FreshSplash/E+ via Getty Images

This article was published on Dividend Kings on Monday, December 19th.

—————————————————————————————

Christmas and the general holiday season are a time for friends and family to get together and celebrate the end of the year and all the wonderful things they are thankful for in their lives.

For my family, each holiday season is more special than the last because of my grandparent’s failing health. Every season could be our last as a family, and thus I’ve spent a lot of time thinking about what really matters in life. I call these seven Fs.

- Family

- Friends

- Faith (including life philosophy)

- Fitness (health)

- Food (essentials to life)

- Finance (enough money to live comfortably and securely)

- Fido (pets in general)

If these are the most important things in life, which provide all true, long-lasting happiness and joy, then these also dictate the best gifts you can possibly give this holiday season.

So let me share with you the six best gifts I think you can give this Christmas to maximize your long-term happiness with those you care most about.

Best Gift Idea #1: Love

Humans are social creatures, and ultimately our relationships with friends and families are the core of what gives our lives meaning. The love we share is what gives us strength. It’s what helps us get through times of tribulation and makes times of triumph extra sweet.

Note that loving someone doesn’t have to mean you like them. We all have relatives we love but who drive us crazy, and not just around the holidays. But when the chips are down, family is there for us because those are the ties that bind us together on this small blue dot of a planet in a wondrous but vast cosmos that otherwise doesn’t care about us.

Best Gift Idea #2: Cash (Time Itself)

Money is one of the three greatest things that humans have ever invented.

Why is money so wonderful? Because it represents the accumulated effort and labor of all of us.

Think of it like this. What is the only thing that everyone, from the poorest to the richest, has a limited amount of? Time. What is the most valuable thing of all? The love of family and friends. What do you need to enjoy that to its fullest? Time.

And while you can’t create more time, you can buy it with enough money.

Years ago, my family would spend all day in October or November raking leaves and getting the lawn ready for winter. Sometimes it took an entire weekend.

But now, for $250, I can buy us an entire weekend’s worth of time. This year we took my Grandmother to the lake for what might be her last ever lake holiday.

- She is recovering from brain surgery after removing a 5-centimeter tumor

That $250 represents a few hours of labor on my part but was able to buy two days of priceless time with those I love and care most about in this world.

Why do I consider cash to be one of the greatest material gifts you could ever give? Because money offers almost God-like powers to bend time and space (the universe itself) to your will.

Whether it’s paying a CPA to do your taxes for you or having your home and lawn cleaned and maintained for you, cash is how you can have other people do the work you hate so you have more time to do what you love with those you love.

All my gifts to family and friends are in the form of cash or cash equivalents.

- checks

- Amazon gift cards

- Mastercard gift cards

But isn’t it better to buy family and friends things that show you care? In theory, yes; in reality, no.

Last Christmas, my uncle, tried to show his love by buying me some books from Barnes and Noble and a gift-card from Barnes and Noble.

It was a very thoughtful gift. In college, I spent every weekend at Barnes and Noble reading. But today, I only have time to listen to audiobooks, and I had to drive to Barnes and Noble to return the books (which I had already read). And it turned out that the gift card couldn’t be returned for cash.

So I ended up giving it to my sister, who lives next to a Barnes and Noble and enjoys their coffee.

By giving cash you let your loved ones buy whatever they need most, including time, the most valuable commodity of all.

Best Gift Idea #3: High-Yield Dividend Stocks (SCHD)

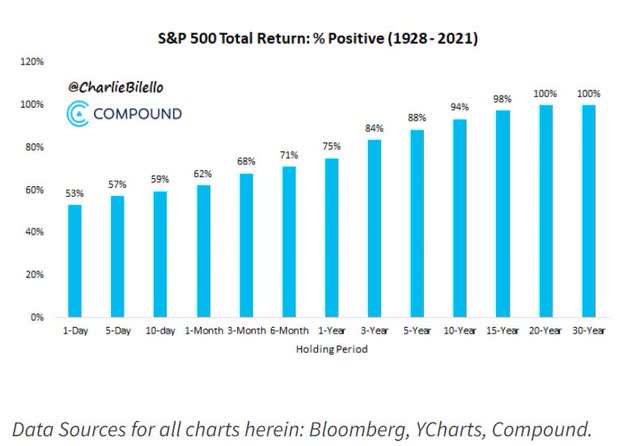

The best-performing asset in history are US blue-chip stocks. Their returns are truly mind-boggling, and can provide far more cash to loved ones than you could ever give.

US stocks have delivered 10% annual returns (7% after inflation) for the:

- Last 222 years = 3.33 million inflation-adjusted returns

- Last 100 years

- Last 50 years

- Last 20 years

In the future, analysts expect the S&P to deliver 1.7% yield + 8.5% earnings growth or 10.2% annual returns, basically their historical norm.

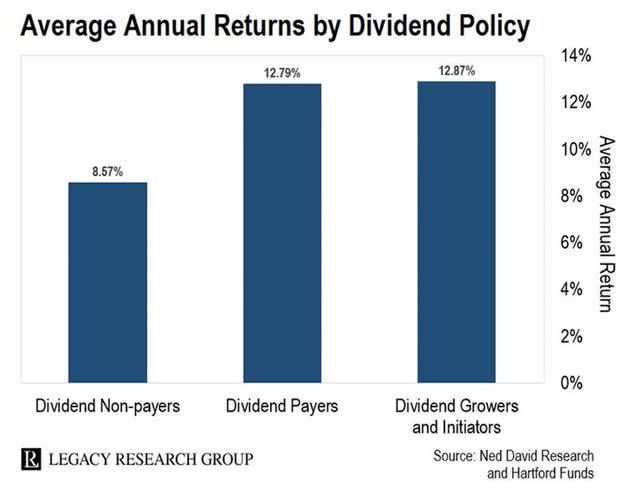

But do you know what’s even better than US stocks? Dividend growth stocks!

In the last 50 years, dividend growth stocks have delivered 7X higher inflation-adjusted returns than non-dividend stocks.

Most people don’t like receiving stocks because they find them confusing. But this is where the world’s best blue-chip ETFs can be so useful. ETFs offer instant diversification and represent a “set and forget” way of investing that doesn’t require anyone to know anything about stocks expect for one thing. They always go up over time.

When it comes to high-yield blue-chip ETFs, the Schwab US Dividend Equity ETF (SCHD) is my absolute favorite recommendation for several reasons.

First, the way it’s constructed screens for safety, quality, valuation, and future growth.

Second, it represents 100 of the world’s best high-yield blue-chips.

