Marcio Silva/iStock via Getty Images

Real Estate Weekly Outlook

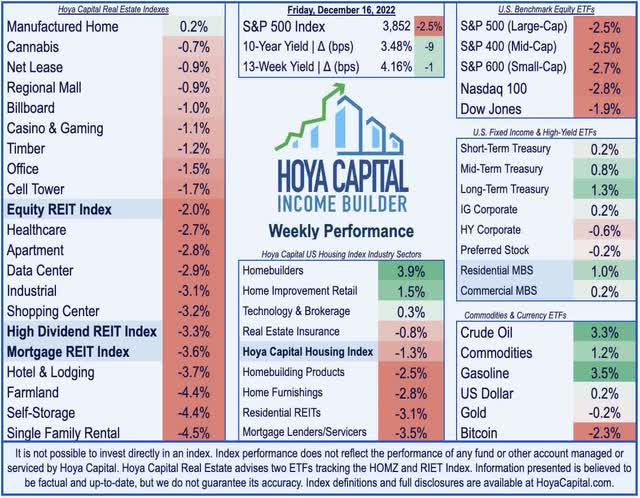

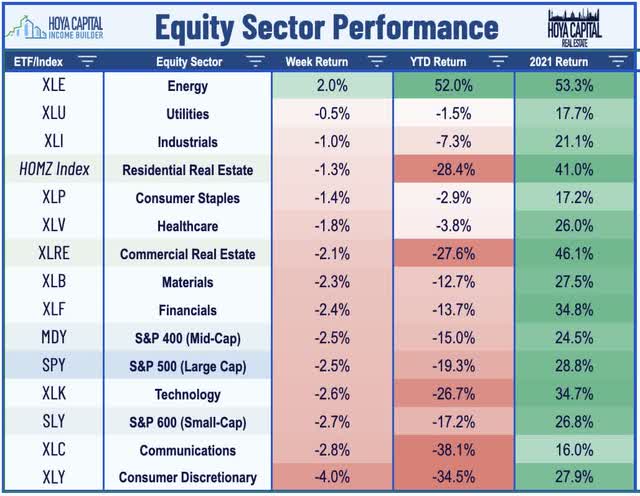

U.S. equity markets slid to the lowest levels since early November this week after the Federal Reserve continued its historically-aggressive monetary tightening course despite mounting evidence of cooling inflation and contracting economic activity. Renewing concern that the central bank may be similarly slow in responding to recessionary pressures as inflationary pressures, the FOMC revised higher its average inflation forecast despite another cooler-than-expected inflation print with the CPI-ex-Shelter Index – the metric that showed the surge in inflation a year before it was reflected in the headline CPI – was negative for the fourth month in the past five.

