jetcityimage/iStock Editorial via Getty Images

Thesis

Tesla, Inc. (NASDAQ:TSLA) is down >40% YTD, but the stock is still very expensive – trading at >x50 P/E, >x8 P/S and >x15 P/B. Every investment opportunity is a function of what you get and what you pay. Arguably, the value that investors get from buying TSLA stock is incredible, but the price investors are required to pay is even more so.

I value TSLA shares based on a residual earnings framework and calculate a fair base-case target price of $408.24/share, implying approximately 40% downside before the risk/reward becomes balanced.

Is Tesla stock expensive?

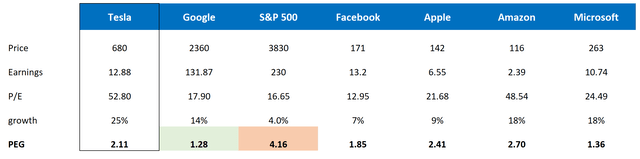

If investors consider an opportunity as a balance of price on one side and both earnings and growth on the other side, the PEG ratio might be an informative metric to judge a stock’s relative expensiveness. The ratio is calculated as a P/E divided by a 3-year CAGR expectation.

Analyst Consensus; Author’s Calculation

The PEG ratio for Tesla is 2.11, which is approximately the median of the FAAMG universe. Most notably, Tesla stock looks cheap when compared to the S&P 500. When compared to Google (GOOG, GOOGL), however, Tesla appears expensive. But in general, judged by the relative PEG comparison, Tesla’s valuation is stretched, but arguably reasonable. However, there is one major risk to the analysis: buying growth is risky. Tesla’s 3-year CAGR expectation of 25% is by far the highest amongst the FAAMG universe and approximately 600% higher than the S&P’s 4% estimate. Can Tesla deliver?

What Bulls say

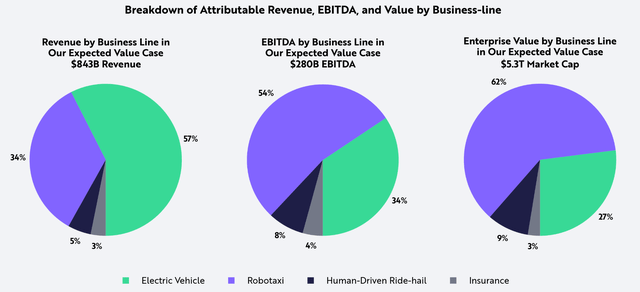

Bulls see in Tesla a secular revolution. Tesla is not just a car company, but a technology company, engaged in the development of battery technology, solar technology, and autonomous driving. That said, the Tesla car is only regarded as a platform to launch a technology ecosystem. Ark Invest, arguably one of the most aggressive Tesla bulls, sees a $5.3 trillion market capitalization by 2026, driven by 54% EBITDA contribution from robotaxi services.

Tesla’s growth expectations are supported by an enormous demand pull. In a recent interview, Elon Musk claimed that Tesla’s growth limitations are not imposed by outside forces, such as demand or competitors, but by supply constraints. In addition, the accelerated EV push from legacy automakers such as General Motors (GM) or Volkswagen (OTCPK:VWAGY, OTCPK:VWAPY, OTCPK:VLKAF) is no concern to the company. In the opinion of Tesla bulls, people do not want to just buy an electric vehicle, they want to buy a Tesla. That said, with the Q1 2022 earnings announcement Elon Musk argued that Tesla could sustain 50% CAGR until 2025. If this estimate is correct, Tesla would overtake General Motors as the US largest automobile manufacturer as early as 2024.

What Bears say

In general, bears doubt Elon Musk’s ambitious targets for Tesla and see in the company’s stock price the culmination of a speculative stock bubble. Popular arguments against Elon Musk’s estimates are anchored on examples where Musk overpromised. For instance, already in 2019, Elon Musk claimed to deliver one million robotaxis by 2020. Now, in 2022, there is still no Tesla robotaxi on the street.

Bears also see current macroeconomic headwinds as a strong argument against the validity of Tesla’s growth targets. Analysts highlight the difficulty of selling >$50.000 consumer products in a macro-environment that is pressured by decade-low consumer confidence, high-inflation, rising interest rates and likely recession. That said, Tesla has already announced job cuts of an estimated 10% and cut about 200 jobs in the company’s autopilot department.

Moreover, from a supply side perspective, Tesla’s manufacturing volume is heavily reliant on the Shanghai plant, which produced 484,130 cars in 2021. This is more than half of the company’s total volume. That said, given the Covid-19-lockdowns in Shanghai, it is estimated that Q2 2022 will likely be a very bad quarter for Tesla. Recently, Tesla has announced delivery results for Q2 2022 and confirmed slightly over 250,000 deliveries. Notably, this is the first quarter of negative growth in a long time.

