Spencer Platt/Getty Images News

Supply-side economics determine the favorability of an investment idea. Industries with tight supply economics are highly attractive because of rising prices, which translates to rising revenues as firms are able to pass on inflation to consumers. Suppliers are able to push prices to more profitable levels, and improve their returns on invested capital (ROIC). The building materials industry is one such industry, and the Louisiana-Pacific Corporation (NYSE:LPX) is one of its big winners. Typically, in an industry as fragmented as building materials, the relationship between prices and supply follows the cobweb model with a boom followed by new investment to the point of excess capacity, which eventually triggers a slump in prices. However, the building materials industry has been exceptionally disciplined and also shackled in its ability to respond to massive demand for builders and building materials, by supply-constraints that were massively exacerbated by the global pandemic.

Construction Prices Are Driving the Housing Boom

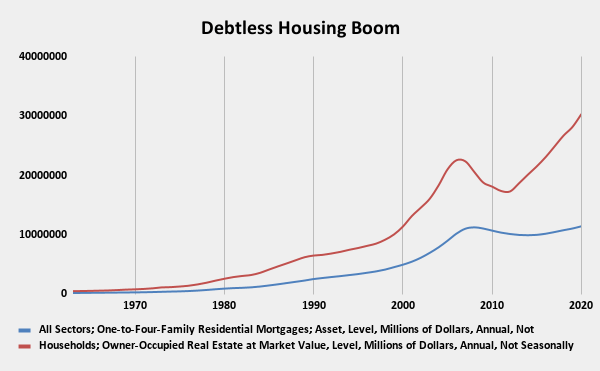

The global pandemic sent home prices through the roof, but it only exacerbated a decades old trend toward higher house prices, with the S&P/Case-Shiller U.S. National Home Price Index up more than 16% in 2021. The Great Recession formed a link in the minds of many people that mortgage debt is a primary driver of housing prices, but the data suggests that this is not the case.

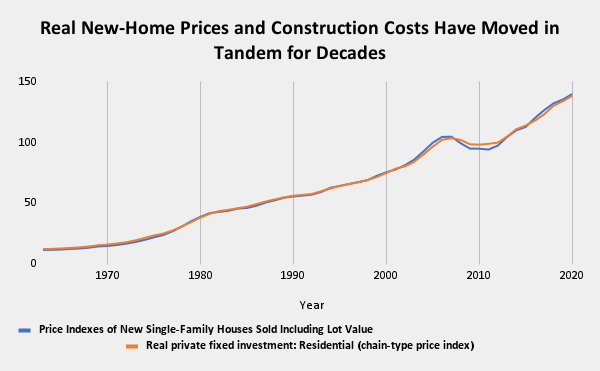

Construction prices are the primary drivers of the housing boom. Since 1963, sales of new single-family homes of comparable quality have moved in lock-step with the cost of residential construction, by 0.98% and 0.91% per year respectively, after adjusting for inflation.

The strength of this relationship is true even in the near-term. Indeed, the housing boom has occurred at a time in which the value of home mortgages owed by households has been dramatically reduced.

