zoranm

The Clorox Company (NYSE:CLX) is a good company to own for the long-term for dividend income and growth but is currently overvalued. The valuation metrics and a discounted cash flow model show that the current valuation is unjustified. The company is facing volume declines in the face of its price increases. Inflation has taken a toll on margins, which are substantially lower than its long-term average. Low-beta stocks such as Clorox have done well during this bear market. Investors may have to be patient for this positive cycle in the consumer staples sector to turn before Clorox may be appealing to buy.

A slight improvement in gross margins in Q2 2023

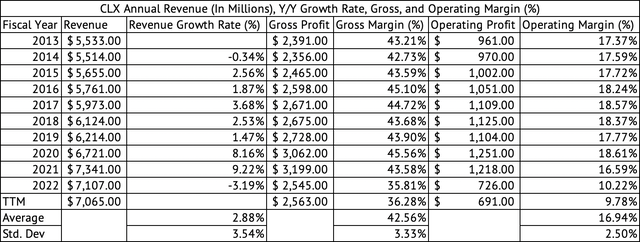

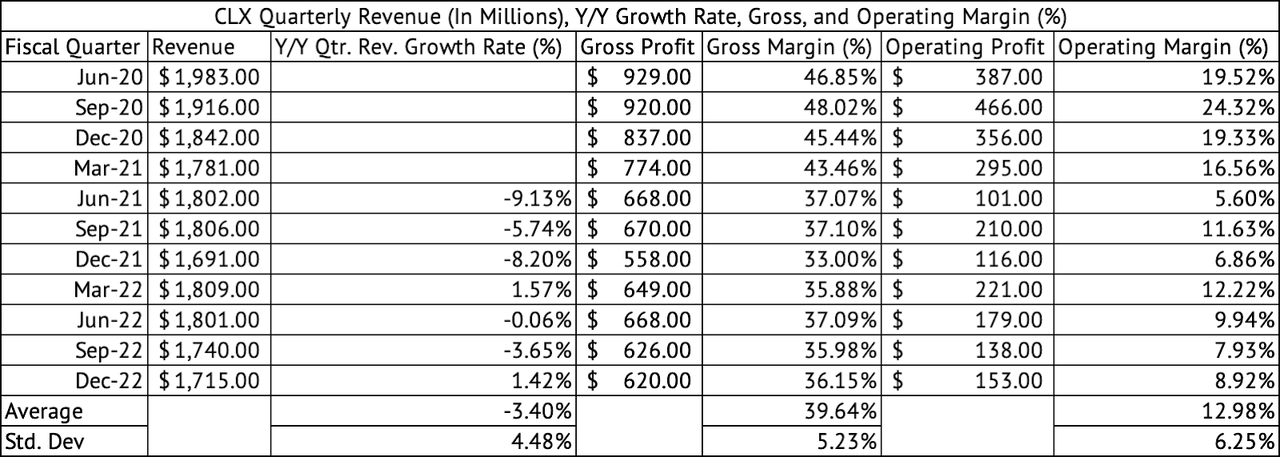

The company’s gross margins averaged 42.5% over the past decade (Exhibit 1). But, inflation took a toll on margins in 2022, with the annual gross margin dropping to 35.81% (Exhibit 2). Its quarterly gross margins since June 2020 averaged 39.6%. Since its June 2021 quarter, the company has reported quarterly margins below 40% (Exhibit 3). The company is working towards improving its margins and showed 17 basis points improvement in its December 2022 quarter compared to its September 2022 quarter. Its quarterly gross margins improved by over 300 basis points in December 2022 compared to the same quarter a year ago.

Exhibit 1:

Clorox Annual Revenue, Gross, Operating Profits, and Margins (Seeking Alpha, Author Compilation)

Exhibit 2:

Clorox Annual Gross Margin [2013-2022] (Seeking Alpha, Author Compilation)![Clorox Annual Gross Margin [2013-2022]](https://static.seekingalpha.com/uploads/2023/2/8/28462683-1675873283207139.png)

Exhibit 3:

Clorox Quarterly Revenue, Gross, Operating Profit, and Margins (Seeking Alpha, Author Compilation)

