Luis Alvarez/DigitalVision via Getty Images

Investment Thesis

On October 30, 2020, Teladoc Health, Inc. (NYSE:TDOC) acquired Livongo, a leading provider of solutions for the prevention and management of chronic conditions including diabetes, hypertension, obesity, and mental health. The Livongo merger is one of several highly synergistic moves likely to help the firm cement its status as a holistic leader in virtual health with distinctive offerings across primary, chronic, mental, home, and other types of care, on a global basis.

Execution challenges and market conditions have since contributed to a collapse of shares, resulting in huge non-cash goodwill impairment charges, which, in turn, have sunken sentiment. But the benefits of recent mergers will accrue for years to come. Meanwhile, while Teladoc faces a lot of competition, it enjoys even more competitive advantages, the preliminary foundations of a moat. The top-line performance, which shows the firm remains a high growth candidate, bottom line improvements, and overall strong fundamentals including relative balance sheet health, create the conditions for a major rerating of both the business and its stock. Risks to the bullish case including competition, regulations, and adverse market conditions, remain but seem more than priced in and likely won’t make a dent to the bullish case much longer. After digging, valuation points to an even more compelling investment thesis – and significant appreciation potential for the stock.

Business Overview

Teladoc, together with its subsidiaries, is the global leader in whole person virtual care. The firm’s vision is to position virtual care as the first place individuals go to get the care they need and manage their health. The virtual first model is built on an integrated platform, combining a wide array of technologies including AI, machine learning, digital self-management tools, an award-winning user experience through a set of highly flexible interfaces, remote patient monitoring devices, and data science and analytics. Teladoc’s consumer brands include Teladoc, Livongo, Best Doctors, 360Primary, and BetterHelp. These brands deliver access to knowledge, advice, and remediation for a broad array of health care needs via a user-friendly platform designed to meet the expectations of a broad range of consumers (of any age, gender, etc.).

Over the past two decades, Teladoc has evolved its product and service portfolio from a suite of point solutions to a whole person offering, becoming the “front door” to the healthcare system. The firm creates a unified and personalized consumer experience, which likely offers the largest breadth of integrated whole person products and services in the virtual care industry, capitalizing most recently on its combinations with Livongo Health, which significantly strengthened its chronic care management capabilities, and InTouch Technologies, which expanded its care delivery both inside and outside the hospital. Per the company 10K:

Altogether, this creates a well-defined opportunity for Teladoc to treat the whole person, from their mental to their physical healthcare, and from their acute episodic needs to their chronic needs. People who come to us with one of these needs are in turn much more likely to rely on us for other healthcare needs, which creates the opportunity for us to build longitudinal relationships, with care that’s personalized for each individual. We aim to achieve our vision of making virtual care the first step on any healthcare journey by delivering, enabling and empowering integrated whole person virtual care services and experiences that span every stage of the healthcare journey. We offer a portfolio of services and solutions covering hundreds of medical subspecialties from nonurgent, episodic needs like flu and upper respiratory infections, to chronic, complicated medical conditions including diabetes, hypertension, chronic kidney disease, cancer, congestive heart failure, and mental health conditions – all bolstered by technology, machine learning and human expertise to provide an effective care experience that people value and trust. (…) We possess diverse distribution channels, including Business-to-Business (“B2B”) and Direct-to-Consumer (“D2C”), and we’re a leader in each of them. Our customers consist of employers (including approximately 50% of the Fortune 500), health plans, hospitals and health systems, insurance and financial services companies, as well as individual members.

Teladoc’s solutions are delivered with a median response time of less than ten minutes in the U.S. for general medical inquiries from the time a member requests a general medical telehealth visit to the time they consult with a Teladoc Health network provider.

As of December 31, 2021, over 53.6 million unique U.S. paid members and 24.2 million visit fee only individuals have access to Teladoc’s offerings through a variety of channels.

Economic Moat

Teladoc faces lots of competition including virtual care technology/service providers like MDLive, Inc. (now owned by Cigna), American Well Corporation, and Accolade. Other niche industry participants may specialize in point solutions for digital chronic condition management (like Omada Health) or mental health (like Cerebral).

