Marvin Samuel Tolentino Pineda/iStock Editorial via Getty Images

Many regular readers know I have not liked Netflix, Inc. (NASDAQ:NFLX) for many years, because its overvaluation made the stock uninvestible. The last time I penned a bullish article on the company was 2016. I have written two articles in 2022 (February here, April here) explaining how management arrogance about its leading streaming position and intense competition would bring down results this year. If you want to review how “sentiment” has flipped the last year or two from Netflix investors, reread my bearish outlook for the company in January 2021 here. There was near unanimity in the comment section that Netflix could never slow in growth or fall appreciably in price.

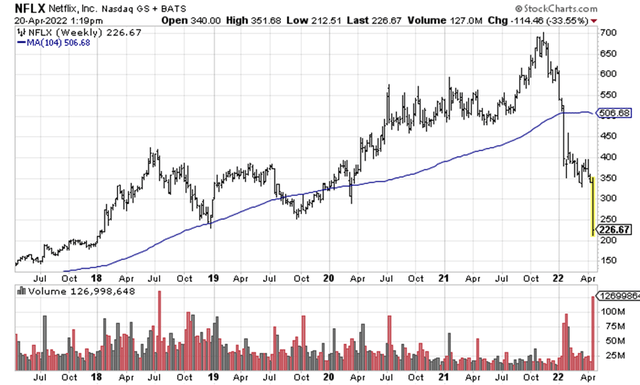

Then reality struck. Competition is appearing everywhere you look in the online media/video streaming industry, and a poor management plan to cope with free market changes in the industry have led to Netflix reporting (after Wall Street’s close on April 19th) its first drop in subscriber numbers in 10 years. So, disappointing growth numbers over the last several quarters have forced overly optimistic investors to first sell the name as a weakening growth story to downright panic selling on April 20th. The stock has cratered almost 70% from $701 in November to $213 at the low today! The current quote is the same as early 2018 over four years ago, meaning anyone that has purchased NFLX during the last 50 months is sitting on a large loss right now. I cannot blame you, if you feel like panic selling your stake.

Below is a weekly chart review of trading over the last five years, with a 2-year moving average.

5-Year Chart, Weekly Changes – StockCharts.com

The Buy Proposition

I purchased shares today with an average cost around $230. The selling is clearly overdone, and I believe the odds favor a strong bounce back toward $300 into the summer months. The contrarian in me will reevaluate the idea on a move into the $275-300 range. This could be a great long-term buy entry point, with Netflix’s sizable overseas streaming position worth something, cash flow and profits now part of the investment picture, and a number of ways to right the ship still available to management. However, competition will hold the price well under $700 for many years. A truly rotten decision would be Netflix stays the course in high-cost subscriptions, basically resting on its laurels and milking existing viewers for all possible revenue. If this is the future, Netflix may not recover much above $300 before succumbing to more selling later in the year.

I have personally been screaming that Netflix needs to branch out and acquire/merge with Paramount Global (PARA). Getting ahold of extra content and program library assets, alongside the top-watched live U.S. TV network, would help arrest its decline. Plus, it could expand the cable-tv-killing Pluto TV service owned by PARA. An all-stock transaction for PARA would be the correct move. Using NFLX’s share currency in exchange for tons more programming would be a win-win for both sets of shareholders. Low or no-cost options for consumers, supported by advertising, is the future of online media growth, which is Paramount’s battle plan and focus. Netflix has a rapidly closing window to retake the lead in this area of the media marketplace if it acts fast.

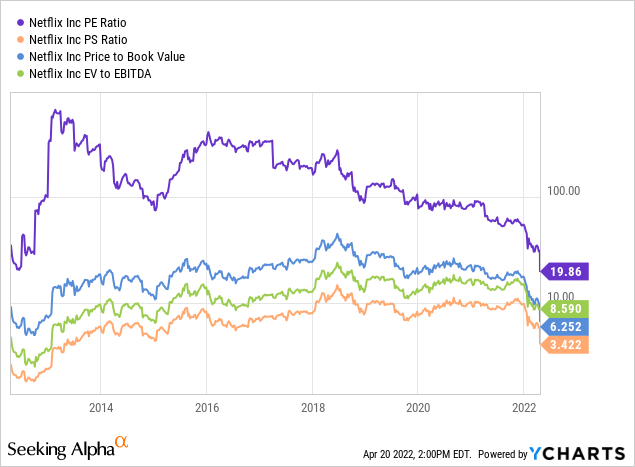

Otherwise, if revenues and profits grow even mildly in 2022-23, the current equity valuation is closer to where it should be, using reasonable math assumptions.

The valuation today using basic fundamental ratios on trailing results is back to 2013’s setup, a good eight years ago. On a $227 price vs. earnings, sales, book value and EBITDA, you can even argue we are reaching for bargain territory. Of course, this assumes NFLX’s future remains bright, and some sort of growth will continue past 2022.

10-Year Fundamental Value Chart, YCharts

The big dump in price this week is also not being confirmed by many momentum indicators (at least so far, we’ll have to wait and see what transpires in coming trading session). Below is an 18-month graph of daily price and volume changes with the Accumulation/Distribution Line, Chaikin Money Flow, and regular Money Flow Index calculations underneath. (Note: the momentum indicators are based on yesterday’s close). My read of the trading condition is buyers have shown up after the two latest rotten quarterly earnings releases, but those buying are only doing so after a large price haircut. In terms of a reversal in price, any type of good news the rest of the year should support a move to fill the massive price gap downward between $325 and $250 outlined today.

18-Month Chart, Daily Changes – StockCharts.com

Final Thoughts

The blowout panic selling on April 20th may have exhausted the vast majority of dumping action by regular investors and institutions on the weak subscriber growth and guidance numbers for 2022. While a sharp rebound is not guaranteed from a $213 low trade, the “risk” of holding Netflix shares is now far lower than the $700+ price in November. A high valuation story has been completely deflated into a normalized area better suited for intelligent growth investors. I can even argue Netflix has real value currently with options on the table to retake past glory for patient investors. It is entirely possible, when viewed 3-6 months down the road, that today’s downside implosion may prove a bit of an overreaction.

I am modeling worst-case downside to $150 a share over the next 12 months vs. best-case upside above $350. For me, risk/reward analysis of -35% to +55% for possible returns says level-headed, unemotional investors may want to start nibbling on this bottom fishing prospect. If you believe the smartest time to buy is when blood is in street, Netflix’s blood red logo looks quite appetizing.

Who knows, maybe a larger fish like Apple (AAPL), Alphabet/Google (GOOG) (GOOGL) or Amazon (AMZN) will make a play for Netflix and marry the leading streaming service with their own creation. Holding market capitalizations in the trillions, the NFLX valuation around $150 billion presently is easily digestible. The only and main obstacle to such a deal is the antitrust regulatory environment under the Biden administration. If Republicans were in control of Washington politics, the odds of a Netflix acquisition would be quite high following today’s collapse.

Be the first to comment