Bryan Bedder/Getty Images Entertainment

The words ‘furniture’ and ‘technology’ may not, to most people, seem to go together very well. But in this modern age of rapid change, there are some companies operating at the intersection of the two concepts. One such example can be seen by looking at The Lovesac Company (NASDAQ:LOVE). By investing in this very niche corner of the furniture market, the company has been able to achieve rapid growth in recent years. Add on top of this the fact that shares of the enterprise look cheap, both on an absolute basis and relative to similar firms, and I would make the case that it probably does have some further upside from here. At the very least, I believe it has enough upside potential to warrant a ‘buy’ rating at this time.

A unique furniture play

According to the management team at Lovesac, the company operates as a technology-driven firm the focuses on the design, production, and sale of high-quality furniture to its clients. Examples of offerings include modular couches that management calls Sactionals, premium foam beanbag chairs that they call Sacs, and other similar home decor and accessories. All of this originated from the company’s initial product, the Sac, which was developed in 1995. From there, the firm has grown by means of innovation to the point where the original Sacs products account for only 10.5% of revenue. By comparison, the Sactionals the company produces account for 87.6% of sales. The company also generates revenue by selling products that help customers to update their Sacs and Sactionals with new covers, additions, and configurations as deemed desirable.

The company is technology oriented in the sense that its offerings include a number of patented features that relate to geometry and modularity. Patents also extend to the coupling mechanisms and other features involved in the production and sale of their furniture. The company also allows for tremendous customization, not only through the roughly 200 tight-fitting covers that are removable, washable, and changeable when it comes to their furniture, but also when it comes to the specialty-shaped modular offerings the company has such as its wedge seat and roll arm side. A little over a year ago, in October of 2021, the company also offered a product line called StealthTech Sound + Charge that introduced features like immersive surround sound, convenient wireless charging, and more. Specific accessories the company sells include drink holders, Footsac blankets, decorative pillows, fitted seat tables and ottomans, and so much more.

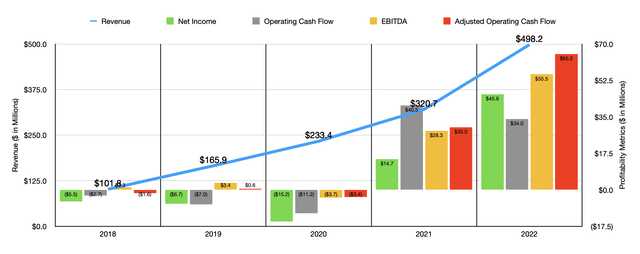

Over the past five years, the management team at Lovesac has done a really good job growing the company. Revenue has risen from $101.8 million in 2018 to $498.2 million in 2021. In the times that we are facing today, I always look at sales growth and profit growth from a rather cautious perspective. After all, ratcheting up prices in order to offset inflationary pressures can result in eventual downside once inflationary issues ease. The good news for investors though is that much of the growth the company has seen over this window of time has been driven by a rise in the number of showrooms the company sells its products through. This number rose from 66 locations in 2018 to 146 in 2022. Many of these locations are at top-tier malls, lifestyle centers, and even at particular Store locations. The company also includes kiosks and mobile concierges in this group. In all, the company has operations in no fewer than 39 states. During the 2022 fiscal year, these showrooms accounted for 60% of the company’s revenue. E-commerce sales accounted for a further 30.2%, while short-term online and in-store pop-up shops, shop-in-shops, and barter inventory transactions accounted for 9.8% of sales.

The bottom line for the company has been a bit challenged over time, but we are seeing drastic improvements today. The firm went from generating a net loss of $5.5 million in 2018 to generating a profit of $14.7 million in 2021. By 2022, profits had surged to $45.9 million. Other profitability metrics have followed a similar trajectory. Operating cash flow went from negative $2.7 million to positive $34 million. If we adjust for changes in working capital, it would have gone from an outflow of $1.6 million to an inflow of $65.2 million. Meanwhile, EBITDA has also improved, rising from $1.3 million to $55.5 million over the same window of time.

