txking/iStock Editorial via Getty Images

This article was coproduced with Cappuccino Finance.

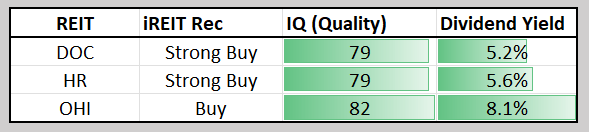

The second article in the series of “Landlord’s Game” covers Healthcare real estate investment trusts (“REITs”).

(Here is a link to the first one: Quest For ‘Wide Moat’ Apartment REITs):

As I referenced in a previous article, “the first version of Monopoly was actually called “The Landlord’s Game”, developed in 1906 by American antimonopolist Lizzie Magie…

One terrific thing about REITs today, and I’m certain that Mrs. Magie would agree, is that there are so many different ways to roll the dice and build a monopoly of dividends.”

As the U.S. population ages and technology develops, spending on health care has been growing substantially, and will only continue to do so in the future.

At the same time, the regulatory environment is becoming more complex and costly. This creates demand for REITs that can offer cost effective solutions for health care real estate. The following three REITs are among the best way to invest in the trend.

Health Care Spending in The United States, Source: Physicians Realty 10-K

Physicians Realty (DOC)

Physicians Realty Trust is a REIT that focuses on acquiring, developing, owning, and managing health care properties. They lease their assets to physicians, hospitals, and health care delivery systems.

Physicians Realty has grown their portfolio substantially, from $124M at the time of their IPO in 2013 to $5.4 B in 2022. The portfolio now includes almost 300 health care properties across 36 different states.

Physicians Realty’s business model is straightforward, but powerful. Leveraging their nationwide relationship with physicians and hospitals, they identify and acquire off-market properties with a dominant market share and high credit quality. Their primary tenants are health care systems, academic medical centers, and leading physician groups.

From the properties, they receive a cash rental stream based on absolute net and triple net leases (94% of their base rent payments), while tenants are responsible for operating expenses. Also, their leases include annual rent escalators between 1.5% to 4.0%, and some of the escalators are tied to Consumer Price Index (CPI). As of December of 2021, the average weighted remaining lease term of their portfolio was 6.3 years.

Earlier in August, they delivered solid Q2 2022 results, mostly driven by exceptional leasing spreads of 8% on renewed leases (256,000 sq. ft.) and effective cost control.

Also, they strengthened their balance sheet greatly by disposing of several Great Falls properties (a surgical hospital and two office buildings). Net proceeds from selling the properties were $116 M, representing a net gain of $54 M. The transaction reinforced their debt-to-EBITDA ratio of 5.65x. This action also eliminated the need to refinance in the next couple of years.

This solid operational performance puts their normalized fund available for distribution at $61 M, which grew 11% from last year’s figure. They also successfully raised $18 M on an ATM program, which will support their acquisition pipeline. They are set up for continued growth, and their fund available for distribution will follow this same trend.

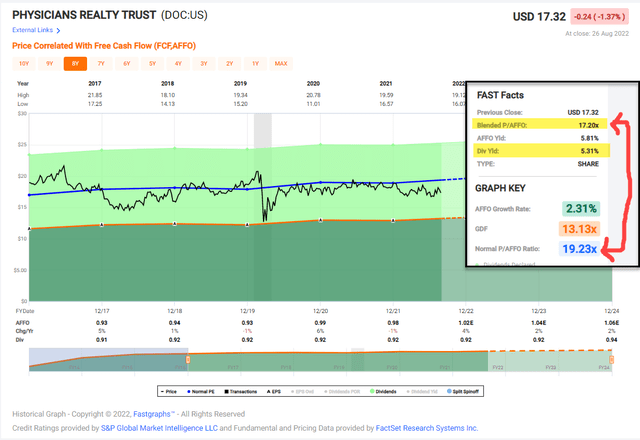

Their AFFO payout ratio (92.18%) and FAD payout ratio (86.94%) are on the higher side compared to their peers, but, with a solid balance sheet and growing portfolio, I believe their dividend is safe.

