South_agency/E+ via Getty Images

A Quick Take On Cadre Holdings

Cadre Holdings (NYSE:CDRE) went public in November 2021, raising approximately $78 million in gross proceeds from an IPO that priced at $13.00 per share.

The firm manufactures safety and survivability products primarily for first responder markets worldwide.

While CDRE has performed well as a stock as talk of ‘defund the police’ has diminished, where it goes from here is an open question.

Since I’m cautious on its forward outlook (as is management), I’m on Hold for CDRE in the near term, although interested investors may wish to put the stock on a watchlist for future consideration.

Cadre Holdings Overview

Jacksonville, Florida-based Cadre was founded to manufacture and sell body armor, ordnance disposal equipment and third-party products.

Management is headed by Chairman and Chief Executive Officer Warren Kanders, who has been with the firm since April 2021 and was previously Chairman and CEO of Armor Holdings.

The company’s primary offerings include:

-

Body armor

-

Ordnance disposal equipment

-

Uniforms

-

Optics

-

Boots

-

Firearms

-

Ammunition

-

Duty gear

The firm sells its products to various law enforcement agencies and other first responders through distributors while working directly with agencies to reach end users.

Cadre sells in over 100 countries and markets through distributors as well as through online e-commerce channels.

Cadre Holdings’ Market & Competition

According to a 2021 market research report by Grand View Research, the global body armor market was an estimated $2.3 billion in 2020 and is forecast to reach $4 billion by 2028.

This represents a forecast CAGR of 5.4% from 2021 to 2028.

The main drivers for this expected growth are an increase in demand for new technological innovations such as liquid armor, dragon skin and DEFCON.

Also, below is the historical and projected forecast body armor market size for the Asia Pacific region:

Asia Pacific Body Armor Market (Grand View Research)

Major competitive or other industry participants include:

-

Point Blank Enterprises

-

Avon Protection Systems

-

Central Lake Armor Express

-

Blackhawk (Vista Outdoor)

-

Others

Cadre Holdings’ Recent Financial Performance

-

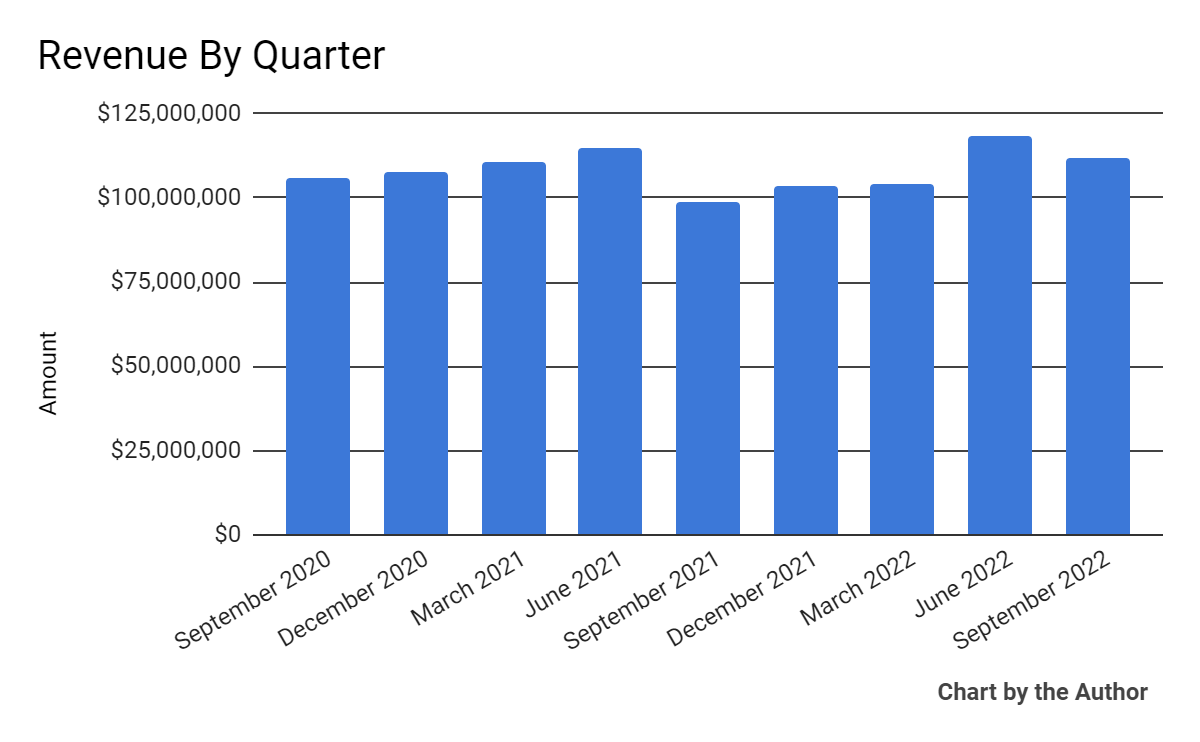

Total revenue by quarter has risen slowly, as the chart shows here:

