chonticha wat

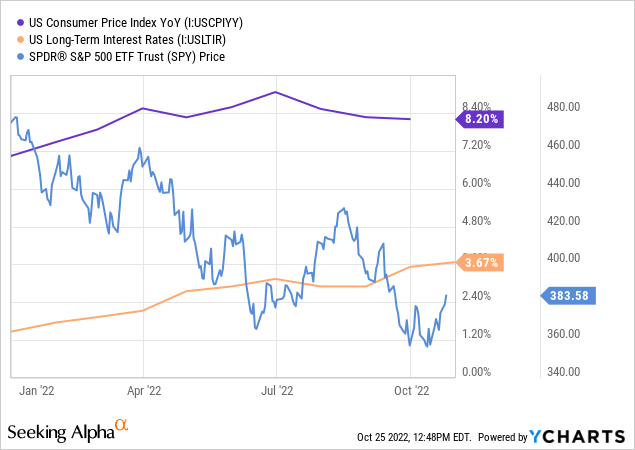

In the current high inflation and rising interest rate environment that is driving up the cost of living while simultaneously hitting stock prices hard, investors are looking for ways to hedge their portfolios.

Gold (GLD)(IAU) has traditionally benefited from periods of high inflation and especially negative real interest rates, though the linear relationship is rather weak. In fact, over the past 50 years, research has shown that only 16% of gold price variation is directly caused by changes in CPI inflation. Much of that linearity occurred in the 1970s and early 1980s where gold prices soared alongside runaway inflation. However, since then we have not seen a similar occurrence, despite us seeing inflation levels nearly as high today.

Nevertheless, when accounting for negative real interest rates (i.e., the nominal interest rate minus the inflation rate), the relationship becomes much clearer:

| Year | Real Interest Rate | Gold Performance |

| 2010 | Clearly Positive | Up Significantly |

| 2011 | Clearly Negative | Up Significantly |

| 2012 | Clearly Negative | Up Significantly |

| 2013 | Clearly Positive | Down Sharply |

| 2014 | Slightly Positive | Down Slightly |

| 2015 | Clearly Positive | Down Sharply |

| 2016 | Clearly Positive | Up Slightly |

| 2017 | Roughly Zero | Up Slightly |

| 2018 | Slightly Positive | Flattish |

| 2019 | Slightly Negative | Up Significantly |

| 2020 | Roughly Zero | Up Significantly |

| 2021 | Clearly Negative | Down Slightly |

| 2022 | Clearly Negative | Down Slightly |

source: Author’s calculations comparing CPI, Long-term U.S. Interest rates, and Gold Price movements

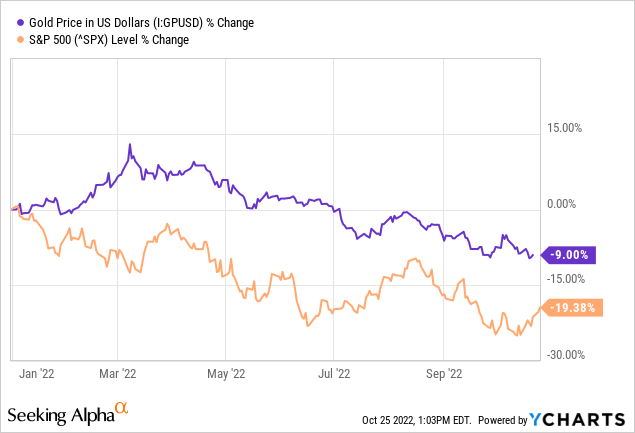

Even this year with gold down despite inflation being near four decade highs and real interest rates in negative territory, it is worth pointing out that gold is still clearly outperforming the broader stock market (SPY) indicating that it is at least hedging equity portfolios to some degree:

Furthermore, gold is valuable as a portfolio diversification tool beyond its direct relationship with inflation. For example, gold may not be as pure of an inflation hedge as energy (XLE) and Treasury Inflation Protected Securities (TIP), but it is also not nearly as cyclical as energy businesses like Exxon Mobil (XOM) and has generally better liquidity than directly holding TIPS and does not come with the other pricing complications of holding a timing sensitive bond fund like TIP.