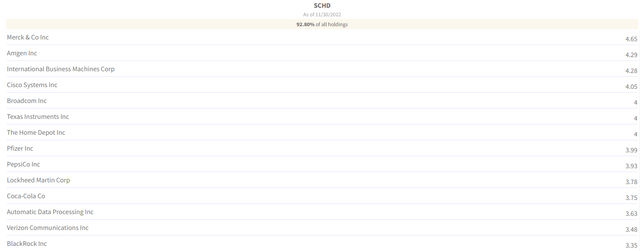

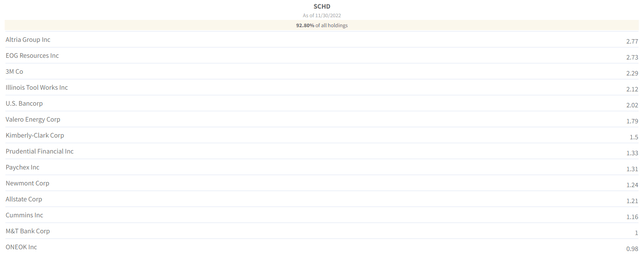

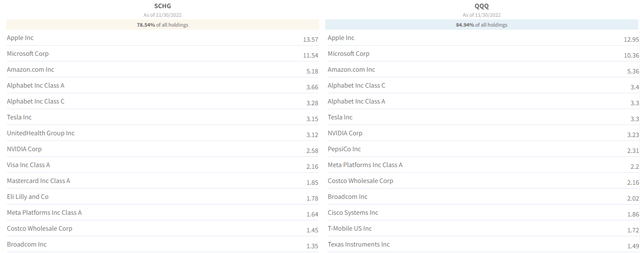

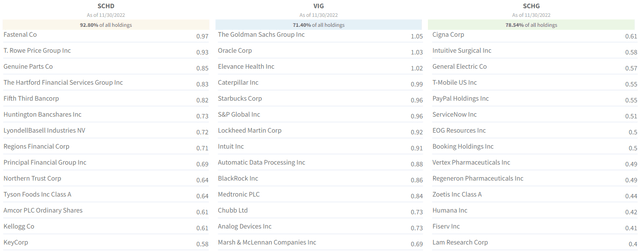

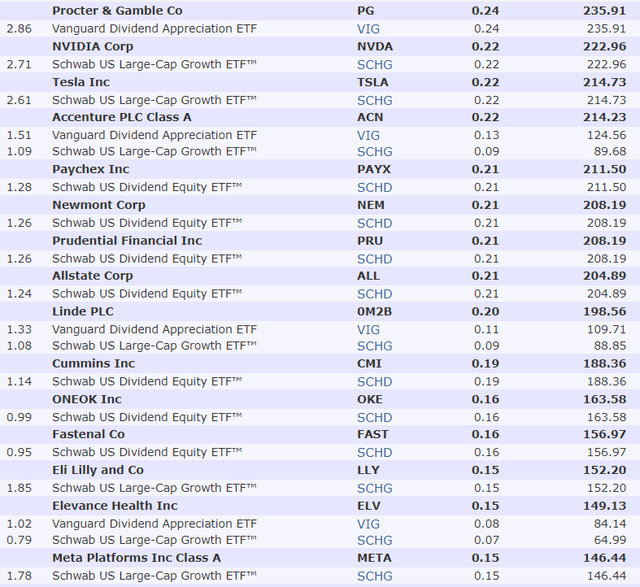

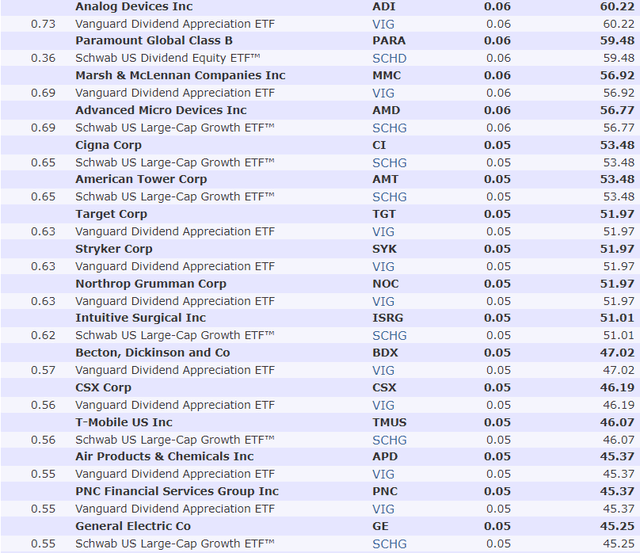

SCHD Top 50 Holdings

FundVisualizer FundVisualizer FundVisualizer FundVisualizer

SCHD’s safety and quality focus is why it owns an all-star team of companies, including:

- world-beater blue-chips

- Ultra SWAN (sleep well at night) companies

- dividend aristocrats and kings

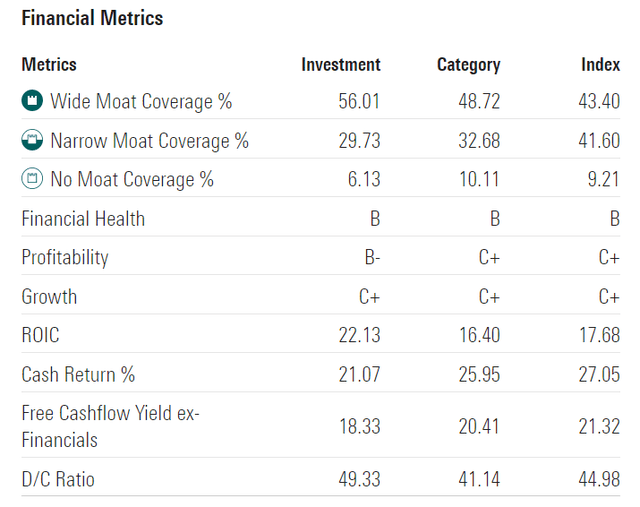

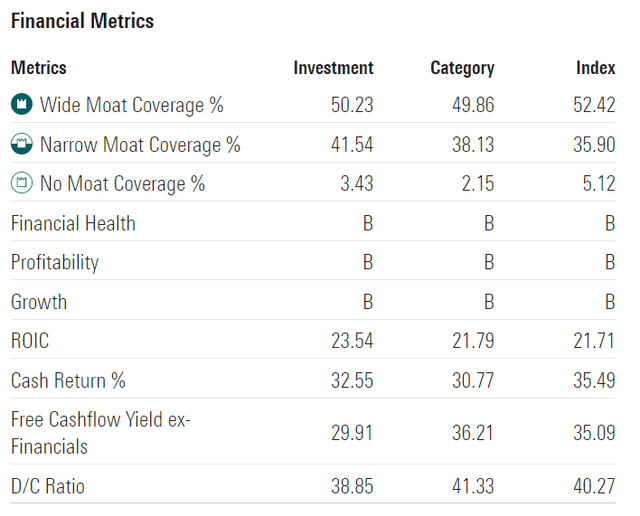

94% of these companies have wide or narrow moats, according to Morningstar, and their profitability and free cash flow margins are exceptional.

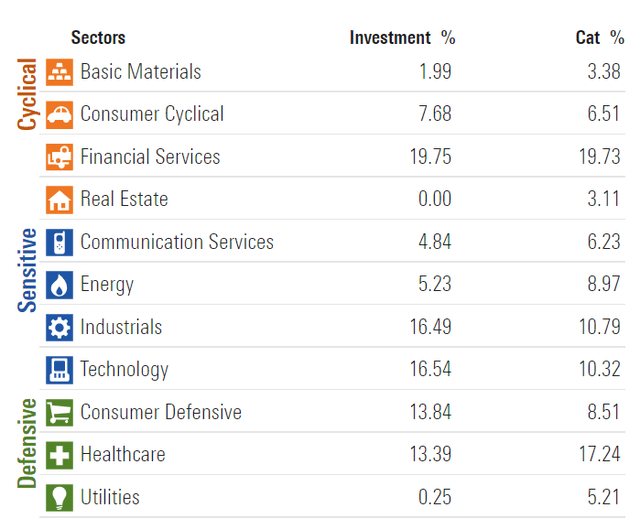

You get exposure to 10 out of 11 sectors, with only REITs missing because SCHD excludes those as part of its process.

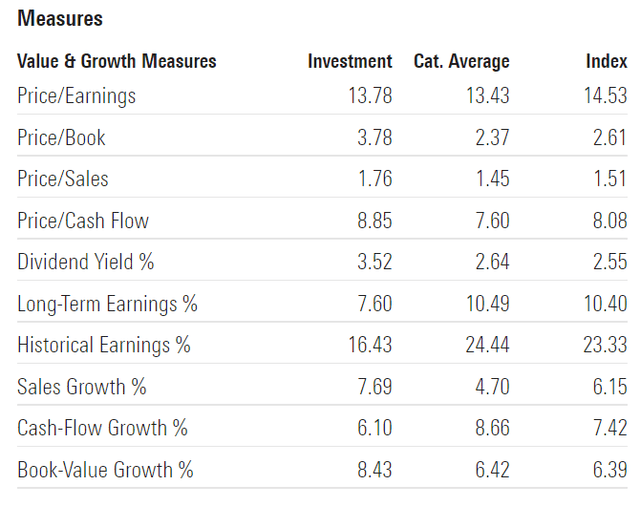

SCHD trades at under 14X earnings, a 22% historical discount to its 10-year median 16.6 PE.

Morningstar analysts think this portfolio will grow earnings at 7.6% in the future, delivering superior total returns to the S&P and dividend aristocrats.

Consensus Long-Term Return Potential

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| Schwab US Dividend Equity ETF | 3.4% | 7.6% | 11.0% | 7.7% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

| REITs | 3.9% | 6.1% | 10.0% | 7.0% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

(Source: DK Research Terminal, FactSet, Morningstar, Ycharts)

How realistic are those forecasts from Morningstar?