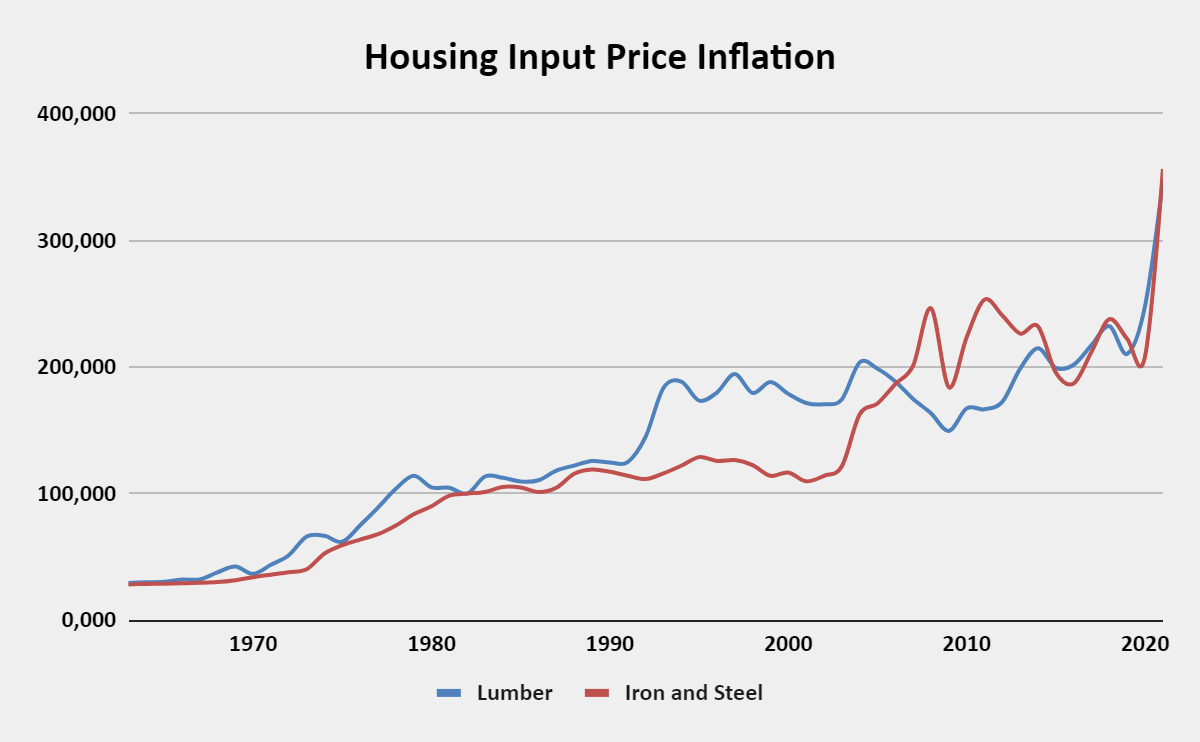

Driving these prices ever upward has been housing input price inflation. The pandemic drove housing input price inflation to record price, with inputs such as lumber and timber both seeing their biggest gains ever, with lumber in particular at one point doubling in value.

The lazy explanation for the housing boom has been record low mortgage rates, but as we have seen, households have largely spent the last decade reducing their outstanding mortgage debt.

Instead, supply of construction materials and builders has simply been unable to match demand. The pandemic has reconfigured demand as remote work has ruptured the relationship between where people’s jobs are and where they live. With increased at-home work, workers have become more mobile, and have started to migrate away from big cities to suburbs and other less densely populated areas with bigger, single-family homes.

Low mortgage rates only really came into play during the pandemic, when there was a sharp increase in the household mortgage debt outstanding.

Consequently, the gulf between supply and demand has never been greater. According to Redfin, a national real estate brokerage, the seasonally adjusted age of inventories declined by more than 35% between 2019 Q4 and the end of 2021. Data from the Census Bureau shows similar declines, with the inventory of for-sale homes declining by nearly 39% between 2019 Q4.

Although we can expect house price inflation to put a brake on consumer demand, and indeed, Nobel Prize winning economist Robert Shiller suggests that this is reflected in house price futures, which suggests a leveling off in the next two years, this will not overthrow the fundamental gulf that exists between supply and demand. America simply does not have enough homes, and suppliers, struggling with a supply chain disruption, as well as pre-existing problems, are not able to ramp up supply to keep up.

The oriented strand board (OSB) industry has not always been able to maintain the capital discipline necessary for sustained profitability to be a function of the industry. Industry capacity has been increased with new plants, but crucially, inventory rebuilds have been hurt by supply chain disruption (including labor shortages) and Covid-19.

