Alexey_M/iStock via Getty Images

With the pandemic bottom of mind, it’s time to check in on the Alphavaxers. Dynavax (NASDAQ:DVAX) and Novavax (NASDAQ:NVAX) were two pandemic darlings. In this article I report how they are faring in this new normal as reflected by their Q3, 2022 earnings reports. Both are reliant on future pandemic related revenues, with Dynavax insulated to some extent by its HEPLISAV-B.

Dynavax and Novavax Q3 earnings are all about performance.

Dynavax

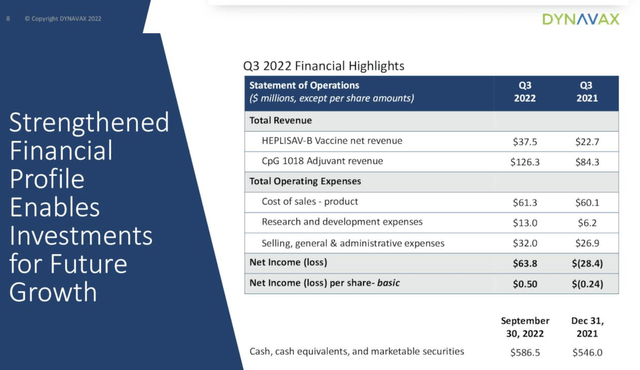

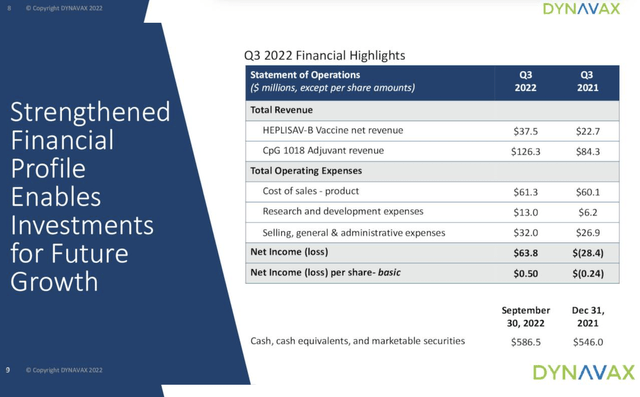

As I have come to expect Dynavax Q3 earnings as reported in its 11/03/2022 Q3, 2022 earnings call (“Call D“) and presentation (“Presentation D“) exceeded market expectations. Its earnings reflected a $0.10 beat of expectations with its revenues beating by $8.33 million.

Dynavax revenues are made up of two components:

- HEPLISAV-B vaccine net product revenue of $37.5 million, up 65% from $22.7 million for Q3 2021; and

- CpG 1018 adjuvant net product revenue of $126.3 million, up 50% from $84.3 million for Q3 2021.

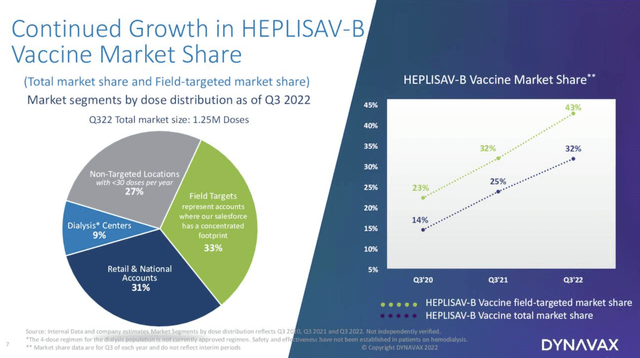

For HEPLISAV-B it was a record quarterly performance. Presentation D slide 6 breaks down the component shares of its market:

This slide shows that HEPLISAV-B has a broad footprint in diverse markets. Dynavax’s CpG1018 adjuvant is currently the larger revenue generator by a healthy margin. Both products have room for healthy future growth although their forward arcs may differ significantly as will be discussed.

Dynavax’s Q3 2022 Financial highlight slide from Presentation D shows how it has swung from a Q3 2021 loss to solid earnings for its current quarter:

Novavax

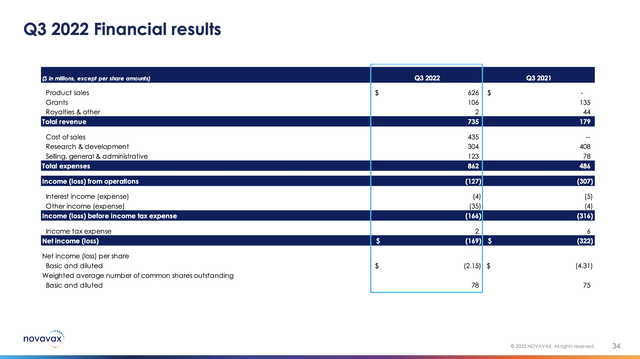

As I have come to expect Novavax Q3 earnings as reported in its 11/08/2022 Q3, 2022 earnings call (“Call N“) and presentation (“Presentation N“) disappointed market expectations. Its Q3 GAAP EPS of -$2.15 missed by $3.79 while its revenue of $734.58 million beat by $179.08 million.

