Pgiam/iStock via Getty Images

Income-oriented investors are going through a rough period this year due to the surge of inflation, which erodes the real value of their portfolios and their income streams. It is thus natural that these investors are doing their best to shield their portfolios from inflation. The dividend yields of most stocks have greatly increased this year due to the ongoing bear market, but investors should make sure that a dividend is safe before investing in a high-yield stock.

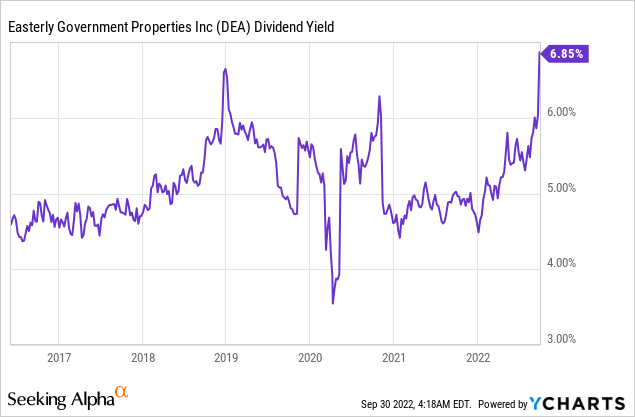

Easterly Government Properties, Inc. (NYSE:DEA) is offering a 7-year high dividend yield of 6.7%, which should be safe given that the real estate investment trust (“REIT”) leases all its properties to U.S. government agencies. As there is no other REIT with 99% occupancy and such a safe tenant profile, investors should lock in the 6.7% yield of the stock before it reverts to normal levels.

Business overview

Easterly Government Properties is a REIT which acquires and develops properties that are leased to U.S. government agencies, such as the FBI, IRS and DEA. The REIT was originally formed in 2011 as Easterly Partners and then changed its name to Easterly Government Properties in early 2015.

Thanks to its unique business model, Easterly enjoys some key competitive advantages when compared to the vast majority of REITs. It leases its properties to U.S. government agencies for at least a decade, and thus it enjoys predictable cash flows, without the usual risk of incurring a default of its tenant. In addition, as the government agencies rarely move to another building, the risk of having vacant properties is extremely low. This helps explain the 100% occupancy rate that Easterly has posted in most years. The occupancy rate of the trust currently stands at 99%.

Moreover, Easterly has a wide business moat, with high barriers to entry thanks to its expertise in the procurement process, protocols and culture of government agencies. The high barriers to entry somewhat enhance the negotiating power of the REIT. This helps explain the fact that Easterly has its rent structured to rise with inflation. This is undoubtedly an important feature of the leases, which mitigates the impact of inflation on the real value of the cash flows of the REIT.

Apart from being resistant to inflation, Easterly is also essentially immune to recessions. While recessions may exert some pressure on the budget of the government, the latter is the most recession-resistant tenant in the entire universe. As a result, Easterly is not affected by economic downturns. The REIT has a short history but it was tested in the fierce recession caused by the pandemic and the resultant lockdowns in 2020. While other REITs incurred a material decrease in their funds from operations [FFO] per unit, Easterly grew its FFO per unit 5% in that year. This is a testament to the resilience of this high-quality REIT to economic downturns.

Moreover, Easterly does not rest on its laurels. It continuously tries to acquire new properties, which are essential to the mission of select government agencies. It also achieves growth thanks to its inflation-adjusted reimbursement and its lease renewal spreads. Since its IPO under its current form, in 2015, Easterly has grown its FFO per unit in 5 of the 6 years, at a 3.9% average annual rate. This growth rate may seem unappealing to most investors but it is decent, especially when combined with the aforementioned advantages of the REIT.

On the other hand, it is important to note that growth momentum has somewhat decelerated lately, primarily due to fewer acquisitions of new properties and the issuance of new units. As a result, Easterly is expected by analysts to grow its FFO per unit by only 2% per year on average over the next 3 years. As Easterly is laser focused on properties leased to government agencies, it obviously cannot grow as fast as other REITs, which have a much broader scope. The inferior growth prospects of the REIT when compared to its peers is a point of concern.

On the bright side, the market of federally-leased properties is highly fragmented. The largest owners of this type of properties own 26.2% of these properties, with no landlord owning more than 5.4%.

Easterly Government Properties Growth (Investor Presentation)

As a result, there is ample room for future growth for Easterly via the acquisition of properties from small owners.

Valuation

While Easterly is essentially immune to recessions, its stock price is not immune to the ongoing bear market, which has resulted primarily from the increasing risk of an upcoming recession due to the aggressive interest rate hikes by the Fed. The stock of Easterly has declined 33% this year and thus it is trading at a historic (7-year) low, at a price-to-FFO ratio of 11.5. This FFO multiple, which is a 7-year low, is much lower than the historical average of 16.6 of the stock.

The exceptionally cheap valuation level of the REIT can be partly justified by high inflation, which reduces the present value of future cash flows and thus exerts pressure on the valuation of most stocks. However, this headwind is likely to prove short-lived. The Fed has prioritized restoring inflation to its long-term target of 2%, even at the expense of economic growth. Given its determination, which is evident in its aggressive interest rate hikes, it is safe to assume that inflation will soon begin to subside. When that happens, the valuation of Easterly will probably begin to revert towards its historical average. Overall, the stock will enjoy a major valuation tailwind when inflation subsides.

Dividend

Due to the decline of its stock price this year, Easterly is currently offering a 7-year high dividend yield of 6.7%.

When a stock offers such a high yield, it usually signals that a dividend cut is just around the corner. However, this is not the case for Easterly. Its FAD payout ratio is somewhat elevated, at 75%, but the dividend has a wide margin of safety thanks to the resilience of the REIT to recessions and its predictable cash flows, which result from the reliability of the U.S. government.

Notably the REIT has a somewhat leveraged balance sheet, with interest coverage ratio of 1.8 and net debt (as per Buffett, net debt = total liabilities – cash – receivables) of $1.4 billion. As the amount of net debt is approximately 11 times the annual FFO of the REIT and almost equal to the market capitalization of the stock ($1.6 billion), it is somewhat high. Nevertheless, given the predictable cash flows of Easterly, its dividend has a wide margin of safety.

Risk

The primary risk of Easterly is the adverse scenario of persistent inflation for years. In such a case, the valuation of the stock will probably remain under pressure for a long period. In addition, due to the low growth rate of the trust, its dividend will gradually become less attractive to income-oriented investors. For instance, the 6.7% dividend currently provides an attractive income stream to the shareholders. However, if inflation remains around 6%-8% over the next three years, the income stream of Easterly will gradually become less attractive.

On the bright side, given the determination of the Fed and the economic slowdown already caused by the interest rate hikes, inflation will almost certainly begin to subside in the upcoming months. Nevertheless, only the investors who are confident that the Fed will restore inflation without hurting the economy with a prolonged recession should consider purchasing Easterly.

Final thoughts

Easterly is probably the REIT with the lowest tenant risk and the most reliable cash flows, as its properties are leased to U.S. government agencies. Under normal conditions, it would be impossible to find this stock with a 6.7% dividend yield. Therefore, those who are confident that inflation will revert to its normal range in the upcoming years are given a rare opportunity to lock in a secure 6.7% yield from this high-quality REIT.

Be the first to comment