JHVEPhoto/iStock Editorial via Getty Images

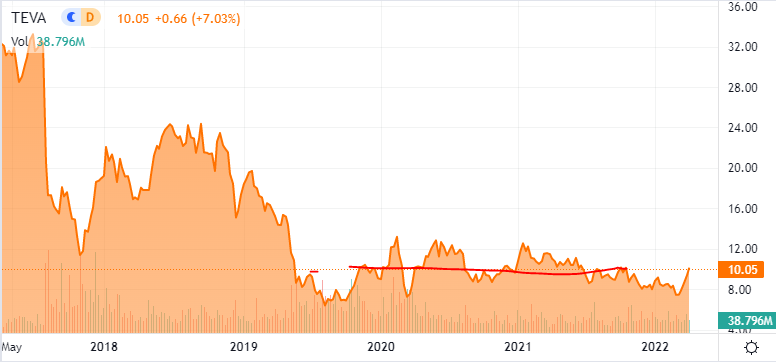

Shortly after investors capitulated and sold shares of Teva Pharmaceutical (NYSE:TEVA) to a $7.24 low in March, shares rebounded. TEVA stock traded recently at a $10 level not seen since last October 2021. Every time the generic drug giant looked like it would hold the double-digit stock price, sellers would emerge.

Why might Teva hold the $10 support level and rally from here? There are three reasons to consider buying Teva.

1. Analyst Upgrades

On April 5, Teva earned at least one analyst upgrade. Barclays cited the drug company’s Humira biosimilar as a positive revenue catalyst. The analyst raised the price target by a modest $2.00 to $13.00.

At a health care presentation, AbbVie (ABBV), which closed at another high, is planning for Humira’s patent expiration. Robert Michael, AbbVie’s Vice Chairman, Finance & Commercial Operations & CFO, said the company expects a vibrant recovery for Humira sales in 2025. The company is not concerned about 2022 as a peak year of sales for Humira. The drug will approach $22 million in revenue. AbbVie will offset a potential drop-off in sales with Skyrizi and Rinvoq.

Despite new highs, investors should still consider ABBV stock as a dividend champ. And although AbbVie shares are enjoying a long-term uptrend, Teva’s chart does not look promising. Below, TEVA stock broke down below $10.00. After each attempt to break out, sellers emerged:

Teva stock chart (Seeking Alpha)

Teva investors should consider the Humira biosimilar as an eventual driver for revenue growth. It partnered with Alvotech to commercialize five biosimilar candidates in August 2020. The firms delayed meeting the $35 billion in sales in the United States. The pandemic temporarily delayed their progress. Now that the government is adopting a living with Covid policy, Teva’s growth promise improves.

2. Opioid Settlement

Uncertainties clouding Teva’s prospects cleared following the Florida settlement. Teva will pay Florida a manageable $177.11 million over 15 years. Florida will also get Narcan, a life-saving medicine generic, worth $84 million over the next decade. Importantly, the settlement is not an admission of any liability or wrongdoing. Furthermore, it will defend itself in states where it has not yet settled.

The Florida settlement sets a potential precedent. Investors may infer that other states will settle on a similarly sized amount. Previously, it settled with Texas, agreeing to pay $150 million over 15 years. It also agreed to supply $75 million of generic Narcan spray at wholesale cost. In Louisiana, Teva agreed to pay $15 million over 18 years, plus $3 million in generic Suboxone at WAC.