However, we do not believe that inflation and negative real interest rates are the biggest reason to buy gold right now: the growing likelihood of a Chinese invasion of Taiwan is. Here are three reasons why.

#1. The Increasing Likelihood Of A Chinese Invasion Of Taiwan

Almost as equally obvious as the rise of inflation this year has been the rapidly increasing temperature of geopolitical tensions across the globe. The Middle East remains a powder keg with regular flare ups that threaten to expand into a broader war across the region, Eastern European tensions between Russia and its former Soviet satellites finally erupted into a hot war earlier this year with the conflict in Ukraine now dragging on for about eight months with no end in sight. Most alarming of all, however, has been the rapid rise in tensions in the Far East, particularly across the Taiwan Strait.

Perhaps encouraged by the U.S. Military’s debacle during its Afghanistan withdrawal last year, China has dramatically increased its flights and military drills over and around Taiwanese airspace. On top of that, the Chinese Communist Party leadership has grown increasingly belligerent in its rhetoric towards the United States and Taiwan.

In fact, Xi Jinping has publicly announced that the reunification of Taiwan with China will happen by 2027, while signing agreements with Iran and Russia to ensure that China will have access to sufficient energy supplies in the event that it faces embargoes from the West in the wake of aggression against Taiwan.

China is also rapidly growing its nuclear arsenal at a time when America’s nuclear force is increasingly dated. Its conventional forces – especially its navy, air force, and missile technologies – are growing in capabilities and size at an even more accelerated pace, thanks in large part to an unparalleled espionage, cyberwarfare, and intellectual property theft campaign against the West. A recent report revealed that dozens of Chinese scientists somehow found opportunities to work on research projects involving advanced U.S. technology at Los Alamos laboratory – on the U.S. taxpayer’s dime – and later returned to China and likely used their U.S. sourced know-how to help the Chinese military develop advanced technologies as well.

Now, President Xi has established himself as the likely Chinese dictator for life. while also issuing an ominous warning of dark times ahead, stating:

We must therefore be more mindful of potential dangers…be prepared to deal with worst-case scenarios, and be ready to withstand high winds, choppy waters, and even dangerous storms.

He went on to state:

The wheels of history are rolling on toward China’s reunification and the rejuvenation of the Chinese nation. Complete reunification of our country must be realized, and it can, without doubt, be realized!

Clearly, China is laser-focused on conquering Taiwan as soon as it believes it is possible and pragmatic to do so. U.S. military leaders are increasingly expressive concerns that this could happen sooner rather than later. The U.S. Navy’s top admiral – Mike Gilday – just said last week that China could invade Taiwan any day now:

When we talk about the 2027 window, in my mind, that has to be a 2022 window or potentially a 2023 window.

Secretary of State Antony Blinken indicated something similar when he said that China will aim to seize Taiwan on a “much faster timeline” than previously thought.

While China’s growing strength and belligerence is certainly concerning, even more concerning is the fact that the U.S. is increasingly incapable of mounting any meaningful check if China were to move aggressively on Taiwan. As former National Security Adviser Robert O’Brien said recently:

What’s so worrying about this report is that the US military used to be designed to be able to fight two and a half wars. This report says we may not be able to fight one war effectively. It’s very concerning. We need to rebuild the military. We need to replenish the stocks of everything that we’ve sent to Ukraine. We’re low on missiles, we’re low on javelins. We’re low on stingers. We can’t supply them to Taiwan now.

In addition to the exacting and perhaps strategically foolish decision to pour so many resources into the Ukraine war (instead of requiring European countries like France and Germany to carry more of the burden), another big reason why the U.S. military is in a state of decline is due to its two-decades long so-called “war on terrorism” that distracted the military from priming its conventional warfare capabilities in favor of developing counterinsurgency tactics. Furthermore, a renewed focus on purging the military of so-called and vaguely defined extremism, advancing so-called social justice initiatives within the ranks and even in the military’s mission statement, and pushing COVID-19 shot mandates have forced out of service many of the U.S. military’s best officers and soldiers.

This lethal combination of breakneck Chinese military growth and widespread American military decline across all of its branches leaves Taiwan very vulnerable to attack.

