imaginima/E+ via Getty Images

Investment Thesis

The Lovesac Company (NASDAQ:LOVE) is an American furniture designer, manufacturer, and retailer. Furniture is a discretionary item, and discretionary spending was severely limited in the pandemic age. Historically high inflation rates are also testing spending prudence. Following these significant events that triggered major economic downturns, LOVE was not immune to the impact of the difficulties that ensued.

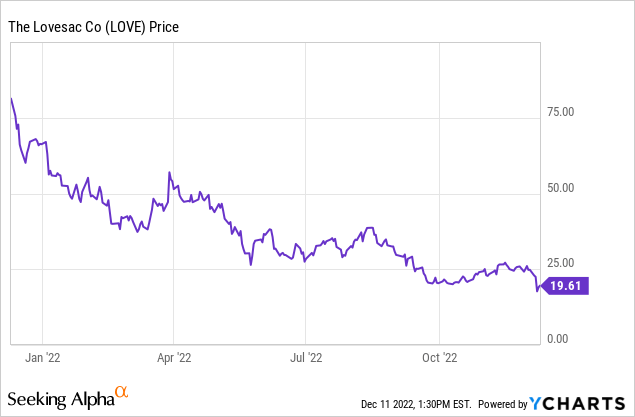

Over the last year, the company has been on a downward trajectory, losing more than 76% in share price; this major slump is primarily due to the aforementioned challenges.

Despite the company’s dismal performance in share prices, its top and bottom lines were very resilient, the company revenues kept growing during and after Covid 19 restrictions, and it maintained profitability. With Covid 19 related challenges and inflation easing, I am optimistic about the company’s future growth. Following my positive outlook of the company, I rate it a buy since it is significantly undervalued with a bright future and a strong upside.

Discretionary Sector Analysis

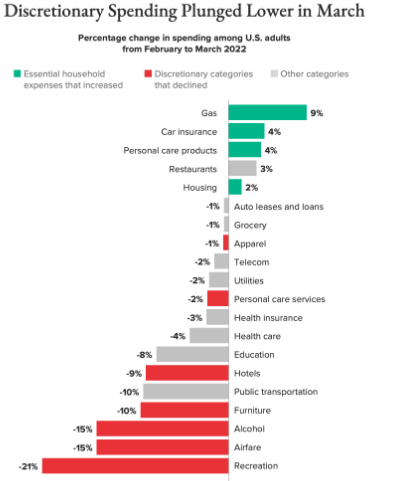

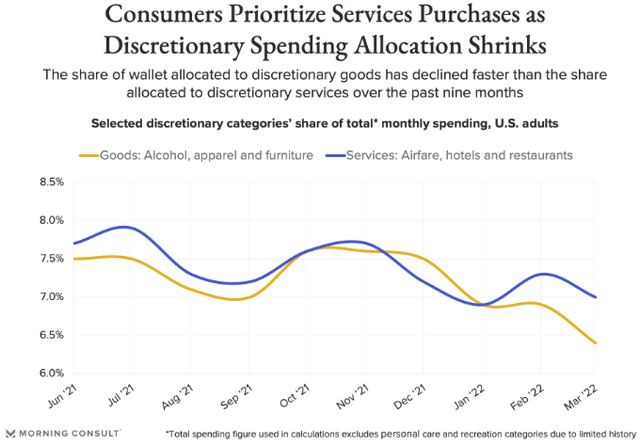

As worries about inflation grew, consumers cut back on spending on things like entertainment, travel, alcohol, and home furnishings. As consumers become less sensitive to epidemic developments, they are reallocating more of their expenditure toward services rather than products, which may help alleviate some inflationary pressures.

Anxiety about price increases and global instability dampened consumer morale in March. Consumers have no choice but to increase their spending on necessities like gas, food, and shelter as the cost of these goods rises with the cost of other needs. Thus, when worries about making ends meet mounted, people reduced their spending on luxuries. Consumer spending fell across the board compared to February, but it was most noticeable in the recreation category. This trend was also seen in the travel, alcohol, home furnishings, and clothing markets.

Morning Consult

While consumers’ propensity to spend on services rather than products suggests that discretionary expenditure has been declining in recent months, the decline is more widespread in the goods sector. There has been a widening chasm between the proportions of income going toward necessities and discretionary expenditures this year. Since January, consumers have allocated a more significant portion of their income toward services and a smaller portion toward products.

Resilient LOVE

Despite the U.S. economic downturn, I attribute the resilience to the following:

- Targeting a very resilient group through reasonable pricing and marketing strategy, as mentioned during its Q2 2023 transcript call.

- Using personal selling, which, in my view, is very effective when the market is performing poorly.

- Its sactionals patents, in my opinion, protect the company from the adverse competition.

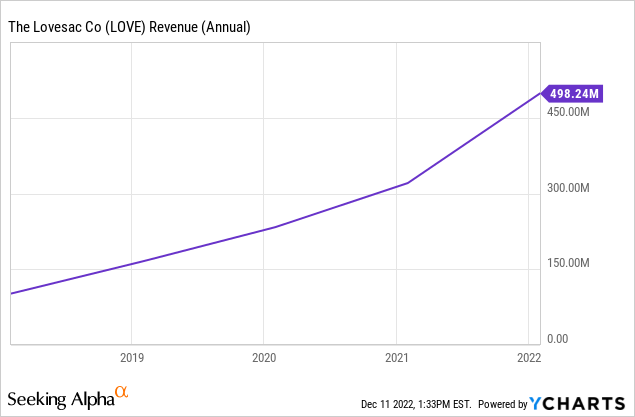

To begin with, the company’s top line has a YoY growth rate of 41.04% and a 3 Year revenue CAGR of 43.7%. Its revenues in 2019, 2020, 2021, and 2022 were $165.88M, $233.38M, $320.74, and $498.24M, respectively. Assuming the 41.04% revenue growth YoY, the current FY should yield $702.71, which I am confident the company can achieve.