Larger competitors include health plans that have developed similar offerings (virtual care, expert medical service, etc.), and global, generalist tech or retail behemoths, such as Amazon (whose acquisition of One Medical could take market share), Alphabet, and Walmart, who are trying to pursue the huge health vertical by leveraging their formidable market might, financial wherewithal, unique database of user behavior data, and multi-faceted intelligence capture capability, to develop or acquire similar virtual care and related/integrated solutions.

But at one end of the spectrum, small niche player do not offer a similar breadth of virtual health (including specialized) capabilities. At the other end, Teladoc can leverage 20 years of healthcare data that neither Amazon nor Walmart (including via recent acquisitions) may boast. Teladoc has a formidable healthcare data mine and knowledge base that are difficult to replicate for any generalist/other market player, no matter how big and tech-oriented. Look at how difficult it is for media and entertainment juggernaut Disney to replicate Netflix’s success in pursuing streaming opportunities, and reach profitability simultaneously (not that it’s easy for Netflix itself to maintain its competitive advantage, but the truth is, many Netflix subscribers aren’t likely to cancel their subscription anytime soon; a first-mover advantage is a tremendous one).

Teladoc indeed enjoys strong competitive strengths including first-mover advantage, powerful distribution capabilities, diversity of client channels served (both B2B and D2C), an increasingly global geographic footprint (key to serve multinationals) and, most compellingly, a unique breadth of services as a virtual health platform. To quote the 10k:

We believe that we are the first and only company to provide a comprehensive and integrated whole person virtual healthcare solution that both provides and enables care for a full spectrum of clinical conditions, including wellness and prevention, acute care, chronic conditions, and complex healthcare needs. We also provide a broad range of programs and services, including primary and specialty care telehealth solutions, chronic condition management, expert medical services, mental health solutions, and platform & program services.

The company’s comprehensive engagement model also constitutes a unique source of strength.

We believe that our ability to drive behavior change on a global scale to deliver the highest utilization of virtual healthcare services in the industry is a key competitive differentiator for Teladoc Health. We utilize a combination of our proprietary engagement science, our “surround sound” capabilities, personalized individual experiences, as well as our deep knowledge and expertise of various populations to increase the adoption of our virtual care services. Our engagement science is a unique combination of the application of predictive analytics and modeling, our deep experience with all population demographics, and expertise in applying this knowledge to our Client populations on a global scale. With our proprietary engagement science, we target members using behavioral triggers, advanced predictive modeling, and demographic/firmographic insights. (…) We have a large and unique set of data points that gives us a longitudinal understanding of an individual’s clinical truth and enables us to engage in a holistic stepped care model. We integrate capabilities for our members across health plan, employer, and health system relationships, in a way that we believe is unique in the industry. (…)

The 10k also points out:

Our core platform is a highly scalable, integrated, application program interface (“API”) driven technology platform, for virtual healthcare delivery, with multiple real-time integrations spanning the healthcare ecosystem. It is equipped to serve over 100 million members (…) We leverage and develop a unique combination of cloud-based technology that integrates smart connected devices with sophisticated data science to deliver personalized health insight. For example, we provide a unique and proprietary (seamlessly integrated) blood glucose meter to members enrolled in our diabetes program. (…) Our platform’s APIs power external connectivity and deep integration with a wide range of payors, electronic medical records, third party applications, and other interfaces with employers, hospital systems, and health systems, which we believe uniquely positions us as a long-term partner meeting the unique needs of the rapidly changing, healthcare industry. (…). Our unique technology designed for the hospital and health system market is a complete end-to-end telehealth solution, including patient intake, emergent and scheduled encounters, video conferencing capabilities, access to medical images, full application-specific clinical documentation tools – including interfaces to hospital’s or health system’s electronic medical records (“EMR”) platform, and complete operational and clinical reporting and analytics. The technology also supports industry-leading medical devices such as robots, carts, and tablets via a unique network architecture for maximum performance, reliability, and security. (…)

Many of Teladoc’s alleged competitors will find it hard to replicate this unique ecosystem and set of capabilities.

