itchySan/E+ via Getty Images

A Quick Take On The AZEK Company

The AZEK Company (NYSE:AZEK) went public in June 2020, raising approximately $765 million in gross proceeds from an IPO priced at $23.00 per share.

The firm develops and sells products for home and commercial outdoor construction and related areas.

Given continued questions about how much volumes will fall and how quickly management can reverse earnings losses, I’m on Hold for AZEK in the near term.

Overview

Chicago, Illinois-based AZEK was founded to provide homeowners and commercial installers with a wide range of engineered products for outdoor spaces, including decks, rails, trims and accessories.

Management is headed by Chief Executive Officer Mr. Jesse Singh, who has been with the firm since 2016 and was previously an executive at the 3M company and CEO of 3M’s joint venture entity in Japan.

The company’s primary offerings include:

-

Residential outdoor products

-

Commercial outdoor products

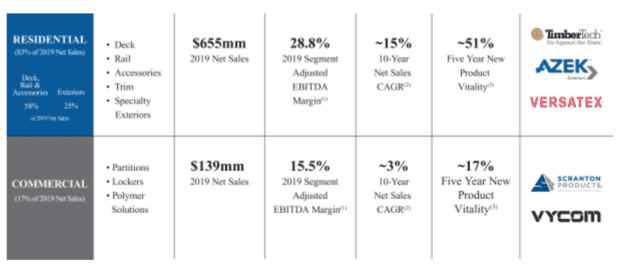

Below is a breakdown of the two business segments by various metrics:

Business Segments (SEC)

For its residential segment, the company distributes its products through more than 4,200 dealers, 35 distributors and multiple home improvement retailers in the U.S. and Canada.

For its commercial segment, it sells through distributors and directly to OEMs (Original Equipment Manufacturers).

Market

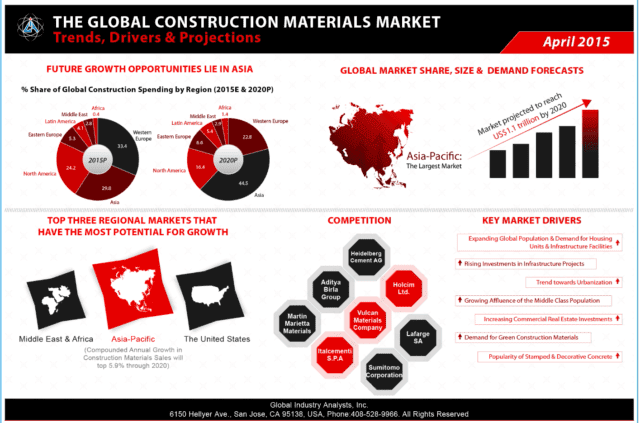

According to a 2015 market research report by Global Industry Analysts, the market for construction materials is expected to exceed $1 trillion by 2020 and grow at a CAGR of 5.9% from 2016 to 2020, as the chart shows below:

Global Construction Materials Market (Global Industry Analysts)

The outdoor materials market is a subset of the total construction materials market.

The upward trend in construction material market growth is expected to be driven by increasing urbanization worldwide, not only in emerging markets but also in developed nations as well.

The Asia Pacific market will likely represent the fastest-growing region during the period, with China remaining the leading construction market.