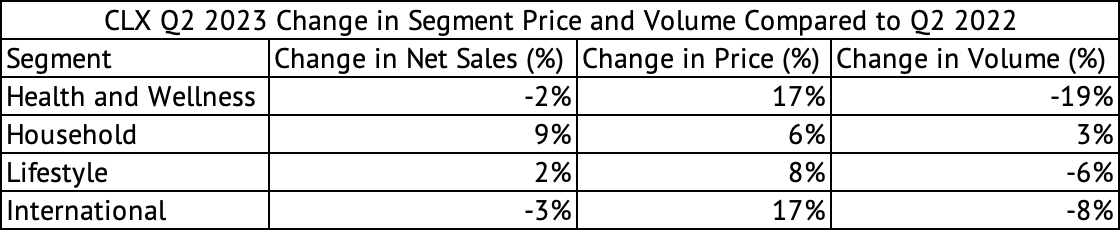

In Q2 2023 (Quarter Ending December 2022), the company’s price increases bolstered sales, while overall volume declines were muted. In the Q2 2023 quarter, the company saw sales increase by 1%. But the company’s various segments show the pressure on volumes as prices increase (Exhibit 4). The company has instituted double-digit y/y price increases and is beginning to see volumes decline. Some segments have exhibited low price elasticities, but that trend may not continue with consumer spending and economic growth continuing to decline.

Exhibit 4:

Clorox Q2 2023 Y/Y Change in Segment Sales, Price, and Volume (The Clorox Company Earnings Press Release, Author Compilation)

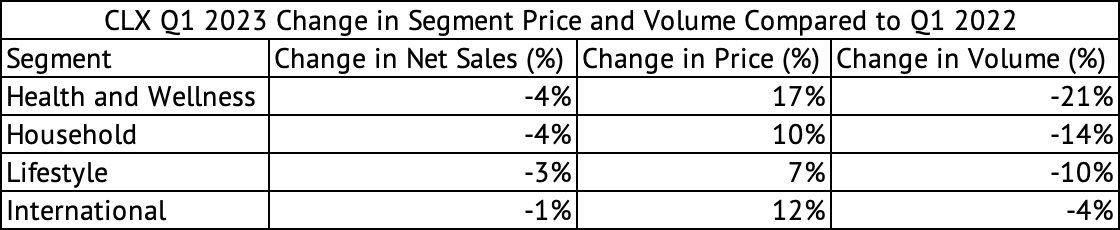

The company’s Q1 2023 saw a similar story of price increases that hurt volumes (Exhibit 5). The company’s Health & Wellness segment saw net sales decrease by 2%, with a 17% change in price/mix more than offset by a 19% decline in volume. A strong dollar and a reduction in volume contributed to the sales decline in Clorox’s international segment.

Exhibit 5:

Clorox Q1 2023 Y/Y Change in Segment Sales, Price, and Volume (The Clorox Company Earnings Press Release, Author Compilation)

Many consumer staples companies have seen low price elasticities – minor, single-digit volume declines in the face of persistent, double-digit price increases. Clorox is no exception, for the most part. Although in its Health and Wellness segment, volume declines outpaced price increases. But consumers have depleted their savings and are pulling back their spending. The volume decreases across the consumer staples sector may accelerate in the coming quarters. But the weakness in the dollar may help many consumer staples companies book higher international revenues and profits in upcoming quarters. The U.S. Dollar Index pulled back from 114 in September 2022 to 103.8 in February 2023.

