Xiaolu Chu

The malaise of 2022 in the equity markets has taken former market leaders and seen them pummeled. The list of names that are at or near 52-week lows is extensive, to say the least, and it includes perennial winners, particularly in tech. One of those names is Tesla, Inc. (NASDAQ:TSLA) after it missed Q3 estimates for deliveries. The stock took a nearly-double-digit decline for it, and with Q3 earnings on tap in less than two weeks, the stock is in a tenuous position.

The last time I covered Tesla, I was bullish on the stock’s then-recent breakout, and identified support levels to use as buying opportunities. That didn’t work out, as the stock was subsequently punished along with the rest of the market in the spring of this year. I can already hear the groans of perma-bears saying how I was wrong, and that’s fine, because I was. What I do is find stocks that are performing well, and use support levels as both entry and exit points. It’s why I remind my subscribers everyday of the importance of stop-losses. There’s no need to become a bag-holder, even if you’re totally wrong, as I was last time I covered Tesla.

Now, the situation has obviously changed since April. With Q3 earnings coming up, the stock has taken a lot of technical damage. Below I’ll make the case that Tesla is a buy, but depending upon your time horizon, maybe not just yet.

Technical damage abounds

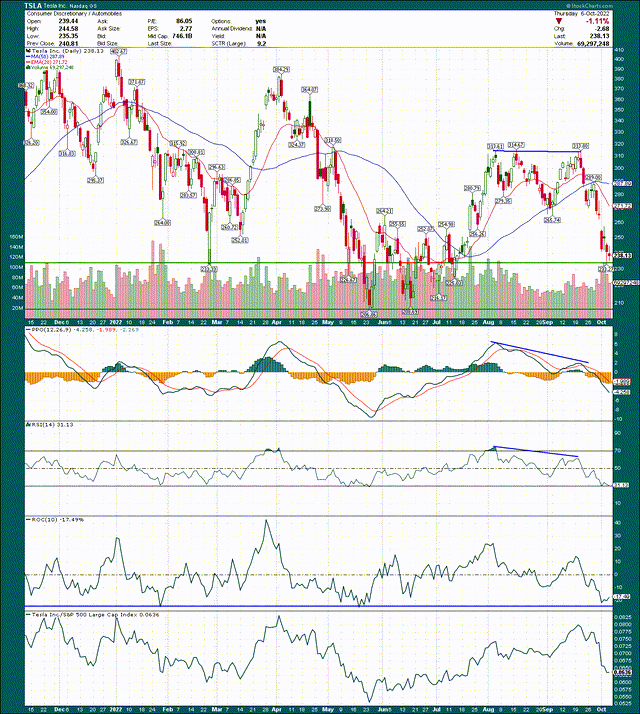

We’ll start with a look at the daily chart, as it provides some shorter-term perspective on the damage the stock suffered earlier this week with its deliveries miss. You can read about it in the link above but basically, Wall Street wanted 358k deliveries and Tesla actually made 344k. That’s not good, if you’re keeping score at home, and the stock was severely punished for it.

I marked the triple top that was made at $314, and from that level, Tesla has declined in a nearly straight line all the way to $238, where it finished Thursday. Triple tops are never bullish, and we can see why here. That’s worrying, but perhaps more so is that the stock blew through support levels on its way down without so much as a pause.

The moving averages were completely ignored, and prior price support at $265 is now not only resistance, but it’s also the top of the gap that was made on the deliveries miss. That level is likely to be fairly substantial in terms of resistance on the way back up, so that’s something to keep in mind.

Now, I’ve drawn trendlines on the PPO and RSI charts that correspond to the triple top in the price chart. We can see the triple top produced flat price action, but momentum weakened the entire time the tops were being made. That’s a negative divergence, and such an event often portends a trend change. In this case, it obviously did and the stock is now almost $80 lower than it was.

We haven’t seen momentum begin to turn around yet, but when it does, that will be your first clue that the downtrend has ended. Divergences work in both directions, so one thing I look for with weak stocks is when we get the clue from the 14-day RSI, and subsequently the PPO, that we’re seeing waning bearish momentum. Tesla is not showing that yet on the daily chart.

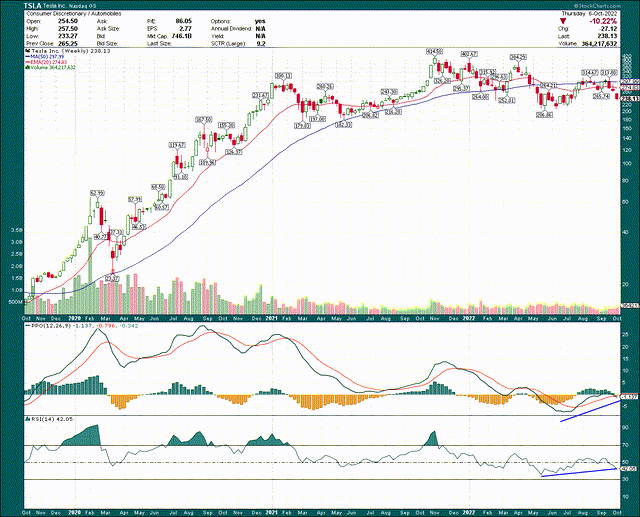

Let’s briefly look at the weekly chart, because there is some cause for optimism here.

