Kevin C. Cox/Getty Images News

Many people love being active. It keeps you healthy and, in many instances, gives you exposure to the great outdoors. So it should stand to reason that there would be a number of companies dedicated to providing outdoor sporting goods products that investors can choose from. One such firm is Sportsman’s Warehouse Holdings (NASDAQ:SPWH). In recent years, the company has achieved attractive growth on both its top and bottom lines. But because of recent weakness from a revenue and profitability perspective, and because of concerns about a potential economic slowdown, shares of the business have been hit rather hard. From their 52-week high point, shares are down 44.1%. No doubt, there could be some additional pain this year. However, for those focused on the long haul, shares of the company do look rather cheap. Because of this, I do believe that the company makes for a decent ‘buy’ opportunity at this point in time.

An opportunity in sporting goods retail

According to the management team at Sportsman’s Warehouse, the company operates as an outdoor sporting goods retailer that is focused on providing its customers with any sporting good items that they could want. The company does this through its significant network of retail outlets, which currently number 125 in all. These stores are located across 29 states, with a special emphasis on the western portion of the US, as well as in Alaska. The smallest of its stores are generally around 7,500 square feet, while the largest is 65,000 square feet. The average size right now is roughly 38,000 square feet. The company does not restrict itself all that much when it comes to location. It has stores located in metropolitan statistical areas as small as 75,000 and has some stores located in areas where the population exceeds one million.

To best understand the company, it would be helpful to break down where its sales come from. During its latest completed fiscal year, the company generated 54.2% of its revenue from the hunting and shooting category of products. This includes ammunition, archery items, ATV accessories, tree stands, firearms, and other related products. 13.1% of its revenue came from camping products like backpacks, canoes, coolers, and more. It generated 10% of its revenue from fishing products and 8.4% from apparel like camouflage, jackets, hats, and more. 7.5% of its revenue came from miscellaneous other categories, while 6.8% was attributable to footwear.

Not too long ago, the business was in the process of being acquired by Great Outdoors Group. However, that deal ultimately fell through. In exchange, in early December of last year, the company received a one-time termination payment of $55 million. It looks as though at least some of those proceeds will be dedicated to buying back additional stock in the company. I say this because, in March of this year, management announced the launch of a $75 million share buyback program. At current pricing, that would translate to 16.9% of the company’s outstanding stock.

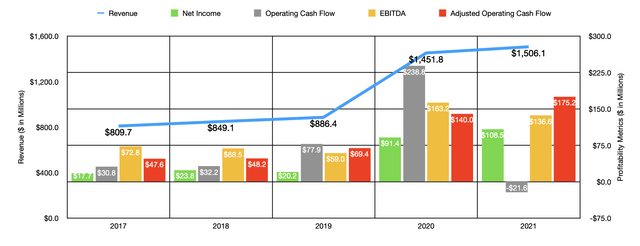

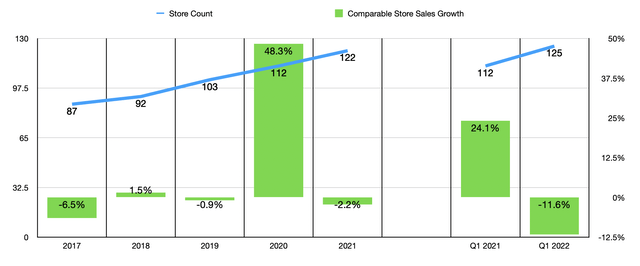

In the years leading up to 2022, the financial picture for the company has been quite positive. Revenue expanded from $809.7 million in 2017 to $1.51 billion in 2021. It’s worth noting exactly where this increase in sales came from. The largest contributor seems to have been a significant rise in the number of stores the company has. At the end of 2017, the company had just 87 locations in operation. By the end of last year, that number had grown to 122. In a healthy retail environment, you would also expect to see comparable-store sales improve. But because of the pandemic, that picture has become clouded. During its latest fiscal year, the company reported a decline in comparable-store sales of 2.2%. But even that would have some pain associated with the COVID-19 pandemic coming to an end and the global economy reopening.

As revenue has risen, profitability has followed suit. Net income rose from $17.7 million in 2017 to $108.5 million last year. Other profitability metrics have been somewhat mixed. Consider, for instance, operating cash flow. This metric did increase for a few years, surging from $30.8 million in 2017 to $238.8 million in 2020. But then, in 2021, it plunged, turning negative to the tune of $21.6 million. If we adjust for changes in working capital, however, the picture looks far more consistent. This metric would have ultimately risen from $47.6 million to $175.2 million, with each year being better than the year prior. Over that same window of time, EBITDA also improved, rising from $72.8 million in 2017 to $136.6 million last year. However, it is worth noting that the peak here for the business was actually 2020. During that year, EBITDA was a robust $163.2 million.

