whitebalance.oatt/iStock via Getty Images

Generating cash during bear markets

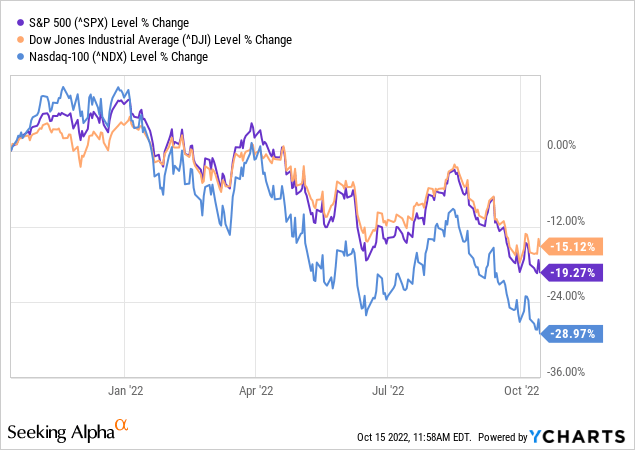

All of the major indices have dropped into bear territory this year. In fact, we are well into the tenth month of declines, as shown below.

In a way, this is good news. The average bear market for the S&P 500 lasts for 289, or about 9.5 months, according to Forbes. The market will likely bottom out well before the economy does because it is forward-looking. When will this happen? I don’t know, and I don’t try to time the market.

Aside from a few standouts, such as top pick AbbVie (ABBV), which you can read more about here, many stocks are down considerably this year.

But there are still ways to make money while waiting for the tide to turn.

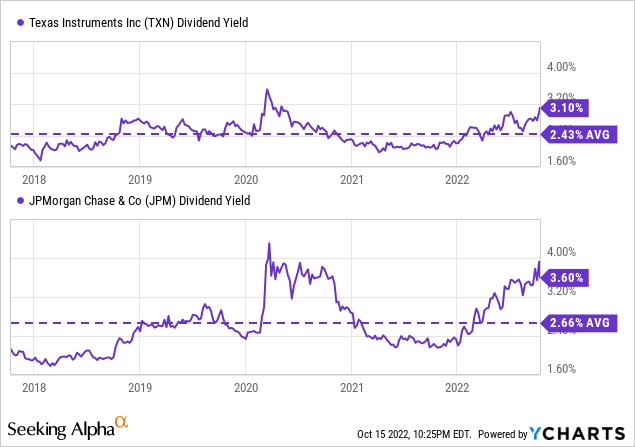

First, solid companies are now offering higher-than-normal dividend yields. I don’t mean dangerously leveraged funds offering 9-10%; that’s not my bag. There is a big difference between solid companies with safe, rising payouts and chasing yields that seem too good to be true (they probably are). These get hyped a lot, so be careful out there.

Many terrific companies that should weather a recession just fine have historically high yields. Two favorites are Texas Instruments (TXN), and JPMorgan Chase (JPM), as shown below.

Texas Instruments has raised the dividend each year since 2004, even during the Great Recession, at a compound annual growth rate (CAGR) of 25%. JP Morgan has grown the dividend for eight years and sees buybacks resuming next year.

Now, without further ado…let’s get creative.

Covered call options

Another way to generate cash is by selling covered call options. Bear markets are terrific times to generate cash this way for several reasons, including:

- Volatility

- Downward trend in prices

- Opportunity to reinvest at a discount for long-term returns.

I won’t go into all the nuts and bolts of covered call options, but there are terrific resources available for beginners, including the link above from Investopedia and this one from Fidelity.

A covered call is the least risky option play. If you sell an out-of-the-money covered call, the worst that can happen is that you miss out on additional gains.

Volatility is helpful to this strategy because it allows us to sell a covered call when the stock has a big up day, and buy it back cheaper when the stock retreats.

The general downtrend lowers the risk that the price will suddenly rise well above the strike price. Especially if we sell significantly out of the money.