Recent Performance Shows Teladoc Is Starting to Turn Around and Deliver

In the Q3 2022, revenue increased 17% to $611.4 million from $521.7 million in Q3 2021. Access fees revenue grew 20% to $540.1 million and visit fee revenue grew 5% to $65.6 million. U.S. Revenues grew 17% to $534.0 million and International revenues grew 17% to $77.4 million.

Q2 22 shows a similar pattern of fast-growing revenue, an 18% increase to $592.4 million from $503.1 million in Q2 21. Access fees revenue grew 20% to $518.7 million and visit fee revenue grew 7% to $66.7 million. U.S. Revenues grew 18% to $521.4 million and International revenues grew 13% to $71.0 million.

Teladoc primarily generates revenue on a contractually recurring, access fee basis, typically on a per-member-per-month basis. In the D2C business, Teladoc primarily generates revenue through monthly member subscriptions. In the D2B business, clients primarily pay monthly access fees based on a per-participant-per-month model, based on the number of active enrolled members each month. Teladoc also generates revenue from health system and provider clients related to its licensed technology platform, primarily in the form of recurring access fee revenue as well as from the sale/lease of devices such as robots, tablets, etc. Teladoc also generates revenue on a per-telehealth visit basis with visit fee only arrangements, but access fees comprise the majority of Teladoc’s (recurrent, thus rather predictable) revenue due to the effectiveness of its platform’s engagement and resulting service utilization. Access fees are paid by Teladoc’s clients on behalf of their employees, dependents, policy holders, card holders, beneficiaries, clinicians, or as is the case with certain subscribers, fees are paid by members themselves. Visit fees are typically paid by clients and/or members. For the year ended December 31, 2021, 85%, 13%, and 2% of revenue was derived from access fees, visit fees, and other, respectively. Average revenue per U.S. paid member increased to $2.61 in the third quarter of 2022, from $2.40 in the third quarter of 2021.

Several key takeaways here. That part constituting the bulk of revenue, i.e., recurring access fees, grows fastest, feeds a healthy top line, and is likely to skew the firm to rapid compounding/high-growth status. A reaccelerating top line also becomes a possibility, given catalysts to come (see below). International revenue seems to be gaining momentum, as well. The lower-growth visit fees are less mission-critical; over time, they’ll get to matter less and less.

Q3 22 net loss totaled $73.5 million, or ($0.45) per share, compared to $84.3 million, or ($0.53) per share, for Q3 21, thus retreated.

Q2 22 Net loss totaled $3,101.5 million, or ($19.22) per share, compared to $133.8 million, or ($0.86) per share, for Q2 21. Q2 22 results included a non-cash goodwill impairment charge of $3,030.0 million, or ($18.78) per share. Excluding the charge, the Q2 22 loss would have been $71.5 million and thus again retreated.

GAAP gross margin, which includes depreciation and amortization, was 68.3 percent for Q3 22, compared to 67.1 percent for Q3 21. Adjusted gross margin was 69.6 percent for Q3 22, compared to 67.6 percent for Q3 21.

Two key takeaways here – excluding the impairment charge, net loss is going down; margins are improving.

It gets better. For the fourth quarter of 2022, Teladoc Management expects:

| 4Q 2022 Outlook Range | |

| Revenue | $625 – $640 million |

| EBITDA | $10 – $37 million |

| Adjusted EBITDA | $88 – $98 million |

| Net loss per share | ($0.40) – ($0.10) |

| Total U.S. Paid Membership | 57 – 58 million |

Source: Teladoc Press Release, Q3 2022

Revenue is still expected to increase fast (at least 20%, sequentially). Meanwhile, net loss per share just hitting mid-range expectations (around $0.25) would constitute very significant improvement over recent numbers. If net loss approaches ($0.10) or beats expectations, Teladoc gets close to break-even. The conditions are starting to emerge for a significant rerating of both business and stock.

Potential Catalysts for Rerating of Business and Stock Price

Driving this rerating of both business and stock are a number of potential-to-likely catalysts including:

Expanding Total Addressable Market

Teladoc’s platforms address significant unmet needs across an increasing number of care settings, including virtual primary care, home care, post discharge follow-ups, chronic care, mental care, wellness/screening, etc.