Now that the economy is stabilizing and inflation is cooling, I anticipate the company will announce a significantly higher quarterly revenue figure.

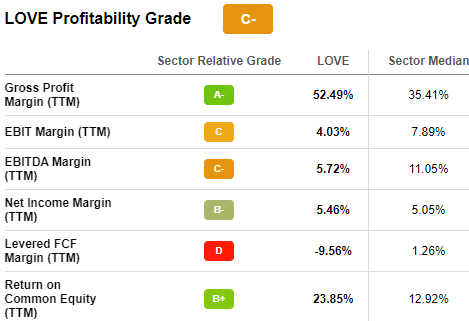

Regarding bottom lines, LOVE has remained profitable as opposed to hefty losses when economic downturns occur. It has a gross margin of 52.49%, an EBIT margin of 4.03%, a net income margin of 5.49%, and a return on equity of 23.85%. However, the profitability metric isn’t flawless as the company has a levered free cash flow (“FCF”) margin of approximately -9%. The company has remained profitable due to the ever-growing revenues during the harsh macro environment.

It has been profitable; however, my satisfaction with its margins is less than full compared to its competitors.

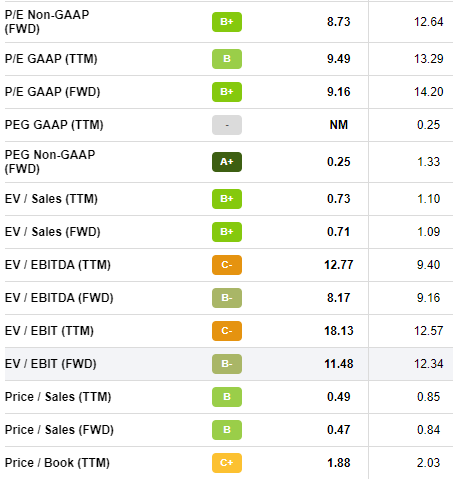

Below are the industry medians, along with how LOVE stacks up.

Seeking Alpha

These numbers show that the firm is falling behind its rivals in key areas and must make changes to catch up.

According to the conference call transcript for the third quarter of 2023, the firm is looking at various options to lower expenses, which should positively affect profit margins and allow them to keep pace with competitors.

In addition to the cost management strategy, the company has a strong brand that serves as a buffer against the competition. This strong brand is improving customer loyalty, something I believe will go a long way in enhancing the company’s top and bottom lines.

“We are generating real-time demand for our superior products even in this challenging macro backdrop. A full 38% of recent customers report not cross-shopping with their sactionals purchases against any other competitor whatsoever. This is a sign of the growing power of our reputation and of true demand for this brand and this product over and above customers just shopping the marketplace for [indiscernible]”

Valuation

As shown by conventional valuation metrics, LOVE is undervalued. Its P/E ratio is 9.49X, its P/S ratio is 0.49X, and its P/B ratio is 1.88X, all of which are lower than the respective industry medians of 13.29X, 0.85X, and 2.03X, respectively. The company’s low valuation may result from the effects of economic downturns and the low debt ratio’s influence on the P/B value.

Seeking Alpha

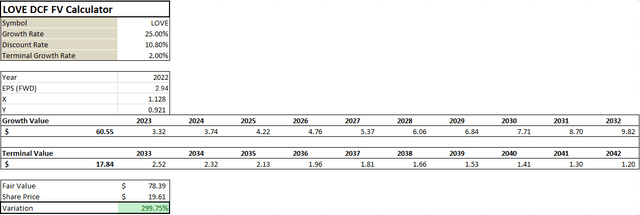

In addition to these conventional valuation metrics, I ran an EPS-based discounted cash flow (“DCF”) model to evaluate the company’s potential and fair value, and below is the output.

In running the model, I used the EPS FWD value of $2.94, a growth rate of 25% despite the company having a 3-5Y CAGR of 35%, which shows how conservative and realistic my assumptions are and a discount rate of 10.8%.

Compared to its current price of $19.61 per share, the model’s analysis shows that the company is worth $78.39 per share. Even more convincing is that the company has a potential upside of almost 300%, which supports my claim that it is undervalued. Now is the time for investors to get into the company at a discount and reap the rewards afterward.

Conclusion

Due to high inflation rates and the effects of covid 19, consumers’ budgets have severely been constrained, limiting them to essential products. As a result, discretionary expenditure has declined significantly, leading companies like LOVE to drop their share value due to the harsh economic times.

However, despite the harsh macroeconomic environment, LOVE has been resilient, reporting strong YoY revenue growth and maintaining profitability. The resilience was primarily due to sound and very effective strategic decisions. Although the company has been profitable, some of its margins are below the industry median necessitating the company to rethink to match the competition. This call comes at a time when The Lovesac Company, during its Q3 2023 transcript call, reported that its pursuing different strategic measures to cut down costs, which I believe will impact profits positively, matching or exceeding the competition.

In conclusion, the company is significantly undervalued, with an upside potential of about 300%. This strong potential solidifies my buy rating on The Lovesac Company.

Be the first to comment