Doing this in a down market allows long-term investors to reinvest the premiums in stocks that are on sale.

2022 has been an ideal time for selling covered call options. And Amazon (NASDAQ:AMZN) has been an ideal stock.

Who says stock splits don’t matter?

There are many who will say that stock splits don’t matter. After all, they don’t change the underlying value of the stock. But they do open up opportunities that average investors usually would not have.

Amazon stock traded for around $2,500 per share prior to its 20:1 stock split in early June 2022. This means that an investor would need to have $250,000 of Amazon stock in order to sell one option since options are sold in lots of 100. The split suddenly opened up the options market for many average investors.

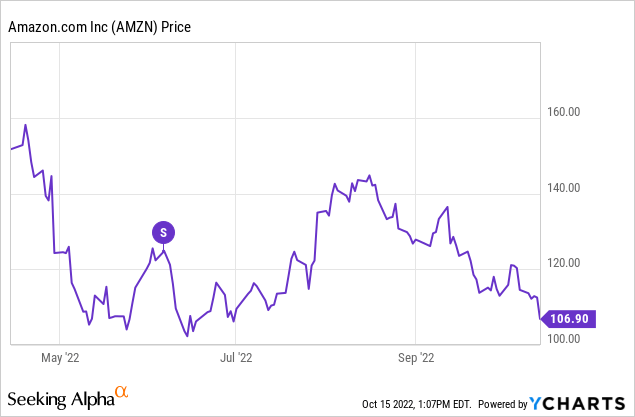

Amazon has traits that make it an attractive candidate for selling covered calls. Its popularity is a huge draw. There is a ton of volume for Amazon stock options, which is very important. It also means that the stock has the necessary ups and downs to book profits. There are numerous spikes and retreats since the stock split, as shown below.

My preferred strategy

There are several ways to execute an option strategy. I prefer a conservative strategy since Amazon is a stock that I would like to hold as a long-term investment.

The conservative strategy means:

- Selling the options well out of the money, even though this means pocketing a smaller premium.

- Keeping the option expiration date 30-60 days out. This also means a smaller premium, but much less risk.

- Not having open option positions straddling earnings releases when the stock could potentially pop significantly to the upside.

Here are two examples

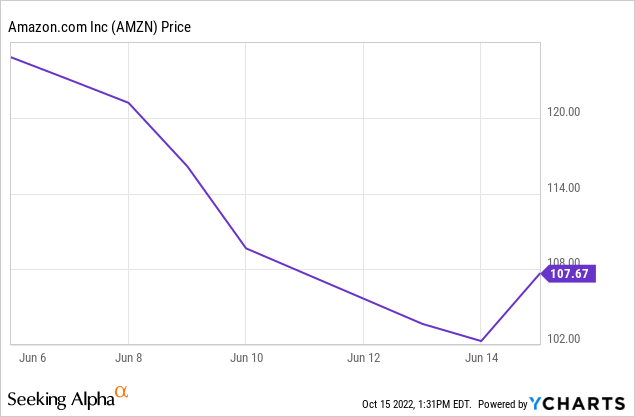

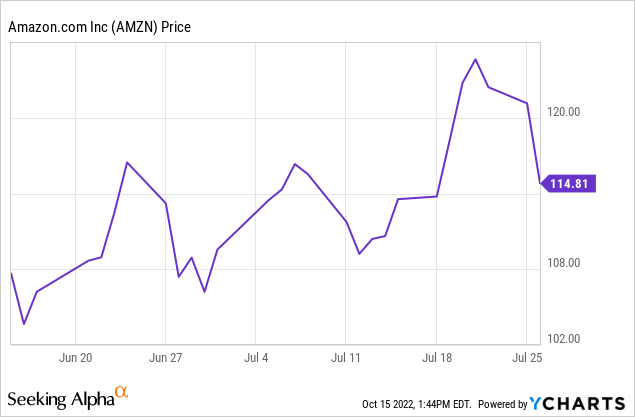

Amazon’s stock price dropped like a rock after the stock split, falling nearly 18% in just over a week. It then bounced up more than 5% on June 15th, as shown below.