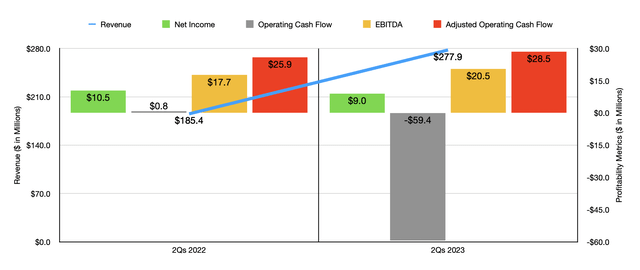

When it comes to the 2023 fiscal year, results continue to impress. In the first half of the year, the company generated revenue of $277.9 million. This represents an increase of 49.9% over the $185.4 million reported the same time last year. Some of this was driven by a 36% increase in comparable store sales. But in addition to that though, the company also saw its showroom count climb from 123 locations to 174. Although the top line proved to be positive, bottom line results have been a bit more volatile, with net income actually dipping from $10.5 million to $9 million. The primary culprit here was a drop in the company’s gross profit margin from 56.7% to 52.9%. That alone accounted for $10.6 million in missed pretax profits for the company. even though the company has seen its product margin improve, higher distribution and related tariff expenses more than offset this. Some other profitability metrics unfortunately followed suit. Operating cash flow went from a positive $0.8 million to a negative $59.4 million. But if we adjust for changes in working capital, it would have risen slightly from $25.9 million to $28.5 million. And over that same window of time, EBITDA also improved, rising from $17.7 million to $20.5 million.

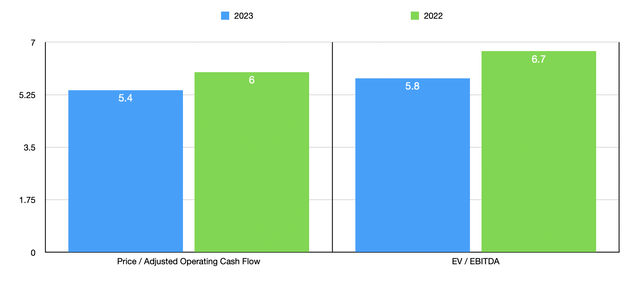

Due to an absence of guidance, we don’t really know what to expect for the current fiscal year. But if we annualize results experienced so far, we should anticipate adjusted operating cash flow of $71.7 million and EBITDA of roughly $64.3 million. These results would imply a forward price to adjusted operating cash flow multiple of 5.4 and a forward EV to EBITDA multiple of 5.8. By comparison, if we use the data from 2021, these multiples would be 6 and 6.7, respectively. As part of my analysis, I also compared the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 1.4 to a high of 13.1. In this case, only one of the five companies was cheaper than Lovesac. Meanwhile, using the EV to EBITDA approach, the range was between 2.1 and 171.5. In this scenario, two of the five companies were cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| The Lovesac Company | 5.4 | 5.8 |

| Hooker Furnishings (HOFT) | 10.5 | 16.4 |

| Bassett Furniture Industries (BSET) | 13.1 | 2.1 |

| Dorel Industries (OTCPK:DIIBF) | 12.8 | 171.5 |

| Flexsteel Industries (FLXS) | 1.4 | 17.2 |

| Ethan Allen Interiors (ETD) | 8.1 | 3.5 |

Takeaway

Based on all the data we have at our disposal, I will say that I am rather impressed by Lovesac and its performance. Although the company has been hit with some margin pressures so far this year, growth continues to be impressive and shares are trading at fundamentally low levels, both on an absolute basis and relative to similar firms. It also helps that the company has no debt and has cash on hand of $17.7 million to help it weather difficult times. Factoring all of these things together, I do feel comfortable giving it a ‘buy’ rating at this time.

Be the first to comment