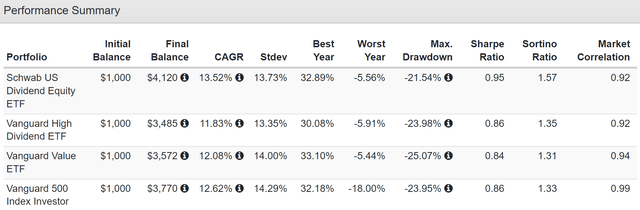

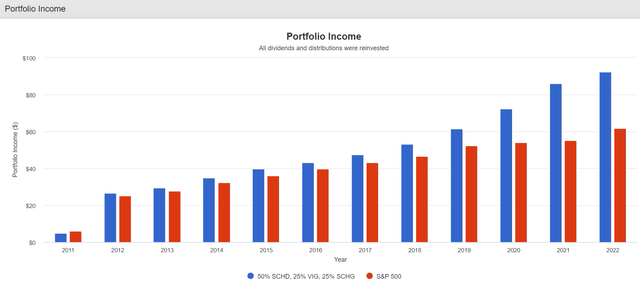

Historical Total Returns Since 2011

How many high-yield ETFs have beaten the S&P over the last 11 years? During one of the best bull markets in US history? I know of none. SCHD also beat gold-standard high-yield ETFs like Vanguard High Dividend Yield ETF (VYM) and gold-standard value ETFs like VYM.

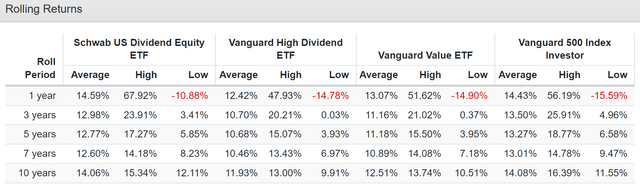

SCHD’s rolling returns are superior to its peers and the S&P across every time period.

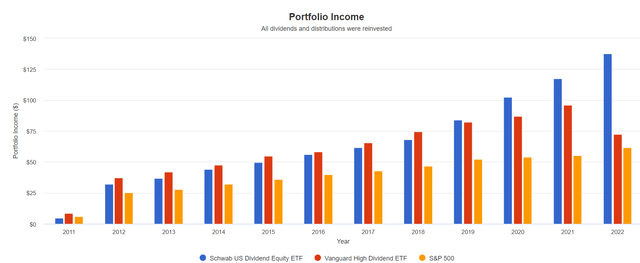

SCHD’s dividend income dependability has been excellent, and the growth rate of its dividends has been outstanding: Over the last decade, its dividends have grown:

- SCHD: 15.7% annual income growth: 13.7% yield on cost

- VYM: 6.9% annual income growth: 7.2% yield on cost

- S&P 500: 9.5% annual income growth: 6.2% yield on cost

Higher safe yield than its peers, much faster growth, and far superior quality that’s likely to keep beating the S&P for the foreseeable future.

Gun to my head, if I had to own just one stock for the rest of my life and reinvest all its dividends, it would be SCHD.

Best Gift Idea #4: The Most Dependable Dividend Stocks (VIG)

You might think that dividend aristocrats are the most dependable dividend stocks on earth.

- S&P companies with 25+ year dividend growth streaks

And individually, you’d be right, though I’d expand the classification to include all companies with such streaks, even if they aren’t in the S&P 500.

- the dividend champions are any company with a 25+ year streak

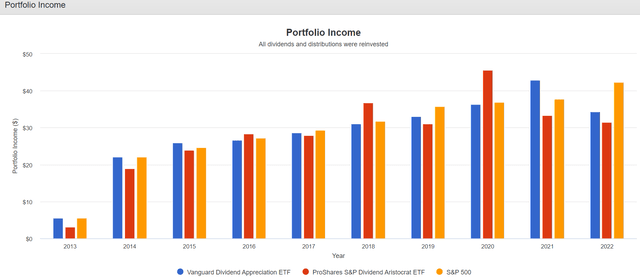

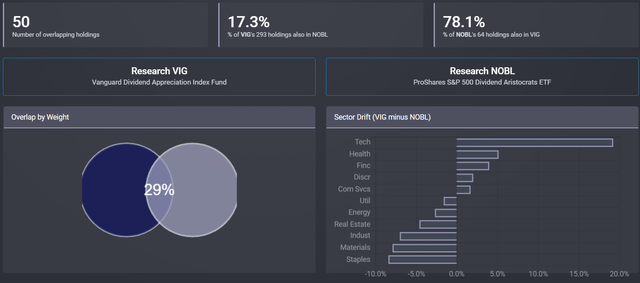

But in an ETF package, the dividend aristocrats (NOBL) aren’t actually as dependable as the Vanguard Dividend Appreciation ETF (VIG).

Due to how it’s rebalanced each year, the aristocrat ETF results in somewhat variable annual income, while VIG’s income dependability is the stuff of legend.

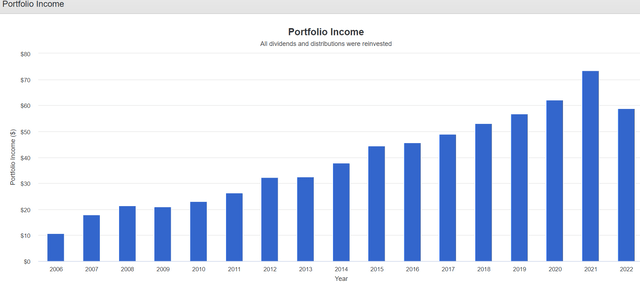

No Dividend Cuts During The Great Recession

VIG’s income growth over the last 15 years was 8.8%, and while the S&P’s dividends were slashed by 25% in the Great Recession, it delivered flat income growth.

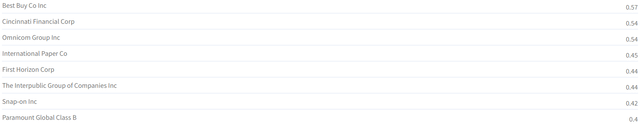

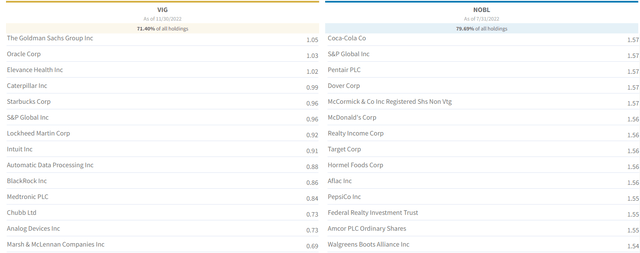

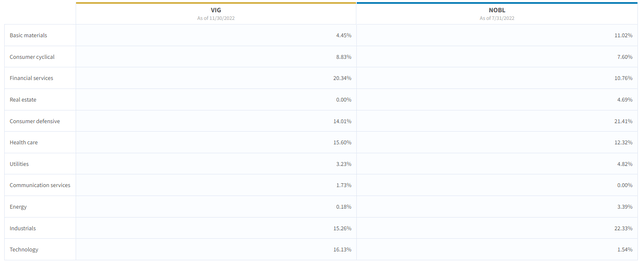

Why is VIG better than NOBL for maximum income growth dependability?

Simple, it has a more diversified portfolio of higher-quality companies.

The fund tracks the S&P U.S. Dividend Growers Index, which provides a market-cap-weighted portfolio of stocks with at least 10 consecutive years of increasing their regular dividend payments. Securities must have more than $100 million in market cap and $1 million in three-month median daily trading value to be eligible for additions.

Existing constituents face lower thresholds to reduce turnover. On top of the long lookback period, the index also excludes stocks with unsustainable yields that are likely to have trouble growing their dividends.

The index removes existing constituents ranking in the top 15% by indicating annual yield and new eligible securities in the top 25%. Selected constituents are weighted by their float-adjusted market cap, subject to a 4% cap on any individual holdings’ weight.” – Morningstar

VIG uses a very reasonable approach to selecting current aristocrats and the highest quality future aristocrats.

Like SCHD, it focuses on safety and quality, screening for more than just dividend streaks.

VIG owns 78% of NOBL’s holdings, but just 17% of VIG’s are owned by NOBL, and there is a 29% weighted overlap of these companies.

