Sundry Photography

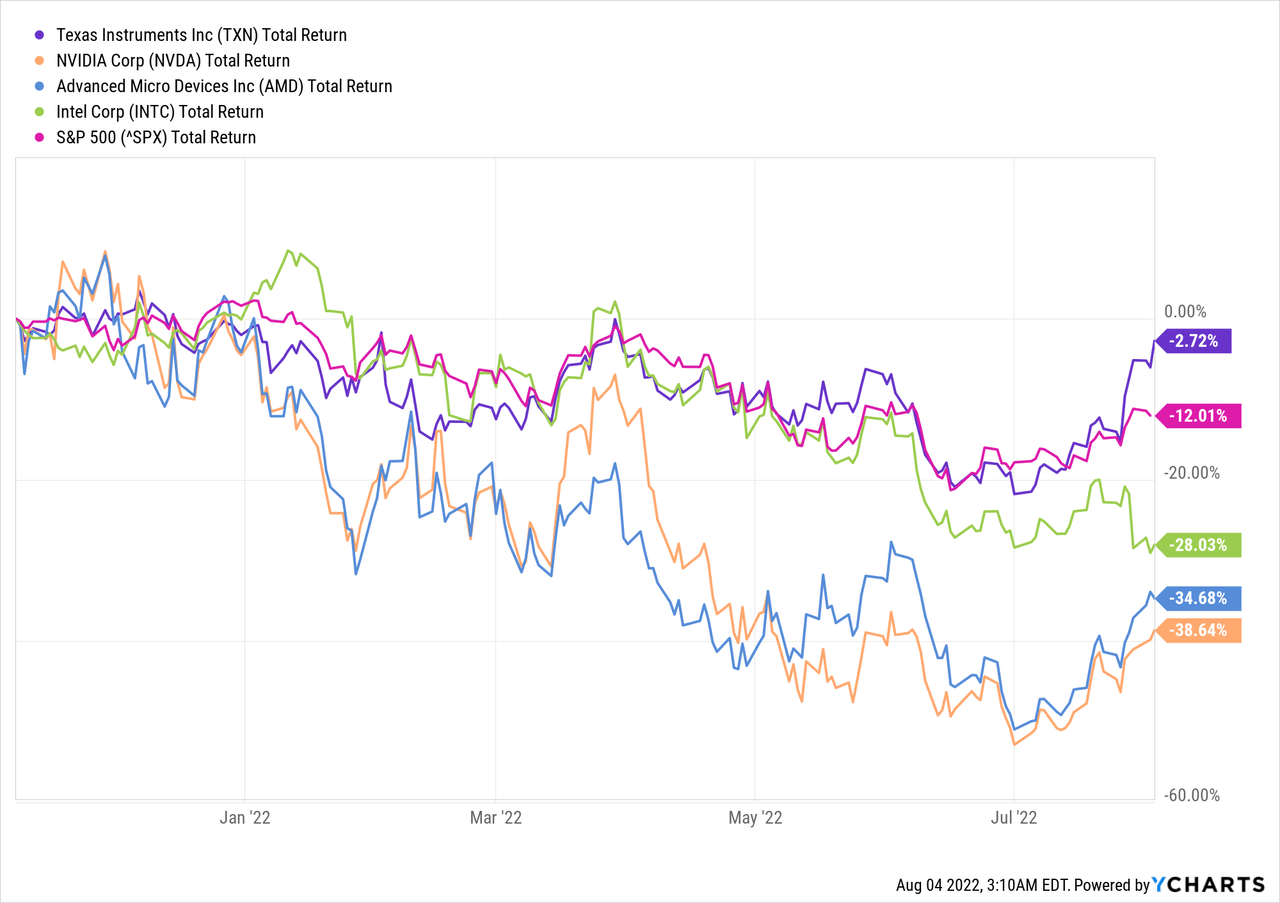

Equity investments in the semiconductors space have been a total disaster in recent months as expectations of a recession materialized and monetary tightening took its toll on high growth and momentum stocks. That is why the high-flyers, such as AMD (AMD) and Nvidia (NVDA) were hit the hardest while at the same time even value plays like Intel (INTC) were not spared (see graph below).

However, back in November 2021 (the starting date of the graph above), I showed why remaining focused on a long-term strategy could be a major competitive advantage in an industry obsessed with quarterly results.

More specifically, Texas Instruments (NASDAQ:TXN) had all of the signs of an attractive long-term investment, even as risks in the semiconductors were mounting. That is why a negative 3% total return during the past nine months is spectacular, considering how other companies in the sector and the equity market as a whole performed during the same period.