9 Quarter Total Revenue (Seeking Alpha)

-

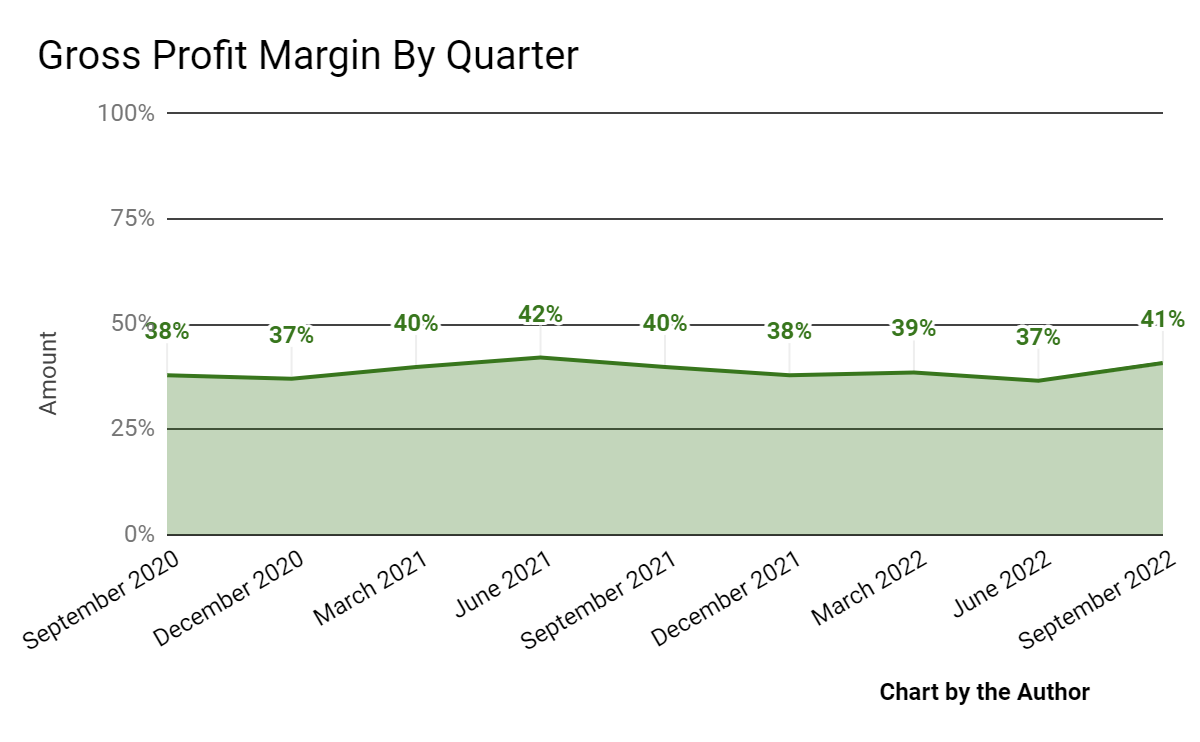

Gross profit margin by quarter has fluctuated within a narrow range:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