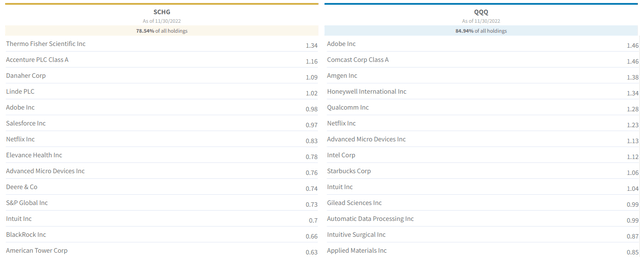

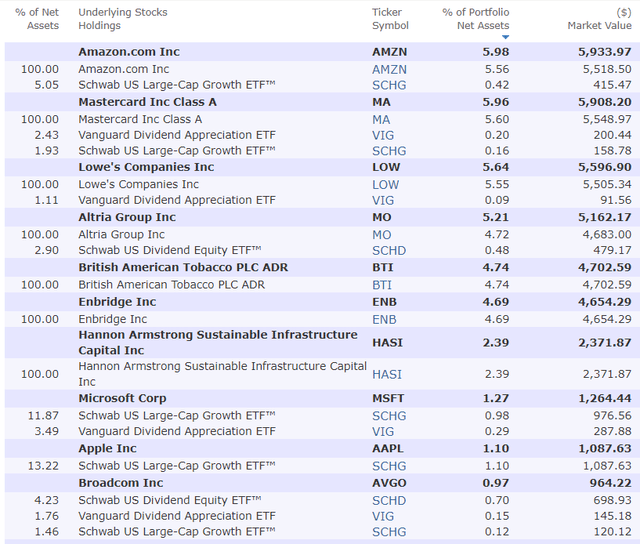

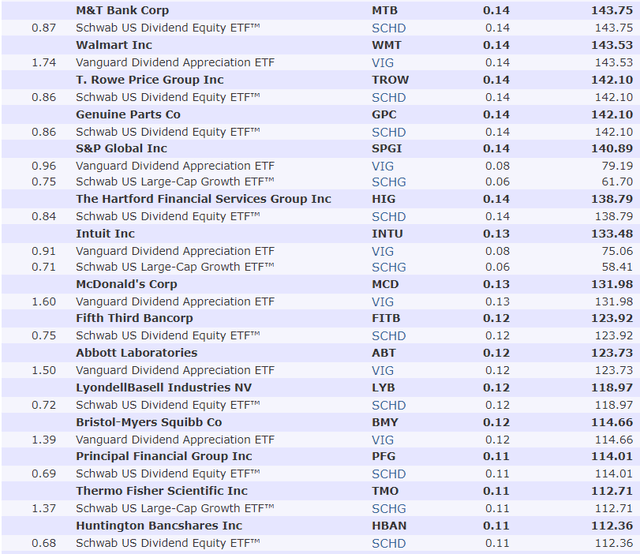

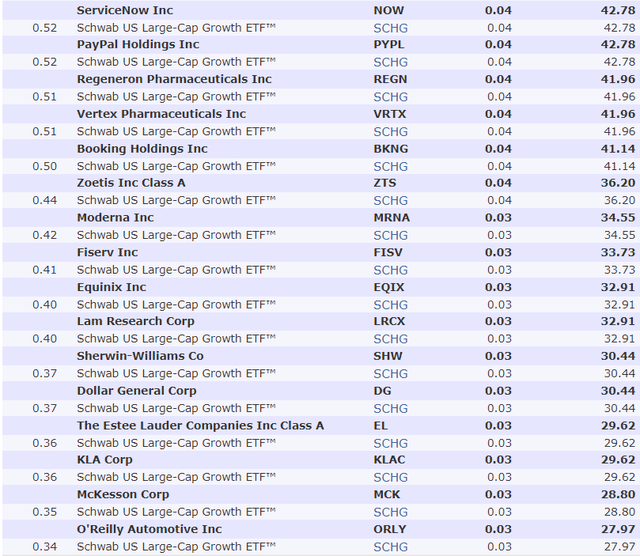

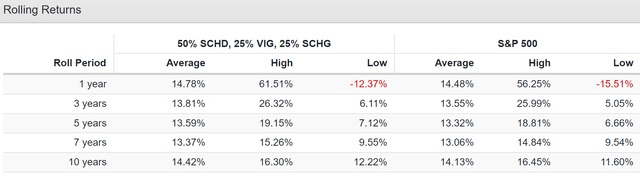

VIG And NOBL Top 50 Holdings

Fundvisualizer Fundvisualizer Fundvisualizer Fundvisualizer

VIG owns almost every dividend champion worth owning, plus future aristocrats like Intuit (INTU), Nike (NKE), Microsoft (MSFT), and UnitedHealth (UNH).

In 2023, VIG is likely to add Apple (AAPL), which Tim Cook has said will eventually become a dividend aristocrat.

VIG offers superior sector diversification and owns a lot more technology which is why it’s expected to deliver about 20% better growth than NOBL in the future.

Consensus Long-Term Return Potential

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential |

| Vanguard Dividend Appreciation ETF | 1.9% | 10.2% | 12.1% |

| Nasdaq | 0.8% | 10.9% | 11.7% |

| Schwab US Dividend Equity ETF | 3.4% | 7.6% | 11.0% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% |

| S&P 500 | 1.7% | 8.5% | 10.2% |

| REITs | 3.9% | 6.1% | 10.0% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% |

(Source: DK Research Terminal, FactSet, Morningstar, Ycharts)

Want to achieve market and even Nasdaq-beating returns from the world’s most dependable dividend growth blue-chips? That’s what VIG offers, thanks to superior growth to the dividend aristocrats.

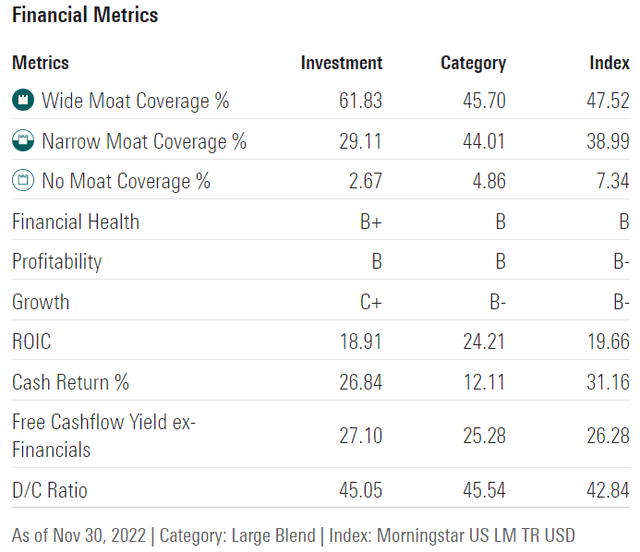

These are some of the best world-beater blue-chips you can own, with 62% wide moats and just 3% no-moat under Morningstar’s moatiness model.

The free cash flow yields of 27% are incredible because these are some of the most profitable companies on earth, with sustainable moats to defend that profitability in the future.

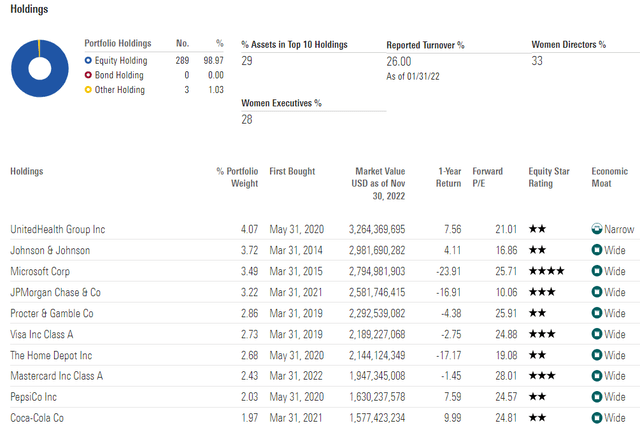

VIG owns almost 300 of the world’s most dependable dividend growth blue-chips, almost five times more than NOBL.

And that includes large weightings for future aristocrats like Mastercard (MA) and Visa (V).

If Mastercard and Visa don’t become aristocrats in the future, I’ll eat my hat.

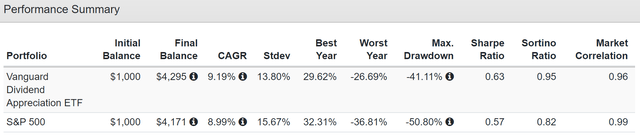

Historical Total Returns Since 2006

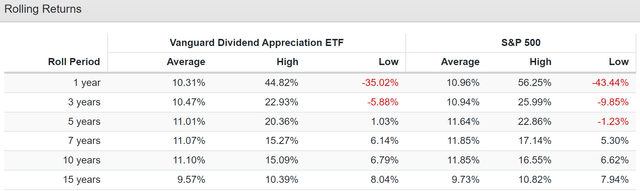

How many dividend ETFs have been able to beat the S&P over the last 16 years? Not many, but VIG did. And with 12% lower annual volatility and a 20% smaller peak decline in the Great Recession.