Most recent results were also a testament that Texas Instruments’ strategy is working and showed that the company is moving in the right direction. These quarterly results, however, should be reviewed with the long-term strategy in mind, or otherwise, they could easily lead to wrong conclusions.

Performance During Cycle Peaks

For anyone who judges equity investments based on their short-term results, the most recent quarter of TXN would have been a surprise. Such an investor would most likely suddenly turn extremely bullish on the company or would ascribe the performance to luck and transitional outside factors.

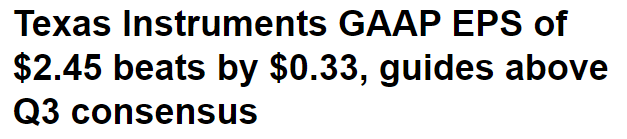

Seeking Alpha

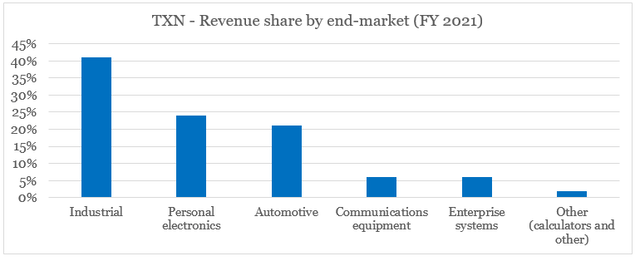

Indeed, as all other peers in the sector and especially those in the analog integrated circuits market, Texas Instruments is largely riding the wave of robust semiconductors demand from a number of large markets. These industry tailwinds are what usually make short-term performance of high-quality businesses indistinguishable from that of other peers (see below).