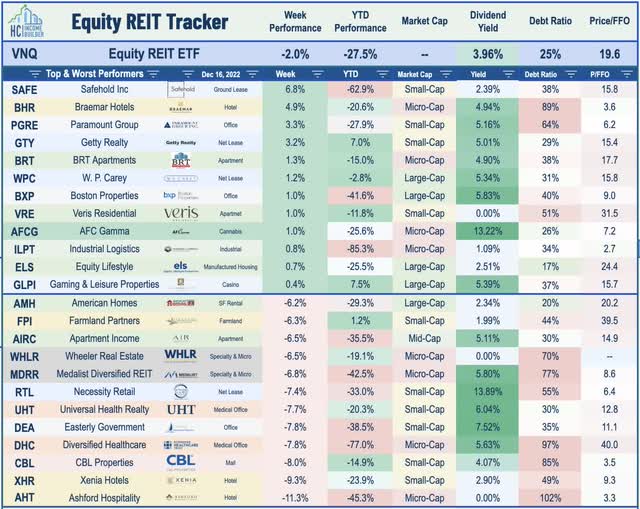

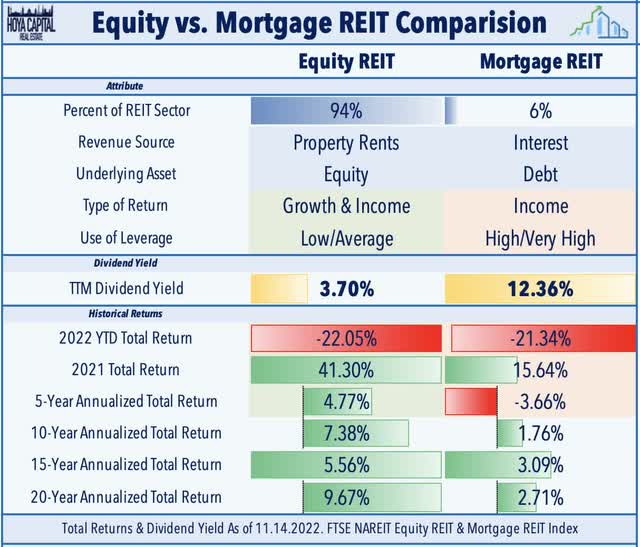

Ending the week on a three-day skid that erased earlier gains of nearly 3% before the Fed meeting on Wednesday, the S&P 500 declined 2.5% on the week – the second week of declines following a strong stretch of five-of-seven weekly gains. The tech-heavy Nasdaq 100 dipped 2.8% to push its year-to-date declines back to over 30%. Buoyed by a retreat in longer-term interest rates and another wave of REIT dividend hikes, real estate equities were among the better performers this week. The Equity REIT Index declined by 2.0% on the week, but the Mortgage REIT Index posted steeper declines of 3.6%. Homebuilders and the broader Hoya Capital Housing Index were a bright spot for a second-straight week after positive earnings commentary and data showing that mortgage rates fell for a fifth-straight week.

Despite another 50 basis-point rate hike and an uptick in FOMC’s median projections of interest rates and inflation, the 10-Year Treasury Yield (US10Y) ended the week lower by 9 basis points at 3.48% while the 2-Year Treasury Yield (US2Y) dipped 19 basis points to 4.18%. Notably, the Fed’s updated median forecast now calls for the Fed Funds rate to end next year at 5.10% – implying another 2-3 rate hikes – which is substantially above the market-implied rate of 4.25%-4.50% in December 2023. The U.S. Dollar Index stabilized after a sharp selloff in recent weeks. Crude Oil rebounded from its lowest levels of the year, but U.S. consumer gasoline prices still fell to 15-month lows. Bitcoin, meanwhile, finished lower by another after the arrest and fraud charges levied on former FTX CEO Sam Bankman-Fried.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