The firm’s virtual primary care offering, Primary360, is available to commercial health plans, employers, and other organizations that sponsor healthcare for individuals and families in the U.S. One out of four working age adults who do not have a Primary Care Physician (“PCP”), and the four out of five who do not have a strong relationship with a PCP, i.e., millions of individuals, may use Teladoc’s platforms to gain critical access to high quality healthcare, constituting an incremental total addressable market of approximately $140 billion in the U.S. alone.

Further, according to Vision Research Reports, the U.S. virtual care market was estimated at US$4.3 billion in 2021 and it is expected to surpass around US$46.5 billion by 2030, poised to grow at a CAGR in excess of 30% from 2022 to 2030. All Teladoc needs to do is maintain market share (a not unlikely prospect given competitive strengths mentioned above and catalysts below) and sales will likely keep compounding fast.

Leveraging Cross-Sale Opportunities

Not only the number of individuals, but also the number of services provided per individual, may go sharply up over time. Teladoc’s model is built on a foundation of integrated, multi-source data, leveraging a unified whole person experience; dedicated care teams for a personalized longitudinal care plan; ongoing guidance and support; navigation and coordination with high quality providers; and “last mile” services like lab testing, prescriptions, and in-home exams.

Add Teladoc’s integrated mental health service, a proprietary stepped care model designed to seamlessly combine app-based tools and coaching expertise with therapists and psychiatrists to ensure that consumers get the level of mental health care needed. Chronic Care constitutes yet another opportunity for Teladoc to cross-sell; the chronic condition management solution helps individuals improve their health outcomes while living with one or multiple chronic conditions, from diabetes to hypertension, weight management, and other concerns.

Increasing Engagement

Not only the number of individuals and the number of services provided per individual, but also the number of times services per individual may be procured, may go sharply over time. Teladoc has an opportunity within its existing membership base to increase engagement by continually driving awareness and usage. Teladoc seeks to continually enhance its user experience, a critical driver of new/repeat engagement, and build longer term relationships with members. Per the 10K:

As we expand the range of products and services available to our members, we are investing in a seamless, relevant, and personalized mobile experience that provides smart guidance for our members. In addition, our integrated smart devices, such as our cellular blood glucose monitor, provide additional touch points for engaging members with relevant AI driven nudges to drive behavior change and improved health outcomes. Our industry leading capabilities and expertise enable unique types of partnerships where our services are delivered to our partners with their brands, logos, and workflows on mobile and web platforms. These integrated member experiences drive higher member engagement, convenience, and utilization.

Multiplying distribution capabilities

Teladoc follows a multi-tier go-to-market strategy, offering a highly differentiated suite of solutions for a broad range of market channels, targeting all healthcare system participants, from employers to health plans/payors, hospitals and health systems, global businesses and other employers/organizations, insurance/financial services companies, and individual members.

After two decades, Teladoc is in a position to use, not just a couple, but most to all possible levers, to target the end-consumer of health services, whether directly or via any-to-any B2B channel, be it a particular employer or health plan or other market player.

We believe that this strategy will help drive an increase in our average revenue per member over time. Within existing Clients, current membership also represents only a portion of the potential members available to Teladoc. Our existing health plan Clients and self-insured Clients associated with these health plans currently purchase our solutions for only a portion of their beneficiaries in the aggregate, and we estimate this provides us the opportunity to grow our membership base by expanding our penetration within our existing Clients.

Teladoc also leverages key partnerships with CVS Minute Clinic and others in the U.S. and internationally to catalyze market entry.

Global market leverage

Teladoc is in the process of expanding penetration of global markets. Its international operations are headquartered in Barcelona, Spain with satellite locations in Europe, South America, and Asia. Per the 10K:

When medically necessary, our doctors can help members navigate the local health systems to obtain the best healthcare for their situation. Our international Client base, largely comprising global financial services companies, provides fertile ground for expansion of our product portfolio through existing partners in attractive markets where our infrastructure is already in place. For instance, we see opportunity for service expansion in global markets through the localization and application of our chronic condition programs for diabetes, hypertension, weight management, diabetes prevention, and mental health.