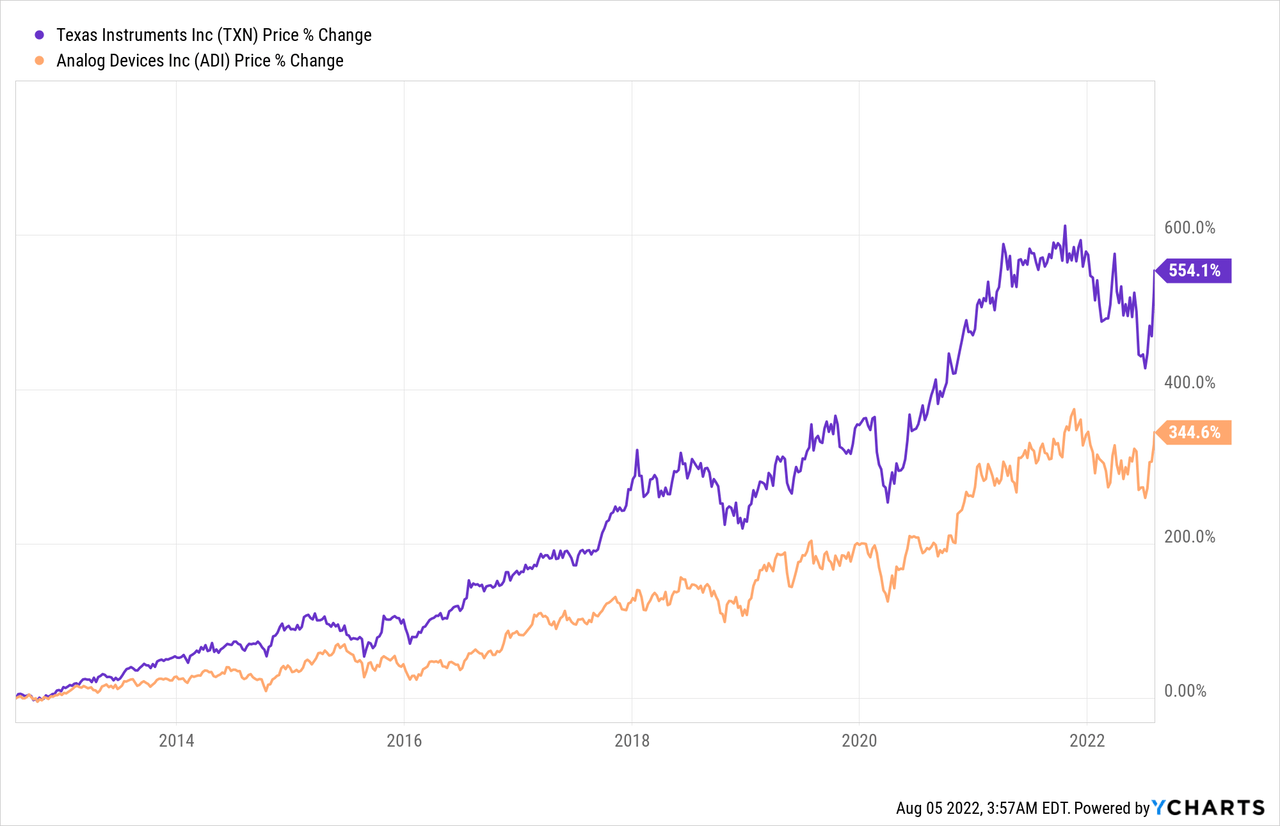

Over longer periods of time, however, companies with strong competitive advantages, well-thought-out long-term strategies and competent management are almost always a better choice.

The overall industry tailwinds remained strong during the first half of 2022, with TXN Q2 results showing strong growth across all markets, except personal electronics.

The industrial market was up high-single digits and the automotive market was up more than 20%. We saw weakness throughout the quarter in personal electronics, which grew low-single digits. Next, communications equipment was up about 25%. Finally, enterprise systems was up mid-teens.

Source: Texas Instruments Q2 2022 Earnings Transcript

While personal electronics is a major component of the company’s revenue mix, growth in all other segments was more than enough to offset the slowdown.

Prepared by the author, using data from SEC Filings

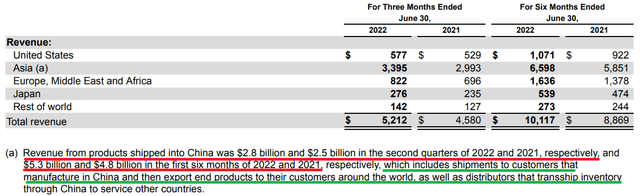

On a geographical basis, revenue performance was also strong across the board, with China remaining the key growth driver for TXN even as demand was impacted by lockdowns.

Texas Instruments Q2 2022 10-Q SEC Filing

Even though the significant exposure to China is a source of major political risk for Texas Instruments, a large proportion of these sales are for products meant for export as well as for distributors located in the country.

The High Quality Business Model

While quarterly revenue growth is largely driven by outside factors, TXN’s major differentiating factor from its peers is the company’s highly profitable business model that allows management to grow organically as opposed to costly M&A deals.

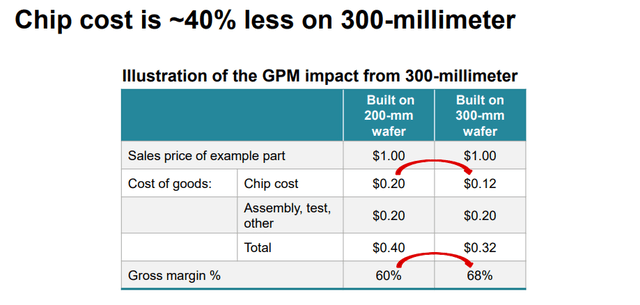

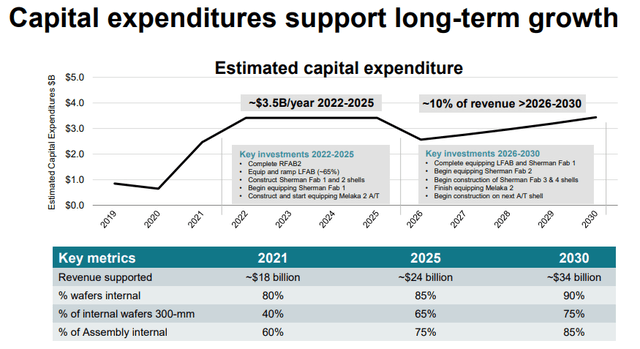

As a result, TXN continues to expand its 300mm wafer capacity and thus is in a better position to retain its industry-leading margins.

Texas Instruments Investor Presentation

For the past year alone, TXN gross profit margin improved by as much as 240 basis points.

Gross profit in the quarter was $3.6 billion or 70% of revenue. From a year ago, gross profit margin increased 240 basis points.