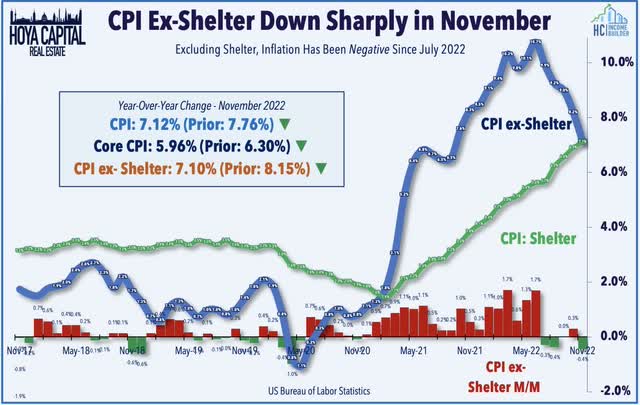

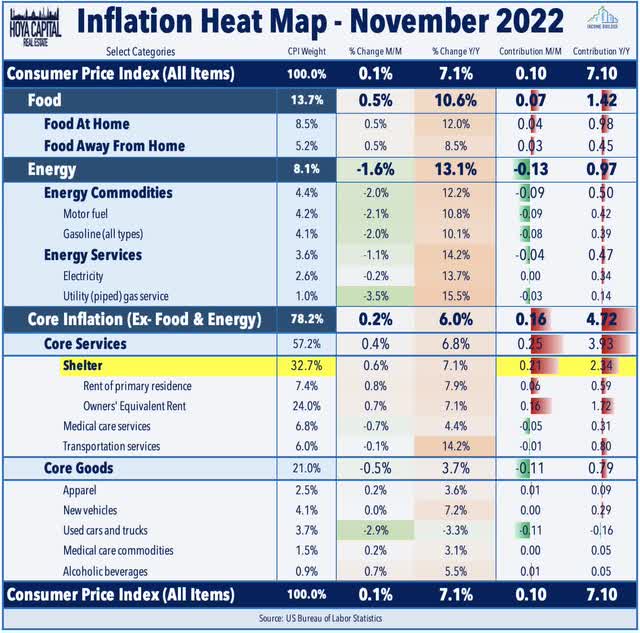

Peak inflation? Sure looks that way. The Consumer Price Index showed a cooler-than-expected increase in prices in November with the Headline and Core CPI coming in well below expectations, indicating that inflationary pressures may finally be rolling over amid a broader global economic slowdown. The Headline CPI Index slowed to a 7.1% year-over-year increase – the lowest since December 2021 – while the Core CPI Index slowed to below 6% – matching the lowest levels of the year. Notably, the CPI-ex-Shelter Index – the metric that we believe officials should most closely watch given the lagged effects of shelter inflation – was negative for the fourth month in the past five. Since July, CPI ex-Shelter has averaged a -1.9% annualized rate – among the most deflationary five-month periods on record. Using this metric, Fed officials would have seen the sharp upward spike in inflationary pressure beginning in early 2021 alongside the dramatic fiscal expansion – a full year before we saw these trends show up in the headline CPI metric.

As we’ve cautioned for the last year, the CPI Index was substantially understating the real-time increase in the single-largest component of the index – Shelter – since mid-2021 due to the sampling methodology which only collects “same-unit” data twice per year. The delayed recognition of surging rents and home values from mid-2021 through mid-2022 continues to exert significant upward pressure on the headline and Core inflation metrics. The cooler-than-expected headline print was even more encouraging given the acceleration in CPI Shelter to 7.1% – the highest annual increase since 1982 – which more than offset the decline across the balance of the basket. Categories recording the most significant price declines in November included used cars and trucks, medical care, and airline fares.

While CPI data shows a continued acceleration in shelter inflation to 40-year highs, the more real-time rent metrics continue to show a moderation back toward the broader inflation rate. Zillow (Z) released its monthly rent index data this week which showed that national rent growth recorded a second-straight monthly decline in November. Notably, 48 of the top 60 markets recorded negative month-over-month rent growth for the month – up from about half in the prior month. The Zillow US National Rent Average remains higher by 8.4% Y/Y in November – but this is down sharply from the peak in February at +17.1%. While the CPI excluding Shelter has averaged -1.9% annualized since July, Zillow data shows that rental rates have risen at a roughly 3.5% annualized rate – still above the inflation rate but well below the double-digit spread that would be implied by the current CPI data.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

Another week, another wave of REIT dividend hikes and special dividends. Highlights of the week included Mid-America Apartments (MAA) – which hiked its quarterly dividend by 12% to $1.40/share. Cannabis REIT NewLake Capital (OTCQX:NLCP) hiked its quarterly dividend for the fourth time this year to $0.39/share – up 26% from the prior year. while its larger peer Innovative Industrial (IIPR) held its quarterly dividend steady at $1.80/share which is 20% above its dividend rate in the prior year. Net lease REIT Realty Income (O) raised its monthly dividend for the fourth time this year to $0.2485/share – up 1% from the prior year while shopping center REIT Urstadt Biddle (UBA) also joined the list of over 120 REITs to raise this year, hiking its quarterly dividend by 5% to $0.25/share. A pair of hotel REITs also announced special distributions with Hersha Hospitality (HT) declaring a $0.50/share special dividend and Host Hotels (HST) declaring a $0.20/share special dividend – two of four REITs to declare special distributions this month.