Trade example #1:

I used this opportunity to sell July 29 $135 calls for $0.74. The $74 premium isn’t much, but the chances of the stock getting called away were very small. The stock would need to gain more than 25% in a month and a half to get to the strike price. Unlikely in a bear market.

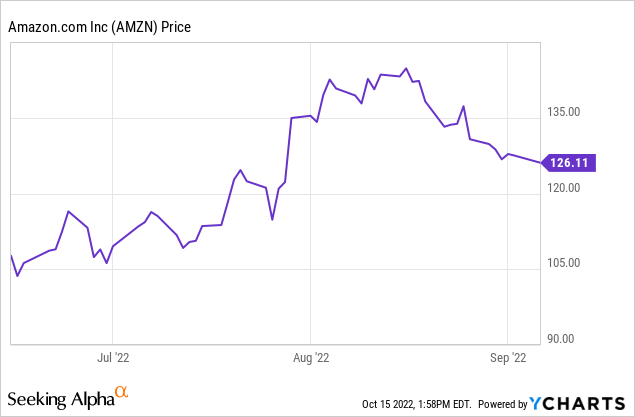

The stock made an impressive effort at a comeback, but I was able to close the covered call position for $0.17 when the stock cratered on July 26th, as shown below.

The net profit on each call option was $57 for an annualized return of over 4%. Low risk, low reward.

Trade example #2:

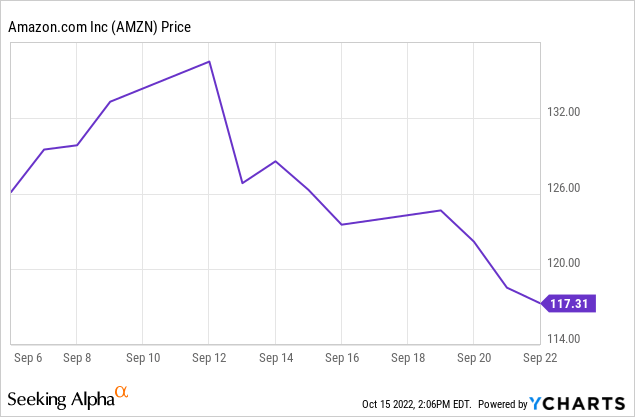

The market made a valiant effort at a comeback after the lows of June and July, but the comeback ultimately fizzled in late August. With the writing on the wall, I sold October 21 $147.50 and $147.00 calls for $1.05 and $1.15, respectively. The chart leading up to the trade is shown below.

I bought back each option just two weeks later, on September 22, for $0.15 and $0.16 as the stock swooned. I could have held the options to maturity, but I like to lock in gains when they are above 80%.

The spoils of the trade were $90 and $99 for a total return of $189. The annualized return is impressive because of the short duration, but this is another low-risk, low-reward way to generate a yield from a growth stock.

With earnings due out on October 27, I am taking a wait-and-see approach. A solid earnings report could mean a sudden pop in the stock price because so much negativity is priced in already.

Understand the risks

Covered call options are low-risk, but they aren’t risk-free. The risk is that the stock rises significantly above the strike price, and we miss out on juicy gains. If the price is above the strike price on the exercise date, we will have to give up our shares or buy back the call at a loss. We can mitigate the risk by taking smaller premiums for options that are further out of the money.

The wrap-up

This is a tough time for many investors. But it also offers significant opportunities. It’s much easier for long-term investors to find fantastic deals when the market is down. Higher dividend yields are easier to find, and it’s a great time to reevaluate positions.

Executing a conservative covered call strategy can also generate income. Selling covered calls is a low-risk way to generate a yield from growth stocks and make small returns in a persistent down market. As discussed above, Amazon is an excellent stock for this approach.

Be the first to comment