5PH/iStock via Getty Images

Description

I believe The Duckhorn Portfolio (NYSE:NAPA) is worth $16.56/share, representing ~16% upside from the date of writing. The wine industry is a significant economic force that has been around for over a hundred years. The longer a wine brand stays on the market, the more authority it commands. NAPA is a wine-producing company that has been in business for over 40 years. With a specialization in luxury wine, NAPA commands a huge market share among luxury wine consumers. That said, until the valuation comes down, I am recommending to stay neutral on NAPA.

Company overview

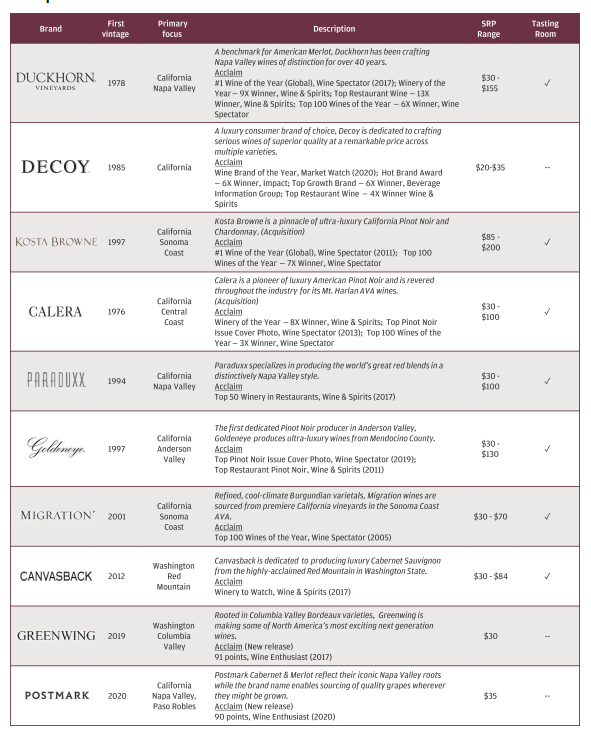

NAPA is a North American-based wine company producing luxury wines at scale. NAPA’s world-class luxury brands include Duckhorn Vineyards, Decoy, Kosta Browne, Paraduxx, Goldeneye, Migration, Calera, Canvasback, Greenwing, and Postmark. They are sold in over 50 countries worldwide and in all 50 states of the U.S. NAPA’s suggested retail price per bottle ranges from $20 to $200.

NAPA sells its wine in four channels. All these channels utilize the long-standing relationships that have grown over the past forty years. The channels include:

- Wholesale channels,

- Distributor channels,

- Retail accounts channels (in California),

- DTC (direct-to-consumer) channels

Luxury wine is a thing

Customer awareness among American Millennials and Generation X adults has increased with more cooking shows, food blogs, and farmers’ markets. The desire for high-quality foods and beverages is growing, with an increasing number of consumers willing to pay more money for items they believe are superior to others.

This premiumization trend is of great benefit to the wine industry, as millennial wine buyers spend more per bottle than other generations. As Millennials continue to advance in their careers, their incomes also grow. With more spending power, wine enthusiasts are set to spend more on wines from experiential brands that have authentic histories.

The luxury wine segment constitutes about 10% to 15% of the total U.S. wine market, and this segment has more than doubled as compared to the larger wine industry since the beginning of this decade (based on management’s estimates). In my opinion, NAPA luxury wines have an SRP ranging from $20 to $200 per bottle, putting them in a better position to benefit from this premiumization.

Portfolio of powerful brands

NAPA’s portfolio consists of ten luxury brands. This professional and comprehensive portfolio is based on three brands: Duckhorn Vineyards, Decoy, and Kosta Browne, which reaffirms NAPA’s credibility and brand strength. The width and depth of NAPA’s luxury brands, paired with production at scale, position it as a premier supplier of luxury wine.

By focusing solely on sustainable luxury winemaking, NAPA is able to produce a high-quality, award-winning wine that resonates with consumers. This focus also gets employees excited, builds trust and credibility among customers, and makes relationships with customers stronger.

Something that sets NAPA apart from a typical luxury brand is its portfolio’s width and depth, which allow for a layered pricing system within the wine segment. The relatively cheaper wines were meant to attract new customers and serve as a gateway to more premium offerings while deepening customer-producer relationships. The Decoy brand also serves as a customer gateway into luxury offerings by providing high-quality wine at affordable prices. Kosta Browne and NAPA’s other winery brands present a diverse luxury wine portfolio, giving consumers a chance to grow and broaden their experience with diverse wines. Even though it’s impossible to know what consumers will want in the future, NAPA’s wide range of wines makes it easier to meet the needs of distributors, their clients, and other consumers.

s-1

Largest pure-play luxury wine company

NAPA is the largest wine company, which focuses exclusively on producing particular wines in order to obtain a larger market share. This approach and their dedicated focus on luxury wine production appeal more to modern wine consumers, who crave authentic and category-excellent wines. I believe their competitors, who produce a diverse range of wines in large quantities, are at a competitive disadvantage with this group of customers.

To pinpoint why NAPA wins with its individual brands, consider what these brands stand to gain from their place in the company’s huge portfolio. Due to their efficient operations, branding, marketing, and distribution capabilities, these brands also hold an advantage over their fragmented, small-scale competitors. The high quality of NAPA’s operational capabilities is a good example of how they can offer a curated selection of the most popular wine varieties while also developing new products in emerging categories. They do this by taking advantage of the fact that they are a pure-play luxury producer at scale.