12% long-term returns forecasts are reasonable, given VIG’s historical rolling returns of 10% to 11%.

Best Gift Idea #5: The Best Growth Blue-Chip ETF (SCHG)

Schwab US Large-Cap Growth ETF is my favorite recommendation for those looking for the world’s best growth stocks. How much do I like it?

Dividend Kings ZEUS Income Growth Portfolio

| Stock | Yield | Growth | Total Return | Weighting | Weighted Yield | Weighted Growth | Weighted Return |

| VIG | 1.8% | 10.2% | 12.0% | 8.33% | 0.2% | 0.9% | 1.00% |

| SCHG | 0.5% | 12.5% | 13.0% | 8.33% | 0.0% | 1.0% | 1.08% |

| SCHD | 3.5% | 7.6% | 11.1% | 16.67% | 0.6% | 1.3% | 1.85% |

| EDV | 4.1% | 0% | 4.1% | 16.67% | 0.7% | 0.0% | 0.68% |

| DBMF | 9.0% | 0% | 9.0% | 16.67% | 1.5% | 0.0% | 1.50% |

| AMZN | 0.0% | 19.2% | 19.2% | 5.56% | 0.0% | 1.1% | 1.07% |

| LOW | 2.0% | 20.6% | 22.6% | 5.56% | 0.1% | 1.1% | 1.26% |

| MA | 0.6% | 23.2% | 23.8% | 5.56% | 0.0% | 1.3% | 1.32% |

| BTI | 7.0% | 10.4% | 17.4% | 4.72% | 0.3% | 0.5% | 0.82% |

| ENB | 6.6% | 4.9% | 11.5% | 4.72% | 0.3% | 0.2% | 0.54% |

| MO | 8.4% | 5.0% | 13.4% | 4.72% | 0.4% | 0.2% | 0.63% |

| HASI | 4.70% | 10.80% | 15.50% | 2.50% | 0.1% | 0.3% | 0.39% |

| Total | 4.2% | 10.4% | 14.5% | 100.00% | 4.3% | 7.9% | 12.1% |

(Source: DK Research Terminal, FactSet)

It’s been added to the DK ZEUS Income Growth portfolio, which I’ll eventually invest my entire retirement portfolio into.

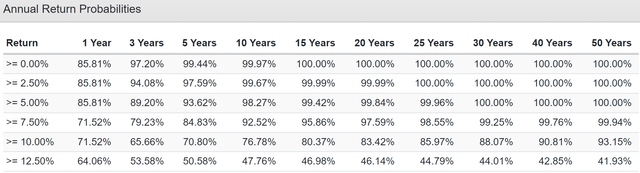

In other words, it’s replacing the Nasdaq 100 (QQQM) in a portfolio that is 99.94% likely to beat a 60/40 over the next 50 years and 93.15% likely to beat the S&P 500.

10,000 75-Year Monte Carlo Simulations

And with a safe 4.3% yield that’s 3X that of the market and 2X that of a 60/40.

ZEUS Income Growth Bear Market Probabilities Over The Next 75 Years

| Bear Market Severity | Statistical Probability | 1 In X Probability |

Expected Every X Years |

| 20+% | 0.86% | 116 | 8,721 |

| 25+% | 0.25% | 400 | 30,000 |

| 30+% | 0.06% | 1667 | 125,000 |

| 35+% | 0.02% | 5000 | 375,000 |

| 40+% | 0.00% | Never | Never |

(Source: Portfolio Visualizer Premium)

S&P Bear Market Probabilities Over The Next 75 Years

| Bear Market Severity | Statistical Probability | 1 In X Probability | Expected Every X Years |

More Likely In Any Given Year To Suffer This Decline Than ZEUS Income Growth |

| 20+% | 23.11% | 4 | 325 | 26.9 |

| 25+% | 16.03% | 6 | 468 | 64.1 |

| 30+% | 11.62% | 9 | 645 | 193.7 |

| 35+% | 8.13% | 12 | 923 | 406.5 |

| 40+% | 5.22% | 19 | 1437 | Infinitely More |

(Source: Portfolio Visualizer Premium)

Higher yield, better returns, and 27X less likely to suffer a bear market in any given year? All while offering a 93% probability of beating the market over the next 50 years? Now that’s what I call a great income growth portfolio.

Why I Now Recommend SCHG Over QQQM

The Nasdaq 100 represents the 100 largest market cap companies that trade on the Nasdaq. It’s historically the best growth ETF in history, but that’s likely to change in the future, and here’s why.

Long-Term Total Return Consensus

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential |

| Schwab US Large Cap Growth ETF | 0.5% | 12.5% | 13.0% |

| Nasdaq | 0.8% | 10.9% | 11.7% |

| Vanguard Dividend Appreciation ETF | 1.9% | 10.2% | 12.1% |

| Schwab US Dividend Equity ETF | 3.4% | 7.6% | 11.0% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% |

| S&P 500 | 1.7% | 8.5% | 10.2% |

(Source: DK Research Terminal, FactSet, Morningstar, Ycharts)

QQQ doesn’t screen for growth; it just screens for the largest Nasdaq-listed companies. Companies that change over time.

In contrast, SCHG has a far superior (and lower cost) strategy.

- 0.04% expense ratio vs. 0.2% for QQQ and 0.15% for QQQM

The Dow Jones U.S. Large-Cap Growth Total Stock Market Index, which this fund fully replicates, absorbs stocks representing the faster-growing half of the U.S. large-cap market and weights them by market capitalization.” – Morningstar

“The Dow Jones U.S. Total Stock Market Index, a member of the Dow Jones Total Stock Market Indices family, is designed to measure all U.S. equity issues with readily available prices.” – S&P

SCHG is screening for the fastest half of the largest US companies.

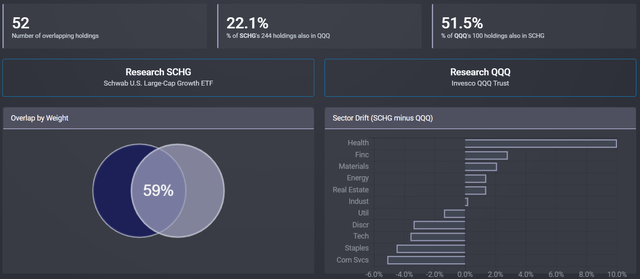

52% of what SCHG owns the Nasdaq owns, but just 22% of what SCHQ owns the QQQs own.

There is a 59% overlap between these two ETFs.

- According to Morningstar, 70% or less overlap makes ETFs good tax-loss harvesting candidates

