Dimitrios Kambouris/Getty Images Entertainment

Job cuts, production nightmares, rising input costs, and a looming recession – Elon Musk has been preparing everyone for the worst at Tesla (NASDAQ:TSLA) every time he has had something to say in recent weeks, spreading fear, uncertainty, and doubt (FUD). On one hand, the adverse remarks may be a drag on the electric vehicle (“EV”) stock’s performance, which still trades at a higher market value than that of the top legacy automakers combined. Meanwhile, on the other hand, Musk may be setting softer expectations to drive a much-needed earnings surprise boost for the stock in a couple of weeks, considering Tesla’s positive track record in beating estimates.

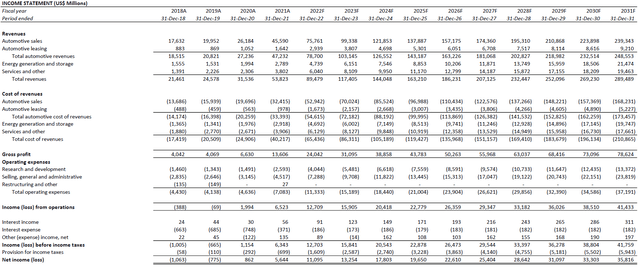

Tesla has lost more than 30% of its market value since it last traded above $1,000 per share in April, as investors grappled with the payment structure on Musk’s proposed Twitter deal weighing on the EV stock’s performance, in addition to the production nightmare in Shanghai due to China’s strict adherence to its COVID Zero policy. Increasing risks of a recession have also driven a series of downward adjustments to price targets on Wall Street in anticipation of a potential slowdown in consumer demand and rising interest rates in the near term. Even Tesla’s confirmation on a three-for-one stock split proposal has done little to salvage the stock from its recent declines.

While recent headwinds may continue to add pressure to the stock’s near-term performance, the EV titan remains an industry leader from a fundamental perspective. Commanding close to 75% of the global EV market, Tesla is taking a page from Apple (AAPL) in smartphones and applying it to the electrification and digitization of the automotive industry. The recent pullback in Tesla’s valuation is creating an attractive entry opportunity to take part in generous upside potential underpinned by continued acceleration in EV and autonomous mobility adoption over the long run.

Waking Up from the Shanghai Nightmare

In addition to challenges in ramping up productions in Shanghai following a three-week lockdown ordered by the Chinese government earlier in the second quarter to keep COVID infection rates at bay, Tesla is also grappling with a nightmare in getting outputs up to speed in its new Berlin and Austin facilities that came online in March and April, respectively. Musk had recently warned of a “tough quarter“, pinpointing supply chain constraints and production headwinds in China as key culprits. The message has heightened investor angst over the extent of adversities experienced from China’s COVID Zero policy in recent months.

Although the Shanghai lockdown has cost Tesla lost production estimated at approximately 40,000 vehicles in the current quarter, it has already shown positive progress in making a strong comeback. Tesla’s Shanghai facility resumed operations in mid-April under a “closed loop” system where employees have been required to live within the facility and adhere to strict COVID prevention measures. The facility’s limited manpower since the latest COVID outbreak in China also has not slowed Tesla from getting production back up to speed, and achieving “record output per week from Giga Shanghai” as promised during its latest earnings call. The China Passenger Car Association reported Tesla had “produced 33,544 cars from its Shanghai plant” in May, an impressive three-fold from volumes (10,757 vehicles) in April.

While Giga Shanghai’s May volumes are still a far cry from monthly shipments of more than 65,000 vehicles prior to the COVID lockdowns, the facility has continued to improve productions toward a run rate of 17,000 vehicles per week since mid-June. This compares to the production run rate of about 2,100 vehicles per day prior to the lockdowns. Combined with Tesla’s notorious reputation for “delivering many units during a quarter-end sprint“, the Shanghai plant just might be on track to achieving record output per week by the end of June as promised.

Looking ahead, Giga Shanghai has recently announced a partial suspension to its production line “in the first two weeks of July to work on an upgrade of the site”. While the development might sound like another test to Tesla’s most crucial artery that bridges it to vast opportunities in the Chinese and European EV markets, the resulting operating efficiencies are expected to help Giga Shanghai make up for the lost volumes sustained during the April lockdown in the latter half of the year.

Tesla aims to ramp up its Shanghai facility’s output to 22,000 vehicles per week by the end of July following the completion of the scheduled upgrades. This would mark a strategic catch-up on plans to produce “8,000 Model 3s and 14,000 Model Ys per week” in Shanghai, which were originally intended for mid-May if it were not for COVID-related disruptions. The upgrades would also contribute to Tesla’s broader plans to increase Giga Shanghai’s annual production capacity to one million vehicles, up from its “original installed capacity of 450,000 vehicles”, in order to better capture burgeoning demand in China – the world’s largest EV market. As such, we remain optimistic about Tesla’s ability in achieving its production target of about 1.5 million units by the end of the year.