Recent Financial Performance

-

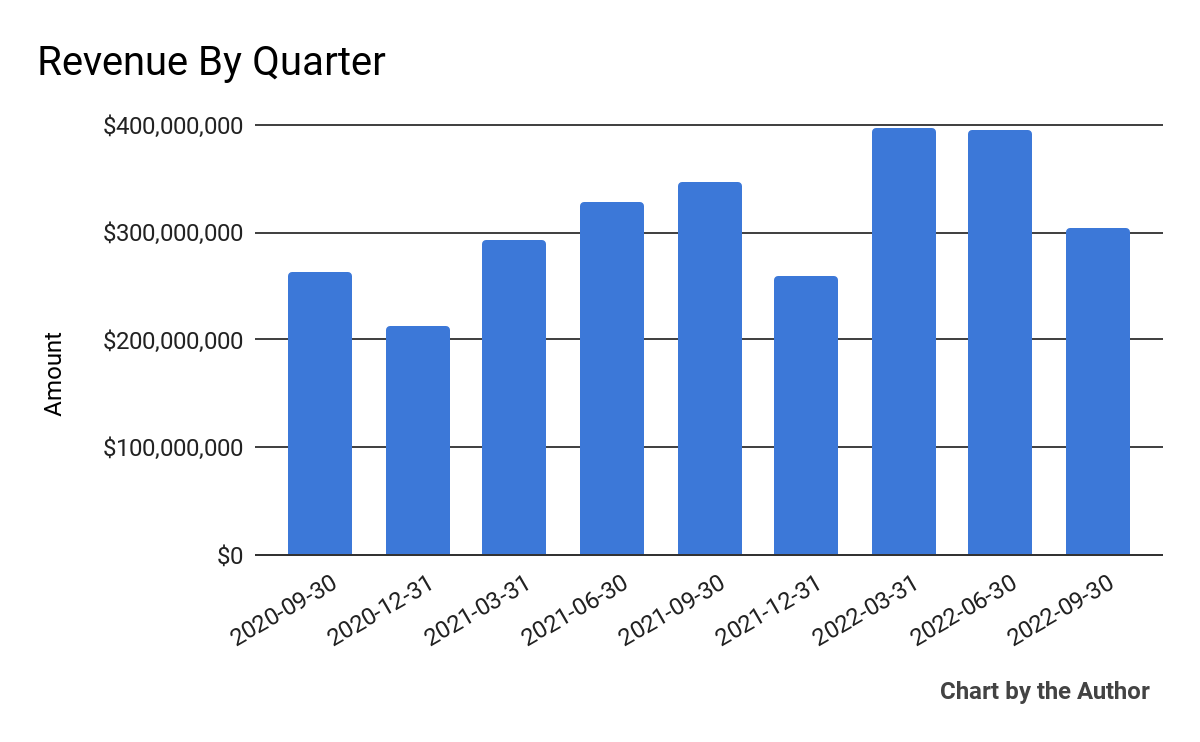

Total revenue by quarter has followed the trajectory shown below:

9 Quarter Total Revenue (Financial Modeling Prep)

-

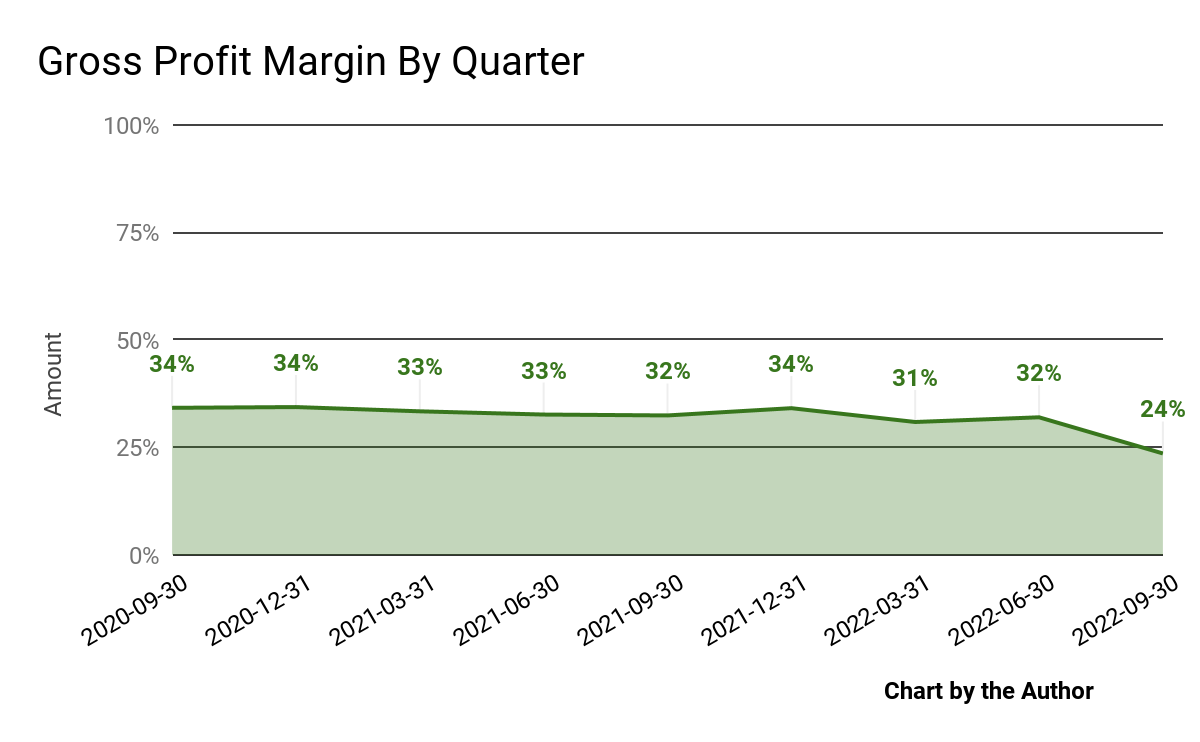

Gross profit margin by quarter has dropped sharply in the most recent reporting period:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

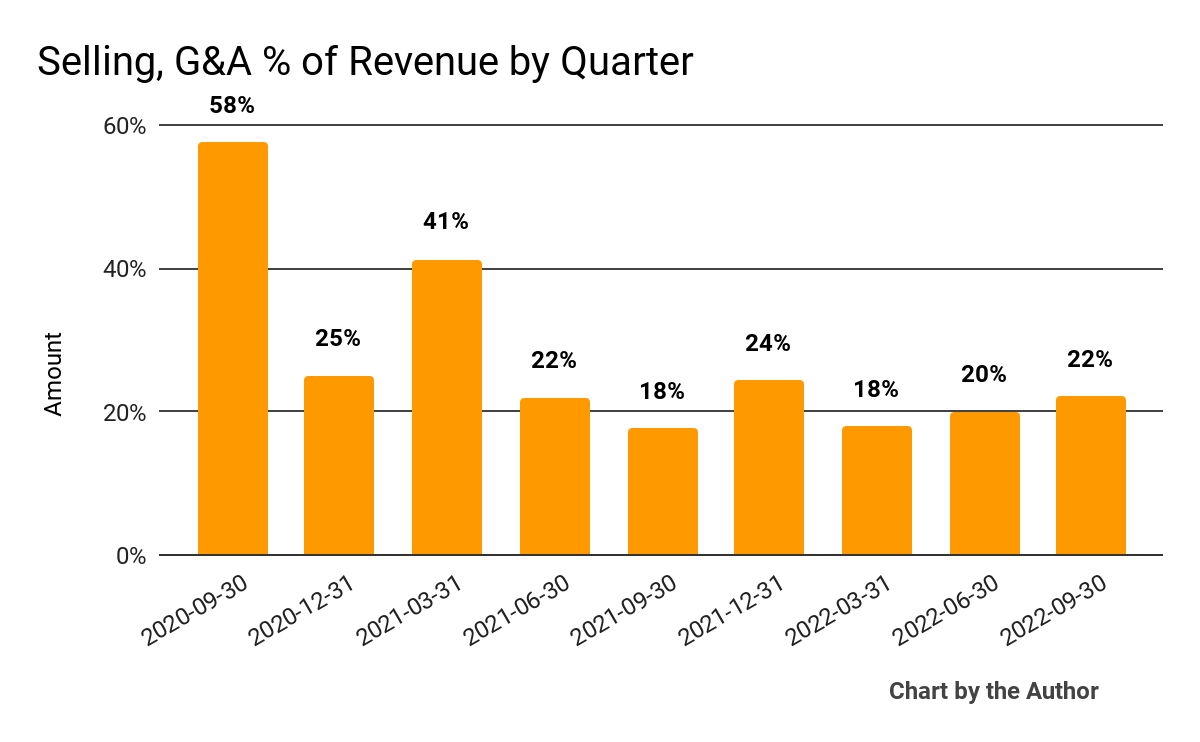

Selling, G&A expenses as a percentage of total revenue by quarter have risen in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