- you can sell QQQ and buy SCHG and not trigger the wash-sale rule

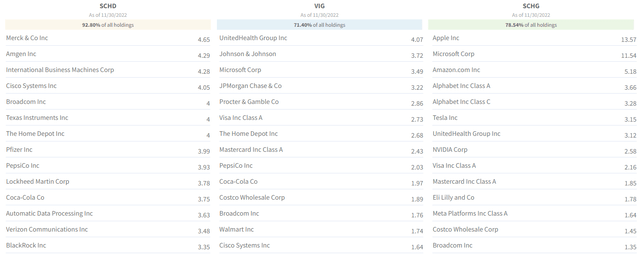

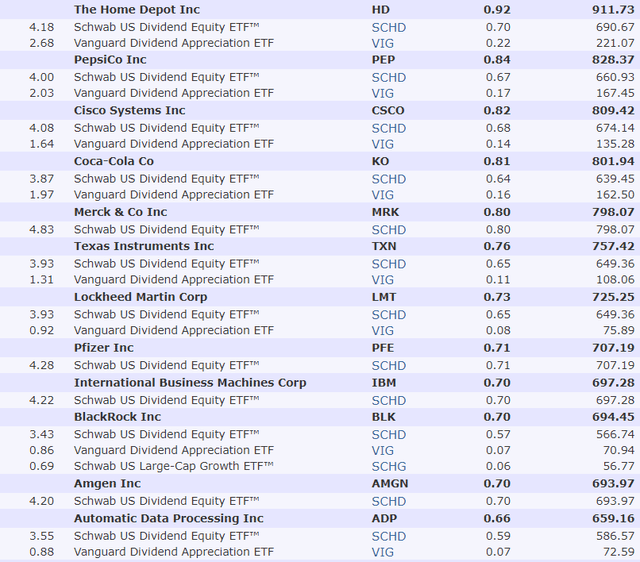

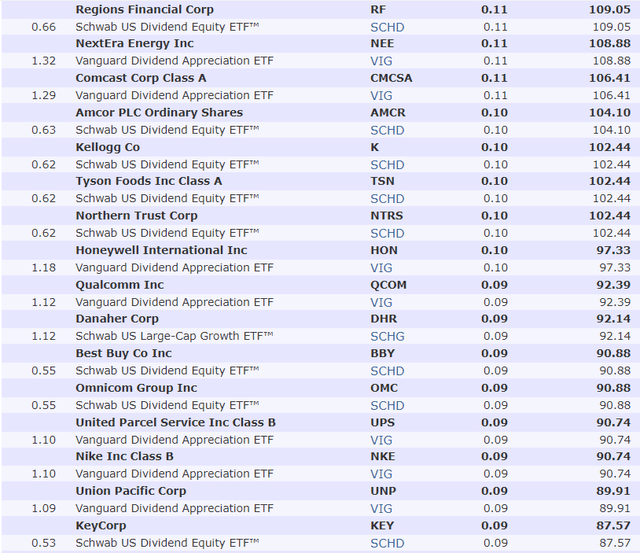

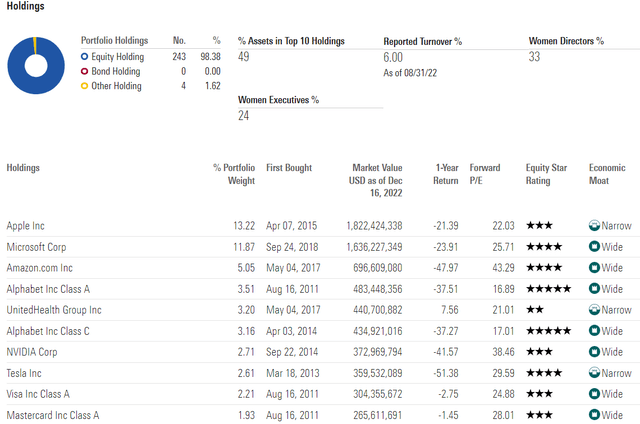

SCHG And QQQ Largest 50 Holdings

Fundvisualizer Fundvisualizer Fundvisualizer Fundvisualizer

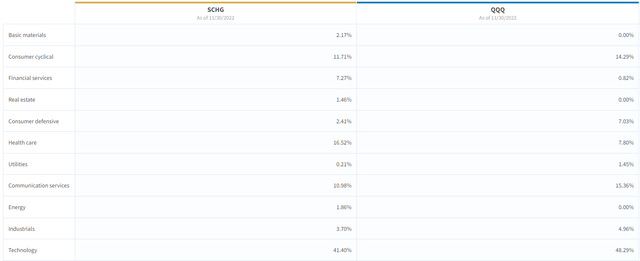

The Nasdaq will never own Mastercard, American Tower (AMT), Zoetis (ZTS), or Eli Lilly (LLY) because they trade on the New York Stock Exchange.

I don’t know about you, but I’d rather own those world-beaters than Baker-Hughes in my growth bucket.

The Nasdaq has spent the last decade being more concentrated than just about any growth ETF in the fastest-growing companies. Not by design but by accident. Now the tide is turning, and the Nasdaq’s growth outlook is dimming while SCHG’s has never been stronger.

SCHG is always designed to find the best growth blue-chips, and Nasdaq isn’t. It’s as simple as that.

SCHG is more diversified than QQQ but still is heavily weighted towards the best secular growth companies.

96% wide and narrow moat world-beaters with 30% free cash flow margins, in the top 10% of all companies on earth.

While the QQQ owns 100 companies, including plenty of non-growth stocks, SCHG owns 243 of the best growth stocks in America.

That includes UnitedHealth (UNH) and Mastercard.

If you want a low cost way to participate in the greatest growth stories of our age, SCHG is one of the best ways on earth to do it.

Not just today but for decades into the future. Because while no one can say what the 50% fastest growing companies will be in 10, 20, or 30 years’ time, one thing is for certain, SCHG will own them. QQQ might not.

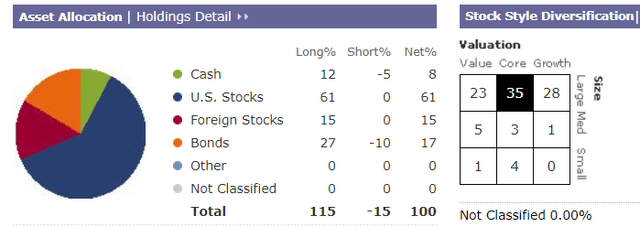

What If You Own All 3 Of These ETFs?

If you own SCHD, VIG, and SCHG as a core bucket in your diversified portfolio, you own 573 of the world’s best companies.

- the best high-yield blue-chips

- the most dependable dividend growth stocks (including almost all dividend champions worth owning)

- the best growth blue-chips on earth

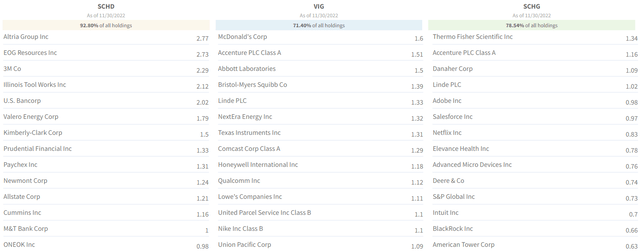

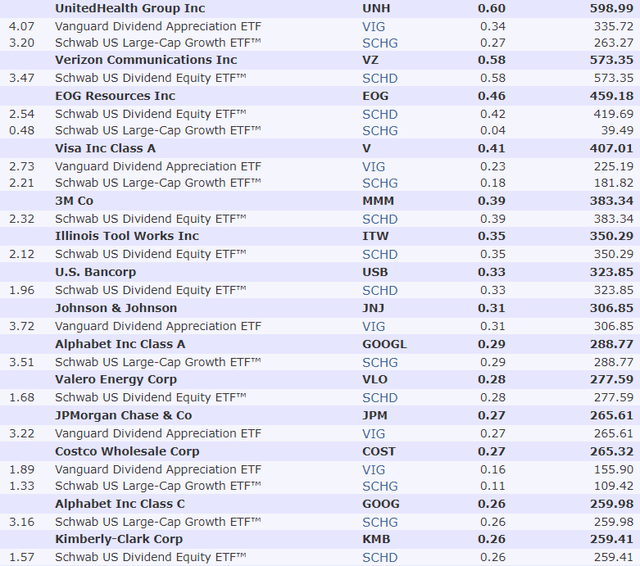

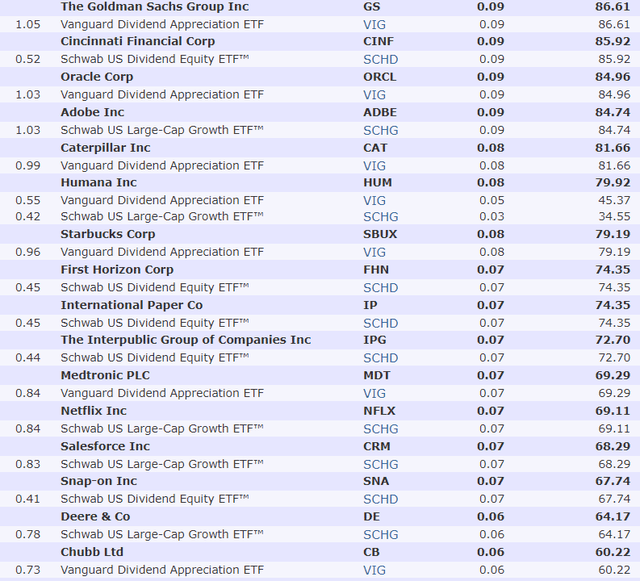

SCHD, VIG, and SCHG Top 50 Holdings

Fundvisualizer Fundvisualizer Fundvisualizer Fundvisualizer

573 companies that represent about 90% of all the companies you should consider owning today or in the future.