I’ve annotated the PPO and 14-week RSI charts with what certainly appear to be positive momentum to me. If Tesla revisits the lows of the year at $206, it will almost certainly be with a positive divergence in place on these momentum indicators. Even if it doesn’t and the Q4 low is ahead of the 2022 low (this is what I believe has the best odds), it will be with improving momentum. The weekly chart is one that I use to identify longer-term trends, and then use daily charts to identify good entry/exit points within that trend. Right now, the weekly chart is saying the weakness in Tesla is likely nearing its end, so we can use that info to make trading decisions.

From a technical perspective, the daily chart is messy, and support levels range from $238 to $206, with a couple of potential stops in between. The weekly chart is showing that the downtrend is more than likely nearing its completion, but I don’t expect a quick resolution to the current consolidation in the stock. Thus, I still think Tesla is a good long-term buy/hold, but I also think there’s no reason to rush out to buy it right this second based on the daily chart.

The definitive EV leader

We all know Tesla is the leader in the EV space, but we also know that competition in the industry couldn’t be more intense. Tesla recognized many years ago that EVs were the path forward, well before the legacy automakers did. That has provided the company with a first move advantage of sorts, and it also has brand recognition and value that others lack.

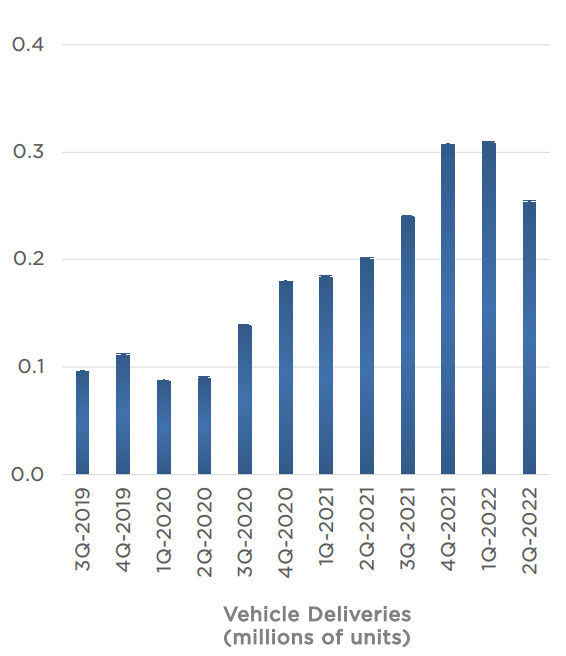

While you don’t want to see delivery misses, the simple fact is that Tesla continues to grow by leaps and bounds despite quarters where it has produced negative sequential delivery growth.

Investor presentation

This chart doesn’t include Q3 since the company hasn’t reported earnings yet, but we also know that Q3 deliveries were 35% higher year-over-year and 42% higher than this year’s Q2. Did the company miss? Yes. Is it a disaster? Absolutely not. These setbacks have occurred at times in the past, and I’ll also note that every time, it was a buying chance. Is this time different? Maybe. But if I take emotion out of the equation, the only logical conclusion I can come to is that this setback is temporary and that Tesla hasn’t forgotten how to be an automaker.

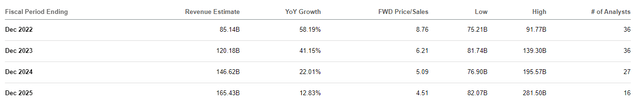

Looking forward, we can see revenue estimates for this year are for $85 billion, which is +58% to last year, with a further +41% next year. Now, one thing you have to understand with Tesla’s estimates is that they have an unbelievably wide range given Tesla’s size. Generally, for a company with a market cap in the hundreds of billions, you have maybe a few percent on either side of the average. Next year’s estimates are for between $82 billion and $139 billion, so the average is to be viewed accordingly. It’s a starting point, but you must make your own judgment about how many cars the company can deliver.

I find a mega-cap with this sort of growth to be attractive, but I also understand this sort of volatility is not for everyone. However, if the company can get close to those averages in terms of revenue growth, there’s a big reward in store.

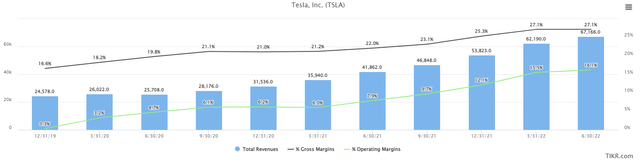

By that I mean the company’s efforts to boost margins, which have really taken hold in the past couple of years. Below, we have trailing-twelve-months revenue in millions, gross margins, and operating margins as a percentage of revenue.