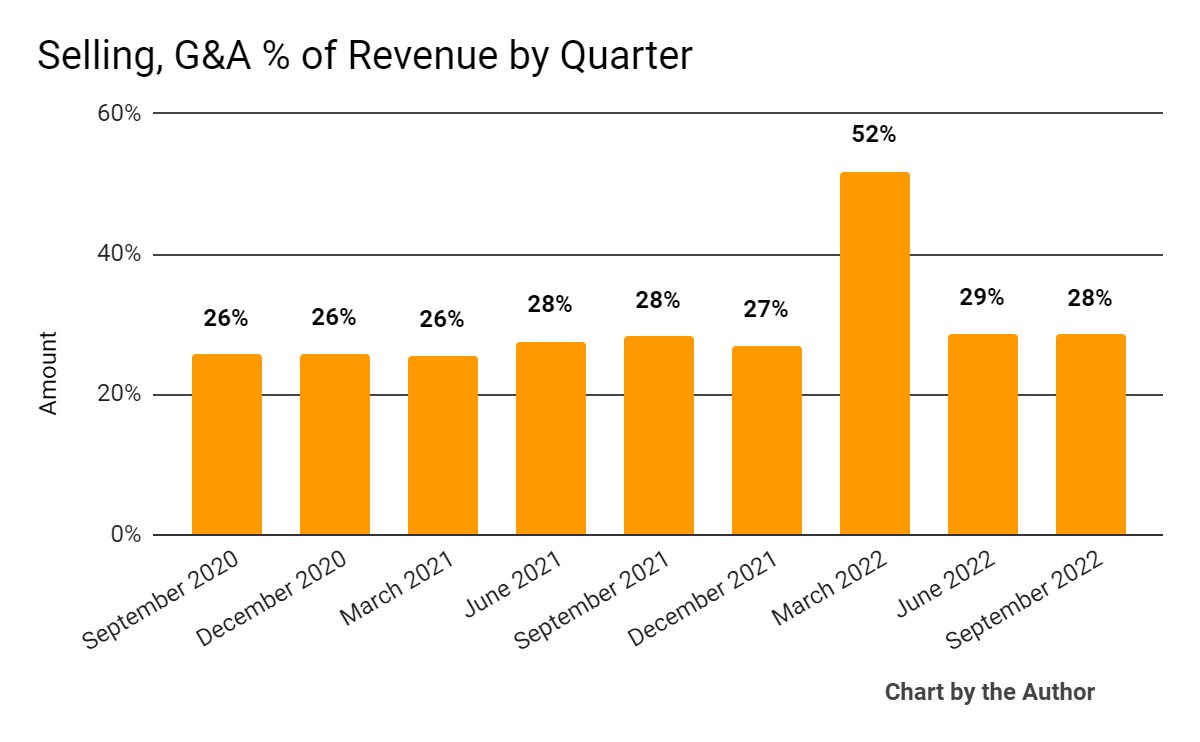

Selling, G&A expenses as a percentage of total revenue by quarter have generally remained in a tight range, with the exception of Q1 2022:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

