Tryaging/iStock via Getty Images

Introduction

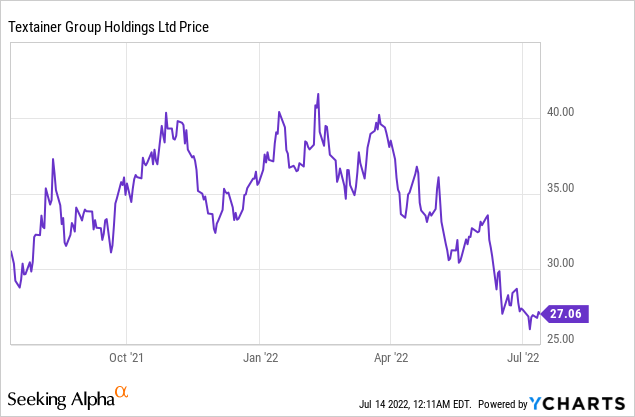

Textainer Group Holdings (NYSE:TGH) is one of the largest container lessors in the world. Backed by multi-year contracts, the recent expansion of the fleet offers excellent visibility on the future cash flows and profitability of the company. Yet the market seems to be more worried about the world economy and Textainer’s share price has been drifting down. I have been accumulating common shares, but in this article, I’ll also explain why the A-series of the preferred shares are getting close to the no-brainer status for income investors.

The Q1 results show how strong the company is performing

I will be rather brief about Textainer’s Q1 results. Not only because I will be zooming in on the preferred shares, but also because we are just a few weeks away from having a new batch of financial results.

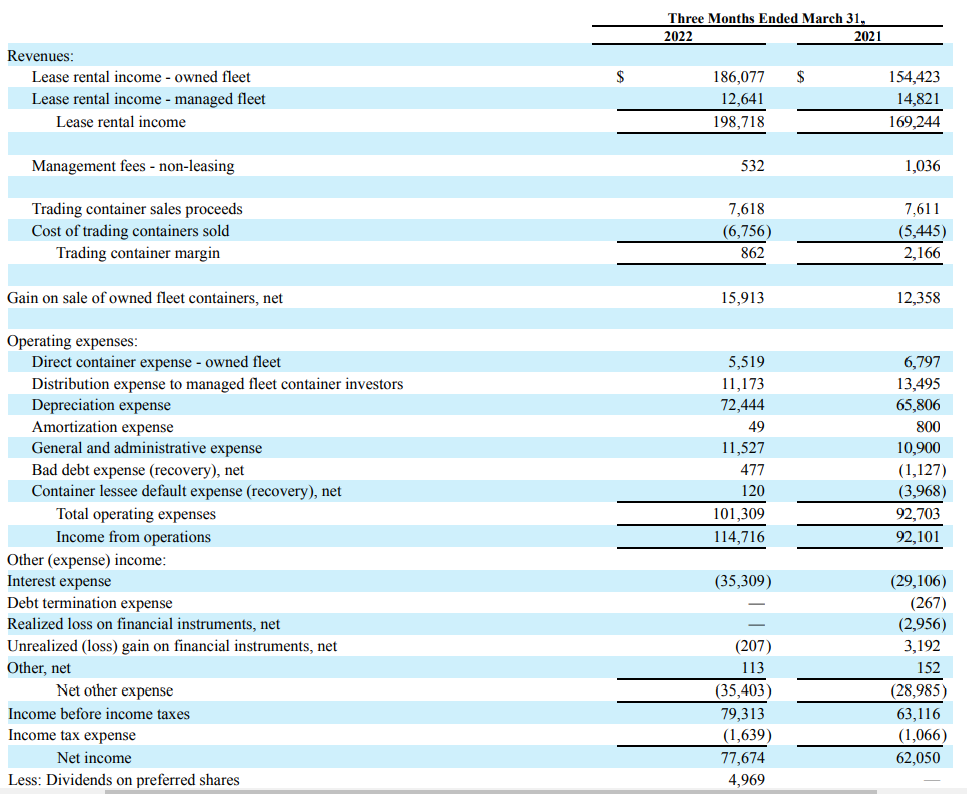

In the first quarter, Textainer reported a total rental income of $199M, an increase of almost 18% compared to the first quarter of last year thanks to the expansion of the container fleet. The operating income increased by almost a quarter thanks to that higher revenue and the increased gain on the sale of ‘old’ containers. That’s an important element as it confirms Textainer’s relatively aggressive depreciation schedule: containers are depreciated faster than their market values decrease. Of course, now the price of steel is decreasing the price of second-hand containers will go down as well. But in any case, it does show how strong the Textainer management is in deciding to ‘recycling’ the capital. And as the cash flow statement will show: the $16M in gain on the sale of containers was generated on proceeds of just under $30M. So the containers sold during the quarter were sold at almost twice the book value.

Textainer Investor Relations

The net income was $77.7M and after deducting the $5M in preferred dividends, the net income attributable to the common shareholders of Textainer was $72.7M or $1.50 per share. Keep in mind the EPS was based on the average share count of 48.4M but as Textainer has been aggressively buying back stock, the actual share count was just 48M shares as of the end of March.

Of interest is the fact that less than 7% of the net income has to be spent on covering the preferred dividends.

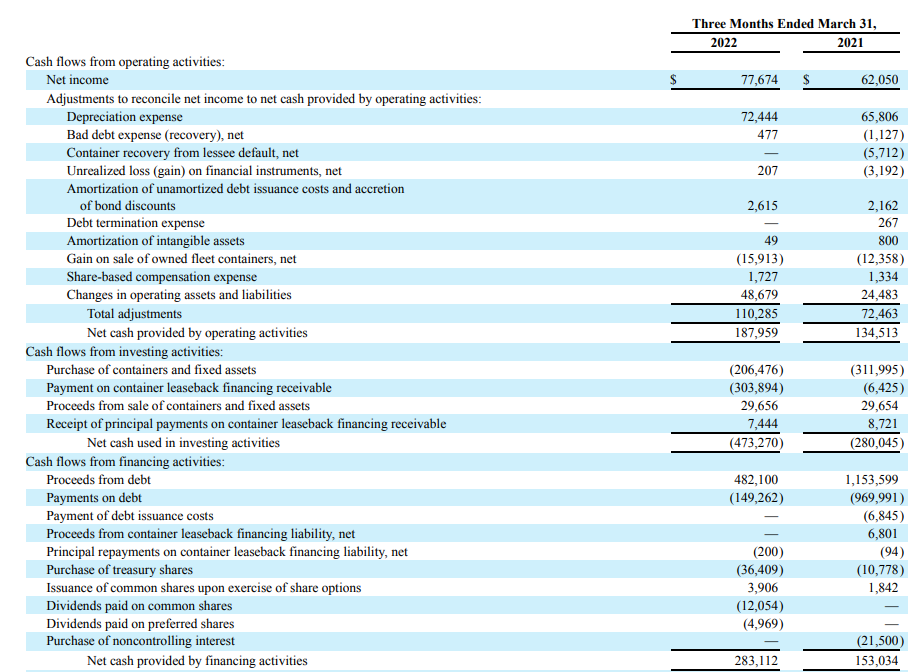

We see a similarly strong result in the cash flow statement. The adjusted operating cash flow was approximately $140M, and this excludes the gain on the sale of containers.

Textainer Investor Relations

Keep in mind, Textainer’s capital expenditures can easily be accelerated or reduced, as it is primarily in function of the demand for its containers. Virtually all of the containers it orders and takes delivery of already have a lessee before even placing the order, that’s why the utilization rate of the container fleet is exceptionally high at 99.7%.

Needless to say, the $510M investment in containers and even the $206M spent in capex (excluding leaseback financing funded containers) are much higher than what’s needed to keep the fleet at the same level. That’s not just a hollow statement: the capex was about three times higher than the depreciation expenses during the quarter. It’s very likely the capex will decrease sharply in the next few quarters as on the conference call, the management indicated the capex would normalize.

Income investors can no longer ignore the A-series of the preferred shares

I initially discussed the preferred share issue in this article, published in April 2021. This is what I wrote back then about the preferred shares which are currently trading with (TGH.PA) as ticker symbol.

The issue is cumulative, which means that if Textainer would skip the payment of a preferred dividend, it will have to make the owner of the preferred share whole: Payments can be delayed, but will have to be paid anyway. As mentioned above, the preferred share will have a 7% dividend yield which means the quarterly preferred dividend payments will be $0.4375. Should the issue remain limited to 6 million preferred shares, the preferred dividend will cost Textainer $1.75 X 6 million shares = $10.5M per year. After an initial five-year period (ending on June 15, 2026), the preferred shares can be called by Textainer. If that doesn’t happen, the preferred dividend will be reset to the five-year Treasury rate plus a mark up of 6.134%.

Back in 2021, the 5-year treasury yield was just under 0.90% which essentially meant that a reset at a similar treasury yield would continue to result in a 7% preferred dividend yield, so I didn’t care too much about the reset clause back then. That has now changed.

MarketWatch

As you are likely aware, the 5Y treasury rate has increased to in excess of 3%. Which means that if Textainer would not call the securities in 2026, it would be paying a preferred dividend of in excess of 9.1% based on the $25 principal value. If I would use the current yield of 3.03%, the preferred yield upon the reset in 2026 would come out at 9.17%, or $2.29/share. But as the preferred share series A is now trading at less than $24, the yield would actually exceed 9.5%.

The higher the 5Y treasury rate goes, the more likely it is Textainer will call these preferred securities (the B-series have a 6.25% fixed rate and are thus a much cheaper source of funding for Textainer).

This raises the question if we should look at TGH-A from another perspective: although these preferred shares are perpetual, the increased market rates make it more and more attractive for the company to call these securities. So rather than applying the current yield of 7.3% ($1.75 in annual preferred dividends divided by the current share price), perhaps a yield to call is more useful in this scenario. As we are about 4 years away from the call date, the yield to call is actually 8.2%.

Investment thesis

I have a long position in the common shares of Textainer as well as both series of preferred shares. Additionally, I have written some out-of-the-money options on Textainer’s common shares as well, so it is clear I am bullish on the name.

While Textainer is buying back its own shares and paying a dividend to the tune of $1/Share per year (paid in quarterly installments), income-oriented investors should definitely consider the company’s preferred shares Series A if you believe the 5-year treasury yield will remain above 1% in the foreseeable future. I believe this is a win/no lose scenario: either the company calls the securities in 2026 resulting in a YTC of 8.2%, or the preferred dividend will reset to a likely higher yield.

I will be adding to my Textainer preferred share A position but would also like to add to my common share position to get exposure to potential capital gains.

Be the first to comment