M. Suhail/iStock Editorial via Getty Images

Introduction

At the beginning of the month, I participated in the Seeking Alpha’s Top Pair Trade Thesis Competition. My suggestion, which can be read here, was to go long McDonald’s Corporation (NYSE:MCD) and short Texas Roadhouse, Inc. (NASDAQ:TXRH).

Now, after writing a follow-up on MCD’s recent earnings, I would like to do the same for TXRH, whose Q2 earnings have just been reported. I would like to keep on covering the company to see where it is heading towards.

Here is a quick summary of why I saw TXRH as weaker than MCD in the current economic context.

- Although belonging to the same industry, the two stocks have a low correlation, thus offering a pair trade opportunity.

- 93% of MCD’s restaurants are franchised and pay annual fees to the company, making its revenue more stable and predictable. TXRH runs directly more than half of its restaurants.

- With high commodity prices, MCD has a better bargain power due to its size and its control over the supply chain. Moreover, beef price is increasing dramatically, damaging more TXRH than MCD.

- MCD’s average ticket is estimated to be less than half TXRH’s. In case of a recession it will attract more customers who choose to move down from costlier meals to more affordable ones.

- TXRH is known for its conservative balance sheet. However, MCD’s financials show a mature company that, while keeping its top line stable, has been able to increase its margins to great extent (at the end of 2021 net margins were at 33%, a result that we usually find in the luxury industry). TXRH doesn’t have a similar marginality and can thus suffer more from a double hit coming from inflationary pressure and customer’s reduced spending. MCD’s debt is far bigger than TXRH’s, but 95% of it is fixed-rated at an average annual interest of 3.2%. Thus, while TXRH is still focused on growth and expanding its business, MCD has all the characteristics to be a safe haven during times of volatility and economic downturns.

Now, don’t get me wrong. I am personally a fan of TXRH and enjoy the company. My thesis was simply that a month ago it was not the right stock to be invested in. Actually, to be fair, in my article I also suggested that this pair trade was particularly effective in the early stages of a recession. However, it could also be reversed as the first signs of a recovery appear, which, historically, have been periods where TXRH has outperformed MCD.

In a month, my long thesis on MCD is still confirmed, although it has weakened a bit for two reasons: MCD’s price has gone up a bit, reducing the possible upside; MCD reported earnings that were somewhat mixed: guest count decreased and net operating margin did too, coming in at 37.7% instead of 45.7%. As long as this contraction is only temporary, we can still give MCD its current multiples, but in case we see this trend for another 3-6 months, MCD will have to be rerated.

TXRH Q2 Update

Let’s get to the main purpose of this article: TXRH’s Q2 earnings report.

I was particularly curious to see how two aspects of the business were doing: comparable sales and management of beef price due to its impact on margins.

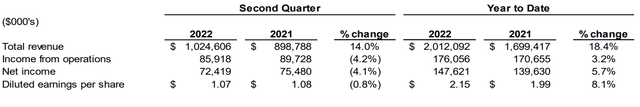

First of all, let’s take a look at the main numbers for the quarter and YtD.

This was the first $1 billion quarter for the company, a 14% increase in revenue YoY. Consequently, it is also the first half to reach a revenue of $2 billion. Keep in mind that in 2016 the company’s revenue for the full year was just shy of $2 billion. This is to have a grasp of TXRH’s growth, which is really pleasant for investors to see. However, if we move down from the top line, we see that TXRH witnessed a margin contraction: income from operations for the quarter was down 4.2% YoY and net income was down YoY by 4.1%. If we zoom out and look at the first six months, we see that the company was overall positive in these two items, with the first growing by 3.2% and the second by 5.7%. What does this mean? While Q1 was positive, TXRH was indeed somewhat hampered during Q2.

Comparable sales

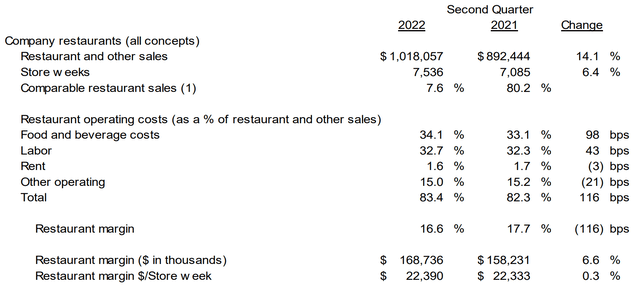

If we dig a little bit deeper into the numbers shown above, we can see that the company reported a 116 bps decrease in restaurant margin that was 16.6% vs. 17.7% YoY.

Comparable restaurant sales did increase by 7.6%. However, commodity inflation was 11.8% for the quarter (14.4% YtD) so it was not offset by the comparable sales increase. The impact on the operating costs is visible with a 1.1% increase on total sales.

What drove comparable sales growth? This is one of the main aspects to pay attention to. In fact, there are two possible drivers: price increases and guest traffic. Restaurants have to balance between these two in order to pass on inflationary pressure while keeping customers.

Tonya Robinson, TXRH’s CFO, explained that this time:

comparable restaurant sales increased 7.6% driven by 8.4% average check growth, while guest traffic declined 0.8% overall, dining room traffic was up 3.8%. Check growth includes positive mix of 1% driven by year-over-year improvement and the percentage of guests choosing a dine-in as well as all guests continuing to order higher-priced entrees

These words cause me a little concern: the company was able to increase prices, even though not at pace with inflation. However, overall traffic didn’t increase, meaning that they might have a temporary drawdown in customer retention. The CFO also reported some numbers that seem to outline a temporary slow down for TXRH:

By month, comparable sales grew 8.7%, 9.6% and 5.2% for our April, May and June periods, respectively. And comparable sales for the first four weeks of the third quarter were at 3.9% as compared to the same period in 2021. While the comp percentages softened in June and July, we believe this is more a function of the guest count trends that we are lacking from last year, rather than a significant change in the level of sequential guest demand this year.

