imaginima/E+ via Getty Images

Texas Pacific Land Corp. (NYSE:TPL) stock performance, since I wrote about last year, has been very disappointing given that energy prices have soared. The transformation from a trust to a corporation did not really benefit investors very much. I sold my remaining shares recently after doing a more detailed research on their major shareholder – Horizon Kinetics.

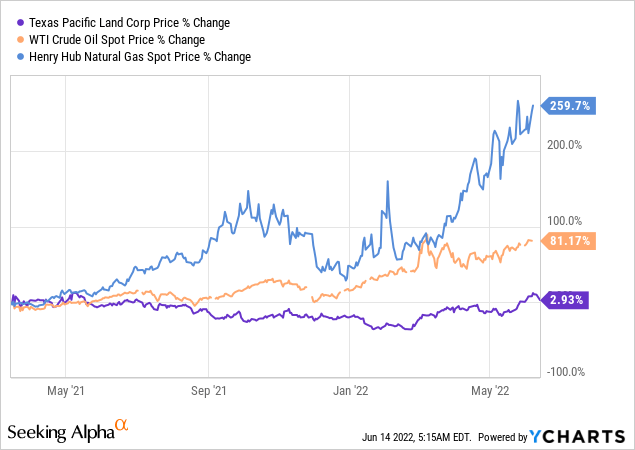

TPL Stock Performance Compared to Energy Prices

In my March 16, 2021 article on TPL, I stated that I had just sold almost all my TPL shares because the current price did not offer a margin of safety. The stock price had risen sharply in anticipation of the number of potential benefits from transforming to a corporation from a trust. TPL was, in theory, an excellent vehicle to take advantage of potential higher energy prices because the new corporation did not have any hedges. While the stock price has risen sharply the last few months in 2022 as energy prices soared, it has performed poorly since May 2021 as issues associated with company had a negative impact on investor’s earlier enthusiasm for the company’s future.

Price % Changes Since 3/15/21 TPL, WTI, Natural Gas

As a corporation they can now hedge their positions, whereas when they were a trust, they were not allowed to hedge. So far, they have not announced any hedges, but it might be prudent to hedge at least part of their expected future oil and natural gas royalties given the current very high prices, in my opinion.

Changing From a Trust to a Corporation

Investors were expecting a potential large number of benefits by changing from a trust to a corporation in early 2021. The change from a trust to a corporation did enable TPL to become part of the Russell 3000 because trusts are not included in indexes, but that was really the only positive development. They did not have a stock split, which I was hoping for because it would most likely increase trading liquidity.

I was also expecting that having a board of directors would add depth to management of the corporation. I was wrong. The board, in my opinion, has been a negative. One board member, Dana McGinnis, was actually voted off the board at their last annual shareholder meeting because he did not get enough votes by shareholders (49.09%) and there wasn’t even a proxy fight. A number of the directors did not even own a share of TPL stock when they were elected to the board. What? They are on the board without any of their own money invested in TPL but were being paid over $200,000 annual retainer fees. They each now own at least a token number of shares.

They have not borrowed any money yet, which they are allowed to do as a corporation but not as a trust. It is debatable if it is a plus or minus for shareholders to increase financial leverage. TPL also has not made any major acquisitions as a corporation.

The dividend, which was recently increased to $3 per quarter, was not impacted by transforming to a corporation. They are also paying a special $20 dividend. I personally wished they would have paid a higher special dividend instead of authorizing $100 million in share repurchases earlier this year, which would have resulted in an additional $12.90 per share dividend.

TPL’s accounting firm was replaced in 2021. It seems that over a number of years before the accountants were changed, there were depletion miscalculations, which are currently under review for the impact on prior year filed income tax returns. The new accounting firm, Deloitte & Touche, is a much larger and very respectable accounting firm.

Impact of Horizon Kinetics

Before when TPL was a trust, there were only three trustees, and they did not have your typical annual voting on these individuals that happens with corporations and a board of directors. The trustees served for life. Now Horizon Kinetics can have a significant influence on who is on the board and on company policy in general because Horizon beneficially owns an aggregate of 1,798,184 shares (23.2%). (Note: the latest proxy has the ownership lower, but that number excluded “shares held by other portfolio managers and other employees of Horizon personally”.) Using the total number of TPL shares actually voted at the last shareholder meeting of 59.43%, Horizon’s effective voting power was 39% and was enough to vote out a director. Another major holder, Soft Vest L.P., owns 4.8% and also has a board seat. Effectively these two groups collectively “control” TPL. (They also worked together in the 2019 proxy fight.)

It is, therefore, critical for TPL shareholders to understand Horizon. Oddly enough, Horizon frequently writes their own TPL reports, as fund managers, that are published on Seeking Alpha’s website. We are, therefore, able to get some insight into their TPL investment analysis from these published reports.

