertainty that is transpiring. And it’s also true that the company is trying to accomplish this while the print portion of the firm is almost certain to continue declining until, someday, management shuts it down.

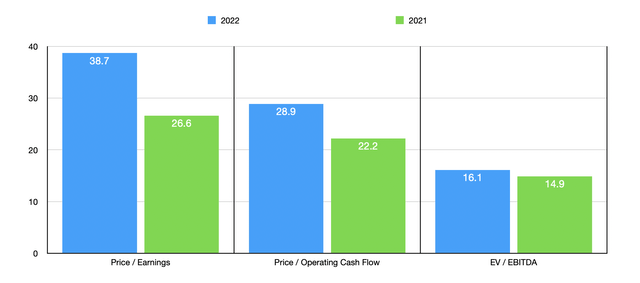

When it comes to the 2022 fiscal year and its entirety, we don’t really know what to expect. But if we annualize results experienced so far this year, we should anticipate net income of $151.1 million, adjusted operating cash flow of $202.7 million, and EBITDA of $334.1 million. Given these figures, we can see that the company is trading at a forward price-to-earnings multiple of 38.7. The forward price to adjusted operating cash flow multiple would be 28.9. And the EV to EBITDA multiple would come in at 16.1, this latter multiple is aided by the fact that the company has no debt and has cash and investments of $468.62 million on its books. By comparison, using data from 2021, these multiples would be 26.6, 22.2, and 14.9, respectively. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 22.6 to a high of 42.7. In this case, three of the five that had positive earnings were cheaper than The New York Times. Using the price to operating cash flow approach, the range was between 7.9 and 870.1. Four of the five companies were cheaper than our prospect. And finally, using the EV to EBITDA approach, the range was between 6 and 15.9. In this scenario, our prospect was the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| The New York Times | 38.7 | 28.9 | 16.1 |

| News Corporation (NWS) | 22.9 | 8.6 | 9.3 |

| Pearson plc (PSO) | 23.5 | 16.8 | 8.9 |

| John Wilsey & Sons (WLY) | 22.6 | 7.9 | 9.0 |

| BuzzFeed (BZFD) | 42.7 | 870.1 |

15.9 |

| Gannett (GCI) | N/A | 11.5 |

6.0 |

Takeaway

Based on all the data we have at our disposal, I still remain bullish about The New York Times from a long-term perspective. The company has plenty of excess cash on hand, it continues to grow, and management remains optimistic about the future of the firm. But at the moment, I am more neutral on the company. Higher costs, a slowdown in growth, and an elevation of its trading multiples, have led me to be this way. Because of this, I have decided to decrease my rating on the company from a ‘buy’ to a ‘hold’.

Be the first to comment