How analysts see it

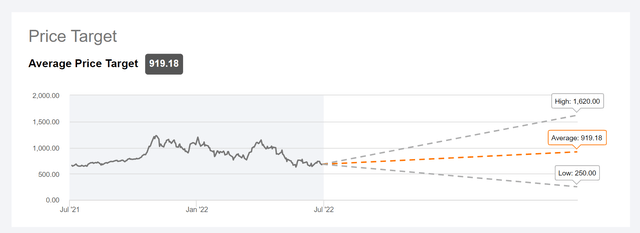

Analysts are divided on Tesla as well, but on average positive. Based on 37 analysts who cover the stock, there are 13 Strong Buy ratings, 8 Buy ratings, 5 Sell ratings and 2 Strong Sell ratings. The average target is $919.18/share, with maximum at $1.620/share and minimum a $250/share.

According to the Bloomberg Terminal, as of July 2022, analysts see Tesla’s strong fundamental growth as sustainable. Revenues for 2022, 2023 and 2024 are estimated at $84.96 billion, $114.0 billion and $144.78 billion. This would equal a 3-year CAGR of >25%, from 2022 to 2025. Respectively, EPS is estimated at $11.98 $15.73, and $21.34.

Residual earnings valuation

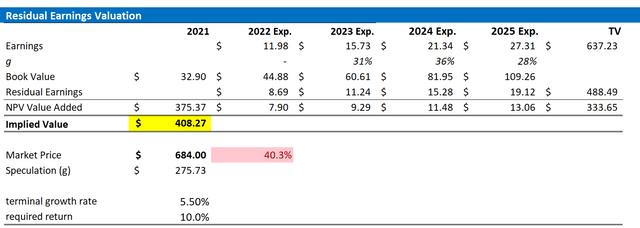

So, if analyst consensus is right about TSLA’s business forecast, what could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast revenues and EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework.

- The estimate of the cost of capital, I use the WACC framework. I model a three-year regression against the S&P to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 01, 2022. My calculation indicates a fair WACC of approximately 10%.

- For the terminal growth rate, I apply expected nominal GDP growth at 3% plus two and a half percentage points to reflect Tesla’s considerably elevated growth potential.

- I do not model any share buyback – reflecting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for TSLA of $408.24/share, implying that Tesla stock could have another 40% downside.

Analyst Consensus EPS; Author’s Calculation

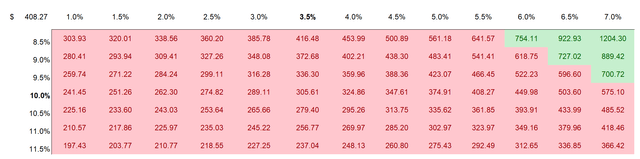

I understand that investors might have different assumptions with regards to Tesla’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation. The risk/reward looks skewed to the downside.

Analyst Consensus EPS; Author’s Calculation

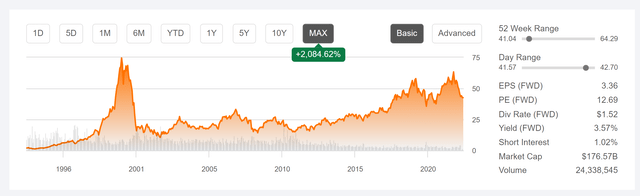

Beware of paying too much

If an investor pays too much for an opportunity, his return will suffer accordingly – even though the underlying thesis for investing might be perfectly rational and correct. For example, in the late 90s/early 2000, Cisco (CSCO) stock ran from approximately $5/share in mid-1997 to more than $80/share in early 2000 (stock-split adjusted). Investors were excited buying into the company’s growth story that was driven by the World Wide Web adoption. Valuation did not matter, until it suddenly did. Within approximately 24 months, Cisco stock crashed by 90%.

Today, Cisco stock still trades approximately 50% below the March 2000 ATH – more than 20 years later! Most interestingly, investors were perfectly right about the World Wide Web. Investors were also right about Cisco being a high-quality company. But investors simply paid way too much.

Conclusion

Tesla is undoubtedly an amazing automaker and, in my opinion, the company has a bright future ahead. But buying >25% CAGR expectations for multiple years is highly speculative, I argue. Instead of modelling speculative growth, a prudent investor should model a non-speculative margin of safety. This is currently not reflected in Tesla’s >$700 billion market capitalization. That said, I advise to be careful with investments in Tesla. Even though the stock is down more than 40% YTD, I am targeting another 40% before would see the risk/reward as balanced. Thus, as a function of the target price, I assign a Sell recommendation.

Be the first to comment