Novavax reported in its Q3, 2022 earnings press release that its revenues were made up of:

…$628 million of revenue comprised of $626 million of product sales from NVX-CoV2373 based on the sale of 35 million doses sold by Novavax and $2 million of royalties, milestone and adjuvant sales to our license partners. Grant revenue of $106 million in the third quarter of 2022 compared to $135 million in the prior year resulted from a decrease in activity under our agreements with the Coalition for Epidemic Preparedness Innovations.

Its cost of sales for Q3, 2022 is likely not representative of its run rate cost of sales insofar as they were impacted by various adjustments. Its financial highlights slide from Q3, 2021 compared to the current quarter shows how it continues to generate losses despite its significant revenues:

Such losses have been building up or a long time. Novavax founded in 1987 reports an accumulated deficit of ~$4.1 billion in its latest 10-Q (p. 3).

Both of the Alphavaxers will be feeling the pain as the pandemic winds down.

Dynavax

Dynavax has a nice underlying revenue source in its HEPLISAV-B vaccine. During the Call D, Dynavax pegs the Hepatitis B market potential at $800 million by 2027. It expects to eventually garner better than 50% share of this market. This seems to be a realistic goal given the following as noted by SVP Casale during the Call D:

Heplisav-B is a first and only FDA approved adult Hepatitis B vaccine that allows series completion with only two doses in one month. Series completion is essential for high levels of protection. In an era of universal Hepatitis B recommendation, two dose Heplisav-B can make series completion easier and protect more patients faster.

Accordingly, even though CpG1018 adjuvant sales are likely to shrink dramatically as the pandemic tails off, Dynavax will still have prospects for ongoing earnings. In any case as regards CpG1018 during the Call D, CFO MacDonald advised that Dynavax already had write downs and adjustments totaling ~$38 million. In terms of the future she advised:

As we look ahead to 2023, we believe our customers will likely have sufficient adjuvant stockpile as of the end of 2022 to service their initial commercial agreements, translating to substantially lower adjuvant sales expected in 2023.

Despite these anticipated headwinds, Dynavax reiterated its 2022 guidance. It still expects aggregate CpG 1018 adjuvant revenue to range from $550-600 million with ~60% gross margin. This is a slight bump from its 2022 guidance as given in Q4, 2021 for CpG 1018 revenue of at least $550 million with a ~50% gross margin.

Novavax

Currently the pandemic is everything to Novavax; it has no unrelated backup product revenues outside of COVID-19. This puts considerable strain on Novavax with the pandemic’s future course so unsure. Indeed as has been the case with Dynavax, Novavax has to fight to hold onto its existing APA’s.

Novavax’s Q3, 2022 10-Q sets out the scope of this issue as aggregating ~$4 billion in un-, or partially, satisfied performance obligations. Under the heading, “Liquidity Matters and Capital Resources” at pps. 33-34 it describes renegotiations with:

- Gavi,

- the UK,

- the EC and

- OWS

In each case Novavax’s customers are angling to reduce and/or delay their commitments. Gavi and the UK are seeking to recover partial repayments of APA advances. During the Call N, Novavax CFO Kelly responded to a question asking for a near term liquidity assessment. The question cited potential liabilities to CEPI, Gavi, the UK and Novavax’s outstanding convertible loan.

Kelly addressed Gavi head-on; he was adamant that it had no right to a return of any of the $700 million it had paid to Novavax. As for the convertible loan, $325 due in 02/2023, he is comfortable that with Novavax’s $1.3 billion in liquid assets that it can retire or convert it as the situation dictates.

He did not discuss the UK or CEPI. Novavax’s 10-Q (p. 9) addresses CEPI, indicating the:

… timing of any loan repayments is currently uncertain given the [uncertainty in the] timing and quantities of future orders under the Company’s APA with Gavi…

The UK situation is addressed at several locations in the 10-Q. A minimum of $40 million will be required to be repaid. An additional $185 million repayment hinges upon a timely supportive recommendation from an independent UK advisory committee.

It is time for the Alphavaxers to move on and to develop new revenue sources.

Alphavaxers

As the pandemic winds down the easy COVID-19 money is being swept off the table. Today (11/17/2022) we are in an environment where COVID vaccine customers are looking for clawbacks of perceived excesses. This presents fundamental challenges for both of the Alphavaxers.

