itchySan

The greater the artist, the greater the doubt. Perfect confidence is granted to the less talented as a consolation prize.” – Robert Hughes

Today, we put The AZEK Company Inc. (NYSE:AZEK) in the spotlight for the first time. The firm has a somewhat unique approach in its industry and the stock has seen some insider buying as well. An analysis follows below.

Company Overview:

The AZEK Company is based out of Chicago. The firm manufactures and sells building products for residential, commercial, and industrial markets in the United States. Its residential division offers outdoor living products, which includes decking, railing, trim and molding, and accessories under the TimberTech, AZEK Exteriors, VERSATEX, and ULTRALOX brand names. The commercial division manufactures engineered polymer materials that are used in various industries. This division also offers bathroom partitions, shower and dressing stalls, lockers, and other storage solutions under brand names such as TuffTec and Duralife.

May Company Presentation

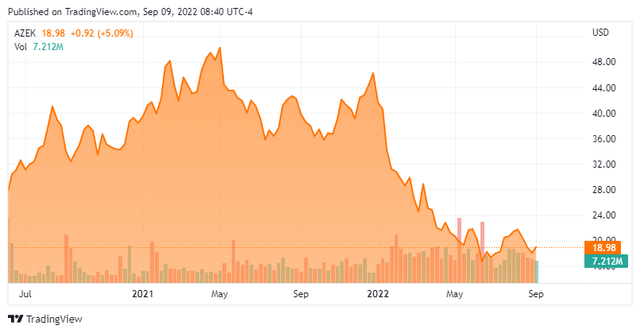

The stock trades around $19.00 a share and sports an approximate market capitalization of $2.9 billion.

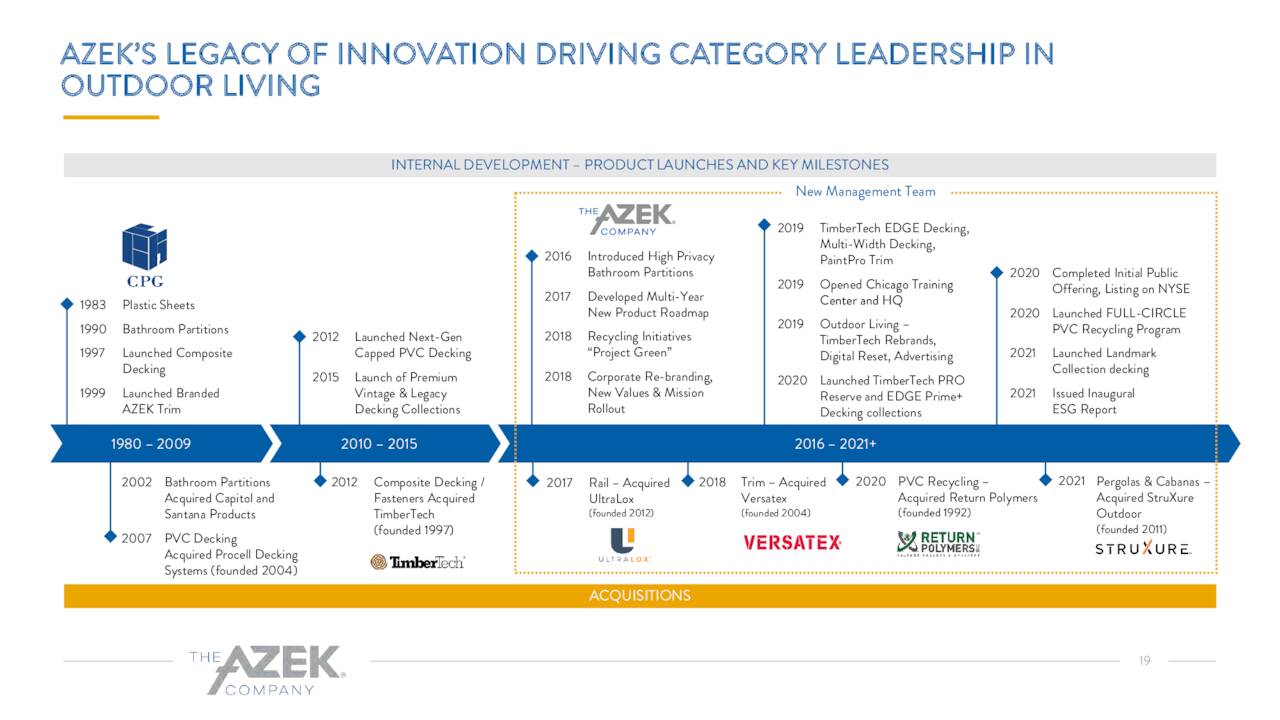

May Company Presentation

The company has grown both by the launch of new products as well as a series of ‘bolt on’ acquisitions in recent years as can be seen above. The company specializes in low-maintenance and environmentally sustainable outdoor living products. The company is committed to increasing their use of recycled materials.

Second Quarter Results:

On August 4th, the company posted second quarter numbers. The AZEK Company has non-GAAP earnings of 29 cents a share, three pennies above the consensus. Revenue grew over 20% on a year-over-year basis to $395 million, besting expectations by some $9 million. Adjusted EBITDA increased 19% over the same period a year ago to $86.5 million. Net margin rose to 7.0% from 6.6% in 2Q2021. Net cash provided from operating activities came in at $133.2 million during the quarter versus net cash provided in operating activities of $112 million during the prior year period.