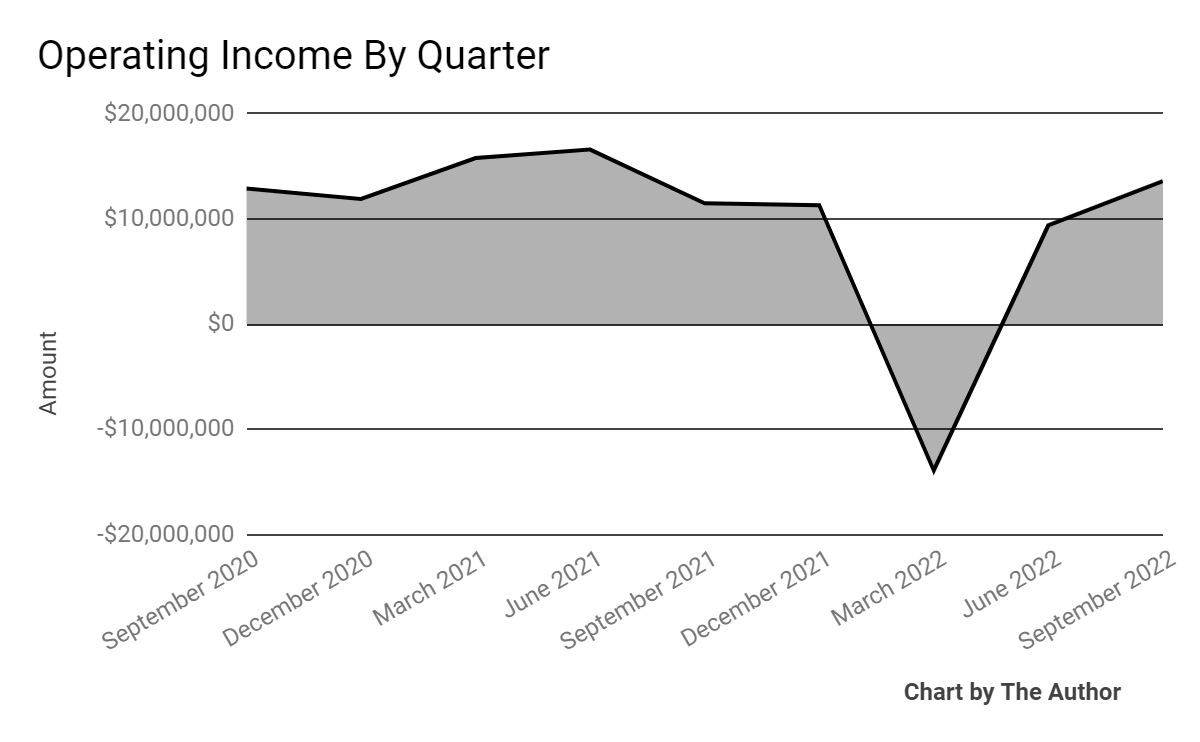

Operating income by quarter has mostly been positive, with the exception of Q1 2022:

9 Quarter Operating Income (Seeking Alpha)

-

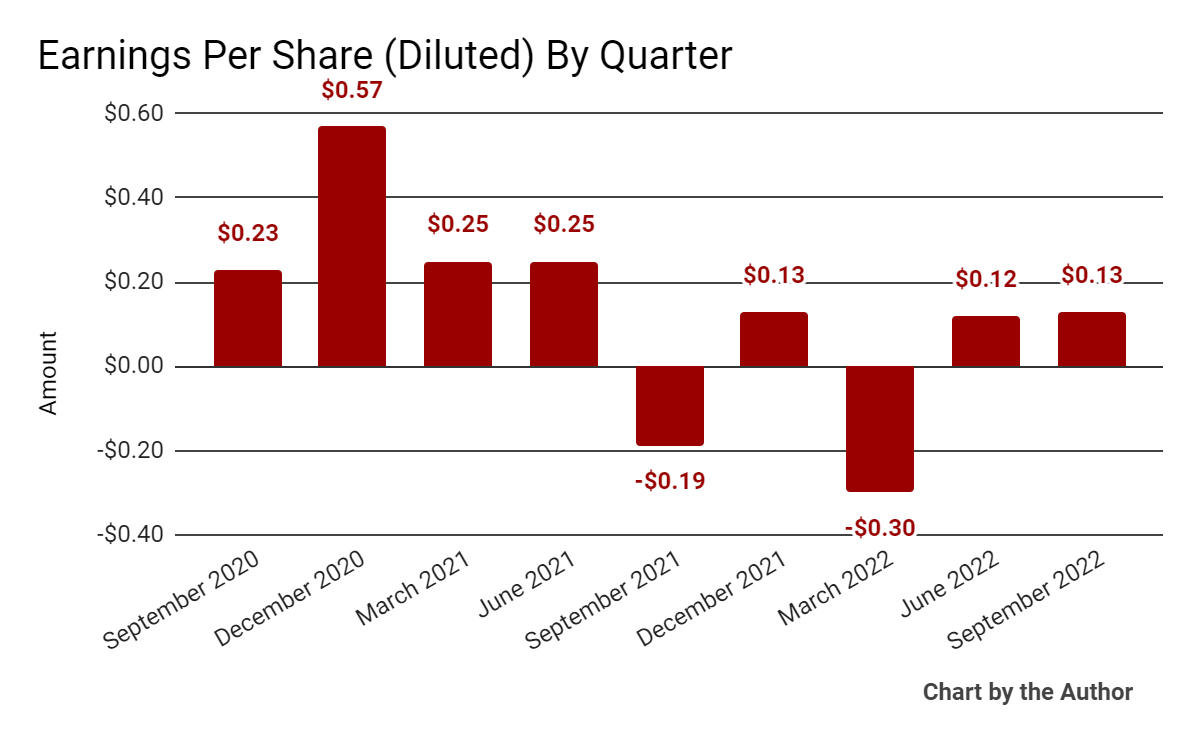

Earnings per share (Diluted) have been positive with few exceptions:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