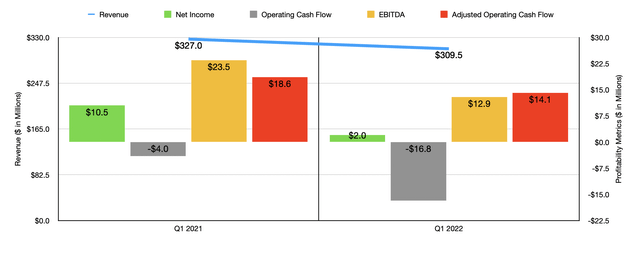

Growth for the company has, unfortunately, not continued into the 2022 fiscal year. Revenue in the first quarter of the year came in at $309.5 million. That compares to the $327 million the company reported the same time one year earlier. This decrease of 5.4% came even as the number of locations rose from 112 to 125. The culprit, then, was an 11.6% decline in comparable-store sales. Management chalked this decline up to decrease demand following a rather strong recovery from the COVID-19 pandemic era. It also attributed some of the pain to social unrest. The biggest declines in terms of category came from the miscellaneous products the company sells. The year-over-year decline there was 19.4%. This was followed by a 15.7% reduction in the camping category and a 14.9% reduction in the hunting and shooting category.

With revenue falling, profitability also declined. Net income of $2 million paled in comparison to the $10.5 million reported just one year earlier. Operating cash flow went from a negative $4 million to a negative $16.8 million. Even if we adjust for changes in working capital, it would have fallen from $18.6 million to $14.1 million. Meanwhile, the EBITDA for the company dropped from $23.5 million to $12.9 million. Given these recent circumstances, I personally would prefer if management use their capital to improve operations. But as you will see, shares are cheap enough that it may not be a bad idea to buy back stock. This is especially true when you consider that net debt for the business stands at just $40.8 million as of this writing. That is small in the grand scheme of things.

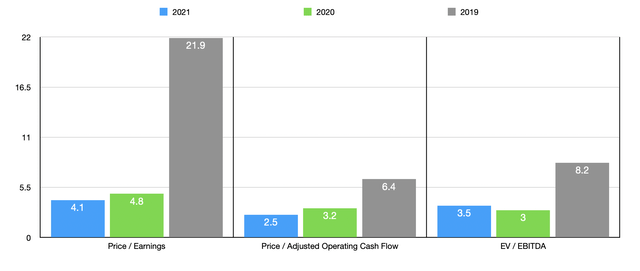

Given the uncertainty regarding the 2022 fiscal year, I have decided not to project out what financial performance might look like for the year. Instead, I will value the company based on results not only from its 2021 fiscal year but also from its 2019 and 2020 fiscal years. Using our 2021 figures, the company is trading at a price-to-earnings multiple of 4.1. Even if financial performance were to revert back to what it was in prior years, shares would still be cheap. This is because, using our 2020 figures, the company is trading at a price-to-earnings multiple of 4.8. The only way this looks elevated is if we use the 2019 figures, with our multiple ultimately totaling 21.9 in that case. Using the price to adjusted operating cash flow multiple, we get a reading for 2021 of 2.5. This is down from the 3.2 reading that we get using our 2020 figures and from the 6.4 reading we get if we use our 2019 figures. When it comes to the EV to EBITDA multiple, we get 3.5, 3, and 8.2, respectively.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 2.8 to a high of 28.4. Only one of the five companies was cheaper than Sportsman’s Warehouse if we use our 2021 results. Using the price to operating cash flow approach, the range was from 5.0 to 57.2. In this scenario, our prospect was the cheapest of the group. The only way in which shares looked rather pricey compared to peers was when using the EV to EBITDA approach, this would give us a range of 1.3 to 22.2. In this scenario, four of the five companies were cheaper than Sportsman’s Warehouse.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Sportsman’s Warehouse Holdings | 4.1 | 2.5 | 3.5 |

| Dick’s Sporting Goods (DKS) | 5.9 | 7.6 | 2.6 |

| Clarus (CLAR) | 28.4 | 57.2 | 22.2 |

| Hibbett (HIBB) | 5.2 | 8.3 | 2.8 |

| Big 5 Sporting Goods (BGFV) | 2.8 | 5.0 | 1.3 |

| Academy Sports and Outdoors (ASO) | 5.0 | 5.9 | 3.3 |

Takeaway

At this point in time, I understand why investors are cautious about Sportsman’s Warehouse. Recent weakness is not promising and it’s entirely possible that this weakness will continue if the economy suffers further. But with a low amount of debt on its books, the company does not look to be a risky prospect in the grand scheme of things. In fact, it might be this kind of pain that opens the door of opportunity for many investors. Given how cheap shares are in almost every scenario, the company should offer some nice upside moving forward. Because of this, I have decided to rate the business a ‘buy’ for now.

Be the first to comment