Management provided guidance for consolidated net sales between $1.327 to $1.353 billion, which was inclusive of a recalibration of channel inventory as well as full year Adjusted EBITDA of $295 million to $307 million. Leadership also announced the small acquisition of INTEX Millwork Solutions, LLC, which is a provider of high-quality railing solutions, column wraps, and pergolas. That company utilizes alternative materials like PVC boards and aluminum to manufacture its products.

AZEK’s Management also noted on its earnings press release that it was seeing some “demand moderation” and is working with their “dealer and distributor partners to reduce their inventory levels primarily in fiscal Q4 2022 and into fiscal Q1 2023.” The company is now estimating a $90 million-plus inventory recalibration headwind in the fourth quarter. Management also expects FY2022 capital expenditures to come in towards the lower end of their previous guidance of $180 million to $200 million.

Analyst Commentary & Balance Sheet:

Since second quarter results hit, a dozen analyst firms including JPMorgan and RBC Capital have maintained or assigned Buy ratings on AZEK. Several of these had slight downward price target revisions. Price targets proffered range from $22 to $29 a share. Wedbush seems the lone pessimist on the company’s prospects with a Hold rating and $21 price target on the equity.

Less than five percent of the outstanding float is currently held short. Insiders are accumulated shares in the stock so far in 2022. Two directors have bought just over $550,000 in equity in aggregate over the past two weeks. Several other insiders have purchased just over $2 million of stock in total so far in 2022. There have been no insider sales of AZEK so far this year.

As of the end of the first half of this year, The AZEK Company had cash and cash equivalents of $159.6 million and approximately $147.2 million available for future borrowings under a Revolving Credit Facility after posting net income of $27.5 million for the quarter. This is against just under $665 million in gross debt. Management bought back $58 million worth of stock in the second quarter.

Verdict:

The current analyst firm consensus has the company delivering 98 cents a share of EPS in FY2022 as revenues rise 14% for the year. Growth is projected to slow to the mid-single digits in FY2023 as EPS rises slightly to $1.03.

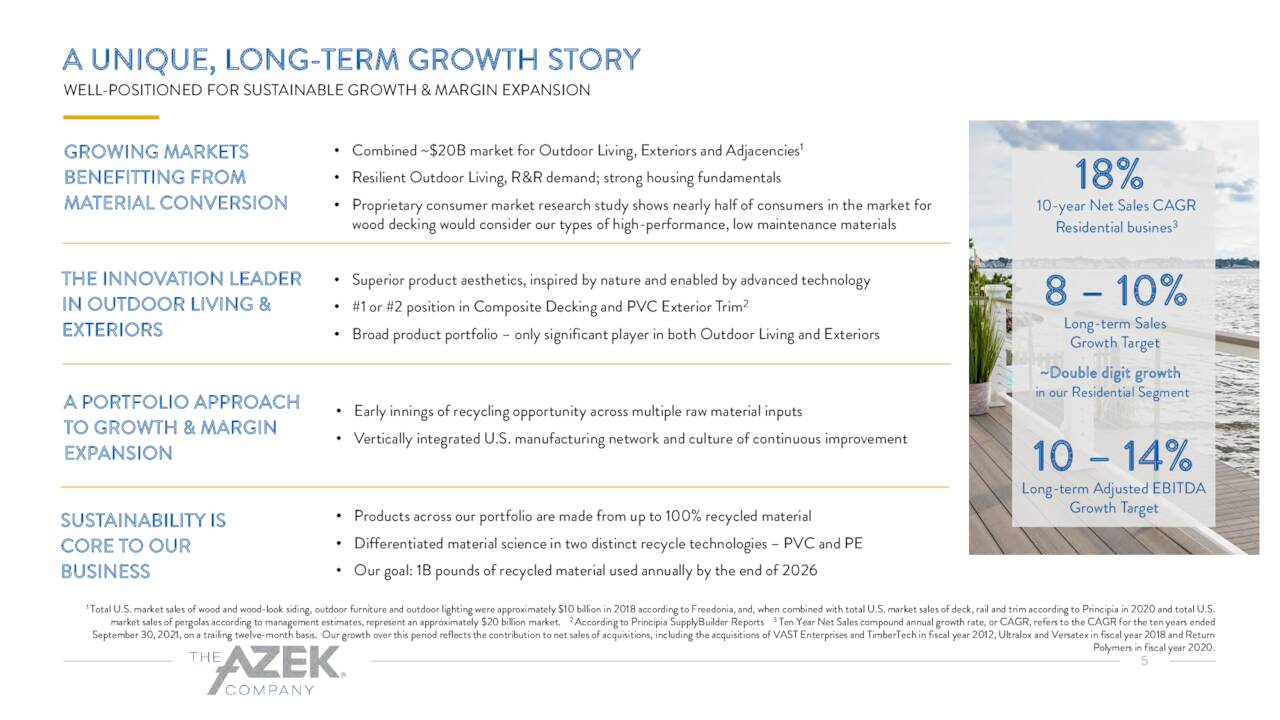

May Company Presentation

The company has done a commendable job of growing through innovation and strategic acquisitions over the past decade. It is also a nice vote of confidence to see consistent insider buying in the shares However, with higher mortgage rates reducing housing activity significantly and the consumer struggling, that growth is going to slow substantially through the rest of 2022 and into 2023 at the very least. Paying 19 times this year’s earnings when many home builders are selling for less than five times profits, and other building suppliers like Beacon Roofing Supply, Inc. (BECN) are selling at roughly eight times earnings, seems excessive. Therefore, we are passing on any investment recommendation on The AZEK Company at this time.

Love without sacrifice is like theft“― Nassim Nicholas Taleb

Be the first to comment