- the remaining 33% to 50% of your portfolio can be used to buy the companies the ETFs don’t cover

- or simply overweight your top conviction favorites

Dividend Kings ZEUS Income Growth Portfolio: 576 Of The World’s Best Companies + SpaceX

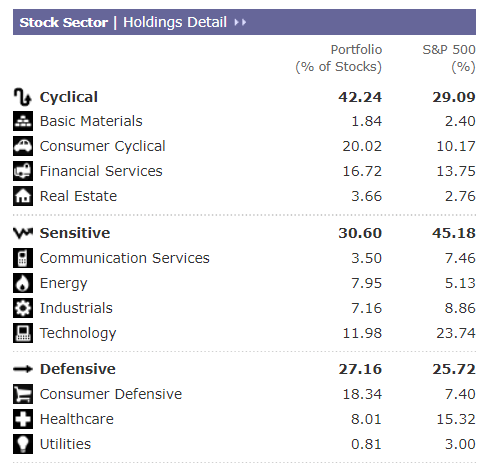

(Source: Morningstar) (Source: Morningstar) (Source: Morningstar) (Source: Morningstar) (Source: Morningstar) (Source: Morningstar) (Source: Morningstar) (Source: Morningstar) (Source: Morningstar)

576 of the world’s best blue-chips and a 0.04% position in SpaceX via Alphabet’s 7% stake.

A diversified and prudently risk-managed portfolio that’s equally balanced between growth and value.

(Source: Morningstar)

Exposure to every sector of the economy, including 4% REIT exposure.

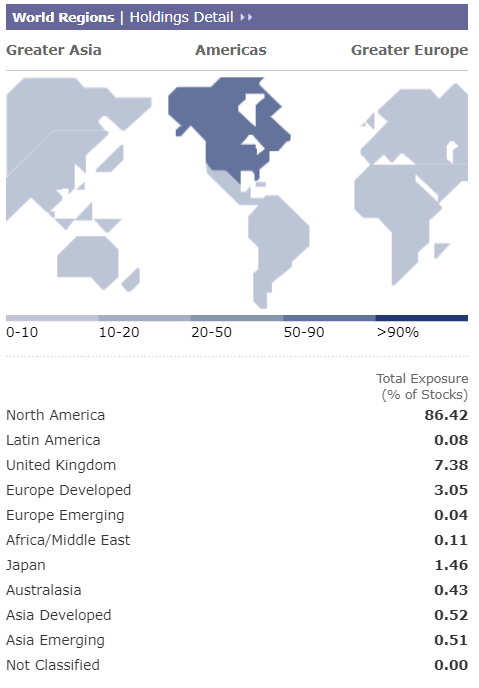

(Source: Morningstar)

Exposure to every country on earth. In fact, these 576 blue-chips count every human on earth as their customer.

- your dividends are coming from every person on the planet

Consensus Long-Term Return Potential

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential |

| Schwab US Large Cap Growth ETF | 0.5% | 12.5% | 13.0% |

| Vanguard Dividend Appreciation ETF | 1.9% | 10.2% | 12.1% |

| 50% SCHD, 25% VIG, 25% SCHG | 2.3% | 9.6% | 11.9% |

| Nasdaq | 0.8% | 10.9% | 11.7% |

| Schwab US Dividend Equity ETF | 3.4% | 7.6% | 11.0% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% |

| S&P 500 | 1.7% | 8.5% | 10.2% |

(Source: DK Research Terminal, FactSet, Morningstar, Ycharts)

Looking for a better alternative to the S&P for your portfolio’s ETF bucket? Here it is.

- 50% growth and 50% value

- 573 of the best growth and value companies in America

- higher yield than the S&P

- faster growth than the S&P

- better diversification than the S&P

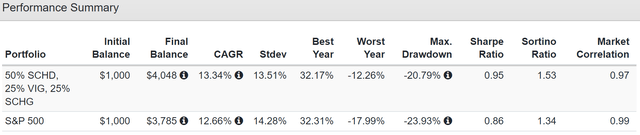

Historical Return Since 2011

Better returns than the S&P with lower volatility and smaller peak declines.

Safer, More Dependable, And Faster Income Growth Than The S&P

If you’re interested in safe and growing income, then these three ETFs are far superior to the S&P as well.

- 13.0% annual income growth over the last decade vs. 9.5% annual for the S&P 500

- 9.2% yield on cost vs. 6.2% S&P 500

Best Gift Idea #6: Matched Charitable Contributions

Charitable contributions are the gift you give the world to whatever cause you are most passionate about.

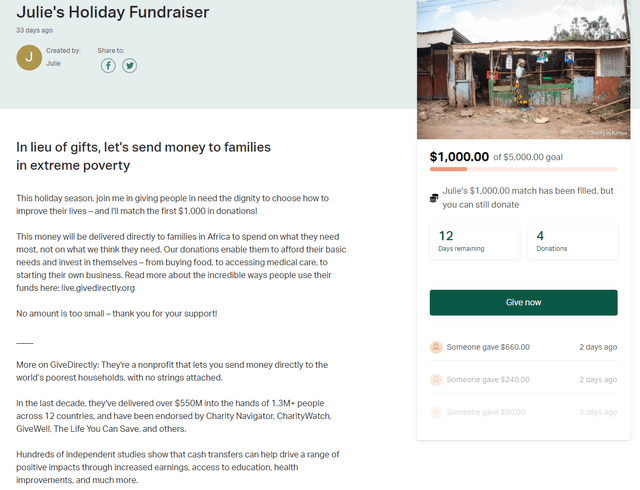

My favorite charity is GiveDirectly, which allows me to help alleviate poverty, and, one day, even potentially help eliminate it entirely.

- $480 per year can lift one person out of poverty for a year

- each $1 donated generates $2.6 in economic impact (vs. 1.36 to 1.73 multiplier for US infrastructure spending)

The key to any charitable giving is that it should be highly effective and something that you care deeply about.

GiveDirectly Donations Since 2021

| Cumulative Inflation-Adjusted Donations | $1,703 |

| Cumulative People Lifted From Poverty | 10.48 |

| Cumulative Inflation-Adjusted Effective Economic Impact | $11,166 |

| Cumulative Economic Multiplier | 6.56 |

(Source: GiveDirectly)

While this isn’t the only charity I donate to, it’s the one to which I put most of my annual donations.

I also buy food shelf meals every time I go grocery shopping.

That’s because one of my greatest passions in life is effective altruism, meaning charity that’s highly efficient and that you know is working. In this case, for every $1 I’ve donated, I’ve helped boost the economy in developing countries by $6.6, adjusted for inflation.

With this charity, I can literally estimate to the person how my donations are impacting the world and the economy.

- I love spreadsheets, so this charity is right in my wheelhouse

- my degree is in economics so I want to maximize the economic impact of my donations

Maximize Your Charitable Giving With Matching Contributions

Do you know the key to good philanthropy? Working the system so you can maximize the impact of every dollar you give.

Companies offer charity matching, usually 1:1, for a certain amount.

My father’s company, US Bank, offers 1:1 matching for $1,000 of annual contributions. So what does my family do?

- my family donates $500 per year to Ukraine’s refugee effort

- and I match that with my own $500

- so $2,000 total donation from my family

- and 3:1 match for my donation

But guess what? Effective donations don’t have to stop at a company match.

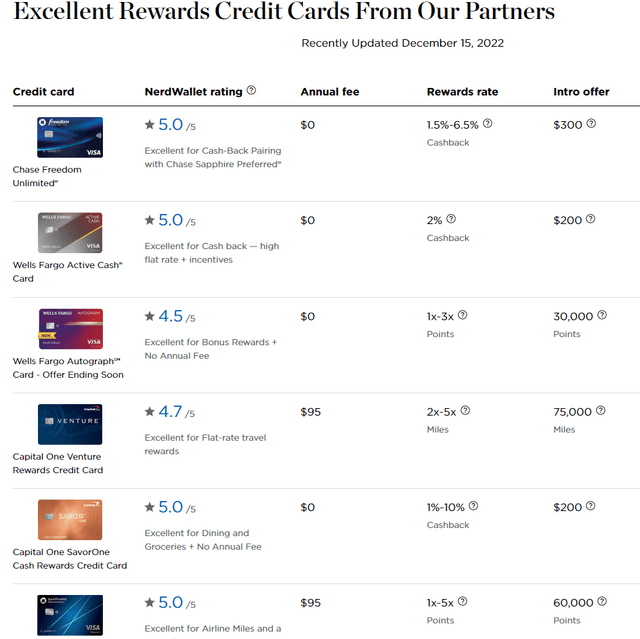

Let Visa, Mastercard, And Amex Turbocharge Your Charitable Giving

In the last few months, I have gotten two credit cards that offer $500 in cash back if I spend $4,200 within a certain amount of time.