Teladoc leverages partnerships with Telefonica in Spain, Vivo in Brazil, and others, to accelerate international penetration.

Raising Interest Rates

Inflationary pressures and raising interest rates to combat them have punished high-growth, long-duration stocks, i.e., the shares of those not-yet-profitable companies expected to generate the bulk of their earnings in the future. This includes innovative firms, those very same names you’ll find in Cathy Wood’s ARKK fund. This has been true for the past two years, and quite brutal, but many of these stocks are now likely bottoming. At some point, value kicks in, becomes so compelling that the stocks can only fall so far. That’s probably where we are now. High-growth, long-duration stocks are where oil stocks were a year and a half ago. When the market turns, Teladoc’s shares will likely enjoy another major tailwind.

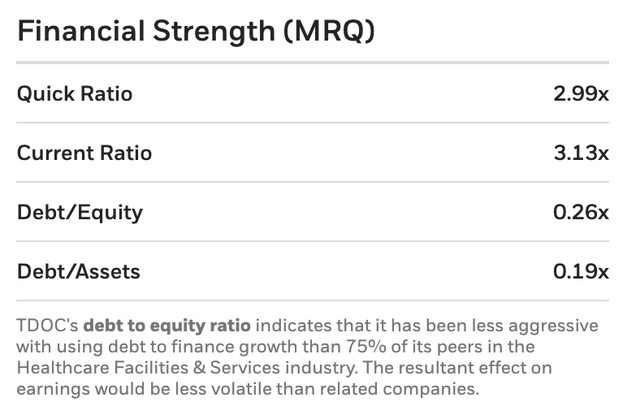

An Assessment of Fundamentals

Teladoc’s debt-to-equity ratio of just about .26 indicates that it has been less aggressive with using debt to finance growth than 75% of its peers in the Healthcare Facilities & Services industry. This signals relative balance sheet health and flexibility.

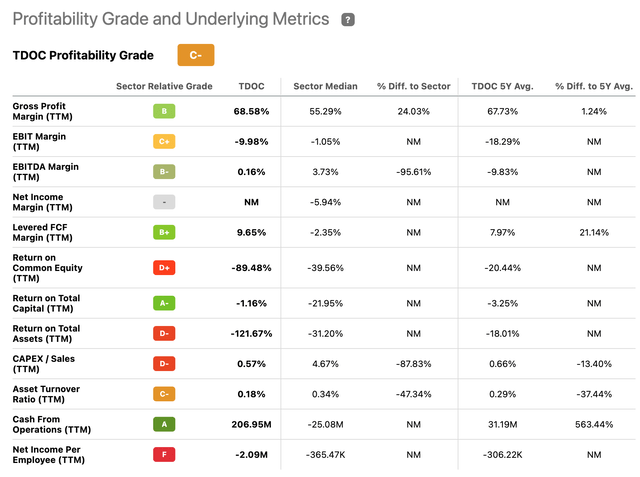

Net income-related gauges are negative since the firm is not profitable yet, and the firm’s returns on both equity and assets show room for improvement, but the company’s profitability grade also shows solid gross profit margin (nearing 70%) and cash from operations.

Teladoc’s Cash Flow Statement shows the firm records solid cash from operating activities, a critical gauge.

Valuation

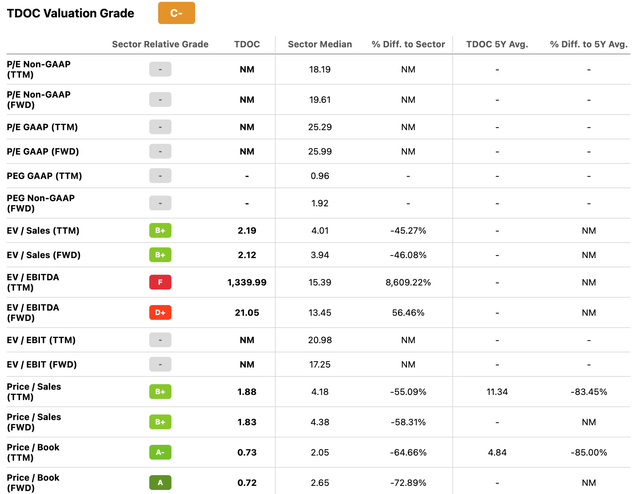

Since reaching an all-time high of $308 on Feb 15, 2021, the stock has lost a horrific 91.2% of its value.

