undefined undefined/iStock via Getty Images

The Fed is reinforcing its rate-hiking statements:

Federal Reserve policy makers on Wednesday said officials would continue to tighten monetary policy, ahead of a key disclosure expected to shed light on how quickly they plan to trim the central bank’s bloated balance sheet.

“I expect a series of deliberate, methodical hikes as the year continues and the data evolve,” Philadelphia Fed President Patrick Harker told the Delaware State Chamber of Commerce on Wednesday. “I also anticipate that we will begin to reduce our holdings of Treasury securities, agency debt, and mortgage-backed securities soon.”

Here’s the exact language from the Minutes:

Many participants noted that – with inflation well above the Committee’s objective, inflationary risks to the upside, and the federal funds rate well below participants’ estimates of its longer-run level-they would have preferred a 50 basis point increase in the target range for the federal funds rate at this meeting. A number of these participants indicated, however, that, in light of greater near-term uncertainty associated with Russia’s invasion of Ukraine, they judged that a 25 basis point increase would be appropriate at this meeting. Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified. A number of participants noted that the Committee’s previous communications had already contributed to a tightening of financial conditions, as evident in the notable increase in longer-term interest rates over recent months.

This should be anything but a shock at this point.

Regarding the outlook:

The staff continued to judge that the risks to the baseline projection for real activity were skewed to the downside and that the risks to the inflation projection were skewed to the upside. The COVID-19 pandemic remained a source of downside risk to activity, while the possibility of more severe and more persistent supply issues was viewed as posing an additional downside risk to activity and an upside risk to inflation. The Russian invasion of Ukraine was perceived as adding to the uncertainty around the outlook for economic activity and inflation, as the conflict carried the risk of further exacerbating supply chain disruptions and of putting additional upward pressure on inflation by boosting the prices for energy, food, and other key commodities. Finally, the possibility that continued high inflation would cause longer-term inflation expectations to become unanchored was seen as another upside risk to the inflation projection.

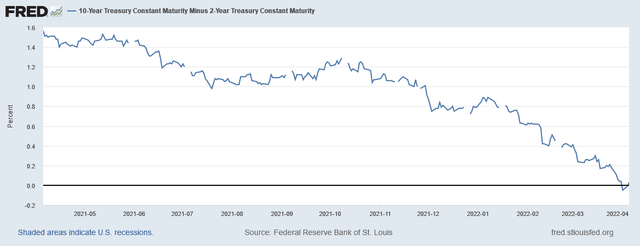

Remember that the 10-2 interest rate spread recently inverted:

This has a good track record of predicting recessions.

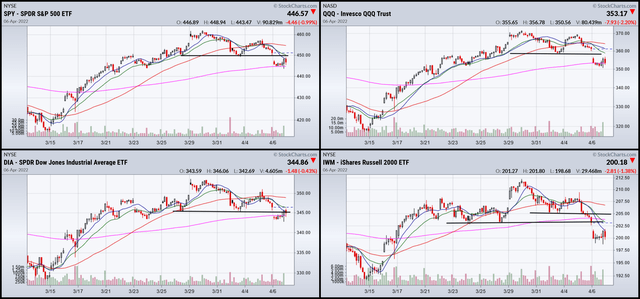

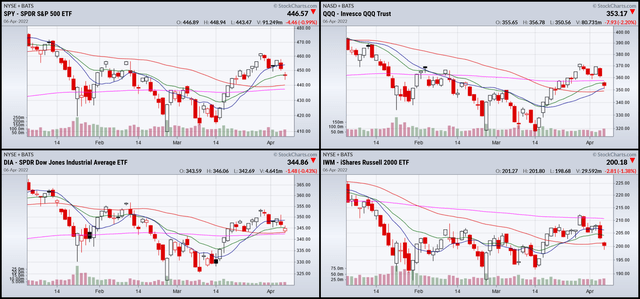

Let’s take a look at the charts:

1-Month SPY, QQQ, DIA, and IWM (StockCharts)

Yesterday, I noted that the IWM may be signaling a move lower. This would follow the recent history of small-caps telegraphing downside moves. Today, the larger caps gapped lower.

3-Month SPY, QQQ, DIA, and IWM (StockCharts)

On the three-month charts, prices gapped lower. The SPY is still above the 200-day EMA; the DIA is right at that key level, and the QQQ broke lower.

So far this week, there’s a slow erosion lower.

Be the first to comment