Prykhodov

Introduction

As layoffs are implemented by major tech companies, such as Meta (META) and Amazon (AMZN), we may wonder which one of big tech companies will be up next and will have to reduce its headcount. In this article, I would like to share my research on a point that I don’t see often debated. I think that if we look at stock-based compensation expenses (SBC) we see that Apple (NASDAQ:AAPL) and Google (NASDAQ:GOOG, NASDAQ:GOOGL) are walking two different paths. By looking at a very few numbers, I think it is clear that Google is in a much worse position than Apple and may happen to be the next company that needs to cut costs by conducting layoffs.

Stock-based compensation (SBC)

What we are going to see in this article is quite simple and it is based on a few simple charts.

The issue is easy to grasp, though often overlooked: stock-based compensations can have a meaningful impact on free cash flow [FCF], making it not so free as one may think.

In fact, we usually recognized free cash flow as cash flow from operations minus capital expenditures. Usually, SBC is added back to cash flow from operations and it actually seems to be an addition to FCF. However, sooner or later, SBC is funded with real cash that is taken from the supposedly “free cash flow” that belongs to the shareholders.

This is what happens: those companies that reward their employees with SBC, though they don’t really draw cash from their operations to issue stock, they for sure have to use some cash from financing activities. True, some companies may issue new shares, diluting the shares outstanding while others may repurchase shares for their SBC so that they can pay their employees the promised incentives. In any case, these are real dilutions to shareholders and they represent real cash obligations that take away a portion of the free cash flow.

So, while SBC can be a good way to reward employees, from a shareholder point of view, it must be factored in as an expense that eats away a part of the free cash flow. By giving away a portion of free cash flow, every shareholder should know that, by accepting some sort of dilution, he or she is retaining employees. From this point of view, every shareholder would want that the company is making sure it is hiring and retaining the best employees available.

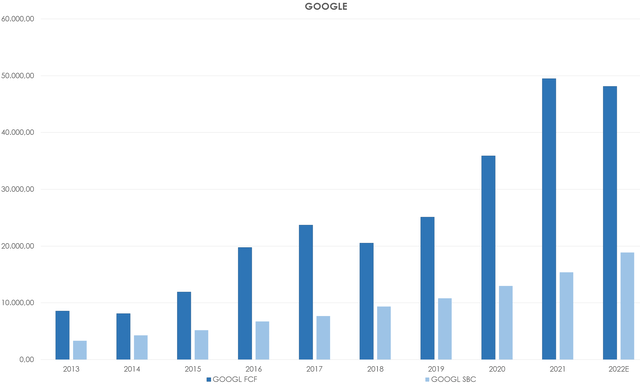

Google: FCF and SBC

Let’s see what Google has done in the past decade. In dark blue we see its free cash flow, while in light blue its stock-based compensation. Google’s FCF moves upwards at a CAGR of 18.87%, reaching almost $50 billion per year in 2021. This is staggering and many investors have been pleased by it.

However, SBC has grown at the same CAGR, moving up from $3.34 billion in 2013 to $15.38 last year. As we see from the graph below, SBC as a percentage of FCF is in a range between 31% and 59%, depending on the year. In other words, SBC on average eat away about a third of free cash flow. This is significant.

Author, with data from SA

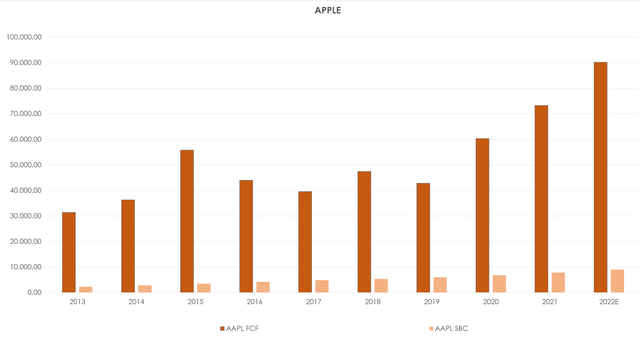

Apple: FCF and SBC

Let’s look at Apple. Here, once again, we see a beautiful upward trend of free cash flow, that increased from $31.42 billion in 2013 to $90.22 billion in the recently ended fiscal year. Apple’s FCF, though it has almost tripled in a decade, compounded at a CAGR of 11.12%, which is slower than Google. However, when we look at SBC, we see that Apple manages it much better, keeping this kind of expense between 7% to 14% of total free cash flow.

Author, with data from SA

This means that Apple is protecting its free cash flow more than Google, by diluting less and keeping on hand a much greater portion of its free cash flow for its shareholders.