#2. The Market Impact Of A China-Taiwan Conflict

This leads us to our second reason why owning gold makes sense right now due to the increasing risk of China invading Taiwan: a market crash would almost certainly follow.

The reasons for this are numerous, at least some of which should be obvious:

- the mere uncertainty that would follow from the two most powerful militaries and economies in the world being brought into likely military conflict would certainly cause the market – which infamously hates uncertainty – to plunge.

- such an invasion would almost certainly plunge the world into a depression. There are estimates that $2.6 trillion could be wiped out from the global economy in the immediate aftermath of a war over Taiwan and the longer it would drag on, the more severe the economic carnage. The U.S. Commerce Secretary has already warned that the mere loss of Taiwanese semiconductors would cause a severe and deep recession in the United States:

If you allow yourself to think about a scenario where the United States no longer had access to the chips currently being made in Taiwan, it’s a scary scenario. It’s a deep and immediate recession.

- The Rand Corporation’s research suggests that U.S. GDP would decline by 5%, which is almost twice as much as the decline experienced in the wake of the 2008 financial crisis.

- Many U.S. mega cap companies (such as Apple (AAPL) and Tesla (TSLA)) would suffer immense hits to their business as generate considerable revenue from China and/or produce products/source significant components from there. This in turn would also weigh on the broader stock market.

For these reasons alone, holding some gold in your investment portfolio appears to be a prudent move right now as its diversification benefits would undoubtedly be valuable in such a scenario. However, this is not the only reason why gold would be catalyzed by a Chinese invasion of Taiwan.

#3. The Coming Chaos

The biggest reason why a Chinese invasion of Taiwan – especially if the U.S. were drawn into the conflict – would likely catalyze gold so much is because this war would undoubtedly bring with it significant economic and financial chaos.

First and foremost, it is highly likely that China would unleash major cyberattacks on and potentially highly disruptive physical attacks within the United States that would target its physical and financial infrastructure. As a result, the massive chaos would crush corporate operations and earnings, at least in the short-term, and even the financial markets themselves could be so disrupted by cyberactivity that they would get shut down as well. In such a scenario, holding physical precious metals will be invaluable.

Furthermore, if the Chinese achieve even a degree of success in accomplishing their strategic objectives and tarnish the U.S. military’s highly regarded reputation as the undisputed global superpower, it could seriously jeopardize the U.S. Dollar’s status as the global reserve currency. If the U.S. military is no longer able to enforce the current global order and effectively protect global trade and exchange of goods – especially valuable commodities like oil and LNG while they transit across global waters – due to the rise of peer or even superior competitors like Communist China, the Dollar loses some of its appeal as a safe-haven asset and a guaranteed medium of exchange across the globe. In such a scenario, gold – and perhaps some other mediums of exchange and stores of value such as silver (SLV), Bitcoin (BTC-USD), and Ethereum (ETH-USD) – would undoubtedly soar in value.

Investor Takeaway

We are truly in challenging times with a future that at times looks so promising thanks to the enormous technological innovation taking off all around us. In fact, we have technology leaders like TSLA and SpaceX CEO Elon Musk making incredibly bullish predictions about the future, saying things like:

[thanks to technology, there is coming] a future of abundance where there is no poverty, where you can have whatever you want, in terms of products and services.

At the same time, we are faced with enormous hurdles to get over before we can reach that bright future:

- sky-high inflation

- an energy and food crisis in many countries around the world

- growing division and political unrest in the United States and parts of Europe

- war in Eastern Europe

- a growing risk of global depression and possibly even World War 3 in the increasingly likely event that China invades Taiwan

What are investors to do in this environment? At High Yield Investor, we abide by the motto:

Always bet on a bright future, but remain guarded against a gloomy one.

As we discussed in this article, one of the best ways to remain guarded against a gloomy future is to invest in gold. Blue chip miners like Newmont Corporation (NEM) and Barrick Gold (GOLD) and even highly liquid ETFs like GLD and IAU certainly have a role to play, but we also believe – for reasons discussed in this article – that physical precious metals are also useful to hold in a portfolio.

Be the first to comment