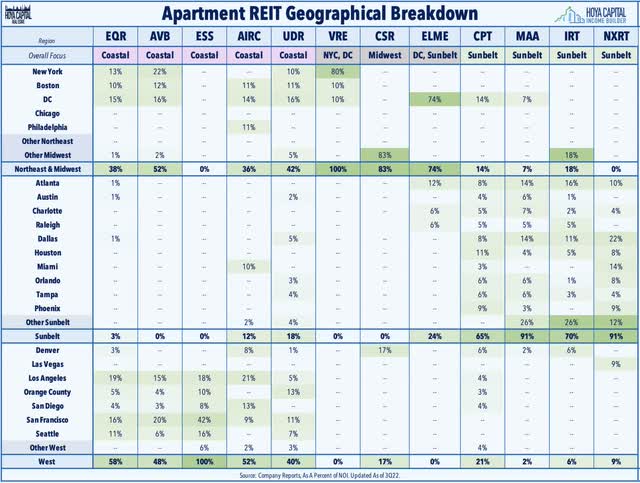

Apartment: Veris Residential (VRE) was of a dozen REITs in positive territory for the week after it received two additional buyout offers from Kushner Companies, which proposed an all-cash deal at $17.50/share last Thursday and upped the proposal to $18.50 on Sunday – up from the initial unsolicited offer back in October at $16.00/share. Veris announced that its Board rejected both subsequent proposals and published its letter sent to Kushner Companies which noted that it believes that the proposed takeout deal – roughly 50% above its price before Kushner’s initial bid – “undervalues” Veris. The letter did, however, state that the Board is open to engaging in “serious, constructive, and direct negotiations.” Veris – formerly known as Mack Cali – is nearing the completion of its transition from an office REIT to a pure-play multifamily REIT and now owns a portfolio comprised of roughly 7,700 units – primarily in the New York metro area.

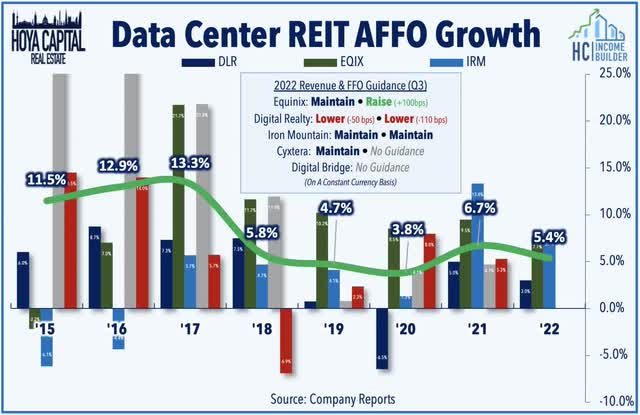

Data Center: Sticking with the M&A theme, Equinix (EQIX) was among the better performers this week after announcing plans to enter the South African market with a $160M data center investment in Johannesburg that augments its current footprint on the African continent in Nigeria, Ghana, and Côte d’Ivoire. The new data center is expected to open in mid-2024 with 4.0MW of total capacity across 690+ cabinets. Digital Realty (DLR) dipped 5% on the week after the company announced that it would replace CEO Bill Stein with its current CFO Andy Power at the end of the year. Stein has served as DLR’s CEO since November 2015, and it is speculated that the termination was related to the firm’s relative underperformance. DLR has underperformed the REIT Index on a 1-year, 3-year, and 5-year basis while EQIX has outperformed the REIT Index in each of those periods. The new CEO Andy Power has served as DLR’s President since November 2021 and as its CFO since 2015, overseeing DLR’s global portfolio, asset management, and the firm’s financial functions.