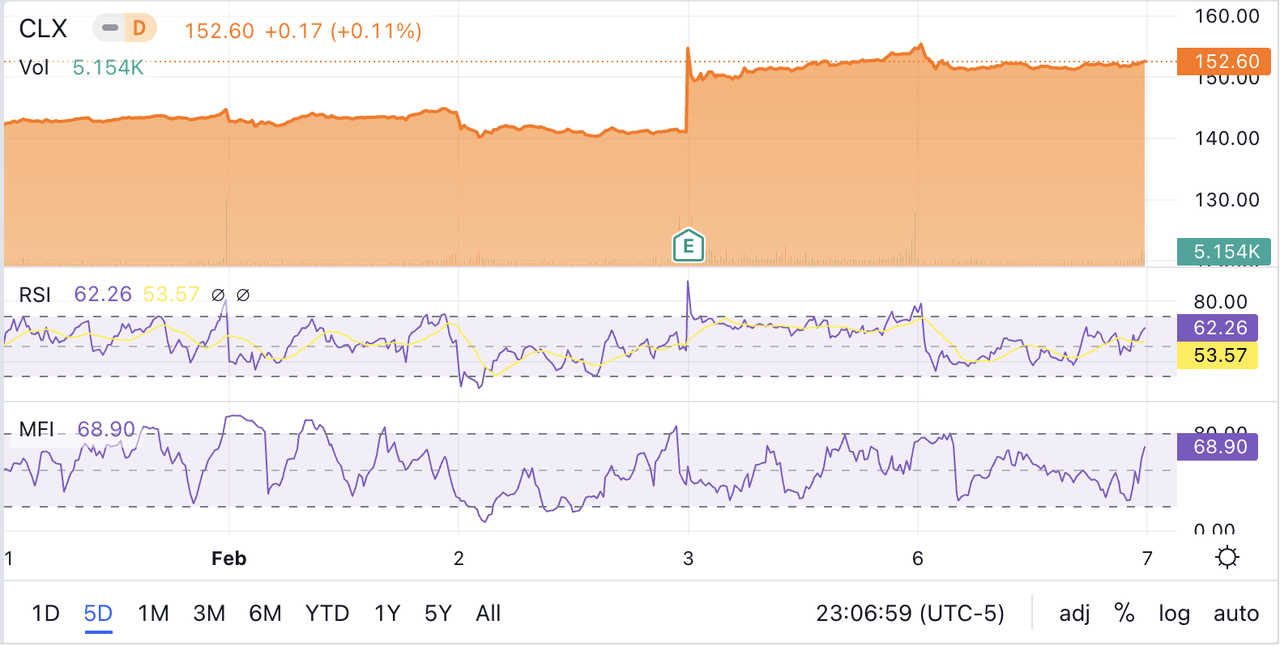

Good price momentum over the past few months

The stock had positive momentum over the past three months, returning 11.9%. The positive earnings report on February 2 pushed the stock higher, with its 5-day RSI and MFI technical indicators near overbought levels (Exhibit 6). The stock returned 146.2% (Total Return) over the past decade, compared to the 234.3% return of the S&P 500 Index.

Exhibit 6:

RSI and MFI Technical Indicators for Clorox (Seeking Alpha)

A monthly return comparison of Clorox and the Vanguard S&P 500 Index ETF between June 2019 and January 2023 shows that Clorox has performed poorly. The stock had an average monthly return of 0.11% compared to 1% for the Vanguard ETF. Investors love the consumer staples sector for its low volatility or beta.

Based on a linear regression model, Clorox had a beta of 0.25 in its monthly returns between June 2019 and January 2023 compared to the Vanguard S&P 500 Index ETF. This low beta means the stock’s monthly returns change by 0.25% for every 1% change in the Vanguard ETF. The consumer staples sector has outperformed the major indexes over the past year, with the Vanguard Consumer Staples ETF (VDC) declining by 3.4% while the Vanguard S&P 500 Index ETF (VOO) returned a negative 8.6%, and the NASDAQ-100 ETF returned a negative 14.5%.

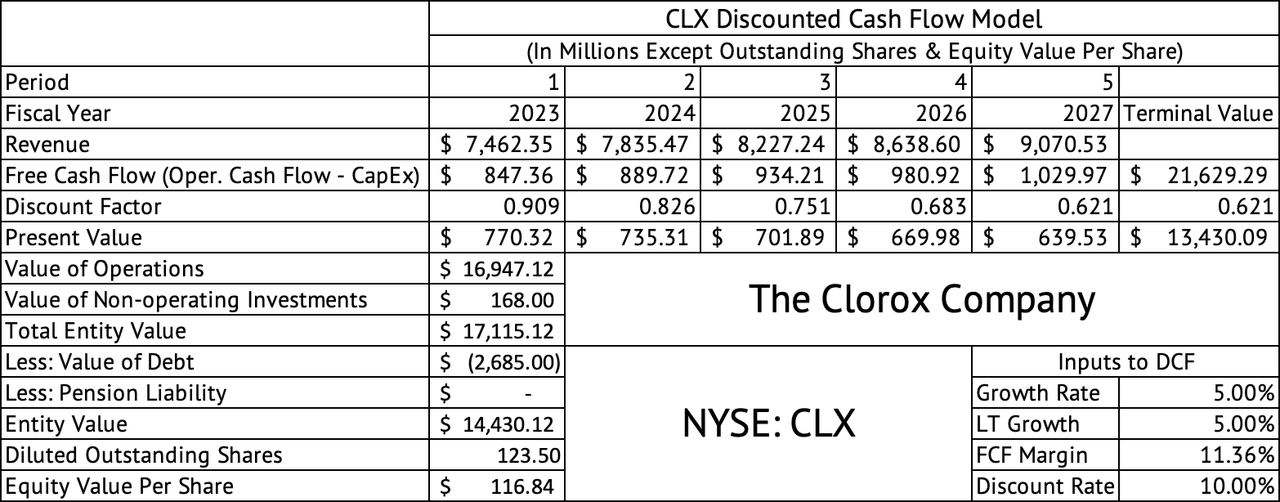

This price momentum has pushed up the valuation of Clorox to unsustainable levels. The stock is trading at a forward GAAP PE of 43x. The company is overvalued based on every valuation metric. The stock trade at a forward EV-to-sales multiple of 3x and 58x price-to-book ratio. A discounted cash flow model shows that the stock is overvalued by 30% to 60%. The model assumes an optimistic growth rate of 5%, a free cash flow margin of 11.3%, and a weighted average cost of capital of 10% (Exhibit 7).