Whether weakening sales are due to seasonality or consumer choice is still debated. Q3 will show the truth, as schools reopen and people get back to their usual routine.

I think it is pretty easy to see a softening of growth (which is, in any case, growth), even though the company states that this is due to the particular environment we’ve see in the past two years. Thus, the company will have to address a problem for which there seems no way out without hurting a bit its results: if it increases prices to offset inflation it may speed up the process of demand softening; if it doesn’t in order to focus on customer retention it will lose further margins. True, TXRH’s value proposition is not only about pricing and the company’s management always stresses the fact that to dine at TXRH is an experience. However, pricing may be a factor that customers will pay more attention to in the upcoming months. However, Tonya Robinson revealed where TXRH is leaning to:

we still believe in the philosophy that commodity inflation is cyclical and commodity costs are cyclical. So, while you – we are feeling some significant inflation right now that cycle at some point will turn. And so that philosophy hasn’t changed and you know that just means we may take it on the chin a little bit more during that short-term cycle and count on the guests being loyal and coming back to us and that’s what we’ve done in the past and it’s really benefited us so.

I think this, over the long-term, is the right choice. A company with a solid balance sheet can indeed take part of the hit in order to preserve its relationship with its customers. Seen in this way, the higher cost is actually a marketing expense. However, investors will probably see some quarters of weaker reports which may cause the stock to go through some volatility.

A further reason why I think TXRH should be cautious with its October pricing is that a little warning sign is coming from a little softness the company reported on alcoholic beverages and some appetizers, pointing out that consumers are starting to be a little bit more careful about check management.

Beef price

Let’s get to the main theme of the earnings call: beef price. Indeed, there has been a little beef deflation during the quarter, as reported both by Tonya Robinson and Jerry Morgan, the company’s CEO. However, the company is not confident that this trend can continue and didn’t give an outlook for this commodity. It was reported that TXRH locked in 70% of beef prices in Q3, but only 30% in Q4 and Tonya Robinson did warn about possible pressure later on this year:

we’re hearing about beef supply, potential issues on beef cattle supply, how farmers are taking a lot of capital to feedlots right now and things like that. We’re kind of expecting there could be some pressure maybe later on in Q4. We do have a little bit of beef deflation in Q3. But we expect that to kind of flip back around in Q4.

TXRH was particularly hit by ribeye increase, a cut the company can’t go without as it is so linked to its brand image. The company started seeing big increases during the second half of 2021, so as it laps that moment there should be a certain easing in comparables regarding this cost.

Shareholder return

TXRH is known for its focus on a conservative balance sheet. In order to protect it, it was quick to suspend its dividend during the pandemic, to resume paying it as soon as the unwinding events enabled it to understand how to operate. It was also quick to raise it catching up with its long streak of growing dividends. One of the things I appreciated the most about the earnings report is that the company took advantage of its depressed price to repurchase shares of common stock at a fast pace. Usually, companies execute buybacks at high prices. TXRH did the opposite, thus really increasing shareholder’s equity in the company and creating value for them. During the past quarter the company repurchased 1,673,387 shares of common stock for $128.2 million. During the first six months of the year, the total number of repurchased shares is now 2,734,005 for a total of $212.9 million. This combined average repurchased share price of $77.87, is $10 less than the current market valuation. This was a smart move from TXRH’s management and Tonya Robinson spent these words on it:

we saw it was just some opportunity earlier in the quarter to really take advantage of what was going on in the markets. And we had some excess cash […] and we felt very comfortable bringing our cash balance down.

This choice made the company end with a decrease of $145 million in cash from Q1. Cash flow from operations was $111 million, but to the $60 million in capex and taxes the company added another $31 million of dividend payments, $25 million of debt repayment, and the already mentioned $128 million of share repurchases. At the moment, as said before, I don’t see it a problem for the company to be cash flow negative, given the use of its cash and it solid balance sheet. But if pressure on margins keeps up, then we could probably see a reduction in buybacks which do help in supporting share price.

Valuation

Although I liked some parts of the report, especially the ones that show TXRH’s business culture focused on customers and shareholders, I still see headwinds in the upcoming months. Free cash flow will decrease and we could actually see another negative quarter.

The discounted cash flow model I used in my previous article is still valid and I do think the company may still be hampered a bit. This is why I think that the current fair price is in the 50s. However, I think investors should put this stock on their watchlist and be ready to reverse a short position into a long one as soon as the company shows signs of taking a hit while preparing to exit from the more and more likely recession. Since the beginning of the month, the news U.S. GDP was negative for the second quarter in a row offers one of the developments my original pair trade thesis was waiting for before being reversed. More aggressive investors may still go short on the stock, more cautions one might now just wait on the sidelines before jumping in. I would be interested to read in the comment section opinions on this double possibility, as it is always of great interest to discuss with our investing community.

Conclusion

Though TXRH is a great company, I don’t see this the right moment to initiate a position. Long-term investors who have owned the stock for some time should just do fine as they weather these quarters. However, those who don’t own the stock will probably seize a better opportunity down the road as the economy slows down a bit and the company decides to take a hit in order to preserve customer loyalty.

Be the first to comment