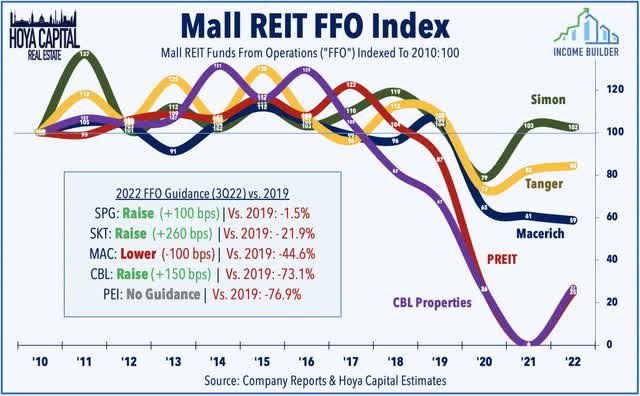

Malls: Pennsylvania REIT (PEI) plunged another 25% this week after it was delisted by the New York Stock Exchange after failing to maintain at least a $15M market cap for 30 days. PEI now trades the OTC Markets, operated by the OTC Markets Group under the symbol (OTC:PRET) while its preferreds are now traded under ticker symbols PRETL, PRETM, and PRETN. PREIT has dipped more than 85% this year despite signs of stabilization in the beaten-down mall sector. Following nearly three years of rental rate and occupancy declines, the supply-demand dynamic has recently favored retail landlords, rewarding mall REITs with some long-elusive pricing power. While lower-tier mall REITs can’t afford a deep recession, upper-tier malls are no longer teetering dangerously on edge. Simon Property (SPG) and Tanger Factory Outlet (SKT) have been among the best-performing REITs since reporting decent third-quarter results.

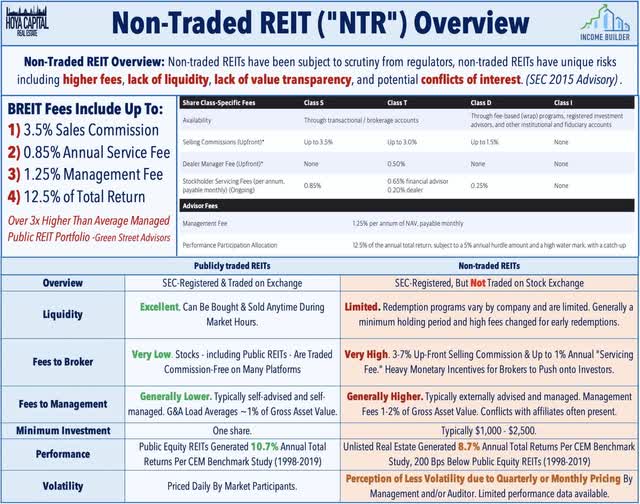

Bloomberg reported this week that Blackstone (BX) and Starwood each received inquiries from the Securities and Exchange Commission after both firms limited investor redemption requests in their non-traded real estate funds. BREIT and SREIT have each seen investor redemption requests exceed their quarterly limits, driven by a combination of factors including their published Net Asset Value which appears to be 20-30% above public market valuations of comparable assets. Citing unnamed sources, Bloomberg reports that the SEC “reach out to the firms… and is trying to understand the market impact and circumstances of the events, how the firms met redemptions, and if affiliates sold before clients.” We’ve discussed the risks of non-traded REIT (“NTR”) space across many reports over the past half-decade and continue to watch the area for signs of stress given their typically-high leverage and sensitivity to investor fund flows – which we expect could eventually become an area that’s “ripe for picking” for the more conservatively-managed REITs.