Exhibit 7:

Discounted Cash Flow Model for The Clorox Company (Seeking Alpha, Author Calculations)

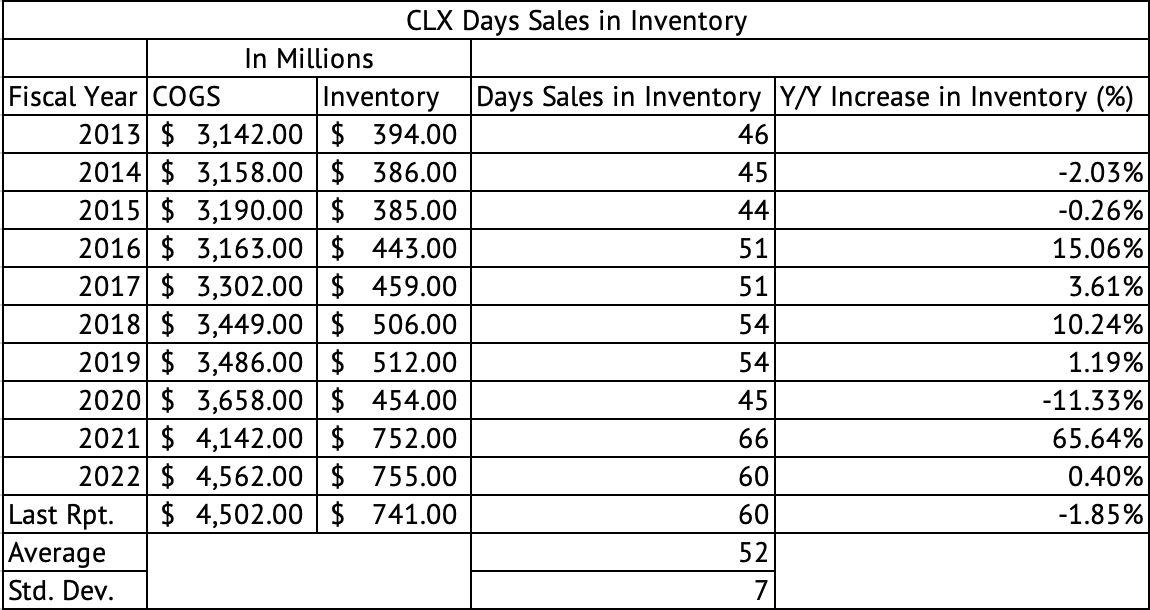

High inventory levels

The company may have more work to do in reducing its inventory costs. Currently, Clorox is carrying about 60 days of sales in inventory (Exhibit 8). Its average over the past decade is 52, with a standard deviation of 7 days. The carrying cost of stock has increased due to inflation, which has pressured gross margins and reduced operating cash flows. When asked about further gross margin improvement during the Q2 2023 earnings call, Kevin Jacobsen [CFO] said that he would not provide an outlook for gross margins due to the “volatility” in the operating environment.

Exhibit 8:

Clorox Days’ Sales in Inventory (Seeking Alpha, Author Calculations)

Inflation may be fading in the U.S., but there are pockets of high inflation across the globe. It may not go down in a straight line, and the U.S. may see high inflation bouts. Still, as consumers further pull back on their spending, inflation may drop to the Federal Reserve’s 2% target in 2024. Consumer staples companies should benefit from lower levels of inflation.

Dividend and Debt

Clorox offers a dividend yield of 3.1%, a better yield than the 1.56% offered by the Vanguard S&P 500 Index ETF. But, the yield is substantially less than the 4.45% yield offered by the 2-Year U.S. Treasury Note. The yields on the short end of the U.S. Treasuries have increased by over 30 basis points since the beginning of February. The yield curve remains inverted, with the 10-year U.S. Treasury yielding 3.6%.

The company has grown its dividend by 7.2% annually over the past five years. The payout ratio is high due to margin erosion and lower cash flows. The company paid $577 million in total dividend payments over the past twelve months. The company generated $951 million in operating cash during the same period. The company’s debt to EBITDA ratio is 3x, high for this current interest rate environment, but there are other companies with much higher debt levels than Clorox. A debt-to-EBITDA ratio closer to 2x may give the company more flexibility. But, as the company’s gross margin trends towards its long-term average, that may help lower its debt ratios.

Clorox is a great, well-managed company, but the stock is overvalued. The company has had little growth, but it is valued as a high-growth technology stock, which investors have seen in the past decade. The company continues to face challenges in improving its margins to its long-term average. The market volatility of the past year has pushed investors to seek protection in low-beta stocks. Many consumer staples companies, including Clorox, have benefitted from this trend. Dividend income seekers may be better off investing in the 2-year U.S. Treasury, which offers 100 basis points higher yield than Clorox. Investors should wait for a pullback in the stock before investing in it. There is no reason to chase this rally in the Clorox Company.

Be the first to comment