Musk Reminds You Again About Production Pains

In addition to Shanghai, Musk has also reiterated the headache of ramping up production at Tesla’s brand-new Berlin and Austin facilities during a recent interview. On top of “losing billions of dollars” during production ramp-up, Musk also cited Tesla’s struggle in meeting planned production volumes of the Model Ys using the “new 4680 cells and structurally integrated battery pack” in Austin.

While Tesla had intended to concurrently produce Model Ys with the predecessor 2170 cells in Austin as a temporary solution to keep up with demand, Musk noted that the required tooling “got stuck in China”, exacerbating the current production challenge. The latest nightmare in bringing Berlin and Austin production volumes to scale is a reminder of Musk’s repeated warnings of how difficult the task is to new entrants in the fast-expanding EV industry:

Production is hard. Production with positive cash flow is extremely hard.

The difficulty and value of manufacturing is underappreciated … It’s relatively easy to make a prototype by extremely difficult to mass manufacture a vehicle reliably at scale.

Prototypes are trivial compared to scaling production and supply chain. If those are solved, achieving positive gross margin is the next nightmare.

Source: Elon Musk

Although Musk is raising concerns about the difficulty and high costs of getting productions up to speed in Berlin and Austin, the added pressure on Tesla’s near-term consolidated margins due to early-stage ramp-up at the new facilities are largely expected and have already been priced into the stock’s performance. It is also within general expectations that the Austin and Berlin facilities are not expected to deliver meaningful “production and delivery cadence” until the latter half of the year.

Recap: Fundamental and Valuation Outlook

Although Wall Street analysts have rushed to trim volume and margin estimates this week for Tesla due to its global production nightmare, we are maintaining our most recent fundamental forecast for the company.

Consensus estimates on Tesla’s second quarter volumes have dropped from an average of 300,000 units to approximately 270,000 units after a slew of downward adjustments observed across Wall Street. Morgan Stanley updated its second quarter volume forecast for Tesla to 270,000 units (vs. previous forecast: 316,000 units), while others like RBC have followed suit to account for the anticipated production shortfall in Shanghai, Berlin and Austin.

Meanwhile, we are maintaining our second quarter volume projections from April at the 270,000-level, which already considers impacts of the pandemic lockdowns in Shanghai, as well as nominal volume contribution from Austin and Berlin until the latter half of the year.

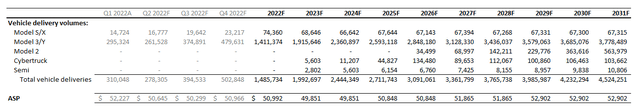

Tesla Volume Projections (Author) Tesla Financial Forecast (Author)

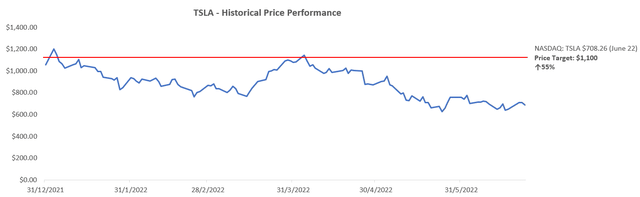

From a valuation perspective, we are also maintaining our 12-month PT on the stock at $1,100, which represents upside potential of close to 60% based on the stock’s recently traded price of $700 apiece (June 23). The 10.7% WACC applied in discounted our projected cash flows for Tesla updated from April already reflects Tesla’s capital structure, as well as its risk profile ahead of tightening economic conditions in the near term.

Tesla Valuation Analysis (Author) Tesla Valuation Analysis (Author)

Tesla_-_Forecasted_Financial_Information.pdf

Author’s Note: Please see here for further detail on key growth and valuation assumptions applied.

Final Thoughts

In addition to common concerns about Tesla’s near-term production challenges, demand risks stemming from a looming recession, paired with Musk’s recent decision to pre-emptively reduce Tesla’s salaried headcount have also shaken investors’ confidence on the stock’s near-term performance ahead of economic uncertainties. Earlier concerns that Musk’s consideration of collateralizing his Tesla shares to fund his proposed Twitter acquisition – a financing option that has since been dropped – has also stirred volatility for the EV stock.

Yet, the fear that Musk has recently been amplifying is merely near-term challenges that are not expected to have a lasting material impact on Tesla’s long-term valuation prospects. Its demand environment remains robust, backed by unmatched industry leadership, as well as proven success in managing across the value chain with strong pricing power to weather through current macro headwinds.

Looking ahead, broad-based market volatility and Tesla’s company-specific challenges over the coming months will create an attractive entry opportunity to take part in an unmatched growth story alongside imminent mass-market EV and autonomous mobility adoption.

Be the first to comment