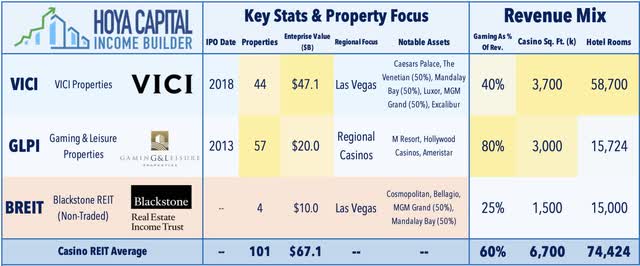

Casino: Speaking of Blackstone, this week we published Casino REITs: Hold ‘Em As Others Fold ‘Em. Seeking to raise capital to meet redemptions, BREIT has quickly pivoted from buyer to seller – spawning the major $5.5B deal with VICI Properties (VICI) announced last week for BREIT’s 49.9% interests in the MGM Grand and Mandalay Bay. In addition to its 49.9% JV stakes in the MGM Grand and Mandalay Bay which it had acquired alongside MGP in 2020, BREIT owns an 80% stake in The Cosmopolitan of Las Vegas and a 95% stake in The Bellagio while Blackstone’s private equity division also owns the Aria Resort in Las Vegas. The report noted that Casino REITs are the lone property sector in positive-territory this year, benefiting from their attractive “inflation-hedging” lease structure, the rebound in Las Vegas travel demand, and broader institutional investor acceptance. VICI boasts inflation-linked escalators on 96% of leases while Gaming and Leisure Properties (GLPI) benefits from indirect inflation hedges linked to tenant performance.

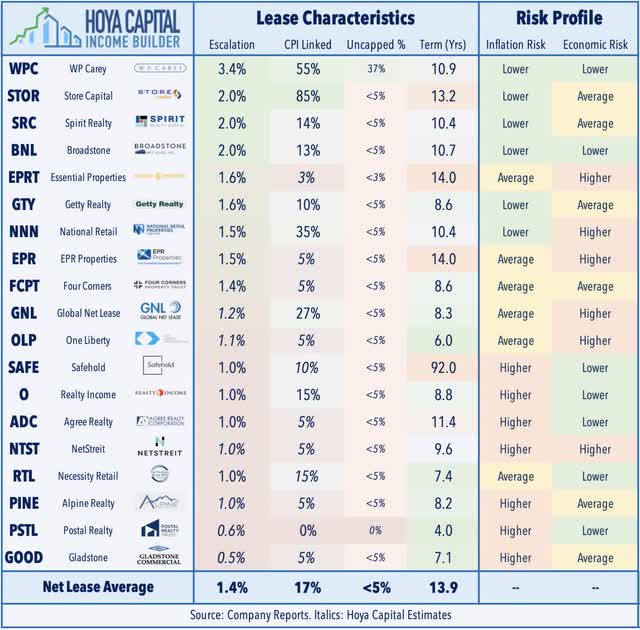

Net Lease: On a related note, this week we published Net Lease REITs: Calling The Fed’s Bluff which also focused on the lease structures utilized by REITs across the triple-net sector. Curiously, net lease REITs have seemingly never bought into the idea of a “new normal” of sustained higher interest rates and have plowed ahead with acquisitions. Acquisition cap rates have expanded only modestly – roughly 50-100 basis points on a YTD basis per recent commentary – during which time we’ve seen benchmark rates climb by 250-300 basis points. While we do believe that the worst of the inflationary pressures are behind us, there does appear to be complacency reflected in valuations and strategies in REITs with higher interest-rate risk – notably those focused on “corporate” properties with bond-like lease structures. We see the best value in REITs that focus on “middle-market” tenants and the middle-tier of cap rates, where you’ll typically see more rate-hedging lease structures and initial yields that grant more breathing room for higher financing costs.