As the industry has consolidated, there has been little appetite to reactivate idle capacity. At present, there is little evidence that the industry is planning the kind of large-scale plant reactivations, but with three quarters of the industry now controlled by just four players, the barriers to entry have never been higher. This oligopoly is good for the economics of the industry and has installed a much needed capital discipline. The incumbents are simply unwilling to spend the hundreds of millions of dollars and many years it takes to install new capacity. In terms of future profitability, it would simply not make any sense. The asset growth anomaly tells us that low asset growth stocks outperform high asset growth stocks. Indeed, in the absence of sustainable competitive advantages, there is an inverse relationship between capital expansion and future returns. New capacity means reduced profitability and the industry at large is committed to better economics.

The Louisiana-Pacific Corporation is Focused on Profitability

In his letter to the shareholders, Chief Executive Officer Brad Southern highlighted the company’s 2019-2022 strategy of increasing efficiency and economic gains. By the end of 2020, the company had already exceeded its target of unearthing $165 million worth of cumulative EBITDA efficiency and economic gains, with $178 million in cumulative impact.

Since Southern took over in 2017, he has focused on reducing operating costs, improving profitability and investing in growth markets. He has been unafraid to shut down mills, and he pushed through other tough decisions to bring down costs. In 2019, a time when the housing market was considered to be “slow”, and pricing for OSB was down 50% year-over-year, and the company’s net sales were down 27%, he was ruthless in driving down costs and continuing the company’s drive to improve its economics.

Southern identified the Louisiana-Pacific’s supply-side related problem: “OSB has struggled to consistently earn its cost of capital the last 10 years. To some extent, past leaders have given up on that. That’s not how we’re approaching it. I want all our businesses to earn cost of capital consistently.”

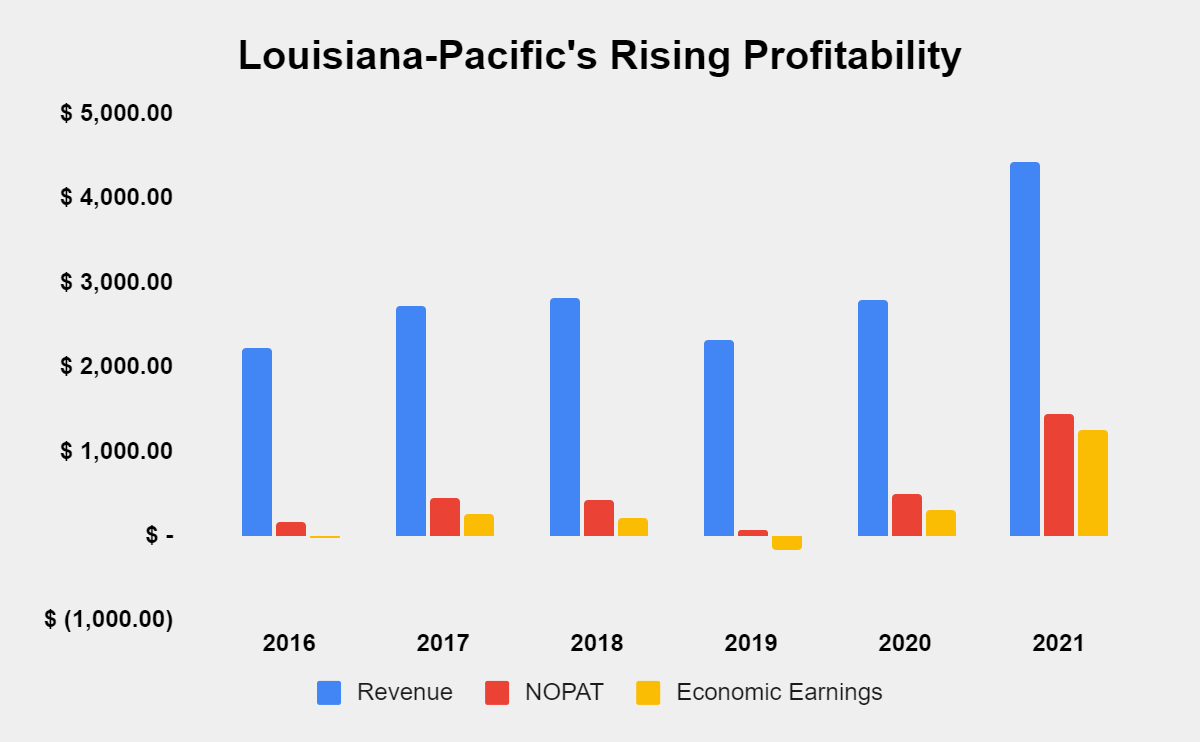

This commitment to increasing shareholder value is clear in the operational results of the company.