At current price, a number of gauges point to more attractive valuation. Both EV and price over Sales (both trailing and forward), as well as price per book, seem to indicate that the shares are more reasonably priced. Only EV/EBITDA (both trailing and forward) indicates otherwise, primarily because the firm has yet to reach meaningful positive EBITDA.

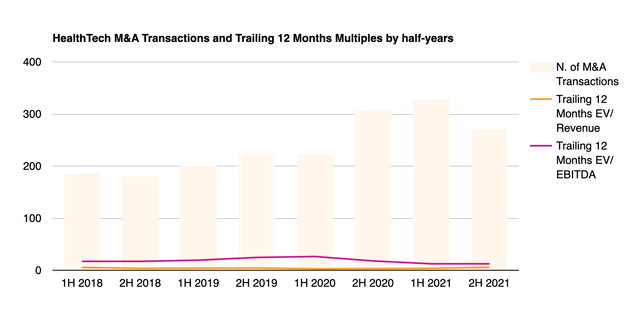

Consider that in the second half of 2021, the trailing 12-month median EV/S multiple for health tech was 5.6x, up from 3.6x the previous half-year and around 3x the year before. It’s now severely compressed, given the most recent market trends (closer to 2-2.5x).

Sure, the shares may trade at a discount on an EV/sales basis to profitable peers (albeit at a premium to market laggards or not only unprofitable, but also market-share losing direct peers).

A 12-month target of 1.8x 2023 sales estimate of $2.72 billion yields an enterprise value of $4.896 billion, just 10% above current market cap of $4.4 billion, or a share price around $35. The stock is no longer expensive, not by any stretch. But even this mere statement is misleading for at least several major reasons.

Our analysis above makes the case that revenue if not likely to decelerate meaningfully; quite the opposite is likely to happen. Further, Teladoc may soon see a significant decrease in net losses. Management’s very own outlook suggests it. A higher valuation multiple is thus likely to apply on an (itself increased) sales number. Let’s drill.

First, full year 2022 management outlook revenue range is $2,395 – $2,410 million, just about 20% above 2021 revenue of $2,032.7. This is not exactly slow growth. Second, analysts see 2023 revenue of $2.72 billion (average estimate, see above), or a 15% increase year-over-year, but it’s quite possible, if not more likely, that Teladoc will reach the high estimate of $2.81 billion (given strengths and catalysts mentioned above). Third, a 1.8x EV/sales multiple posits Teladoc well below most health care tech peer valuations and seems too conservative, as the company, based on short-term outlook (Q4, 2022, impairments are well in the rearview), is approaching break-even. Any major break-through in net loss over non-decelerating (if not re-accelerating, there is plenty of room for growth based on our analysis above) revenue is likely to result in a significant adjustment( rerating) of the multiple. Apply 2.5x $2.81 billion = $7.025 billion, now 59.7% above current market cap, good for a major rerating of the share price to around $43 within a year.

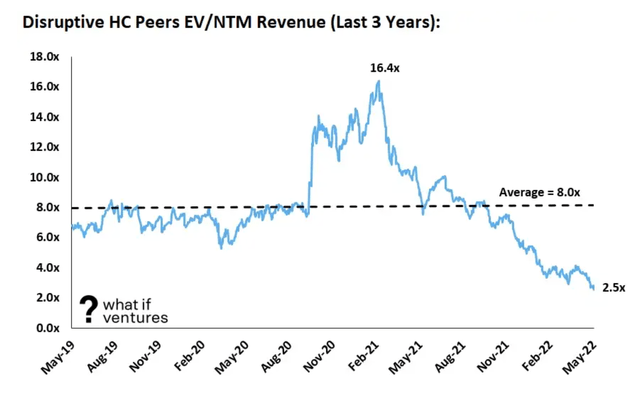

It gets better. Once the market turns, and it sure can fast and furious, especially for high-growth names, the multiple is likely to expand dramatically. Check out the disruptive healthcare peers’ record of EV/Revenue (next-12-month) multiples over the past 3 years; the mean is as high as 8. I won’t even dare to mention the peak… Apply similar multiples and you’re clearly looking at potential for a multi-bagger in a relative short order.