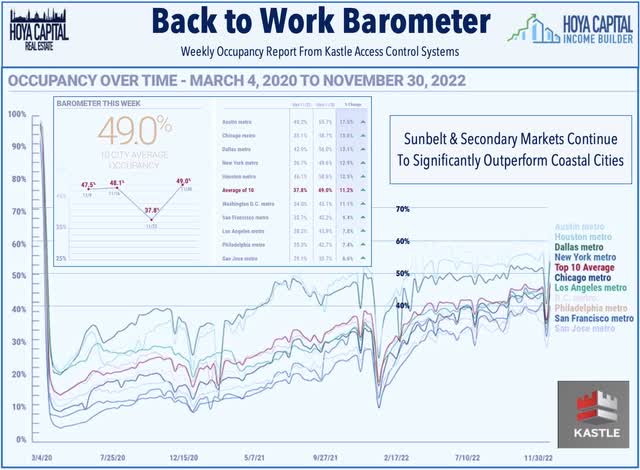

Office: Sunbelt-focused Highwoods (HIW) was busy this week, announcing a pair of large joint venture deals including the acquisition of a 550k SF Class A building in Dallas through a joint venture with Granite Properties for a total purchase price of $395M. The McKinney & Olive building was constructed in 2016 and is currently 99% leased. Earlier in the week, HIW announced a 50/50 joint venture with The Bromley Companies to construct Midtown East in Tampa with a total value of $83M. Located in Tampa’s Westshore submarket, the 18-story tower will be the future headquarters of Tampa Electric and Gas with construction expected to begin next quarter with a scheduled completion date in 2025. Vornado (VNO) was also busy this week, announcing a series of deals to develop its 350 Park Avenue office building and a pair of adjacent properties at 40 East 52nd Street and 39 East 51st Street. Citadel will master lease 350 Park Avenue for ten years. Recent data from Kastle Systems shows that average office utilization rates remain below 50% of pre-pandemic levels with coastal urban markets continuing to lag.

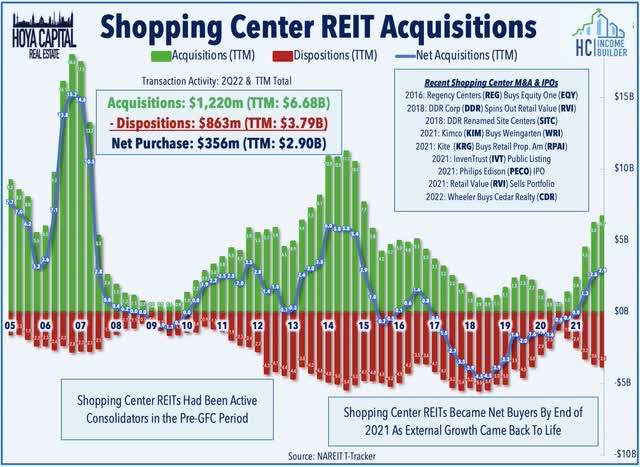

Shopping Center: Kimco (KIM) announced this week that it will restructure as an Umbrella Partnership Real Estate Investment Trust, or UPREIT – a structure now utilized by most REITs to streamline acquisitions in a tax-deferred manner. The UPREIT structure allows property owners to exchange their property for ownership shares in the REIT in a “like-kind” transfer known as a 721 Exchange – which has similar benefits as the more commonly known 1031 Exchange. Under the 721 structure, property sellers receive OP Units in the REIT – typically exchangeable on a 1-for-1 basis to REIT common shares – and in doing so, the property seller can defer capital gains until they sell the REIT stock. The reorganization – which is a bit legally complex and hence the delay from many older REITs in “upgrading” to a UPREIT – is not expected to have any material impact on Kimco’s operations or financial position.

Mortgage REIT Week In Review

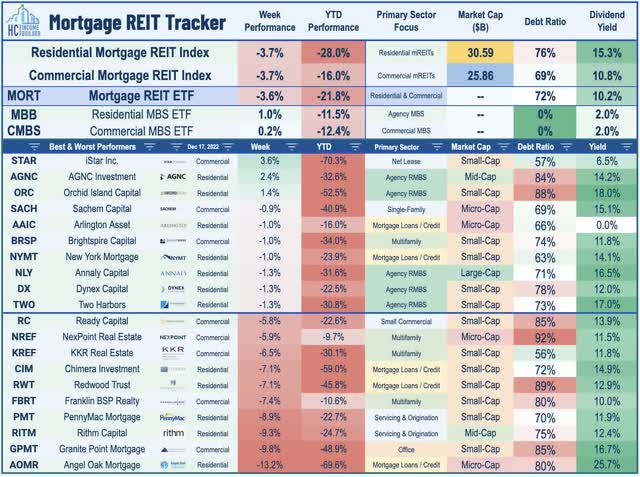

Mortgage REITs were also broadly lower this past week with the iShares Mortgage Real Estate Capped ETF (REM) dipping 3.7% despite a continued rebound in mortgage-backed bond valuations. The iShares MBS ETF (MBB) – an unlevered index tracking mortgage-backed securities – has rebounded nearly 8% from its lows in late October to trim its year-to-date declines to under 10%. Orchid Island (ORC) was one of three mREITs higher on the week after holding its quarterly dividend steady – one of 13 mREITs to declare dividends this week that were steady with their prior rates – a list that included Blackstone Mortgage (BXMT), New York Mortgage (NYMT), Apollo Commercial Real Estate Finance (ARI), and KKR Real Estate (KREF).

