Tast Nawarat

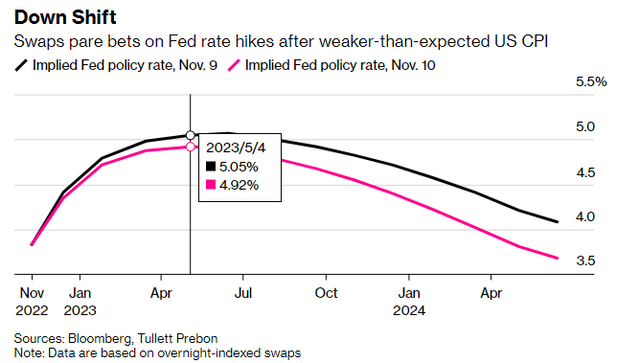

I view last week’s record surge in stock prices as a long-anticipated acknowledgement that the rate of inflation peaked this summer and will begin to fall at a more rapid pace than originally thought. As a result, the Fed will not have to be as aggressive in its rate-hike campaign, which suggests that the terminal rate will be lower than originally expected. In turn, interest rates fell across the curve and the dollar continued its decline, which both provide a boost to the top and bottom lines of corporations. The only potential headwind last week was the collapse in everything cryptocurrency, but it turned out to be a sideshow. Instead, it looked more like the final nail in the coffin of speculative excesses that the tightening of monetary policy intended to extinguish. That does not mean digital coins will vanish, as I’m sure Bitcoin and the technology behind it will be with us indefinitely, but it is no longer a relevant factor in swaying market sentiment.

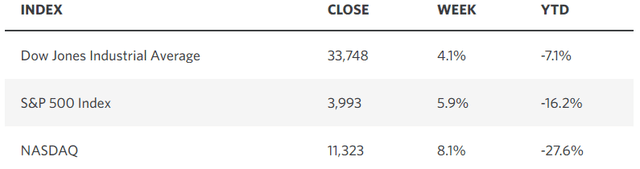

My outlook for Fed policy goes one step further than last week’s acknowledgment, because I think the December meeting will bring a final 50-basis-point increase in the Fed funds rate for his rate-hike cycle, resulting in a terminal rate of 4.25-4.50%. The consensus still sees the peak at closer to 5% not arriving until March of next year, according to CME Fed funds futures pricing. A further reduction in expectations for rates should provide risk assets with more fuel to the upside.

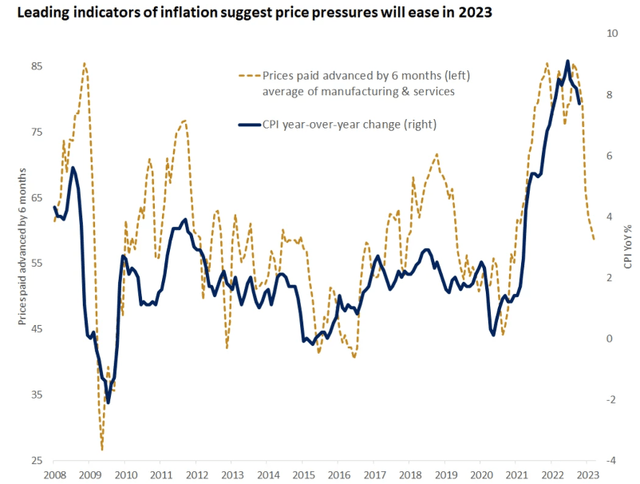

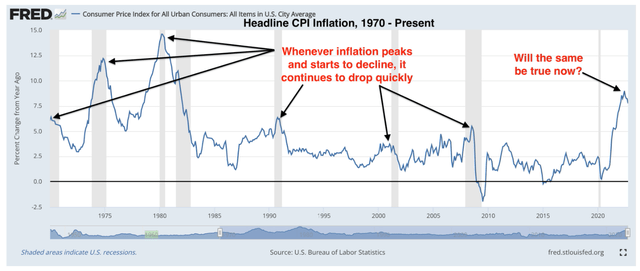

I am extremely confident that October’s inflation print was the beginning of a more pronounced downtrend. Goods inflation was the first to start decelerating due to less consumer demand, lower shipping costs, excess inventories, and the easing of supply shortages. We are just starting to see the first signs of inflation for services begin to decelerate, with rents declining on a monthly basis and home prices rolling over. Outside of the core, the food-at-home index had its smallest monthly increase since December 2021. Energy prices will soon start to realize very difficult comparisons on a year-over-year basis as we near the end of the first quarter of 2023. Lastly, the prices paid by purchasing managers in both the services and manufacturing sectors have fallen to levels that suggest we will see the Consumer Price Index fall very close to the Fed’s target during the second half of next year.

This does not mean I am free of concern. History shows that when inflation peaks and starts to decline during a cycle, the decline is very rapid. That is the good news. The bad news is that it is often accompanied by a recession, which has been the impetus for the price decline.

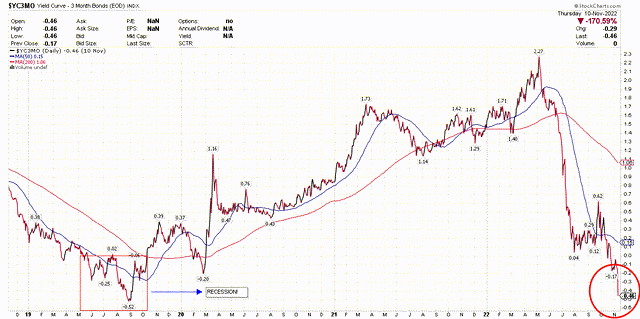

The inversion of the 3-month Treasury yield and 10-year yield over the past two weeks is an early warning sign that a recession in 2023 is still a possibility. The 3-month yield at 4.2% is a reflection of near-term monetary policy action, while the 10-year yield at 3.9% is more closely tied to economic growth and consumer prices. The inversion is the bond market’s way of telling the central bank that its policy is becoming too restrictive and could result in an economic contraction. I think Chairman Powell is taking this into consideration, but he wants to see more definitive signs of price declines before taking his foot off the brakes. I think he will have enough reasons to do so by December, and this inversion will dissipate, but it can’t be ignored.

We saw the same inversion during the summer of 2019, which started nearly one year in advance of the recession in 2020. An important note is that it lasted six months, while the one today has lasted three weeks. I expect this yield curve to flatten with 10-year yields creeping back above 4%, and the easing of Covid restrictions in China could be the catalyst. Last week, the government shortened quarantine requirements for visitors by two days and reduced the degree of contract tracing for new infections. Recent air pollution data in China’s five largest cities show there has been an immediate increase in economic activity. This should further improve the global supply chain and increase the expected rate of global growth.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment