Aleksei Savin/iStock via Getty Images

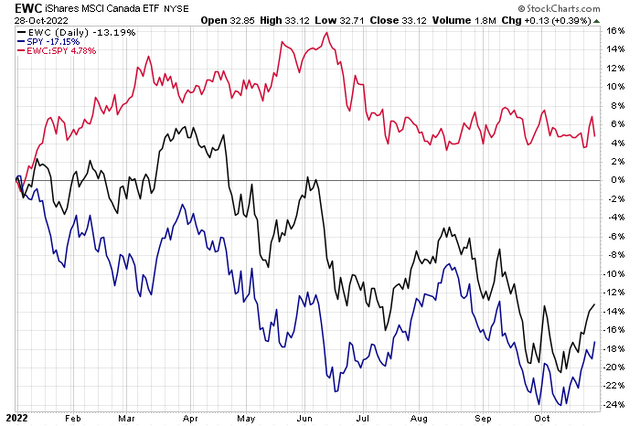

Canadian stocks have treaded water against the S&P 500 during the second half of the year so far after a fast start to 2022. The iShares MSCI Canada ETF (EWC) is down by 13% YTD compared to a total return drop of 17% on the S&P 500 Trust ETF (SPY). One railroad company, headquartered north of the border, reported disappointing earnings results last week, but is the stock a value today? Let’s take a look.

Canada Stocks Keeping Pace With Domestic Markets

According to Bank of America Global Research, TFI International (NYSE:TFII) is a North American trucking and logistics company. The firm manages a growing network of more than 160 wholly-owned operating subsidiaries acquired over time. TFII operates through four business segments: 1) Less-Than-Truckload (LTL) (44% of 2022 Pro-forma Revenue) 2) Truckload (25% of 2022 Pro-forma Revenue), 3) Logistics & Last Mile (19% of 2022 Pro-forma Revenue), and 4) Package & Courier (P&C) (12% of 2022 Pro-forma Revenue).

The Canada-based $11.4 billion market cap Road & Rail industry company within the Industrials sector trades at a low 10.7 trailing 12-month price-to-earnings ratio and pays a small 1.2% dividend yield, according to The Wall Street Journal. TFII’s Q3 report featured a bottom-line beat, but it missed on margins and revealed a volume deceleration that spooked investors.

The company’s diversified transportation businesses help sustain solid earnings growth this year, but a weak economy could pressure profits in 2023. Exposure to e-Commerce is a variable, and possible risk should a global slowdown take place. After its UPS Freight acquisition, the firm trades near other LTL company valuations. The stock has historically sold for a P/E multiple in the 11 to 14 range but could be warranted given its reformed business mix. Downside risks include how integration goes with the acquisition and higher wages for its workers.

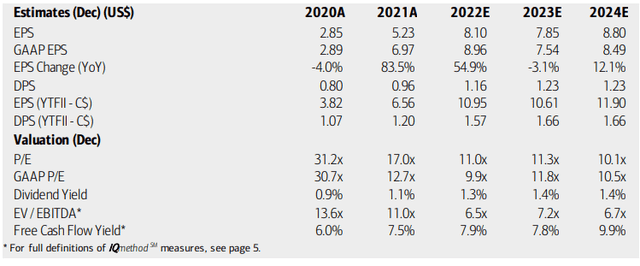

On valuation, analysts at BofA see earnings moderating by 2024 after a volatile few years, leading to both operating and GAAP P/E ratios retreating to cheap territory in the coming quarters. TFI’s dividend is expected to grow by year-end 2023 while its EV/EBITDA multiple ventures into inexpensive territory too. The company’s free cash flow yield also looks attractive as it increases toward 10% should the stock remain steady. Overall, the valuation looks decent with reasonable growth potential depending on broad economic conditions.

TFI International: Earnings, Valuation, Dividend Forecasts

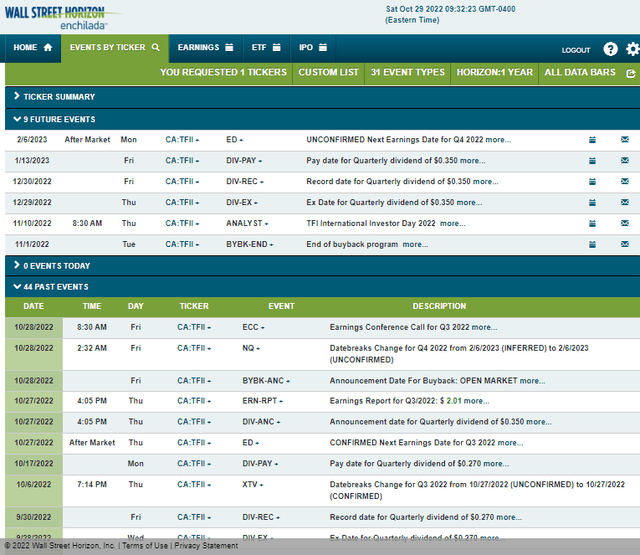

Looking ahead, TFI has an upcoming Investor Day on Thursday, Nov. 10 that could bring about some stock price volatility. According to FactSet, news breaks, product and market trend updates are shared, and executives give pivotal outlooks this type of corporate event. Perhaps color will be given on the Q3 margin miss to assuage investors’ anxiety.

Other key dates include the end of the company’s share buyback program on Nov. 1 and an ex-dividend date on Thursday, Dec. 29. The next earnings date is unconfirmed for Monday, Feb. 6 AMC, according to Wall Street Horizon.

Corporate Event Calendar

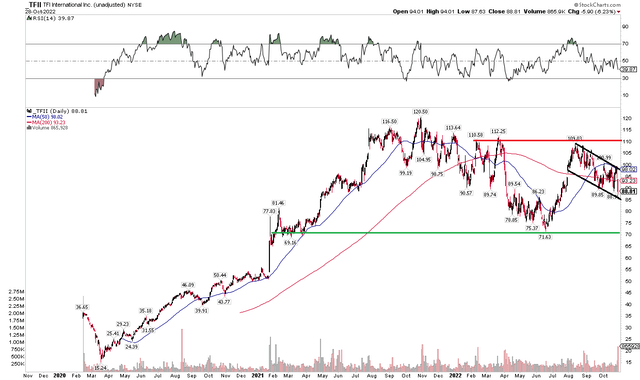

The Technical Take

TFII continues to trade in a bull flag pattern with a possible bullish cup and handle formation taking shape. Before a long position is taken, though, the stock must climb above the $109 to $114 area. I would hold off on buying the stock here – it’s hard to say how much more downside there is to go. I see support at the June low near $72. Friday’s high-volume down day could result in lower prices over the coming weeks.

The chart looks like a short-term sell but there is longer-term upside potential if we see a breakout in the cup and handle – that would lead to a price objective of near $150. Keep this chart on your radar in 2023.

TFII: Bullish Cup and Handle In Play, But Bearish Momentum Currently

The Bottom Line

TFI looks like a decent value at some point, but its cyclical nature could be hurt by a broad economic slowdown. The chart’s bearish near-term price action portends more downside to come. I’d buy the stock on valuation should it fall toward the low $70s. It’s also a technical buy above $114.

Be the first to comment