A pair of mREITs trimmed their payouts, however, including Ready Capital (RC) – which declined 6% after it trimmed its quarterly dividend to $0.40/share from $0.42/share – and MFA Financial (MFA) – which slipped 4% after trimming its quarterly dividend to $0.35/share – down from a $0.44/share. Elsewhere, Rithm Capital (RITM) dipped 9% despite holding its dividend steady and announcing a new repurchase program of up to $200M in common stock and $100M in preferred stock – replacing an expiring program of the same size. Last month, we published Mortgage REITs: High Yields Are Fine, For Now, which noted that despite paying average dividend yields in the mid-teens, the majority of mREITs have been able to cover their dividends, but we flagged a handful of mREITs with payout ratios above 100% of EPS.

REIT Preferreds Week In Review

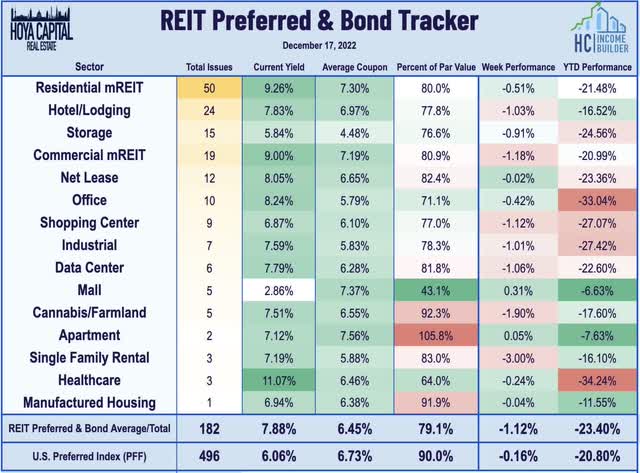

The REIT Preferred Index (PFFR) declined 1.1% this week, lagging the broader iShares Preferred and Income Securities ETF (PFF) which ended the week lower by 0.2%. This week, Gladstone Commercial (GOOD) announced a share repurchase program for up to $20M of its 6.625% Series E Preferred (GOODN) and $20M of its 6.00% Series G Preferred Stock (GOODO) – roughly 15% of the total outstanding shares. Elsewhere, Rithm Capital (RITM) announced a new repurchase program of up to $100M of preferred stock – roughly 10% of its outstanding shares. Also of note this week, the preferreds of Pennsylvania REIT (PRET) were also delisted from the NYSE alongside the delisting of the company’s common stock.

Economic Calendar In The Week Ahead

The state of the U.S. housing market is in the spotlight in another jam-packed week of economic data before the Christmas holiday. On Monday, we’ll see NAHB Homebuilder Sentiment data for December which is expected to rebound slightly after dipping to the lowest level since 2014 – excluding the brief pandemic dip in April and May 2020. On Tuesday, we’ll see Housing Starts and Building Permits data which is expected to show a further pull-back in home construction activity to levels below that of late 2019. On Wednesday, Existing Home Sales data is expected to dip to the lowest levels since 2014 excluding the pandemic shutdown months, but New Home Sales data on Friday is expected to stay around the 600k level as homebuilders have more proactively adjusted prices than existing owners. On Friday, we’ll also see some important inflation data with the PCE Price Index for November – the Fed’s preferred gauge of inflation – which is expected to show a moderation in price pressures to the lowest since late 2021. Markets will be closed on Monday, December 26th – Merry Christmas to all!

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment