Kevin Dietsch

Not only was there no dovish pivot at the FOMC meeting on Wednesday, Powell told the market that the terminal rate would be higher than previously thought, and the potential for a soft landing is getting narrower.

It was not the news the markets wanted to hear, so equity prices fell sharply. Additionally, rates have repriced significantly higher while the dollar has strengthened.

The equity market has been living in the land of yesteryear, where it has grown used to a Fed that changes course when economic growth slows. But this time is very different, and the Fed has continually reiterated that it wants the unemployment rate to rise and growth to slow to below trend. Neither of these requirements has been closely met, and at this point seems to be some time away.

Rates Move Higher

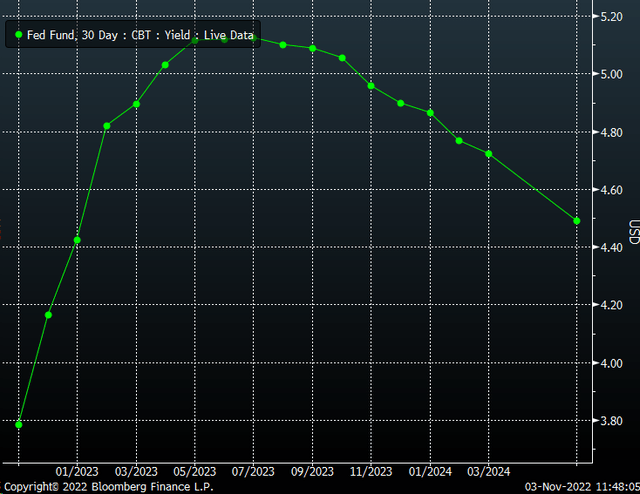

The Fed’s message has resulted in Fed Funds Futures repricing higher, with the terminal rate now at 5.15% in July of 2023, up from around 5.05% for May, just yesterday. So not only are rates seen going higher, but the time to get to that terminal rate is now expected to take longer.

Higher Fed Funds Futures have pushed 2-year yields sharply higher on the day, rising to around 4.7%. The problem is that the 2-yr yield probably still has some room to further rise, which means the dollar index has further to increase.

The combination of higher rates and a strong dollar will continue to do what they have done now for months, sink stock prices. Rising rates and a stronger dollar mean that financial conditions are tightening, and tighter financial conditions create a horrible environment for stocks and ultimately push them lower.

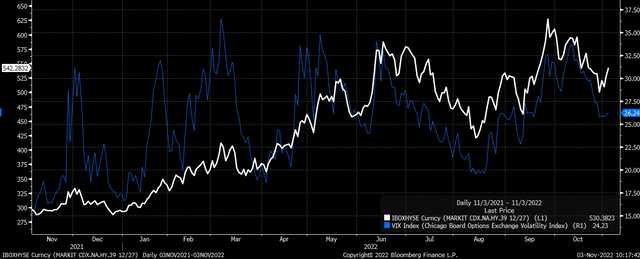

Additionally, credit spreads should widen, and the widening spreads are often associated with higher volatility. The VIX index has been trading in tandem with the Markit CDX High Yield Index for the past year.

Waiting On Real Yields

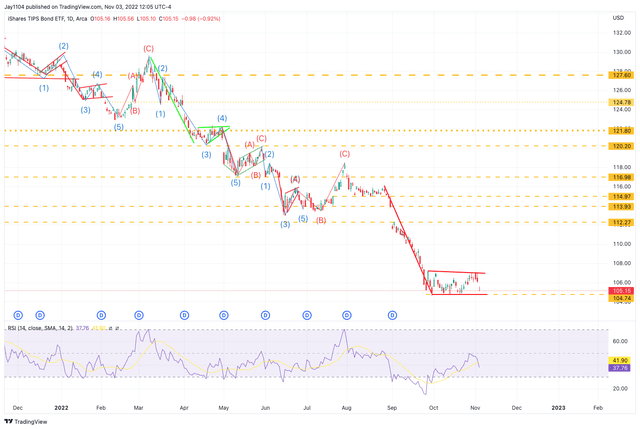

The only saving grace at this point for stocks is that the TIP rates haven’t broken to new highs and until that happens, equities could be spared from making new lows. But much of where these real yields go will be determined between now and next Thursday.

The job report tomorrow and the CPI report next Thursday could have a meaningful impact on how much higher rates will need to go and how much higher real yields need to rise.

The TIP ETF, an excellent proxy for real yields, has been range bound for some time. It is, however, showing signs of perhaps getting ready for its next break lower, and should the TIP ETF drop below $104.50, it is likely to open the doorway for stocks making new lows.

A falling TIP ETF means that real yields are rising.

While it may be too soon to say that stocks are heading to new lows, the conditions are now in place. Powell couldn’t have spelled out what the Fed wanted to see more clearly at the end of yesterday’s press conference. The Fed is likely a long way from being finished raising rates, and even once they are done raising rates, they will be stuck at elevated levels for some time.

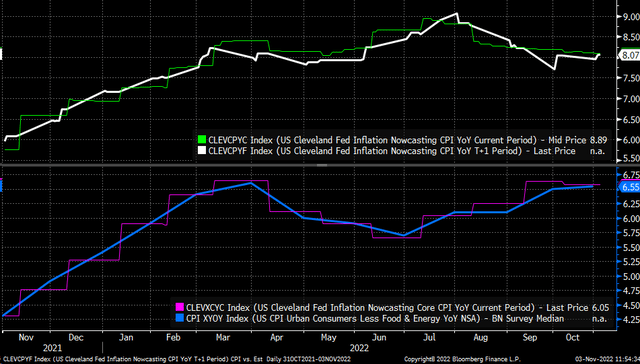

The truth is that the longer it takes for the CPI and Core CPI to start moving lower, the higher rates will need to rise. Currently, there is no relief expected anytime soon. The Cleveland Fed estimates the October and November CPI at greater than 8% and the core CPI at 6.5%.

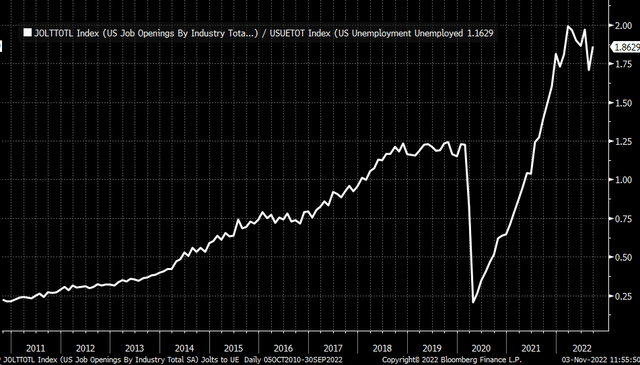

On top of that, the latest JOLTS data shows that the number of job openings is still nearly at a 2-to-1 ratio. Tomorrow’s unemployment rate and data will determine whether that ratio is going up or down. But to this point, that ratio has made no progress in falling. Based on where this ratio was pre-pandemic, the Fed isn’t even close to seeing enough job destruction to suggest the labor market is cooling.

Again, the bond and currency markets were signaling on Monday and Tuesday that there was no dovish pivot coming, which was why rates started moving higher heading into the FOMC meeting.

Again, all one needs to do is follow bonds and the dollar index and not get sucked into chasing equity prices higher, especially when bonds and the dollar are not confirming such a move about a “dovish pivot.”

Be the first to comment