DKart

Thesis

I am bullish on Tesla (NASDAQ:TSLA) stock because of its nonlinear growth potential. Particularly, its FSD and robotics have the potential to be a platform and create the winner-take-all possibility (like that possibility YouTube enjoyed as argued in my earlier article).

Although this article’s goal is to caution TSLA investors (or potential investors) about two near-term issues that could negatively impact its stock prices: the uncertainties unfolding in China and the tax codes. These issues do not change my long-term bull thesis. The goal of the analysis is to help TSLA investors (both existing and potential) to be better prepared when/if these impacts generate large price volatiles disproportionately during Q4 (especially when it gets closer to the earnings report).

China COVID uncertainty

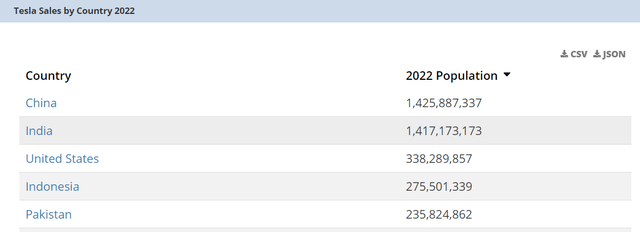

I view the ongoing protests in China against Zero COVID as a huge uncertainty in the near future for TSLA. China is both a key market and also a key manufacturing site for TSLA. In terms of volume, China has become the large market for TSLA as seen in the chart below. In terms of topline, as of 2021, TSLA’s China sales reach about ½ of its sales in the United States. In terms of the bottom line, the China market is even more important. Income from China made up about half of its total pretax income. As a manufacturing site, China’s abundant supply of labor and industrial hub like Shanghai has been a huge draw for TSLA (together with other American and European automakers). China has been a key for them to make products quickly and cheaply (and then sell them locally to the largest market on earth).

Source: Worldpopulationreview.com

However, with the protest unfolding and potentially worsening, China’s role as a key market and manufacturing site may come to a halt temporarily. For example, Volkswagen, another automaker that has been relying on China heavily, just announced that its China sales not only stagnated in 2022 but also a whopping 14% below expectations.

I won’t be surprised if TSLA suffers a similar or even worse setback. And there are good reasons that it could be worse for TSLA, because of its special tax treatment in China, as detailed next.

TSLA’s China tax break

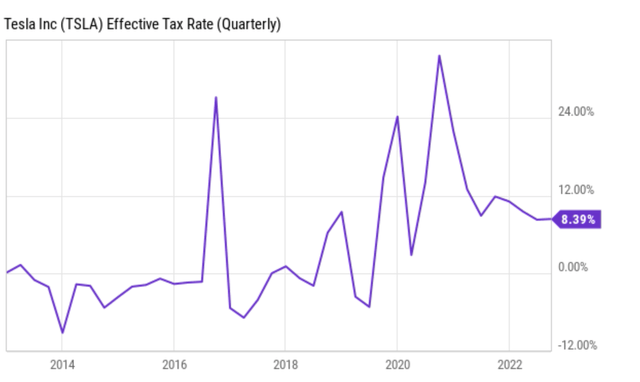

The following chart shows TSLA’s effective tax rates in recent quarters. As seen, its effective tax rate for the past quarter is only 8.4% as of Q3. Its effective tax rates have been actually systematically lower than 10% (except for a few outlier data points). Take Q2 2022 as another example. According to its Form 10-K, TSLA raked in a total of $3.6B pretax earnings in Q2 with a tax provision of only $346M, translating into an effective tax rate of 9.6%. The key reasons behind such low rates are temporary tax incentives, especially those from China. TSLA enjoys a tax rate of 15% in China, a whole 10% below the normal rate of 25%.

But the aforementioned tax break is set to end in 2023. If the tax reduction is not renewed by 2023 and the tax rates do flip back to 25%, the increased tax burden in China alone would create a large impact on its net earnings given the size of its China sales.

The risks are furthermore increased by the fact that TSLA’s EVs are also exempt from China’s 10% purchase tax. According to this Reuters report, the exemption is also set to expire next year (i.e., 2023):

BEIJING (Reuters) – China will exempt Tesla Inc’s TSLA.O electric vehicles from its purchase tax, the Ministry of Industry and Information Technology (MIIT) said on Friday, a concession made amidst trade tensions with the United States. Tesla sees China as one of its most important, growing markets, and the exemption from a 10% purchase tax could reduce the cost of buying a Tesla by up to 99,000 yuan ($13,957.82), according to a post on Tesla’s social media WeChat account.

Other nonlinear risks

To recap, so far, I already see TSLA exposed to 3 risks in China: as its key market, its key manufacturing site, and also a large source of its tax incentives. But the risks do not stop here. These risks could trigger other ripple effects further down the road in a more nonlinear fashion.

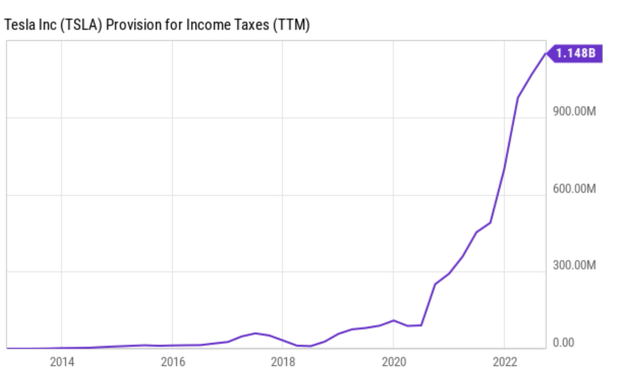

As aforementioned, TSLA’s tax provisions are already quite low (only about $1.1B for TTM 2022 as you can see from the chart below). And its actual tax is even lower, actually close to zero based on this CNN report.

The reason for its nearly zero tax paid is explained by Sullivan, an expert on US corporate tax practices, as the following. The quotes are slightly edited by me.

TSLA reports that its US operations suffered a loss (of $130 million in 2021 for example) on a pre-tax basis by claiming that all of its pre-tax profits came from overseas operations, even though ~45% of its revenue came from US sales. This is a common practice for US multinational corporations: structuring their operations so that overseas subsidiaries are the ones reporting income, leaving the US operation to have little or no taxable income to report.

As a result, if its China sales do stagnate or shrink (which is very likely in my view in the near term), it will have less overseas revenues and income to work with. To put it more bluntly, the above common practice will become less potent.

Summary

To recap, TSLA investors (both existing and potential) should not overlook the near-term risks given its reliance on China. I can see TSLA being exposed to large China risks at least in three ways directly: as its key market (largest market by volume), its key manufacturing site, and also a large source of its tax incentives. And these are only the first-order direct risks. They could trigger other second-order ripple effects (e.g., to impact its tax liability in the U.S. too).

These risks do not change my long-term bull thesis, which is built on its nonlinear growth curve and the winner-take-all potential as a platform (similar to the role YouTube played in video sharing as detailed in my earlier article). However, these risks could cause large and disproportionate price volatilities in the near term, especially during the Q4 earnings season. By becoming aware of these risks, such volatilities could create even better entry points for long-term holding.

Be the first to comment