Source: Texas Instruments Q2 2022 Earnings Transcript

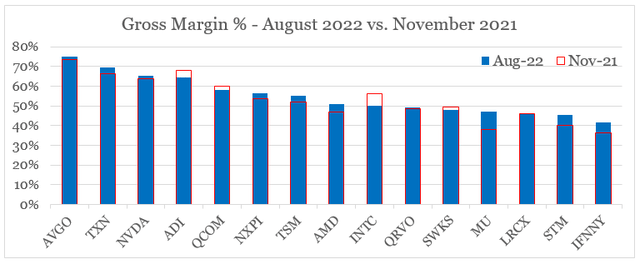

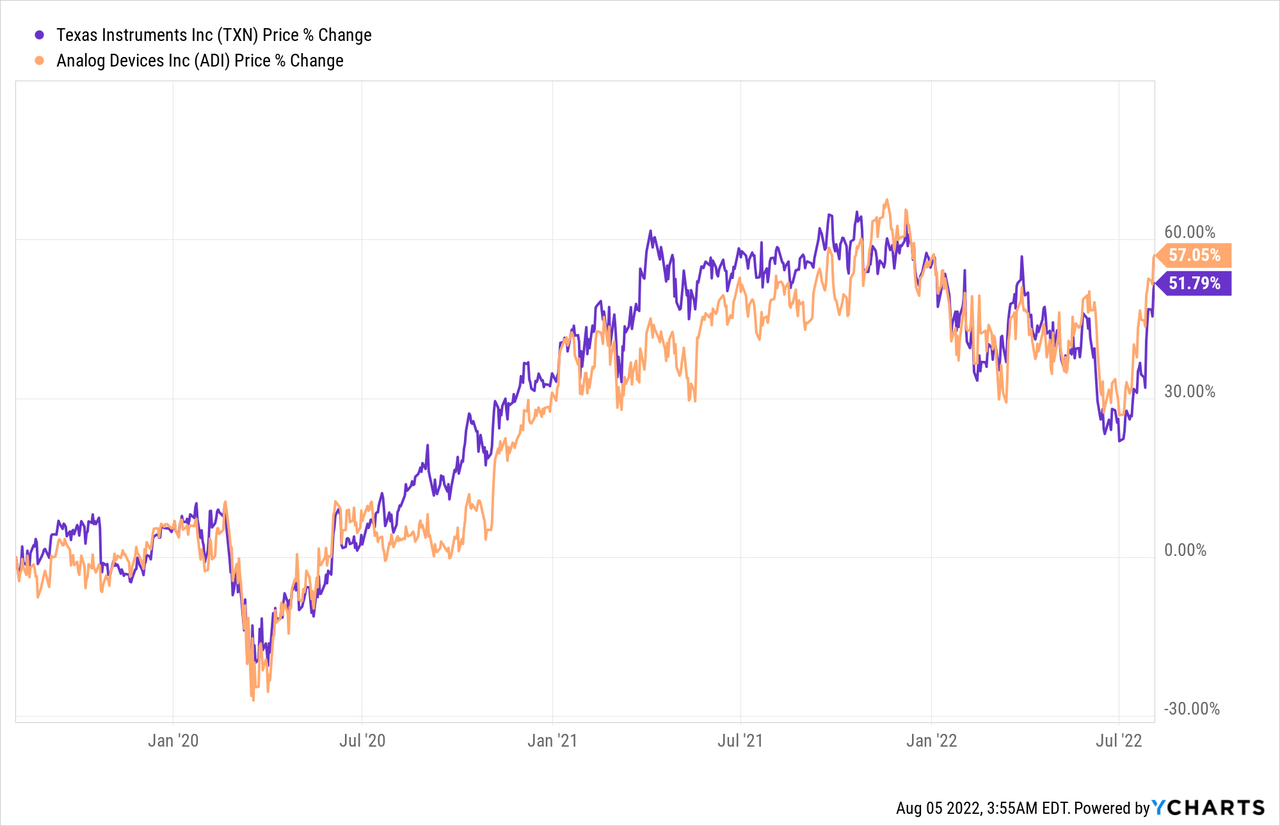

That is why TXN is not only one of the most profitable semiconductor companies, but contrary to its major peer – Analog Devices (ADI), has also managed to increase its gross margin since I first covered the company in November of last year.