NAPA’s sales force, unlike their competitors, who rely on distributors to do their marketing, takes the initiative of introducing and promoting their brands to strengthen their account relationships. This provides a significant competitive advantage because the sales force becomes extremely knowledgeable about how customers connect with winery brands. I believe this has allowed NAPA to gain substantial shelf and menu space. As a preferred luxury wine supplier, I expect NAPA to benefit from a further enhanced prioritization by the distributors due to their operation efficiency and the sell-through confidence they command.

Fragmented industry gives NAPA an advantage to consolidate the market

The luxury wine industry is flooded and competitive, but NAPA has the benefit of being among the few luxury wine producers that operate at scale. Their competitors range from small-volume local wineries to divisions of large conglomerates. There is a noticeable trend toward fewer wine distributors with an increase in the number of wineries in the United States. This has been caused by mergers and acquisitions. In the year 1995, 3,000 wine distributors served 1,800 wineries, compared to 950 wine distributors serving 10,400 wineries in the year 2020. This is according to NAPA’s prospectus, and they predict that this trend is set to continue.

I think that NAPA’s position as an attractive, scaled-up luxury producer and their one-stop-shop solution for luxury wine consumers should help them build a bigger network of distributors and retailers in a market with fewer distributors and a lot of competitors.

Differentiated distribution strategy

NAPA’s ideal customers get a chance to interact with them through NAPA’s wine clubs and tasting rooms, in grocery shops, or when ordering food at a restaurant. The platform that enables this interaction is innovative and scalable. The platform is aimed at fulfilling consumer needs through an interconnected experience across channels at attractive margins. NAPA also leverages their long-standing wholesale channels across the country to develop deep and impactful relationships with their trade accounts, ensuring the on-premise and off-premise success of their brands across a diverse range of outlets globally.

Something that stands out about NAPA is that it has been selling directly to retail accounts in California since its founding, 40 years ago. I believe this is a huge differentiator from other California wine producers who sell through distributors, as selling directly to retailers offers three main advantages:

- The direct connection with retail accounts gives NAPA more control over sales, branding, and other marketing support.

- This approach gives direct feedback on sell-through rates.

- Profit margins are larger when selling to retailers directly as compared to using distributors.

NAPA’s D2C channel is a great marketing tool. It consists of a multi-winery e-commerce website that features award-winning subscription wine clubs and seven unique, high-touch tasting rooms located throughout Northern California and Washington. NAPA’s ultra luxury wines are featured in the DTC channel and yield a higher average bottle price. Members also get access to new releases, member benefits, and active cross-marketing through loyalty and sales. These strategies are incredible because they raise awareness for other NAPA’s world-class wines and properties while maximizing their own winery brand and property, resulting in a long-term connection with consumers and wholesale customers.

The key reason NAPA was able to sustain its growth is because of a strategic combination of complementary paths to consumers. This will also be a key factor for long-term scalability. The success of a business is based on its ability to connect customers with its products. NAPA balances this with direct and authentic customer and consumer touch points that drive connectivity, insights, and trust.

NAPA’s comprehensive omni-channel route-to-market differentiates it from its competitors as it enables NAPA to engage with distributors, customers, and consumers and meet their needs across price points, varietals, and appellations, driving long-term sustainable growth.

Valuation

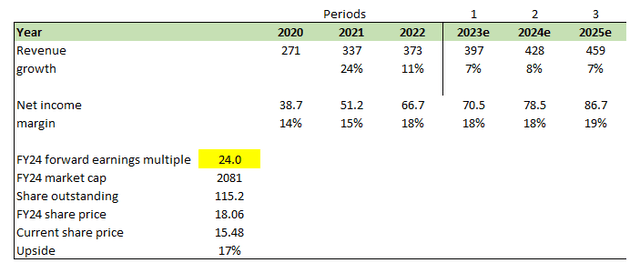

I believe NAPA is worth USD18/share in FY24, representing 17% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue will grow organically in the pace of high-single digits as guided by management.

- Since NAPA is a relatively mature company and margins are more or less in the mature stage, although there are still some room to grow, I assumed margins to stay flat moving forward. If margins were to increase, it would only be good news.

- NAPA currently trades at 22x forward earnings and I expect no changes to this given its mature profile.

own estimates

Key Risks

Consolidation within distributors

The notable trend of distributor mergers and reductions might reduce distribution and sales of NAPA’s wines due to reduced attention and resources allocated to its brands during and after transition periods. This might be due to NAPA’s brands representing a smaller portion of the new business portfolio.

Demand for wine declines

A number of factors, including demographic shifts, the availability of desired substitutes, and a decrease in discretionary spending, could reduce consumer demand for wine. This will affect negatively NAPA’s business.

Decrease in wine quality

Most of NAPA’s winery brands and labels have been ranked among the top U.S. luxury wine brands and have received positive reviews from the industry’s top critics and publications. These positive third-party reviews have played an instrumental role in NAPA maintaining and expanding their reputation as a luxury wine producer. NAPA has no control over these ratings or the methods used to evaluate wine. If they stop being favorable and start sending negative reviews and ratings, it will negatively affect NAPA’s businesses.

Summary

Having been ranked numerous times among the top U.S. luxury wine brands, NAPA utilizes the more than 40 years it has been in business to dominate the market and gain new territories. By focusing on luxury wine categories, NAPA has gained market trust and credibility. They take advantage of this by expanding their sales and entering new markets. With more wine consumers preferring heritage editions, which NAPA offers in a variety of price points ranging from affordable to high end, this trend indicates a burgeoning business opportunity for NAPA. However, valuation matters. NAPA is more or less fairly valued at its current share price as of the date of this writing.

Be the first to comment