Xiaolu Chu

With China’s new energy vehicle (“NEV”) subsidies set to expire at the end of this year, there is an obvious incentive for the nation’s electric vehicle (“EV”) makers to spur price-sensitive purchasers into buying now. Among the companies seeking to take full advantage of short-term price incentives in China is Tesla Inc. (NASDAQ:TSLA).

Last month, the U.S.-based EV industry pioneer slashed prices across its vehicle line-up in hopes of stoking buyer demand heading into the final stretch of the year. However, it appears the latest cuts have not been enough to gin up demand.

Tesla’s apparent failure to stoke demand is a problem for a company that has long claimed to be supply-constrained in all its major markets, including China. The company’s recent moves to slash prices have already thrown this claim into very serious doubt. Those few who still accept the claim may soon be forced to reassess their beliefs yet again.

Success in the Chinese market is absolutely critical to the Tesla investment thesis. Indeed, CEO Elon Musk has gone so far as to declare, “I really think China is the future.” Thus, as 2023 heaves into view, it is worth taking a closer look at the state of Tesla’s China business.

Let’s dive in.

Price Cuts Fail To Juice Up Demand

In September, rumors began to swirl in the Chinese market about imminent major price cuts for Tesla’s vehicles. While Tesla initially denied these rumors vociferously, it did not take long for them to come true. On October 24th, barely a month after denying any plans for a significant price cut, Tesla announced across-the-board price cuts for its flagship Model 3 and Model Y vehicles in China.

According to a November 22nd report by Chinese tech publication Sina Technology, the latest price cuts have produced far fewer new orders than Tesla had anticipated:

“It is reported that Tesla has launched two rounds of heavyweight price cuts and promotions in the past month. However, the two rounds of promotions did not receive the desired effect from Tesla. After announcing the price cut, Tesla China’s official website was ‘paralyzed’ by the influx of traffic, but according to the prediction of Sun Shaojun, the founder of Auto Fans, only about 50,000 orders were received by Tesla in this round. Rather than the 100,000-170,000 rumored by the outside world.”

The report claims that new order volume in China has fallen considerably in recent months, with stores nationwide averaging just a few sales per day. This reality is starkly visible in the sales data. Year to date through October, sales of Tesla’s Model 3 sedan are down 9.2% from 2021 levels.

According to a report last week by Chinese tech outlet Huxiu, Tesla plans yet another price cut ahead of the new year. Thus far, Tesla has denied the claim, stating that it has no intention of cutting prices again this year. Based on Tesla’s recent track record of denying price cutting plans only to enact them soon after, investors may well doubt the company’s sincerity.

Turning To Exports To Move Metal

Tesla’s less-than-spectacular demand in the Chinese market is hardly a new revelation. Indeed, I addressed the issue in an article published almost one year ago exactly. At the time, I highlighted some of the early signs of many of the issues that have sprung up in full force only in the past few months. Specifically, I observed that China was “already showing early signs of demand saturation.” Over the last year, this distressing possibility has become a grim reality.

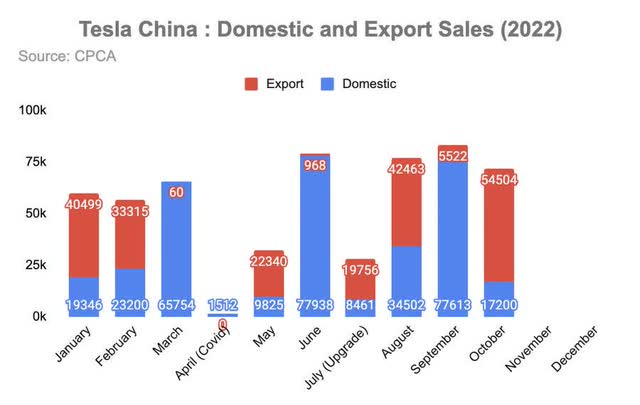

In response to softening demand in China, Tesla has turned increasingly to the export market in order to offload excess domestic production. This has been the case throughout the year; in October, Tesla shipped off more than three quarters of its China production to foreign markets. November has followed a similar pattern, with dozens of shipments of China-made Tesla vehicles being shipped to markets across East Asia, Australia, and Europe.

Tesla’s reliance on export markets for its Chinese production may only intensify in the face of domestic demand saturation. While the Chinese market will undoubtedly be able absorb a big chunk of Tesla production eventually, current constraints make this unlikely in the short run. However, these efforts may run at cross purposes to Tesla’s plans for other markets, especially in Europe. The European market has been the top destination for Tesla’s China exports to date. This makes sense in light of the continent’s deep and sophisticated EV market. Yet European demand is increasingly being served by domestic production courtesy of Tesla’s newly christened plant in Brandeburg, Germany. As Tesla’s German plant spools up production, it may soon be able to absorb most-or even all-of the demand currently being satisfied through Chinese imports.

With Europe’s demand increasingly satisfied via domestic production, Tesla will need to find another destination for its excess China production. Reports have surfaced this month that Tesla intends to start importing China-made vehicles into the U.S. and Canadian markets. While this may solve one problem for Tesla, it risks creating fresh problems for the company, most notably for its U.S.-based plant in Fremont, CA.