When I spoke to Horizon, they do not consider their position to be a “controlling” position. When I use the word “control” I am not using the exact legal definition. They did acknowledge, however, that they could impact any major issues, such as acquisitions. (Horizon’s TPL trades for 2017-19 are available here.)

I Have a number of problems with Horizon. First, TPL is the largest holding, even over 50%, or a very large holding in their various funds that they manage. What happens if a lot of investors decide, for whatever reason, to withdraw money from the funds, even if that specific fund has a large cash position? Will Horizon sell stocks across the board in the respective funds, or will they mostly reduce their largest holding – TPL? This could have a major negative impact on TPL stock price.

Second, there seems to be some inconsistencies with Horizon. A Horizon fund is called “Internet Fund”. This internet fund’s second largest holding is TPL, which accounts for 14.2% of the fund’s assets. How is TPL an internet company? Even if TPL was technically allowed to be purchased in that fund, why was it bought in an internet fund? I also have issues with Horizon holding TPL in their “Small Cap” fund. TPL’s capitalization is over $12 billion, which I would not consider “small”.

Third and most important, I am very uncomfortable with Horizon asserting their strong support of the recently announced cryptocurrency mining alliance with Marathon Digital Holdings (MARA) in their June 6 Seeking Alpha report. If they think that this a proper direction for TPL to head, I want nothing to do with TPL because I am strongly anti-cryptocurrency. Horizon, for example, also has extensive holdings of Grayscale Bitcoin Trust (OTC:GBTC). Many investors own TPL for oil and gas reasons – not because they want to be trading a cryptocurrency company. While the current impact might be very modest, it does indicate a mindset at Horizon that I am not comfortable putting my money with – so I sold my remaining TPL shares.

Oil and Gas Results

Often oil and gas company investors are able to get a large amount of data and metrics about reserves and future drilling plans, but TPL is not a production company – it only holds royalty interests. (It also has other business segments, such as water, which are beyond the scope of this article.) I was hoping to get at least a modest increase in the amount of metrics reported after it became a corporation with more active management, but I was disappointed. Their data included in their SEC filing was still general to the Permian Basin and not specific to their royalty interests.

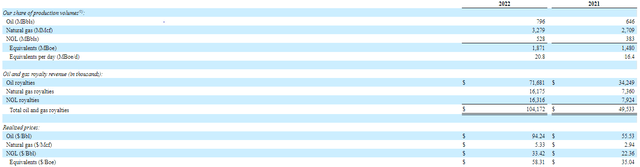

First Quarter Results

First Quarter Results (sec.gov)

I like to use approved drilling permits as a general indicator of future drilling and potential production. Since TPL does not include this in their filings, investors should consider using Texas Railroad Commission’s website. You can get approved drilling permits for each month for each county. This data is further broken down to specific energy companies. The problem, of course, is that we can’t determine if the permits were for the specific areas in the county where TPL holds a royalty interest. The numbers do give a general sense of potential drilling, but I mostly use the numbers on the negative side. If the permit numbers are low and the trend is negative, it does indicate limited future drilling in the entire county, including the TPL area. The reverse may not be correct because we can’t accurately determine if the high number permits are in fact in areas where TPL holds royalty interests.

The 2022 numbers for Culberson County continue to be disappointing. This county is very important because it accounts for 30% of TPL’s 1/16th royalty interest acres. Only 64 drilling permits were approved for the county so far this year compared to a total of 124 in 2021. (Culberson County is mostly gas and only limited oil.) This contrasts to Midland County that had 365 approved, but Midland accounts for only 3.5% of TPL’s 1/16th royalty interest and 15% of their 1/128th royalty interest. We do not, however, know the number of permits in Midland that would actually impact TPL. Reeves County had 286 permits, and this is also a very important county for TPL because it accounts for 31% of 1/16th royalty interests and 3.5% of 1/128th royalty interests. (Reeves County is more gas than oil.) The Reeves County numbers are especially encouraging because the 286 permits so far in 2022 compares to a total of 334 in all of 2021. Again, we are not sure if these approvals in Reeves County actually impact TPL.

Conclusion

Because TPL already soared in February and March 2021, it was not the right horse to be on after May 2021 as energy prices dramatically ran up. Their transformation from a trust to a corporation has not been as beneficial to shareholders as many investors were hoping.

Because I have some issues, especially their strong support of cryptocurrency mining, with their largest shareholder, Horizon Kinetics, I sold my remaining TPL shares. While I think there still is potential for higher revenue from oil and natural gas royalties, there are very strong headwinds against fossil fuels. I am, therefore, maintaining my neutral/hold recommendation for TPL.

(This article was not an attempt to be a complete coverage of Texas Pacific Land Corp., I only covered a few important issues, which is how I almost always write on Seeking Alpha.)

Be the first to comment