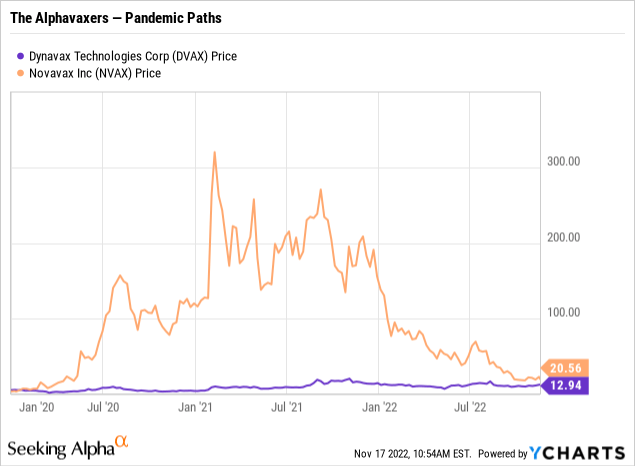

Taking a quick look at their comparative price action from the pandemic’s birth in early 2020 until today shows how each is struggling in this environment.

It is hard to see from the chart, but both of the Alphavaxers were trading at ~$5.00 in the beginning of 2020. Accordingly, each is a pandemic multibagger, with Novavax at ~4X and Dynavax having >2X. Of course Novavax was coming off of a 1 for 20 reverse split in 05/2019, so its share price has been something of a bouncing ball.

The future of the pandemic is highly uncertain. However, at this stage from an investment standpoint it is important to realize and plan for a future in which the demand for COVID vaccinations drops dramatically. The discussion below will look at each of the Alphavaxers potential outside of COVID-19.

Dynavax

As previously discussed Dynavax already has a hedge against declines in CpG1018 which may arise as the pandemic tales off. However it will need additional revenues to balance the likely CpG1018 adjuvant COVID-19 related reductions.

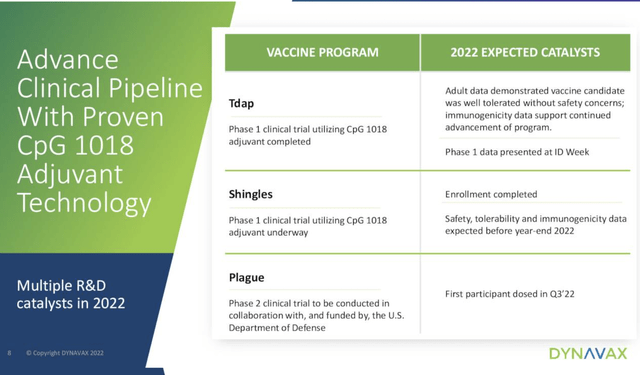

When it comes to a pipeline Dynavax doesn’t even bother with a conventional pipeline on its website. The Presentation D includes the following:

There may be some marvelous opportunities in one or more of these, however there is nothing that looks remotely likely to provide revenue contributions in the next several years.

Looking carefully through the Call and the Presentation I see nothing that points to a hot catalyst to support Dynavax’s growth going forward into Q4, 2022 and beyond. The good news is that it has built nice liquidity and runs a trim operation as shown by its Presentation financial highlights slide below:

Unfortunately it has announced no initiative, outside of its HEPLISAV-B and its pipeline in development, that will bolster its revenues if, and as, its pandemic adjuvant revenues drop off.

Novavax

At the moment from a revenue standpoint Novavax has pandemic revenues as its mainstay. These come in the form of product revenues, grant revenues and royalties as shown by its Q3, 2022 10-Q (p. 2). For its latest quarter these are all COVID-19 related.

For its near term Novavax has hitched its star to its COVID vaccination and its expanded label in that indication. Its key commercial strategy slide below and the balance of its Presentation slides are clearly focused, in the near term, on advancing Novavax’s COVID vaccination footprint:

Novavax has not given up on its NUVAXOVID vaccine by a long shot. Its Presentation slides listed below describe the bountiful remaining opportunity that it sees:

- Slide 28 — Significant progress globally expanding label for adults, boosting and adolescents;

- Slide 29 — Long-term global market opportunity expected for COVID-19, Annual need for revaccination creating recurring opportunity in 2023+;

- Slide 30 — Novavax’ COVID-19 vaccine, offering vaccine choice and portfolio approach.

The one area in which Novavax is hedging its short term bets is found at slide 37 listing its key strategic priorities for Q4 2022. The final listed priority is its initiation of its COVID-19-Influenza Combination vaccine Phase 2 trial by end of 2022 to enable Phase 3 efficacy trial in 2023.

As I have lamented elsewhere Novavax has deprioritized its stand alone NanoFlu, which was on the cusp of a BLA filing, in favor of its combination product which will likely be delayed until a filing in 2024 or beyond.

Conclusion

I am a long time Dynavax investor and an on and off again Novavax investor. Most recently, I purchased a ridiculously small number of Novavax shares and sold half of my small stake in Dynavax. I am optimistic about the pandemic staying in the background and pessimistic about the Alphavaxers’ pandemic franchises.

I am looking forward to watching the quarterly progress of the Alphavaxers. My hope is that Dynavax is able to continue as a profitable company and that Novavax can become one. As for my expectations, I give Dynavax the edge in terms of likelihood of staying profitable compared to Novavax reaching profitability.

The world is just starting to peek out from the pandemic’s long shadow which now lurks over the Alphavaxers.

Be the first to comment