Prepared by the author, using data from Seeking Alpha

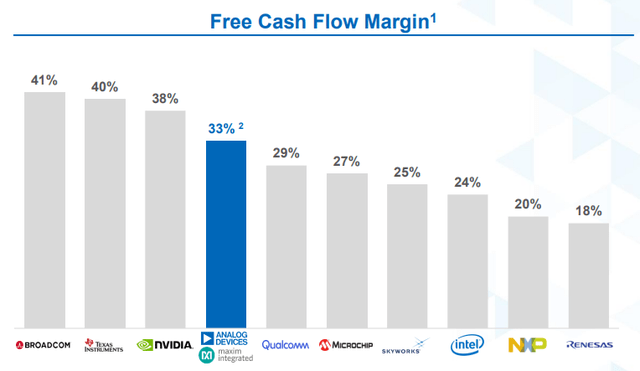

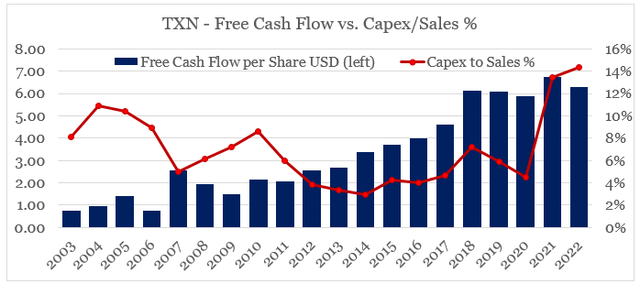

High gross margin profitability also translates into high free cash flow, in spite of the fact that TXN now spends significantly higher amounts on capex in order to expand its manufacturing capacity (more on that later).

Analog Devices Investor Presentation

As we look at the graph above, we should not forget that Nvidia and Broadcom (AVGO) are semiconductor designers and are not as capital intensive as integrated device manufacturers like Texas Instruments. Therefore, as the latter dials up its capital expenditure in the coming years, profitability is likely to come under pressure, but this is by no means a sign of weakness.

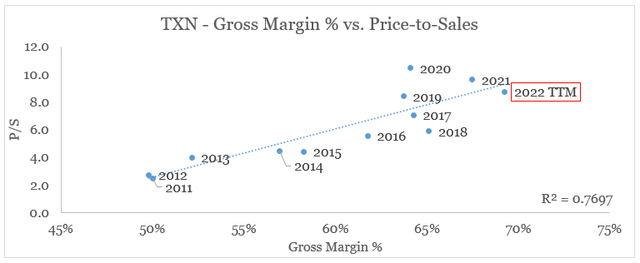

Having said all that, the market is already pricing-in some decline in TXN margins as we see from the graph below, where we plot historical gross margins on the x-axis and price-to-sales multiples on y-axis.

Prepared by the author, using data from SEC Filings and Seeking Alpha

Although this makes sense from a short to medium-term point of view, for long-term oriented shareholders the market is punishing TXN with a lower sales multiple due to temporary margin headwinds associated with TXN strengthening its long-term competitive positioning.

The Benefits Of Conservative Capital Allocation

Turning to capital allocation, again an investor with a short-term horizon could be worried that during the last quarter TXN generated roughly $1.2bn of free cash flow and paid $1.1bn in dividends and $1.2bn in share buybacks.

Cash flow from operations was $1.8 billion in the quarter. Capital expenditures were $597 million in the quarter and $2.8 billion over the last 12 months. Free cash flow on a trailing 12-month basis was $5.9 billion.

In the quarter, we paid $1.1 billion in dividends and repurchased $1.2 billion of our stock.

Source: Texas Instruments Q2 2022 Earnings Transcript

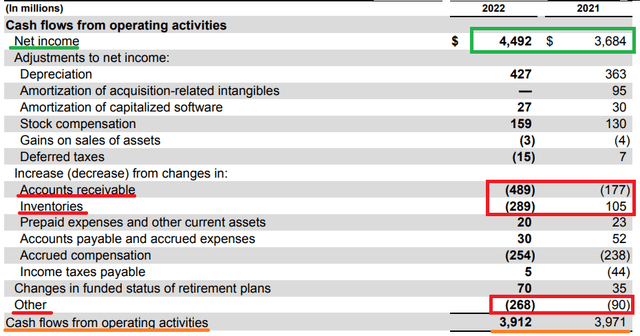

To begin with, in recent months, TXN free cash flow experienced a major headwind in the form of higher working capital requirements.

Texas Instruments Q2 2022 10-Q SEC Filing

The impact, however, is likely to be short-lived as it was largely driven by one-off events during the last quarter.

Accounts receivable for this quarter ended at $2.2 billion, up from $1.6 billion a year ago. This increase primarily reflects the higher proportion of shipments made near the end of the quarter, as COVID-19 restrictions were lifted in China and customers began pulling product.

Source: Texas Instruments Q2 2022 Earnings Transcript

Higher capital expenditure is yet another major driver of TXN’s lower free cash flow. The current rate of investment in manufacturing capacity is unprecedented on a historical basis, with Capex to Sales ratio now standing above 14%.