Stock-Based Compensation (SBC) Is Getting Well under Control

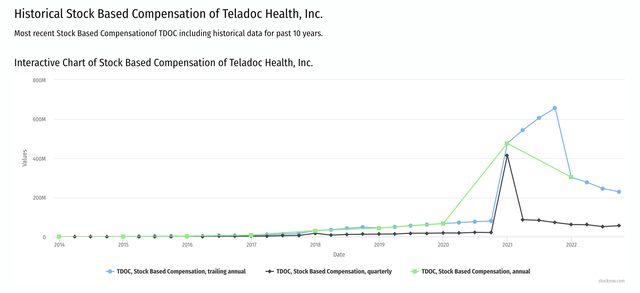

In an effort to retain talent in a competitive job market, Teladoc is resorting to dilutive stock-based compensation to boost total compensation for a significant number of employees deemed mission-critical. Teladoc’s SBC expense program with employees to enhance retention should be gauged relative to competitors. Check out the SBC data for Teladoc below:

Teladoc’s SBC of $303 million constituted 15% of 2021 revenue of $ 2,032.7 million. But more recent trends show SBC is moving in the right direction. For Q3 22, Teladoc’s SBC expense of $55.7 million constituted 9.11% of revenue of $611.4 million. In Q3 21, SBC of $71.7 million was 13.7% of revenue ($521.7 million). In Q2 22, the ratio SBC Expense/Revenue was 10.7%, vs 16.5% in Q2 21. SBC expense has thus been decreasing and is now heading below 10% of total revenue.