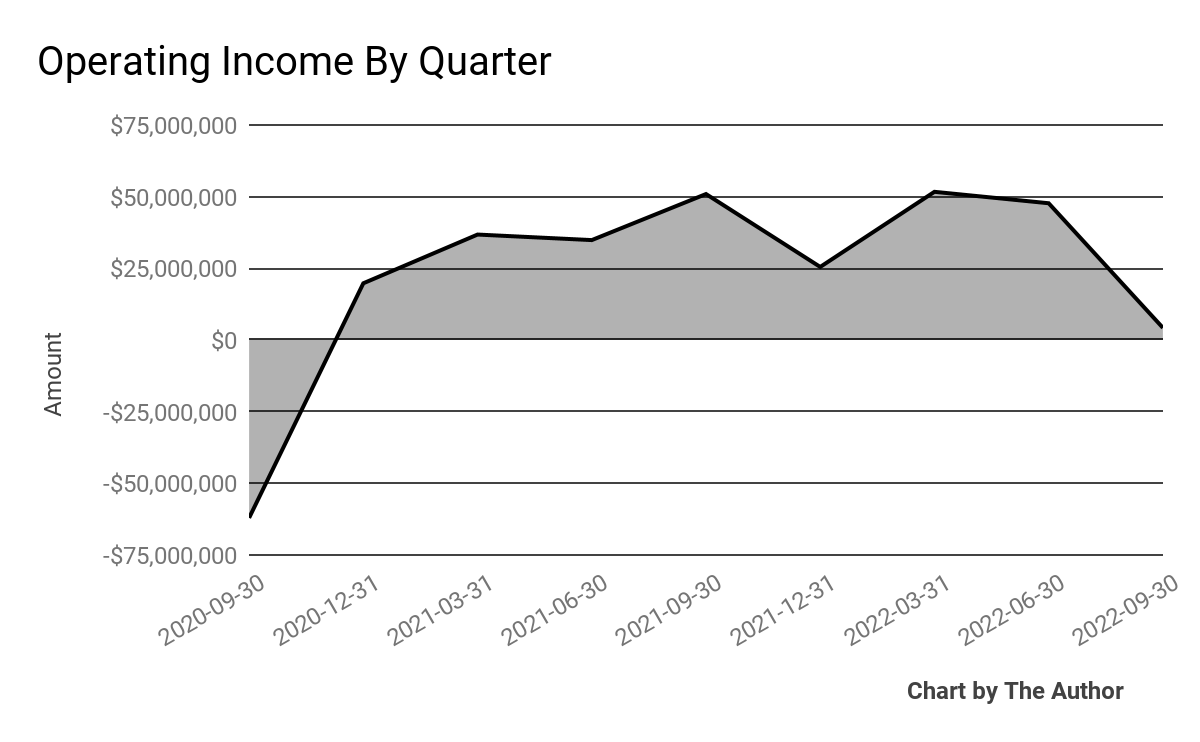

Operating income by quarter has turned sharply downward in the most recent quarter:

9 Quarter Operating Income (Financial Modeling Prep)

-

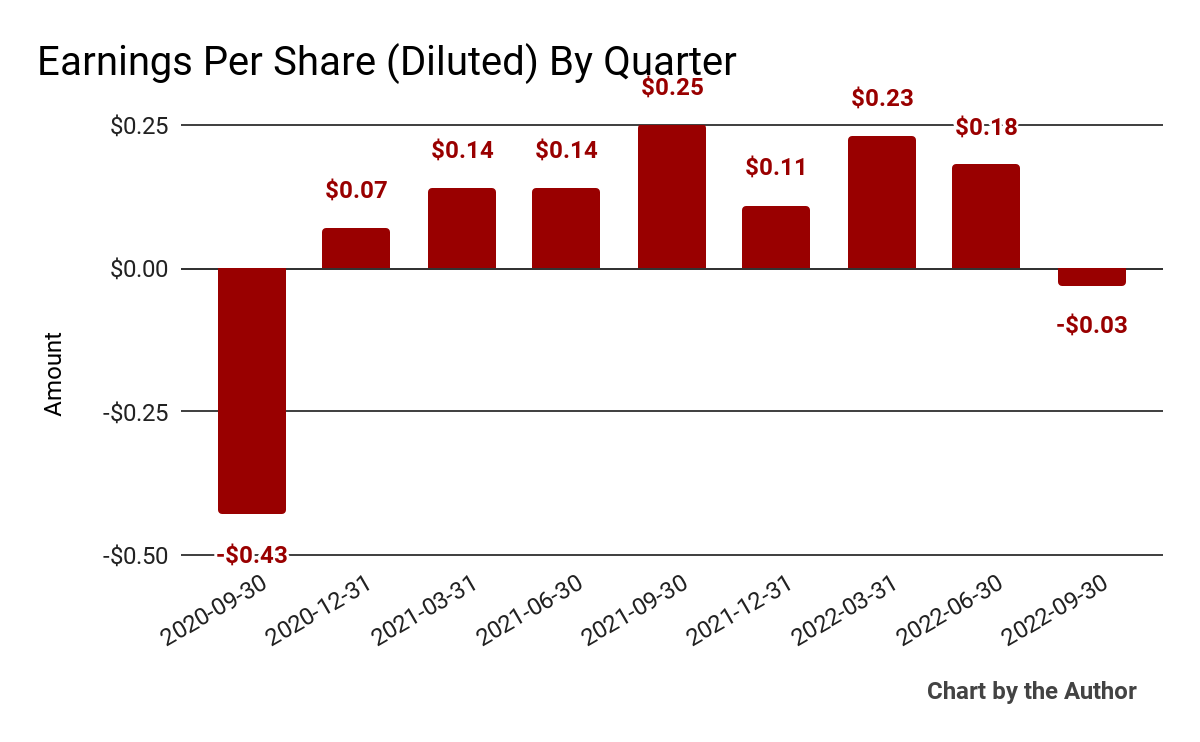

Earnings per share (Diluted) have moved into negative territory in Q3 2022:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

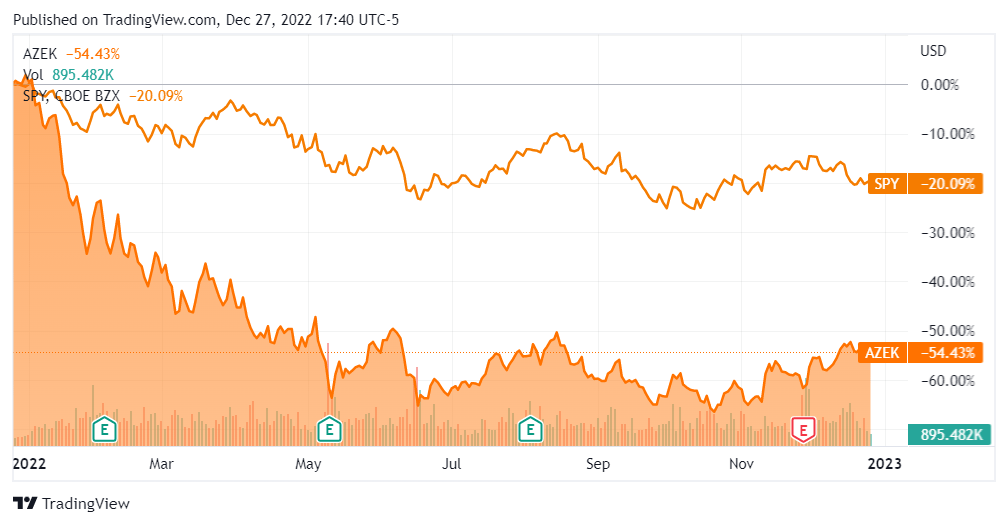

In the past 12 months, AZEK’s stock price has fallen 54.4% vs. the U.S. S&P 500 index’s drop of around 20.1%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.7 |

|

Enterprise Value / EBITDA |

15.0 |

|

Revenue Growth Rate |

15.0% |

|

Net Income Margin |

5.5% |

|

GAAP EBITDA % |

17.8% |

|

Market Capitalization |

$3,125,038,124 |

|

Enterprise Value |

$3,611,341,476 |

|

Operating Cash Flow |

$105,835,000 |

|

Earnings Per Share (Fully Diluted) |

$0.49 |

(Source – Financial Modeling Prep)