Also, their current P/FFO ratio (16.65x) suggests that they are trading slightly under their historical multiple (17.3x, 5-year average). I see this as a great time to grab some shares of Physicians Realty with a strong dividend yield (5.3%).

Healthcare Realty Trust Incorporated (HR)

Healthcare Realty is a REIT that owns and operates medical office buildings. Their assets are located on health system campuses, university medical centers, and outpatient locations.

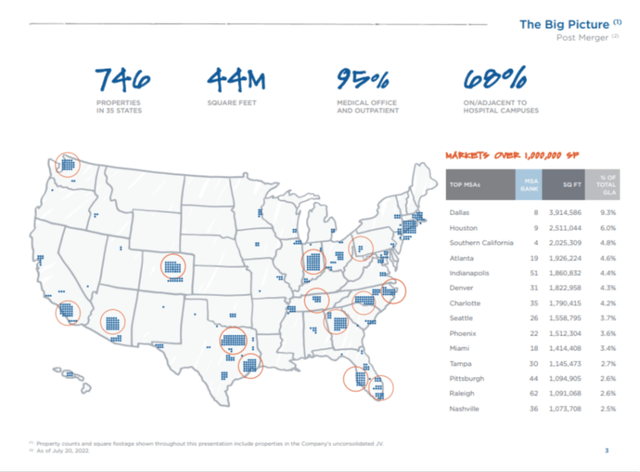

In July, Healthcare Realty merged with Healthcare Trust of America, capturing great synergy between the two organizations. The combined portfolio spans over 700 properties and 40 million square feet. A large portion of their assets are found in major U.S. metropolitan area such as Dallas, Seattle, Houston, Boston, Atlanta, and Miami.

As part of the merger, they plan to sell assets to fund a generous special cash dividend of $1.1 B. They have already closed on several properties, enough to generate $433 M, and are under contract on another $613 M that are expected to close by the end of August.

The total proceeds from these transactions will fund the special cash dividend. Additionally, they are planning to sell more properties (totaling $500 M to $1 B) over the next several quarters to refine their portfolio and to generate a fund for future acquisitions.

As a promising early performance indicator, the combined portfolio is showing great leasing momentum. The two groups as a team generated 600,000 square feet of new leases in 2Q 2022.

As Healthcare Realty grows the overall portfolio and the number of new leases, the company should see a stronger occupancy rate and higher net operating income. NOI has already increased by 3.3% YoY in the last quarter.

Given their strong acquisition activity ($417 M in this year, highlighted by 3 building acquisitions in Raleigh), I expect this growth to continue well into the future.

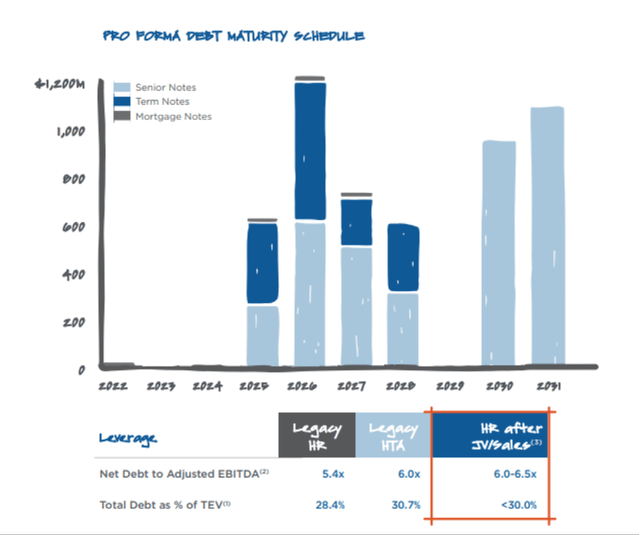

Looking at the balance sheet, the joint entity shows a solid Net Debt to Adjusted EBITDA ratio of around 6.0-6.5x, and Total Debt to Total Enterprise Value will remain around 30% or less.