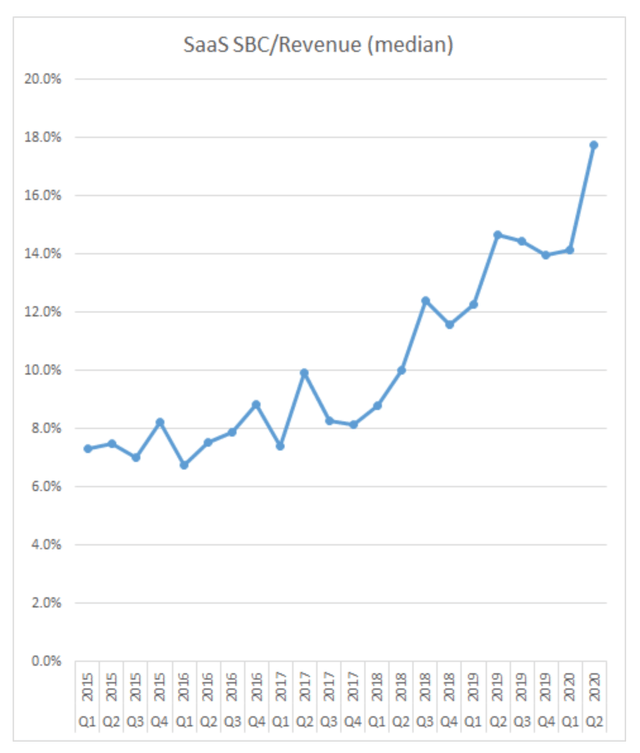

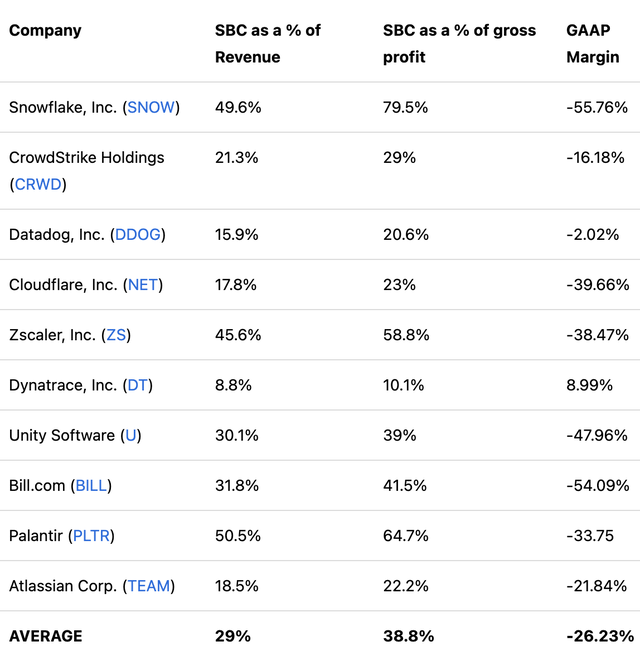

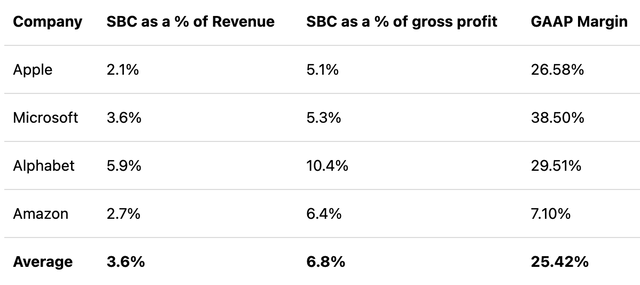

A comparison of the market’s high-flyers for SBC makes it obvious that Teladoc is far from being amongst the most aggressive or worst offenders with SBC, as its SBC/Revenue ratio is well below the median (around 18%).

The list below makes it obvious that other tech firms are much worse offenders.

While Teladoc does not exactly behave like a more established tech vendor à la Apple (AAPL) or Amazon (AMZN), its SBC seems to be falling within the range of reasonable practice (and, if it continues to head down, could end up in the vicinity of Alphabet’s own SBC profile, although this is not a likely prospect short-term).

Management seems to be using SBC aggressively, but also increasingly responsibly.

Risks

Teladoc is subject to a number of risks. One remains competition since it constrains Teladoc’s ability to grow margins, although we do believe that the company will turn profitable way before 2025 (contrary to a number of Wall Street analysts, who seem to predict unprofitability for another couple of years). Still, a history of losses and high accumulated deficit highlights the risk that Teladoc may not achieve profitability for some time, if ever.

Heavy evolving government and healthcare laws and regulations and Teladoc’s ability to stay abreast of new or modified statutes constitutes another key risk. Compliance with regulations concerning data privacy, including personally identifiable information and personal health information (HIPAA restrictions), cyber-security, interstate practice of telemedicine, unfavorable changes to reimbursements, are some other factors to consider. Teladoc’s ability to establish and maintain strategic relationships with third parties and qualified providers is paramount.

The integration of acquired businesses and achievement of all expected synergies, and their impact on Teladoc’s financial metrics and results of operations, are another risk. The shares have suffered from negative investor sentiment due to expected financial losses from recent multibillion-dollar impairments. General market and economic conditions that have punished high-growth enterprises may not help, of course, although some of these developments, again, are now in the rearview.

Finally, Teladoc’s foray into competitive international markets, where complex non-U.S. regulations and legal requirements loom large, entails additional competitive stress and compliance risks.

Conclusion

Teladoc may constitute a significant wealth creation opportunity for long-term investors. The firm qualifies as:

- A technology leader with strong competitive advantages at the leading edge of the rapidly expanding virtual healthcare market,

- Endowed with a still solid growth profile, healthy operating cash flow, significant bottom line improvements, a healthy balance sheet, and increasingly favorable valuation metrics.

- Negative momentum and market sentiment have punished the stock, presenting bargain hunters with an opportunity.

Solid appreciation potential exists within the next five years, but this is a high-risk, high-reward, best deemed as contrarian, investment opportunity. Bullish investors should start accumulating decisively. The more cautious ones – i.e., those waiting for greater visibility into Teladoc’s future top line, operating cash flow, and earnings – might prefer to dollar average.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment