Bet_Noire/iStock via Getty Images

The FOMC meeting will be held on June 15, and it is widely expected that the Fed will raise rates by 50 bps at this meeting. Some firms believe the Fed may raise rates by 75 bps, but I think that is less likely, and there will only be a 50 bps hike.

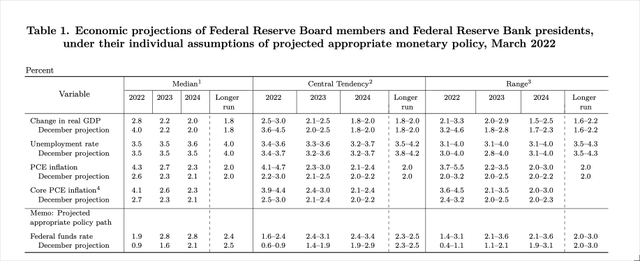

The significant messaging will be the potential policy path from the Fed expressed in the FOMC projections. The plots will provide the Fed’s outlook on GDP, unemployment, inflation, and where they see the Fed funds rate heading for the rest of 2022, 2023, and 2024. The rate estimates for March are now in the rearview mirror and will be adjusted sharply higher.

If the messaging is handled correctly, indicating the Fed sees even higher rates than current market expectations and that the Fed is willing to sacrifice economic growth and jobs, the Fed is likely to achieve its goal of tightening financial conditions.

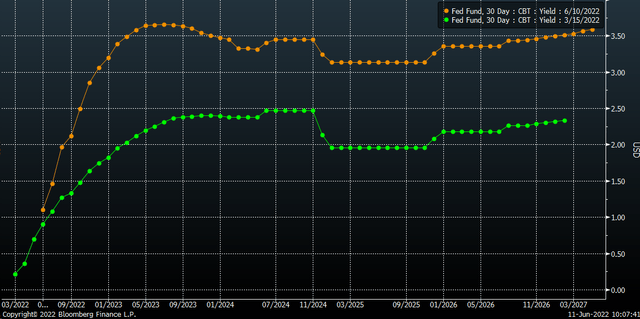

Fed Funds futures are now pricing a rate of 3.05% for December 2022 and a peak rate of 3.65% for July 2023, which comes down to 3.5% by December 2023. For December 2024, the Fed Funds futures have a rate of 3.25%. Current Fed Funds futures are sharply higher than the pricing in March of 1.9%, 2.8%, and 2.8% for 2022, 2023, and 2024, respectively.

The Fed dot plots will need to exceed these current market expectations to keep their hawkish message and tighten financial conditions. If the Fed’s projections come in below market expectations, it will be taken as a dovish message and may result in the market worrying the Fed is not on the right path to bring inflation down.

Additionally, given the negative GDP print in the first quarter and the weak Atlanta Fed GDPNow estimates for the second quarter, it seems highly likely that the GDP estimates will be revised lower. The Fed should also boost its unemployment rate forecast, given the higher rates and weakening GDP growth.

The message in these simple plots would be that the Fed is willing to sacrifice growth and employment to bring inflation down. That is the message the Fed needs to send to the market to keep financial conditions tightening. The Fed needs financial conditions to tighten as much as it can with words and without having to lift rates.

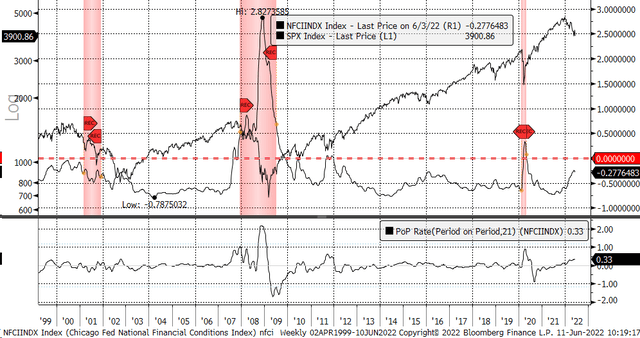

Financial conditions have tightened dramatically this year, but they need to tighten more and get above 0 to have a restrictive and slowing effect on the economy. It is the Fed’s best chance to bring inflation down without over-tightening, and it is much easier for them to unwind than going through a rate-cutting cycle.

What the Fed has been trying to do to this point seems more likely an exercise in trying to get an orderly decline in risk assets and tighten financial conditions. They have done this mainly through messaging and jaw-boning the market to tighten financial conditions to this point that messaging has worked, but for it to continue to work, the Fed will need to deliver another stern message to the market that they will do even more.

If the Fed can signal its willingness to do more and back that up with actual rate hikes and the wind-down of its balance sheet, then the Fed will successfully bring inflation down without ever having to get to 3% overnight interest rates.

But to do that, the Fed needs to be willing to indicate very forcefully it is willing to sacrifice growth and jobs to achieve that goal. If it fails to do that, then the inflation problem will only grow worse.

Join Reading The Markets Risk-Free With A Two-Week Trial!

Investing today is more complex than ever. With stocks rising and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Be the first to comment