Revenue has grown from $2.2 billion in 2016 to nearly $2.8 billion in 2020. In the current/trailing twelve months (TTM) period, the company’s revenues stand at over $4.4 billion.

In that time, the company grew net operating profits after-tax (NOPAT) from $163 million in 2016 to $489 million in 2020, with the current/TTM period having a NOPAT number of $1.4 billion.

Louisiana-Pacific’s return on invested capital (ROIC) reflects management’s efforts at improving shareholder value. In 2016, ROIC was 6.3% against a cost of capital of 7.6%, but by 2020, ROIC had risen to 19.5%, with the cost of capital down to 7%. In the current/TTM period, ROIC has risen to 56.8%.

Unsurprisingly, in 2016, the company’s economic earnings were negative, at -$32 million, but by 2020, they stood at $313 million and in the current/TTM period, they are nearly $1.3 billion.

Source: Company filings

Louisiana-Pacific’s free cash flow (FCF) has actually declined from $610 million in 2016 to $603 million, with a low of -$28 million in 2019. In the current/TTM period, however, it stands at nearly $1.3 billion. The company’s enterprise value has more than doubled since 2016. In 2016, it was $610 million, rising to over $4 billion in 2020, and more than $5.9 billion in the current/TTM period. That gives Louisiana-Pacific a very attractive FCF yield of 21.8%. Buying growing FCF at attractive prices is at the heart of investment, and this certainly makes the company very attractive.

The company’s capital allocation strategy, as stated in the 2020 annual report, is to invest in growth and innovation, and gives at least half of the company’s cash to shareholders in the form of dividends and share repurchases. In 2020, that translated to $65 million in dividends paid and a quarterly dividend increase from $0.145 per share; $200 million in share repurchases and a reduced share count by 5% to approximately 106 million shares outstanding. The company’s operating results suggest that it can support its capital allocation policy.

The Market is Overly Pessimistic About Louisiana-Pacific’s Prospects

The company has grown its economic book value (EBV) from nearly $2 billion in 2016 to almost $6.9 billion in 2020. In the current/TTM period, its economic book value has soared to $19.178 billion, translating to an EBV per share of $217.97. Owners of the stock have seen the share price rise from $18.93 at the end of 2019 to $37.17 at the end of 2021. Currently, the company trades at about $66 per share. That gives a price-to-EBV per share (PEBV) ratio of 0.3. Considering that the company had a PEBV of 1.25 in 2016, somehow the market has become more pessimistic about the company’s fortunes as its operating results have improved.

A PEBV of 0.3 implies that the market expects a 70% decline in Louisiana-Pacific’s NOPAT within the year, and almost no growth over the remainder of the company’s life. These are very conservative.

The market has given investors a margin of safety by assuming a worst case scenario in the company’s fortunes. Given Louisiana-Pacific’s performance since Southern took over, there is little reason to believe that profitability will fall. In fact, consensus estimates predict just a 50% decline in EPS, suggesting that even if profitability declined as supply constraints eased, it will not be as precipitous as the price-implied expectations suggest.

Conclusion

The supply-side economics of the building materials industry have pushed housing prices ever higher. Against historical tendencies, the OPS market has maintained capital discipline throughout the housing boom, and Southern’s reforms have driven costs down and improved profitability. Shareholder value is growing at levels unseen in the company’s history. There is little reason to believe that the supply-side economics of the industry will soften in the next few years. Demand remains very high and there is no immediate solution to the housing shortage. Added to that, the industry has consolidated and improved its capital discipline, so investors should not fear the kind of destruction of shareholder capital that occurred in years past.

Be the first to comment