jetcityimage/iStock Editorial via Getty Images

Covid lockdowns in China during a good portion of Q2 2022 impacted many industries. Electric vehicle maker Tesla (NASDAQ:TSLA) saw its Shanghai factory shut down for a good portion of the quarter, providing a significant headwind for production and delivery growth. Investors and analysts have spent several weeks cutting expectations as a result, but Tesla still missed, and there shouldn’t be any excuses this time around.

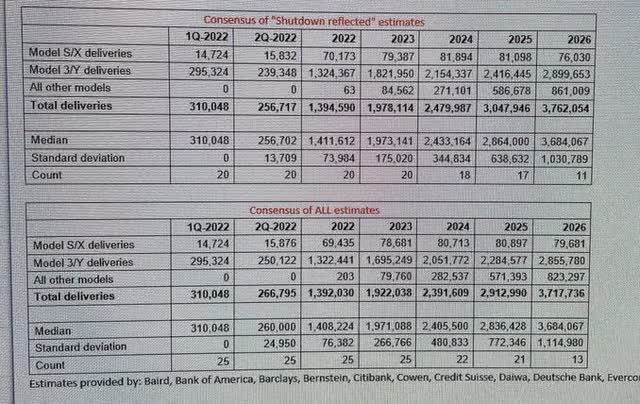

Earlier this year, the expectation was that Tesla would continue to see an increase in production and deliveries each quarter throughout the year. Hopes were that the company could do well over 300,000 deliveries in Q2, but those dreams were slashed when Shanghai needed to close. As a result, analysts have been cutting estimates for basically two months now. The following graphic details what Tesla Investor Relations sent out towards the end of June, showing all estimates and a lower group of estimates that supposedly reflected the Covid shutdown.

On Saturday, the company issued its usual quarterly press release detailing production and deliveries for the second quarter. Tesla came in a little under 254,700 deliveries, which is a complete miss. The company beat by about 300 units on the S/X side, which means things were a bit disappointing on the 3/Y side, especially given the ramps in the new Berlin and Austin factories.

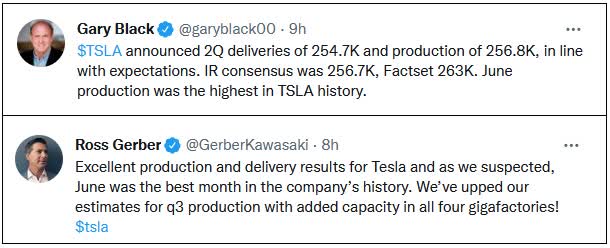

What troubles me the most here is that Tesla bulls were out in full force talking about these results in such a positive way. Gary Black, who runs the Future Fund Active ETF (FFND) that has Tesla as its largest holding, called the number “in line” with expectations as seen below. Ross Gerber, who has Tesla as his top holding in the Gerber Kawasaki ETF (GK), called the numbers excellent. Of course, both of these ETFs have significantly underperformed the market since their respective 2021 launches, so investors may not find much credibility in these Tesla supporters here, to begin with.

Tesla Bull Commentary (Twitter)

In my opinion, you can’t blame the poor results on the shutdowns or call these numbers in line. We’ve known about these issues for months, so nobody can be shocked by them. Tesla Investor Relations sent out two sets of estimates, one of which they had selected to form a lower than usual consensus, and the company still missed by more than 2,000 units. If Apple (AAPL) told analysts to model $100 billion in revenues and then reported $99.2 billion, everyone would report it as a miss and say it was a bad result. I also can’t put too much into the record June production comments because the company is ramping Fremont and opened two new factories earlier this year. It’d be a much more important news story if Tesla did not have record production.

With deliveries down more than 55,000 units from Q1 of this year, it’s obvious that total revenues are not going to top that period’s $18.76 billion figure. Tesla’s average selling prices will benefit from rising prices, a higher mix of S/X sales in the quarter and a lower overall percentage of leased vehicles in the total. On the flip side, a stronger dollar during Q2 will provide a headwind to the company’s topline. For those that include credit sales in their number, that number is expected to come down quite a bit sequentially given the large one-time benefit reported in Q1.

Going into Saturday’s release, the average analyst estimate called for $17.34 billion in Q2 revenues. I believe that number needs to come down by at least half a billion or so to be more realistic. That analyst average included at least one estimate over $20 billion, and we know there are some older estimates included in the total. I’ll do my full income statement model when we get closer to earnings on July 20th and get a better idea of vehicle sales in various geographies, but for now, I think the low to mid $16 billion area seems reasonable.

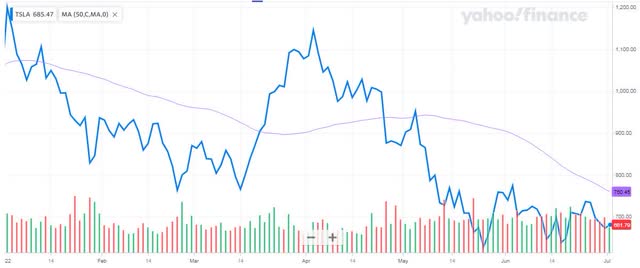

As for Tesla shares, they’ve come down quite a bit this year along with the overall market. The reduction in yearly expectations plus Fed rate hikes has hit this high growth story. Outside of earnings, the upcoming stock split may be seen as a positive catalyst, but this isn’t the same situation as we saw the last time this stock split. As the chart below shows, the stock is under its 50-day moving average (purple line) currently, and this key technical level could provide short-term resistance if the stock cannot break above it.

Tesla Last 6 Months (Yahoo! Finance)

Later this month, the focus should start to move towards Q3 expectations. Now that Tesla has four factories in operation, the company is going to need to prove it can ramp production and deliveries in a significant way. We are going to see a lot of estimates in the 375,000 area or even higher for the current quarter. It will be interesting to see if Tesla needs to reduce prices or introduce lower priced model variants to get that kind of sales unit volume.

In the end, Tesla missed estimates for second quarter deliveries. The bulls will tell you that these numbers were in line and blame things on the Shanghai shutdown. However, I can’t agree with that stance, especially when you basically spend two months lowering expectations. If your IR department is going to send out an adjusted estimate average so expectations come down even further, you should be prepared to see headlines that say you missed when you don’t even reach that meaningfully lower bar.

Be the first to comment