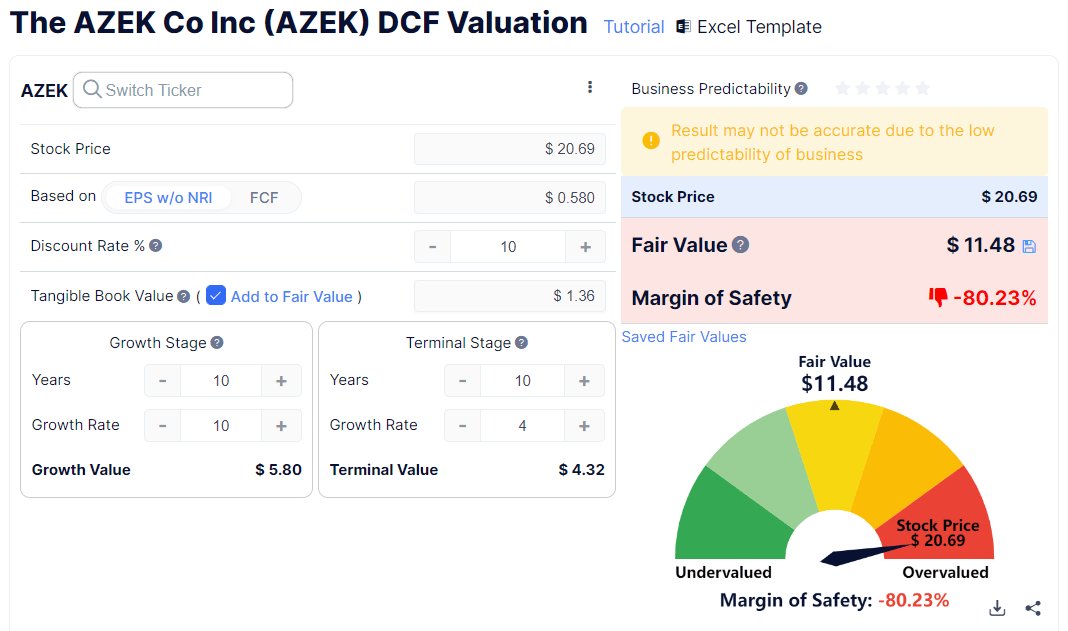

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow Calculation (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $11.48 versus the current price of $20.69, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On The AZEK Company

In its last earnings call (Source – Seeking Alpha), covering FQ4 2022’s results, management highlighted the increasing economic uncertainty from contractors and labor shortage concerns.

Leadership has also ‘taken steps over the last two quarters to bring down overall SG&A expenses.’

As to its financial results, total revenue dropped 12% year-over-year and adjusted EBITDA decreased by 20%, in line with previous guidance.

Gross profit margin dropped markedly, as did operating income, resulting in negative earnings for the quarter.

For the balance sheet, the company finished the quarter with $120.8 million in cash and equivalents and $590.9 million in total debt.

Over the trailing twelve months, free cash used was $65.1 million, of which capital expenditures accounted for $170.9 million in cash used.

Looking ahead, management is expecting a 10% volume drop due to large declines in new construction activity, along with significantly lower capital expenditures given the worsening macroeconomic environment.

Regarding valuation, my discounted cash flow calculation suggests the stock may still be overvalued despite a significant drop in price over the past 12 months.

The primary risk to the company’s outlook is the expected continued drop in housing sector activity, partially as a result of the rise in interest rates causing reduced buying activity.

A potential upside catalyst to the stock could include a ‘short and shallow’ economic downturn in 2023.

Given continued questions about how much volumes will fall and how quickly management can reverse earnings losses, I’m Hold for AZEK in the near term.

Be the first to comment