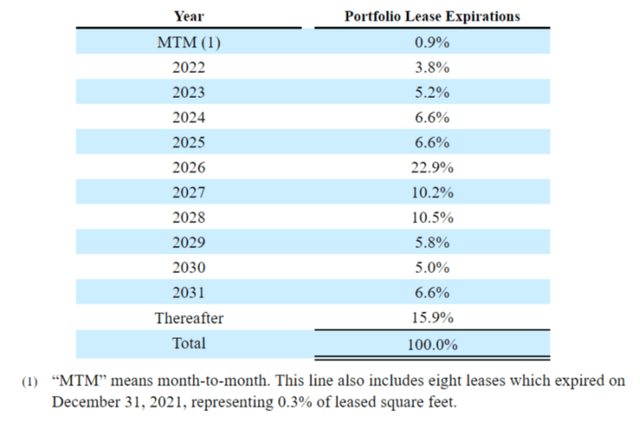

This manageable debt level gives flexibility going forward. Their AFFO payout ratio (86.19%) and FAD payout ratio (88.12%) do fall on the high side compared to the sector, but with a solid balance sheet, favorable debt maturity schedule, and operational efficiency, I believe their dividend payment is safe.

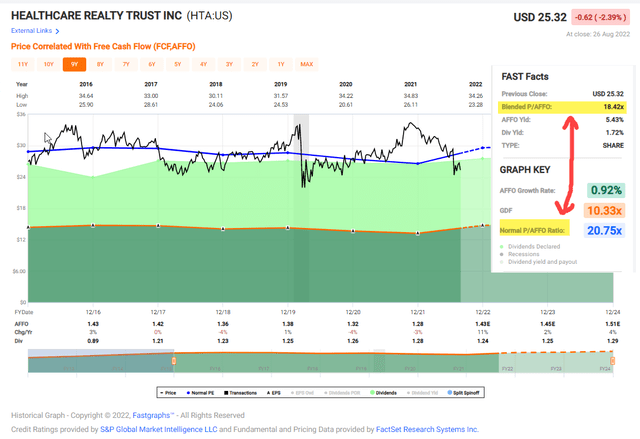

Based on their current valuation (P/AFFO of 18.48x and P/FFO of 14.47x), their stock price is being traded below their historical average, representing an opportunity for some stock appreciation on top of the dividend payment.

Given the rising costs of debt and uncertainty in the economy, it may take some time for the market to realize the true value of Healthcare Realty, but I expect it to rise comfortably in the long run.

Omega Healthcare Investors, Inc. (OHI)

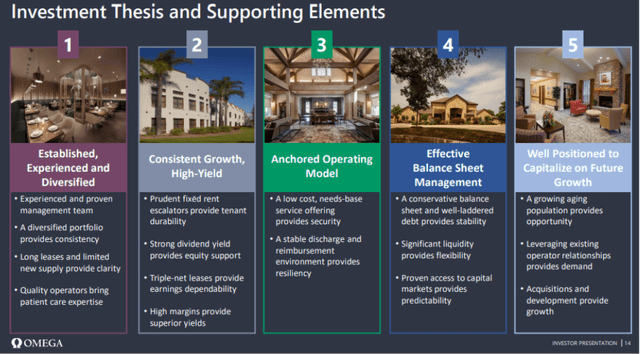

Omega Healthcare Investors is a REIT that provides financing and capital to skilled nursing facilities, assisted living facilities, independent living facilities, rehabilitation and acute care facilities, and medical office buildings. Their portfolio consists of long-term leases and mortgage loans with healthcare operators, and their leases are triple net. Their assets include over 900 healthcare facilities in 42 states in the U.S. and the U.K., and the facilities are operated by over 60 different operators.