There is currently about $2,400 worth of introductory cashback offers that a family of five could get with their regular spending over the course of a year.

That’s $2,400 in free money that Visa, Mastercard, Amex, and other companies are willing to give you for doing what you’re doing anyway.

Imagine if you donated that $2,400 to a charity you care about. That’s an infinite multiplier because you didn’t donate anything; you just bought what you normally bought.

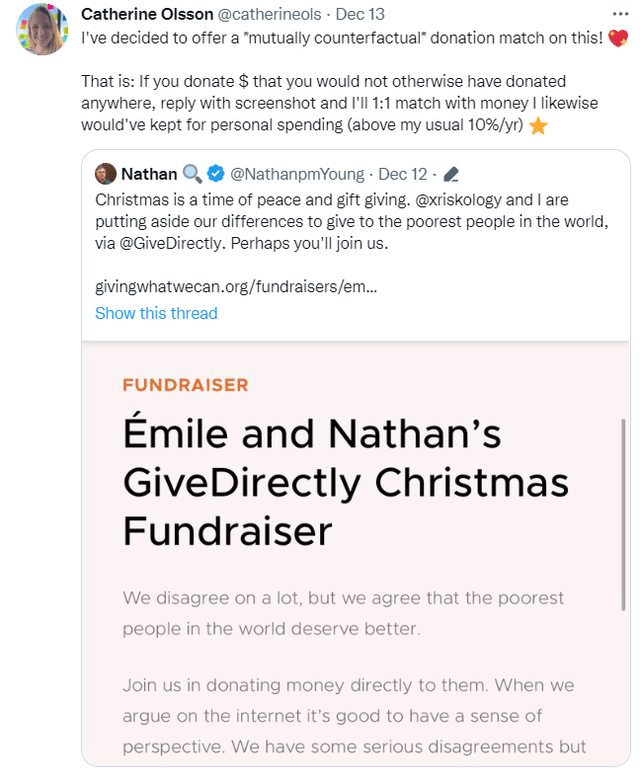

However, you can also crank up those donations by using personal matching programs.

Personal Charity Matching: Taking Your Giving To The Next Level

You can find numerous private matching fundraisers online from a woman named Julie. She had $950 left in her $1,000 match offer, so I donated $950 to max it out.

But I didn’t stop there.

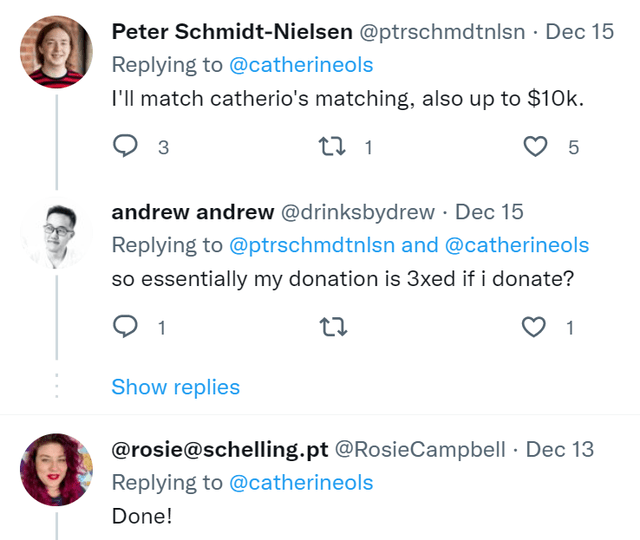

A woman named Catherine Olson was willing to match $10,000 in donations for anyone willing to make an unplanned donation and send her a screenshot of the receipt from GiveDirectly.

This is what inspired my $950 donation because of one final match.

A man named Peter Schmidt was willing to match Catherine’s $10,000 matching of our donations.

So that $950 donation was matched by:

- Julie

- Catherine

- Peter

- $950 became $3,800 worth of donations

- 8 people were lifted out of poverty thanks to a 3X matching campaign this weekend

- $10,000 in economic impact from $950 = over 10X economic multiplier

Thanks to this weekend’s incredible matching generosity from philanthropic strangers, I achieved the most effective giving of my life.

But wait it gets better!

$500 of that $950 donation was from AMEX, Visa, and US Bank, the $500 in cash back.

- So $3800 in donations from $450 in my personal money

- 22.2X economic multiplier

- but I get to take the full $950 off my taxes

Work The System: Leverage Companies, Individual Matches, And The Government To Donate More Than You Ever Thought Possible

You can deduct up to 50% of your adjusted gross income annually through charitable donations.

For those in New York City, in the top tax bracket, the government subsidizes 55% of their donations.

So now take that $2,400 in cashback offers for normal spending for a high-income family (or a middle-class family of 5) in NYC and keep recycling the benefits.

- donate the cash back,

- donate the tax savings

- use personal and corporate matching to 2X your donation each time

A top-income earner in NYC can effectively multiply their donation 2.2X using this system. The median US household has an effective tax rate of 35%. That’s a 1.54X charity median multiplier if you leverage the tax system to maximize donations.

- $2,400 in cash back donation becomes $5,280

- 2X that with matching (or even more during the holiday season through Twitter matching chains)

- $10,560 total donation…and 100% from credit card companies!

- 22 people were lifted out of poverty for a year

- $27,456 economic impact, and you just spent like you normally do.

How much did this family have to donate directly? None. They got $2400 cash back and then leveraged donation matching and the tax system to generate life-changing philanthropy.

- $27,500 in economic impact, and it cost you none of your own money at all

This is what I mean by “work the system” and effective altruism. Just like you can hack credit card offers to vacation free from normal spending, you can change dozens of lives by ensuring your donation dollar is leveraged to the max.

Bottom Line: These Are The 6 Best Gifts You Can Give This Christmas

The holidays are a time for giving and spending time with those we love most. It’s when we remind ourselves what really matters in life; what true happiness comes from.

Love is the greatest gift of all, but among material gifts you can give this Christmas, cash, SCHD, VIG, SCHG, and matched and leveraged charitable donations are hard to beat.

Cash can buy the most valuable commodity on earth, time to spend more time with your loved ones.

SCHD, VIG, and SCHG are three of the best dividend growth ETFs in the world. They represent 573 of the world’s best blue-chips, that:

- yield a safe 2.3% vs. the S&P’s 1.7%

- offer 10.2% long-term growth vs. the S&P 500’s 8.5%

- offer 11.9% long-term return potential vs. the S&P 500’s 10.2%

- historical returns superior to the S&P and with 40% faster income growth and lower volatility to boot

Giving the gift of blue-chip dividend stocks is a gift that will keep giving for decades or even centuries to come. It can be passed down from generation to generation and build multi-generational wealth that can change your family’s lives or even the world.

Because once you have more than enough for your family to live comfortably on, you can use charitable matching and leverage the tax system.

- 1.54X your donation by leveraging the tax system

- 2X your donations through corporate and private matching fundraisers

- 3.08X your overall donations by leveraging both

- and infinite charitable donation leverage if you use cash back, offers from credit cards

- you can help dozens of people by spending none of your own money at all

Personally, I love to use all of these methods, to use the world’s best companies to generate exponentially growing wealth and then donate a growing percentage of that to GiveDirectly.

- 1.8X personal tax leverage multiplier

- with 2X or higher matching each time

- 3.6X personal donation match

- on donations that grow exponentially every year

We live in a glorious dividend-funded utopia if you know how to work the system.

- the world’s greatest companies are willing to work hard for you so that one day you won’t have to

And my greatest joy in life is to help you learn how to take charge of your financial destiny so that you can potentially retire in safety and splendor. And once you’ve done that, you’ll get to spend your time with loved ones and potentially help me change the world through dividend-funded philanthropy.

- donations of thousands can make a big difference

- donations of millions can change lives

- donations of billions can change the world

- donations of trillions…over time…can change everything.

From everyone at Dividend Kings and iREIT, I want to wish you and yours a safe, healthy, and joyous holiday season:)

Be the first to comment