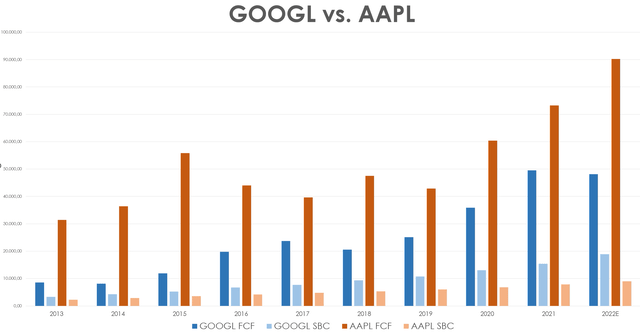

If we put the two graphs above together and we combine them in one, we see even better how Google, though it has a lower free cash flow than Apple, has been deploying a lot more money on SBC than Apple, as the light blue and light orange bars show.

Author, with data from SA

Two factors: headcount and buybacks

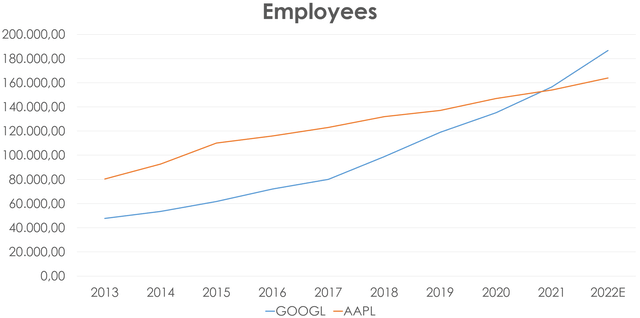

Once we have identified the big difference, we can add to our thoughts another aspect: headcount.

Once again, as we can clearly see from the graph below, while Apple has grown its working force at a constant pace, Google’s headcount has increased at a faster pace year after year, eventually catching up with Apple and even surpassing it. If we consider that at the end of 2021 Google reported $15.38 billion in SBC and 156,500 employees. This means that the average SBC per employee was $98,000.00.

On the other hand, in 2021, Apple had 154,000 employees and its SBC amounted to $7.9 billion. This leads to an average SBC per employee of $55,000.00, which is about a half of Google’s SBC per employee.

Author, with data from SA

The conclusion is quite simple, it costs more and more for Google to retain its workers, while Apple is not facing this issue to a very large extent.

Now, we could argue that these companies do a lot of share buybacks and that in this way the impact of dilution is diminished if not completely offset.

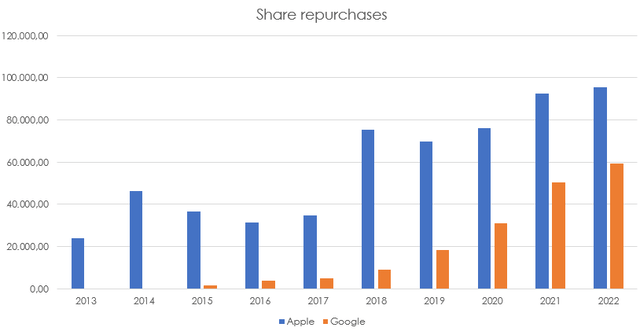

Here in this graph I put together the share repurchases that each of the two reported for the past decade. At first, Google didn’t even do any buyback, even though in recent years it has started “devouring” its share count.

Apple, on the other hand, has been quite consistent in terms of share repurchases.

Author, with data from SA

However, even if both companies spend many billions per year, SBC are not simply wiped away and the dilutive effect, even though mitigated or erased by share repurchases, has an impact on all shareholders.

Takeaway

Considering the situation we have seen, it is clear that Google currently has a workforce that costs much more than Apple’s. The number of employees is increasing quickly and as Google hires more and more, SBC will have an ever increasingly meaningful impact on Google’s FCF. Apple, on the other hand, doesn’t seem to have such an issue.

I am long both stocks, even though Apple is a core position in my portfolio. I also think Google is frankly undervalued and that in the next few quarters we could see its advertising revenue go up once again as many companies resume ad spending at pre-pandemic levels, as I tried to point out in my article “Alphabet: This Is What P&G, Hershey And Airbnb Hint Us About Google“.

However, if the numbers we have seen don’t lie, I think that it is clear that Google has a SBC issue and that it may well be the next big tech company that could announce spending cuts and layoffs. In this case, though unfortunate for those who would be fired, shareholders should be happy because they could see a reduction of SBC and, as a consequence, an increase in real available free cash flow.

Be the first to comment