hirun/iStock via Getty Images

Summit Midstream Partners (NYSE:SMLP) with its $160 million market capitalization is likely one of the worst performing crude oil companies YTD, with its share price dropping more than 30%. The company has spent years improving its capital structure, consistently touching on bankruptcy, however, continued concerns over its ability to drive shareholder returns remains an overhang.

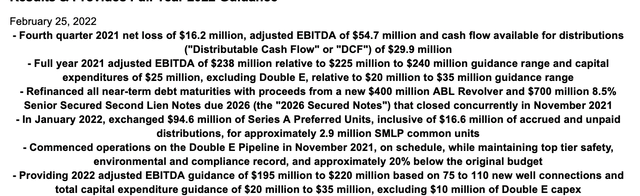

Summit Midstream Partners 4Q 2021 Results

Summit Midstream Partners had strong results to round out 2021, showing its financial strength.

Summit Midstream Partners 4Q 2021 Results – Summit Midstream Partners Investor Presentation

Summit Midstream partners achieved DCF of $30 million, putting the company’s market cap to DCF ratio at 1.33. That’s one of the lowest in the business. The company had $25 million in capital expenditures excluding the Double E pipeline, at the lower end of its guidance range, and with the pipeline completed that number is expected to remain low.

The company has successfully refined all near-term debt maturities with $1.1 billion in refinancing loans, pushing its potential 2022 causing bankruptcy loans to 2026, albeit at an 8.5% dividend yield. The company managed to exchange $94.6 million of Series A preferred units (counting unpaid distributions) for 2.9 million common units.

For 2022, the company expects roughly a 5% adjusted EBITDA drop based on a midpoint of ~90-95 new well connections and capex in roughly the same range with $10 million in Double E capex.

Summit Midstream Partners Financials

There’s several aspects of Summit Midstream Partner’s financials that we want to delve into.

First is the preferred equity. In our view the preferred equity has been a consistent drag on the company’s stock. With dividends halted, unpaid distributions are now almost $20 million. The company has gotten its preferred equity to less than $100 million, but all that does is allow the company to issue more preferred equity, a lever the company has said it’s willing to push.

The company has done incredibly well simplifying its capital structure, and in our view, the company needs to continue doing that. Preferred equity, especially more equity, is not the way to do that, and as the company has learned from the Covid-19 collapse, it’s a potential increase in the liability the company faces.

The next thing to touch on is the company’s debt. Many investors, including us to some extent, have been on the train that the moment the company rolls over its debt meant the market would re-evaluate it. And it did, to an extent, the bankruptcy risk is gone. However, that doesn’t mean the financial position is all roses.

The company still has more than $1 billion in debt versus its $160 million market capitalization. It might have strong DCF, but it’s still eating more than 8% on that debt, counting it almost $100 million in annual interest. The company needs to ignore the noise, ignore the allure and growth, and steadily keep paying down that debt.

Whether it does that remains to be seen.

Summit Midstream Partners Oil Prices Growth

Small midstream companies are always in a unique position in that they’re much more directly tied to oil prices. In some cases they’re even more tied despite the strength of take-or-pay cash flow, because they’re tied to capital spending which can vary more dramatically than oil prices.

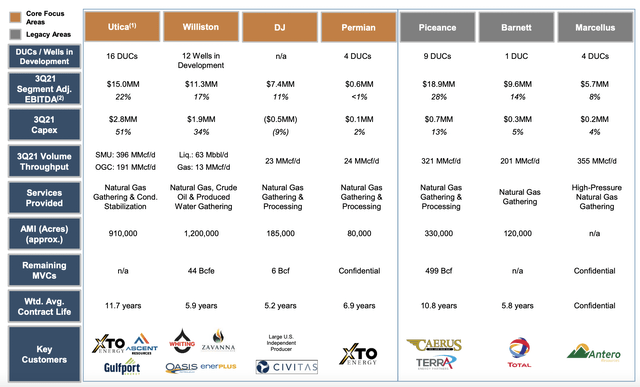

Summit Midstream Asset Performance – Summit Midstream Partners Investor Presentation

Summit Midstream Partners relies on the completion of the wells in development and the new wells. That produces the natural gas that moves through the system. The company is partially protected by minimum volume commitments, for example in the legacy Piceance area it has roughly 3 years of commitments. Contracts extend for almost a decade.

Current prices are heavily in favor of continuing to drill and the Ukrainian-Russian war along with the potential for long-term gas delivery contracts from the U.S. supports that. However, producers continue to be restrained, and until they change their mind, Summit Midstream Partners is stuck. Economics will eventually win out, but it’s a question of time.

Summit Midstream Partners has less time than everyone else.

Summit Midstream Partners Shareholder Return Potential

Despite this financial risk, we think the risk-reward profile is still weighted in favor of investing in Summit Midstream Partners for several reasons.

First, the company still has comfortable positive cash flow. The company has pointed out that most preferred holders who haven’t tendered so far have likely halted, and it has roughly $120 million in annual DCF. The company expects after capital and other expenses to have roughly $75 million with it plans to continue putting towards reducing its debt. Longer term we can see that number growing towards $90 million.

The company has a $150 million market cap and roughly $1.35 billion in debt costing the company roughly $100 million in annual interest (7.4% weighted interest). Here’s a sample payback schedule.

| Year | Year-End Debt | Interest Expense | Cash for Payback |

| 2022 | $1.270 billion | $100 million | $80 million |

| 2023 | $1.190 billion | $94 billion | $86 million |

| 2024 | $1.104 billion | $82 million | $98 million |

| 2025 | $1.006 billion | $74 million | $106 million |

| 2026 | $0.900 billion | $67 million | $113 million |

| 2027 | $0.787 billion | $58 million | $122 million |

| 2028 | $0.665 billion | $49 million | $131 million |

| 2029 | $0.534 billion | $39 million | $141 million |

| 2030 | $0.393 billion | $29 million | $151 million |

The above chart shows the company’s potential should it rapidly pay-down its debt. The company, through steady focus could end the decade with $393 million in debt and $151 million in annual cash flow (after capital expenditures for a year that also includes investment in Double E growth). You can choose the valuation attached to that.

However, it’s clear that by most metrics it’d be worth more than $150 million (the current market cap). Comfortably we can see it worth several times its market cap implying strong double-digit returns.

Summit Midstream Partners Risk

Summit Midstream Partner’s risk is the immense debt load and then also management’s reaction to that debt load. Management was the one that initially caused the massive debt and it’s easy to be incentivized to jump back to expansion in a cheaper market. That’s a continued risk that investors in the companies will face.

The company is not only susceptible to continued capital spending, it’s susceptible to capital spending in its region of operation and continued market performance. All of that could cause the company to underperform in upcoming years.

Conclusion

Summit Midstream Partners has an impressive portfolio of assets and strong cash flow. The company has, at least for the next few years, removed the bankruptcy risk, although that doesn’t mean it’s out of the woods yet, and the market has yet to re-evaluate the company’s valuation and price per share for shareholders.

Going forward, the company needs high prices to promote additional drilling on its assets. Additionally, the company needs to continuously pay-down its debt, saving that interest, and having more additional cash flow that it can utilize towards shareholder rewards. These consistent efforts help to highlight Summit Midstream as a valuable investment.

Be the first to comment