As revenue has risen, so has gross margin, and so has operating margin. This follows as any company that makes physical products tends to see higher operating margins as fixed costs are leveraged down on a per-unit basis. Tesla’s Q3 deliveries miss is disappointing from a top line perspective, and margins may suffer slightly for it. However, this is an extremely positive long-term story as it pertains to profitability, and as the company continues to add more and more state-of-the-art manufacturing capacity, its per-unit margins should continue to increase.

Commodity and labor inflation are obvious potential headwinds, but the company has been able to demonstrate pricing power over time. That’s absolutely critical, and keep in mind that despite the price increases Tesla has implemented over time, it continues to see soaring delivery numbers. Any company with ever-rising volumes and pricing power is desirable.

Looking forward

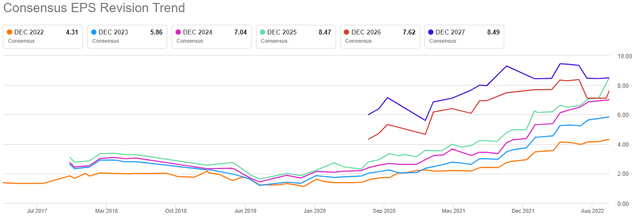

Let’s now take a look at the company’s EPS estimates, and the revisions those estimates have seen of late.

It’s really difficult for me to imagine any way this chart could be more bullish. We see estimates going steadily up and to the right, and this is in the face of supply chain issues and rising commodity costs; imagine what they’d look like under normal circumstances. This is the product of the volume/pricing power combination I mentioned above, and you’d be hard-pressed to find many companies with an EPS revision schedule like this one right now.

Now, if we look to value Tesla, we can do it two ways. First, we can value it based upon its sales, because for a long time, the company had no profits.

Shares go for ~7X forward sales today, which is actually quite low by post-COVID standards. In fact, it peaked at 19X forward sales in early-2021, but please do not expect that sort of valuation to return. This company is more mature than it was even two years ago, and investors will increasingly value it based upon earnings rather than sales.

On the other hand, keep in mind that Tesla’s profit margins are also much higher than they were in early-2021, so on that basis, you’d expect a higher P/S ratio given each dollar of sales contributes more to the bottom line. Either way, I think it’s safe to call Tesla cheap on a P/S basis at the moment.

Let’s now turn our attention to earnings, which is charted below.

Tesla is at ~47X forward earnings today, and while I will not try to make the argument this is some sort of value stock, I will make the argument that it is a value stock compared to its own historical valuations. Tesla is a leader in the tech space, has a nearly limitless market opportunity, and has demonstrated the capability to take advantage of that market opportunity. It’s never going to trade for 6X earnings like the legacy automakers do, so if you can’t wrap your head around that, this one is not for you.

The stock is as cheap as it has been on this basis since it started producing earnings regularly in its entire trading history. In other words, Tesla is indeed quite attractively valued at the moment, particularly given its very strong performance in the face of supply chain headwinds from the past couple of years.

Can it get cheaper? Yeah, absolutely. There’s no guarantee it won’t go to 40X or 30X earnings. However, if you’re looking at the odds, is it more likely it continues to make new lows, or that it rebounds to something more normalized? I know where I come down on that one, as I see the balance of risk to the upside on the valuation.

Tesla’s competition and risks

I mentioned competition briefly above and it’s a very important point to drive home. Tesla is facing more competition in EVs now than it ever has, and that competition will only grow over time. The market for EVs continues to mushroom in size, so as the pie gets bigger for everyone, everyone can grow simultaneously. The competition is making better and better cars, so consumers have more choice. That’s a long-term risk for Tesla if it cannot continue to innovate. Now, for a company built upon a legacy of innovation, I don’t see that as a near-term risk, but it is worth mentioning.

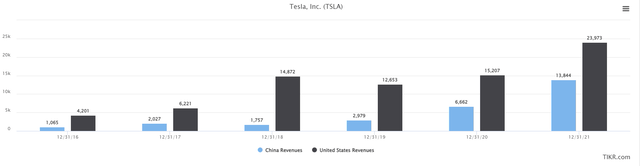

Another risk is that the company is becoming more and more reliant upon China for revenue.

These are annual revenue totals for China and the U.S. just to show the comparison of how important that market is for Tesla. The U.S. is still king and will almost certainly remain that way for some time, but doing business in China carries with it risks that have been all to commonly brought to the fore. These include lack of patent recognition/protection, and political risk given the whims of the governing party aren’t always particularly friendly to foreign corporations. If the Chinese market becomes a problem, that will crimp Tesla’s long-term potential growth.

Final thoughts

If you can stomach the risks from the valuation, competition, and China, Tesla still looks like a great long-term pick to me. The stock is as cheap as it has ever been on an earnings basis, and it continues to deliver massive volume upside in the face of macro headwinds it cannot control. Profitability is soaring and should only continue to improve as volumes rise, so on the whole, I see the fundamental story as attractive still.

The weekly chart is saying the recent weakness is likely nearing its end, so we can use the daily chart to identify price points to buy and to place stop losses. It looks like Tesla may consolidate for a bit longer, but ultimately, I think it’s much nearer the bottom than it is the top, so I’m remaining bullish overall.

Be the first to comment