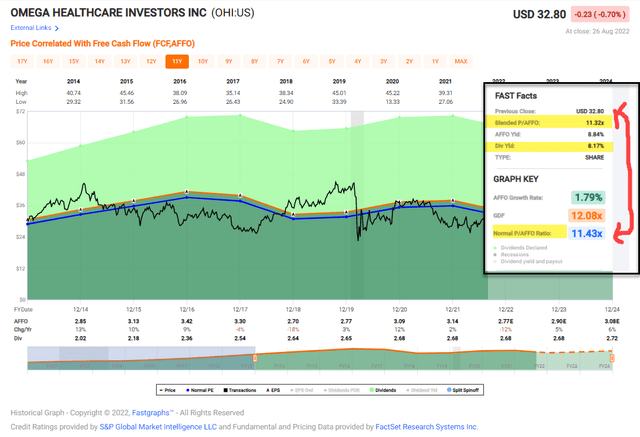

Omega Healthcare Investors offers the attractive combination of a high dividend yield (8.17%), growth (7.8% annualized AFFO growth since 2004), and value (P/FFO of 10.51x). These attractive fundamentals stem from several different elements.

The first one is a diversified portfolio consisting of long leases (9-year average lease term remaining) and high-quality operators. The second is consistent growth coming both from an aging population and built-in growth (annual escalator). Lastly, regulatory restrictions provide high barriers of entry for new competitors, represented by the limited growth of new supply in the space.

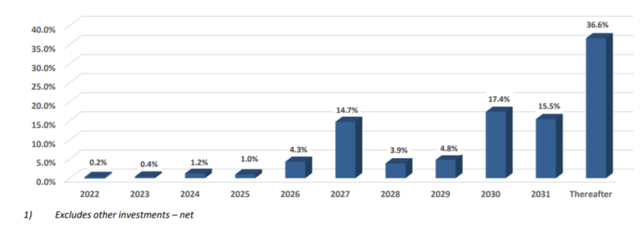

Lease and Mortgage Expiration Schedule, Source: Investor Relations

On the 2Q results, CEO Taylor Pickett, commented that,

“The second quarter saw sequential improvement in both Adjusted FFO and FAD, as some restructured operators returned to paying their contractual rent obligations.

However, our financial results continue to be impacted by nonpayment of rent by a few operators and, with both facility occupancy and profitability still meaningfully below pre-pandemic levels, the risk of further operator issues remains.”

Despite several operators experiencing some business challenges (Agemo, Guardian, and 2 others), Omega Healthcare reported solid performance, supported by the overall strength of their portfolio and effective risk management.

Their AFFO per share of $0.76 for the quarter was higher than the consensus of $0.74, and their revenue of $245 M also topped the consensus of $220 M. The net income for the quarter was $92 M, or $0.38 per share, which was 6% higher than the previous year ($87 M and $0.36 per share). Also, the sale of 13 facilities generated $54 M in cash proceeds, representing a $25 M gain.

Omega Healthcare is actively working with Agemo, Guardian, and another operator to restructure their agreements, sell assets, and to release assets to other parties. Even though some uncertainty and risks remain, I expect the situations with these struggling operators to improve as complications from Covid-19 subside in the future.

For example, Guardian couldn’t make its payment in the first quarter and was placed on a cash basis. However, Omega Healthcare resolved this in the second quarter by selling seven facilities previously leased to Guardian and agreeing to a formal restructuring agreement.

Afterwards, Guardian paid $5.2 M ($3.8 M of contractual rent payment and $1.4 M in interest payment), and Guardian is now current on rent and interest through July.

Looking at their valuation, they are clearly undervalued compared to their peers. The P/AFFO of 11.26x and P/FFO of 10.51x are significantly lower than the sector medians of 17.19x (P/AFFO) and 15.11x (P/FFO).

Also, their current valuation is about 15-20% lower than their 5-year average, representing great value for investors. Their high dividend payout ratio (88% of AFFO and 94% of FAD) should not cause worry, as it is more than compensated by their flexible balance sheet, strong portfolio, and strong operator coverage (1.52x EBITDARM and 1.18x EBITDAR).

Conclusion

The healthcare industry is an industry that just keeps on growing. People want to live long and enjoy a high standard of living. Real estate plays a key role in the healthcare industry because operators need prime locations with manageable costs for their business.

The three REITs in this article provide a great opportunity for investors to take advantage of this trend. All three offer a solid business model, strong growth, well managed portfolio, and flexible balance sheet. These present solid options for dividend-oriented investors.

iREIT

Be the first to comment