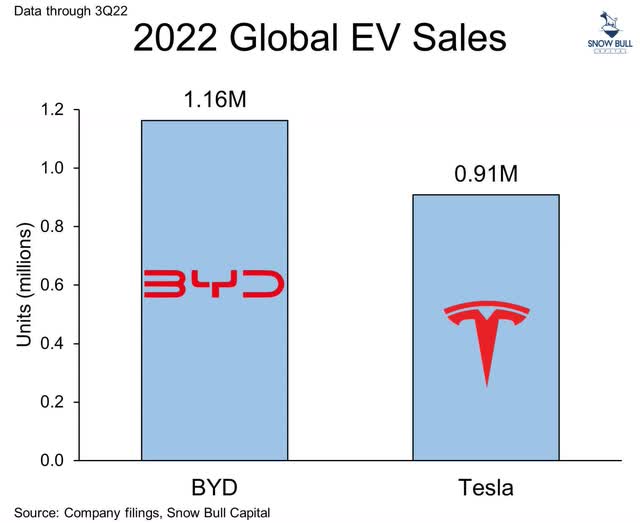

Competition Bites into Growth Narrative

Though it may often seem otherwise (based on the breathless reporting of the American tech press, anyway), Tesla is not the only significant EV company, nor does it operate in a vacuum. In reality, Tesla is just one player in a growing field of EV competition. Tesla is not even the biggest player in the space anymore, a fact that is most clearly observable in China. Thanks in large part to lavish public subsidies and government investments, China has created one of the world’s largest and most sophisticated EV markets. Indeed, it was this growing market opportunity that sparked Tesla’s decision to locate its second ever factory in China in the first place.

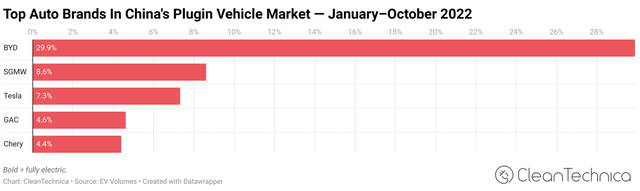

While the Chinese government welcomed Tesla with open arms back in 2019, its efforts have always been focused principally on building domestic EV brands. Chief among these homegrown players is BYD (OTCPK:BYDDF) (OTCPK:BYDDY), which has convincingly supplanted Tesla as China’s top EV maker and continues to grow at a faster clip than its American rival.

The competitive landscape of China’s EV market has only gotten tougher in recent years, a trend that looks set to continue, both as new players and offerings come online, and as domestic economic conditions tighten. The result, as one leading domestic auto industry outlet recently observed, is Tesla “becoming less competitive in the increasingly crowded Chinese market.”

Wall Street analysts have not failed to note the threat of rising competition. In an October 24th investor update, Morgan Stanley’s Adam Jonas highlighted a number of risks related to price cuts and competition:

“Price cuts announced by Tesla China may affect already-weak market sentiment. While we believe luxury ICE brands are likely to be affected more, intensifying price competition could raise market concerns on the order intake of major EV names’ flagship models into the peak season. For Tesla, updates to existing popular models are necessary because the Model 3 is facing an increasing number of strong competitors around the world, especially in China. Tesla’s Shanghai plant [began] deliveries of the China-made Model 3 sedan in January 2020 and the locally produced Model Y in January 2021.”

The risks here are clear. Tesla’s price cuts threaten its luxury brand status, as it reduces sticker prices to move metal and compete on price with domestic rivals. Price cuts also risk attracting the anger of existing owners forced to watch as the value of their cars plummet in real time.

Investor’s Perspective

The importance of China to Tesla’s business cannot be overstated. According to Morgan Stanley, “Tesla generates as much as one-half of its profitability from the Chinese market, arguably making the stock a derivative of a Chinese tech stock.” In other words, Tesla is very much dependent on China, not only for growth, but for economic survival. Thus, any sign of weakness in the Chinese market deserves the full attention of anyone interested in Tesla as an investment.

Market conditions in China currently appear to be moving against Tesla. Intensifying competition and rising market saturation have made growth more difficult for the American automaker. That is a problem for a company that, despite being down more than 50% year to date, is still by far the most valuable automaker in the world. With a market capitalization in excess of $566 billion, Tesla has an absolutely enormous amount of growth priced in already. That may soon prove hard for investors to square comfortably with the observable realities of slowing demand and intensifying competition.

Softening market expectations have weighed on Tesla already. Many analysts have started to pare back their estimates accordingly. Indeed, even the most bullish analysts have not been immune. Last month, both Wolf Street Research and Wedbush had a price target of $360 per share. Both slashed their estimates on October 20th, to $288 and $300, respectively. Even pared down, these price targets seem excessive in light of darkening market and economic realities.

I would caution investors to tread very carefully around this name. The stock has never truly been anchored by fundamentals, which makes it dangerous to play with, for casual stock pickers and veteran traders alike.

Trade carefully!

Be the first to comment