Prepared by the author, using data from SEC Filings and Seeking Alpha

Unfortunately for anyone expecting a quick turnaround, however, this high level of capital expenditure is expected to persist through the coming years as TXN increases the share of 300mm internal wafers and overall internal assembly processes.

Texas Instruments Investor Presentation

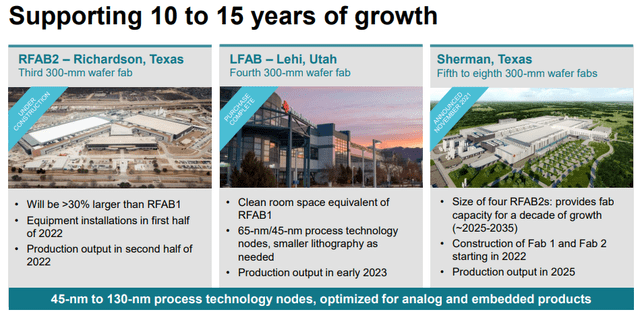

In recent months, work has begun on the Sherman manufacturing complex, which is expected to be producing 300mm wafers in 2025, while the factories in Richardson and Lehi are getting ready for production.

We broke ground on the Sherman manufacturing complex in May and work continues at RFAB2 and LFAB to prepare for production output.

Source: Texas Instruments Q2 2022 Earnings Transcript

Texas Instruments Investor Presentation

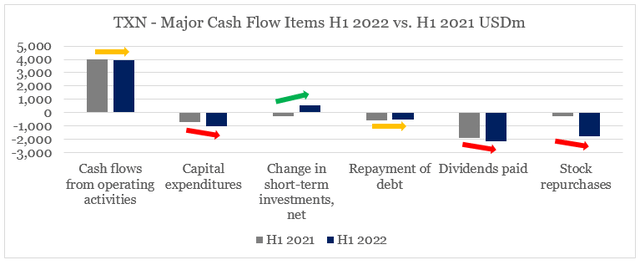

By comparing all major cash flow items for the first half of 2022 to H1 2021, we could see that the Capex, dividends and share buybacks all increased, while TXN continued to pay down debt.

Prepared by the author, using data from SEC Filings

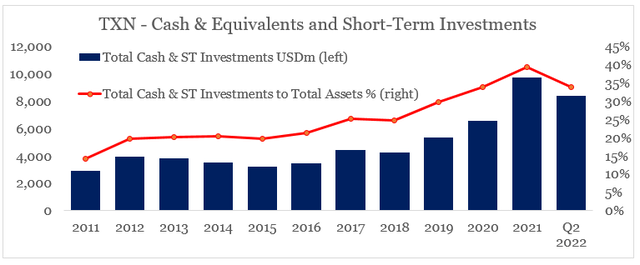

This was possible due to the company’s large amount of cash and cash equivalents and short-term investments. Since 2016, TXN management has significantly increased the size of cash and short-term investments, both on an absolute basis and as a share of total assets.

Prepared by the author, using data from SEC Filings

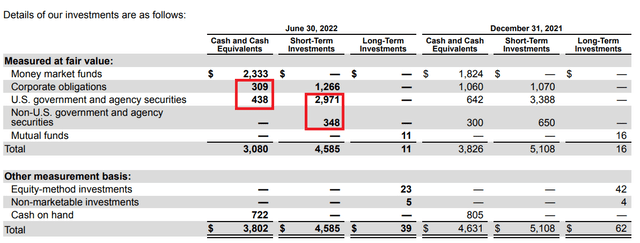

During the first half of this year, the company sold a large portion of its U.S. government and agency securities as well as corporate obligations and other non-U.S. government securities.

Texas Instruments Q2 2022 10-Q SEC Filing

In a nutshell, the conservative capital allocation in recent years, now allows the company to internally finance its ambitious growth program while also not sacrificing shareholder payments. All that might not be obvious by focusing on the company’s quarterly results, but it’s a major driver of shareholder returns over the long run.

Conclusion

Texas Instruments continues to enjoy robust demand and industry-wide tailwinds. Even though the most recent quarterly results were strong, they could lead to wrong conclusions unless they are reviewed within the context of the long-term strategy. Gross margins are at multi-decade highs, and valuation multiples reflect a potential drop in profitability. Free cash flow headwinds persist, however, TXN’s ambitious growth program will further solidify the company’s competitive advantages and reduce reliance on third-party manufacturers at a time of supply chain disruptions and a world faced with deglobalization.

Be the first to comment