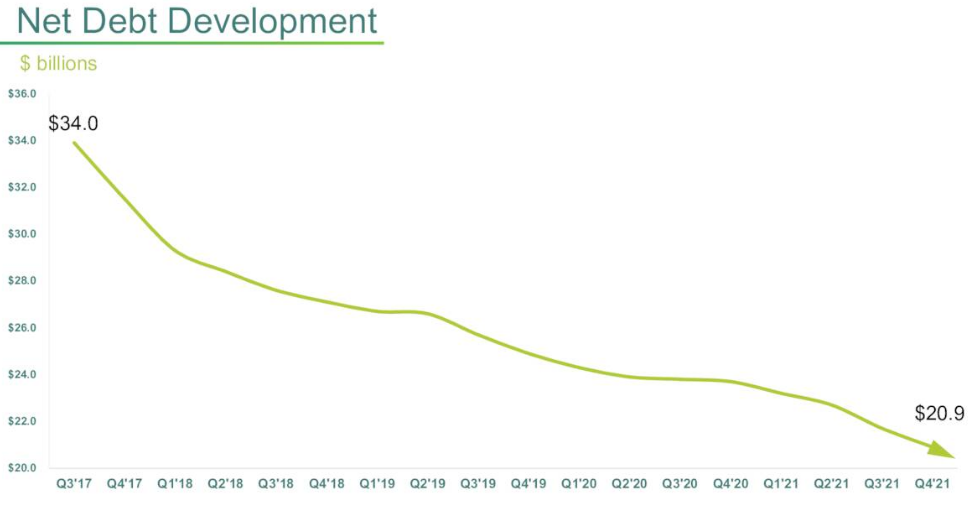

3. Stronger Balance Sheet

In 2021, Teva generated a free cash flow of $2.2 billion (per slide 4). Since Q3/2017, the firm paid down its debt. The settlement amounts with various states will not slow the de-leveraging objective. By Q4/2021, debt fell to $20.9 billion:

TEVA Q4/2021 Presentation

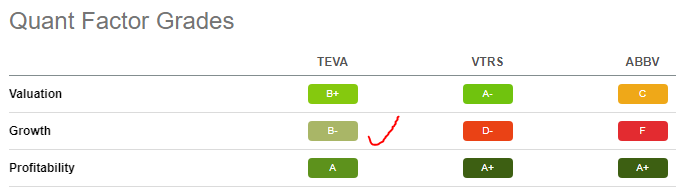

According to Seeking Alpha Premium, Teva scores a B- on growth. This earns it a better grade than that of Viatris (VTRS) and AbbVie:

SA Premium quant score for Teva

Teva is less comparable to AbbVie because the latter is pivoting away from Humira for its growth. It acquired Allergan to strengthen its product portfolio. Teva is betting on biosimilars, Ajovy, and Austedo for growth.

Viatris unexpectedly reversed its growth strategy recently. After raising its dividend, along with Nasdaq adding it to the biotechnology index, VTRS stock could have sustained its rally. Instead, the company announced the sale of its biosimilars to Biocon Biologics. It received $2 billion in upfront cash, a 13% stake, and $335 million in additional payments. As the quant factor grades show, Viatris has strong profitability and good valuations compared to Teva.

Risks

Teva issued disappointing guidance in its fourth-quarter report. For 2022, it expects revenue in the range of $15.6 billion to $16.2 billion. It expects non-GAAP diluted EPS of $2.40 – $2.60.

Teva’s average growth over the next decade is almost 5%:

|

Fiscal Period Ending |

EPS Estimate |

YoY Growth |

# of Analysts |

|

Dec-22 |

2.54 |

-1.67% |

14 |

|

Dec-23 |

2.67 |

5.10% |

14 |

|

Dec-24 |

2.81 |

5.48% |

11 |

|

Dec-25 |

2.98 |

6.09% |

8 |

|

Dec-26 |

3.16 |

5.82% |

4 |

|

Dec-27 |

3.19 |

0.92% |

3 |

|

Dec-28 |

3.45 |

8.11% |

2 |

|

Dec-29 |

3.57 |

3.48% |

2 |

|

Dec-30 |

3.95 |

10.80% |

2 |

|

Average: |

4.90% |

In a 10-year discounted cash flow revenue exit model, readers may assume a modest 1.9 times multiple. This would imply a fair value of around $19.00:

|

Metrics |

Range |

Conclusion |

|

Discount Rate |

7.5% – 6.5% |

7.00% |

|

Terminal Revenue Multiple |

1.8x – 2.0x |

1.9x |

|

Fair Value |

$16.82 – $21.20 |

$18.94 |

Your Takeaway On Teva

Long-time Teva shareholders need to overcome the $10.00 hurdle. After consistently announcing fair opioid settlements, the generic giant has fewer uncertainties ahead. Management may concentrate on building its biosimilar portfolio. Humira is one of many drugs that will raise Teva’s revenue. Profitability will expand as sales in the company’s key products – Austedo and Ajovy – accelerate.

Biotechnology investors should also consider AbbVie. The stock is up by 62% from its 52-week low. The stock also pays a $5.64 per share dividend that yields 3.34%.

Viatris, after plunging from a $16.29 high to as low as $9.66, now yields 4.12%. The company will need to earn back investor trust. It is aggressively paring debt levels like Teva. Interest rates will rise significantly as the Federal Reserve battles inflation. Teva and Viatris are taking the necessary steps to cut costs of managing debt.

Teva is particularly compelling, especially if it posts revenue stronger than expected. It could raise its guidance later this year after recalibrating for lower pandemic-related disruptions in 2022.

Be the first to comment