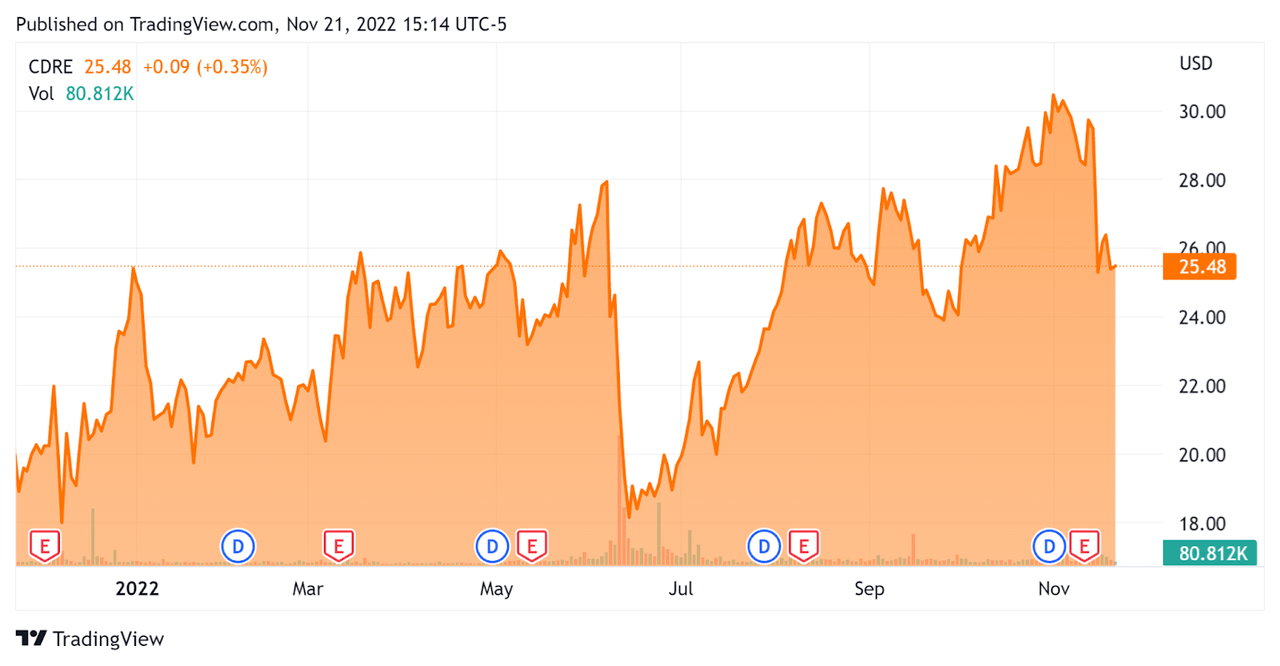

Since its IPO, CDRE’s stock price has risen 26% vs. the U.S. S&P 500 index’s drop of around 15.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Cadre Holdings

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.4 |

|

Enterprise Value / EBITDA |

28.5 |

|

Revenue Growth Rate |

1.5% |

|

Net Income Margin |

0.8 |

|

GAAP EBITDA % |

8.5% |

|

Market Capitalization |

$947,870,000 |

|

Enterprise Value |

$1,060,000,000 |

|

Operating Cash Flow |

$38,610,000 |

|

Earnings Per Share (Fully Diluted) |

$0.08 |

(Source – Seeking Alpha)

Commentary On Cadre Holdings

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted an improving demand environment for first responders as talk of ‘defund the police’ has turned to ‘refund the police’, at least in some cities and regions.

The firm also has a ‘robust M&A pipeline’ and it seeks to use its ‘solid’ balance sheet to enable selective acquisitions as part of a diversification effort within its safety and survivability focus.

Chairman Warren Kanders also noted that the company had previously hedged a ‘substantial portion’ of its debt that reduced its exposure to higher interest rates and said that he expects the firm to ‘further delever through the end of the year.’

As to its financial results, total revenue rose by 12.7% year-over-year, while gross margin percentage grew by 1%, reaching 41%.

The firm continues to experience supply chain disruptions and delays but it retains pricing power to offset higher costs.

CDRE turned a profit during the quarter versus a net loss in Q3 2021, due in part to a more favorable product mix.

For the balance sheet, the company ended the quarter with $39.5 million in cash, equivalents and trading asset securities and $153.1 million in debt.

Over the trailing twelve months, free cash flow was $35.1 million, with only $3.35 million in capital expenditures.

Looking ahead, management reiterated previous guidance for full year 2022, with an expected $448 million in revenue at the midpoint of the range and adjusted EBITDA of $75 million at the midpoint.

Regarding valuation, the market is currently valuing CDRE at an Enterprise Value / EBITDA multiple of 28.5x, which seems excessive given its uneven performance history.

The primary risk to the company’s outlook is a slowing U.S. economy, which could reduce purchasing or slow down sales cycles, hurting revenue growth.

While CDRE has performed well as a stock as talk of ‘defund the police’ has diminished, where it goes from here is an open question.

Since I’m cautious on its forward outlook (as is management), I’m on Hold for CDRE in the near term.

Interested investors may wish to put the stock on a watchlist for future consideration.

Be the first to comment