Michael Gonzalez

Yesterday, Tesla (NASDAQ:TSLA) released its third quarter earnings, beating on EPS but missing on revenue. The quarter was marred by a number of issues, including supply chain issues in China, the Twitter (TWTR) deal, and inflation.

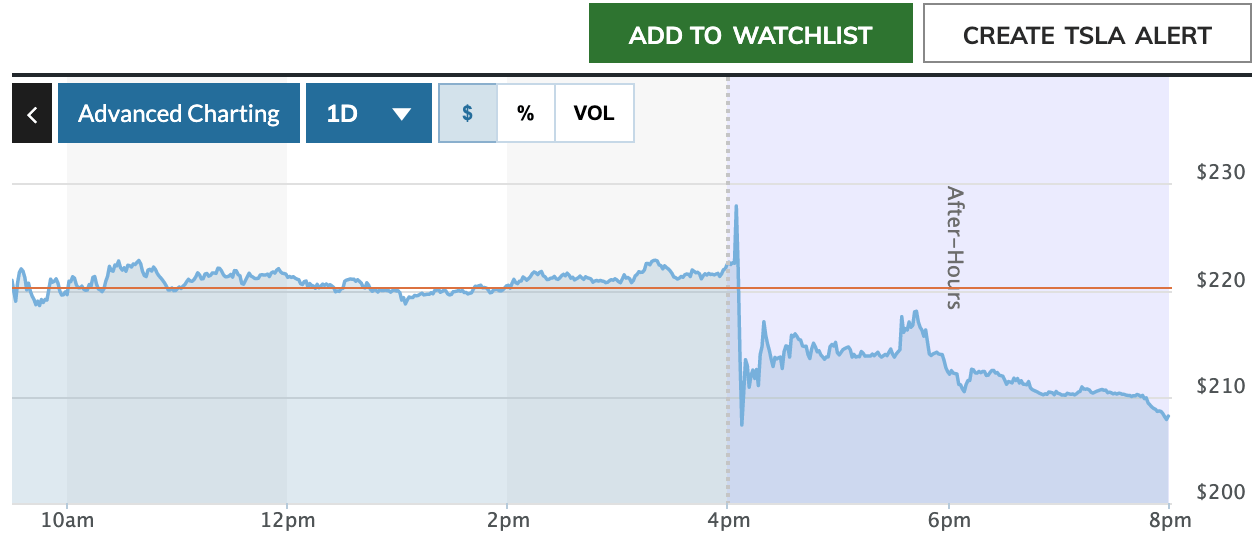

Tesla stock fell 6.5% after-hours shortly after the release came out. Most likely, the selloff was a reaction to comments Elon Musk made on the call rather than the actual numbers. The top and bottom line metrics were mixed; fundamentally, earnings beat expectations. Further, TSLA rose in the earliest minutes of after-hours trading, as the MarketWatch chart below shows.

Tesla after hours trading (MarketWatch)

However, the after-hours trading turned decisively negative just a few minutes after the markets closed. Elon Musk made a number of statements on the earnings call that probably rattled investors. These included:

-

Admitting that he was overpaying for Twitter.

-

Saying he was “uncertain whether COVID lockdowns in China would alleviate.”

-

Claiming Tesla stock could be worth more than Apple (AAPL) and Saudi Aramco combined.

The last item on that list might sound bullish, but you need to consider it in context. Elon Musk has been facing a lot of criticism based on the idea that his Twitter deal is putting downward pressure on TSLA stock. Many of Musk’s own biggest supporters have voiced this critique, and Musk himself has been selling enormous numbers of shares.

Given this, it’s hard to avoid considering the possibility that Musk is attempting to build enthusiasm around Tesla stock to offset the effect of his own sales. In fact, that’s exactly what MarketWatch author Therese Poletti suggested in her article, “Elon Musk pumps Tesla stock with ridiculous $4 trillion target. Is a dump coming next?” In fact, she even implied in the article title that more sales were planned.

It is quite possible that Musk will have to sell more Tesla stock in order to buy Twitter. Recently Barron’s floated the idea that the financing for the deal could fall apart. Barron’s article also said that Musk would be allowed to pull out if the financing fell through, so the coverage wasn’t entirely bearish. Still, there was a heavy implication that Musk would continue to sell stock.

On the whole, Tesla looks a lot more attractive now than it did in the past. At today’s prices, it trades at 50 times earnings and 49 times cash flows–multiples that, although high, are no higher than the P/E ratio Amazon (AMZN) has sustained for decades. A sufficiently fast-growing tech stock can justify high multiples, although it should be said that today’s high-rate environment does not incentivize such bets. For this reason, along with the possibility of Musk selling more stock, I consider Tesla a short to medium term ‘hold.’

Why the $4 Trillion Prediction is a Red Flag

Musk’s $4 trillion Tesla stock price target is a red flag, not because it’s impossible to hit, but because it signals that Musk feels an urgent need to “gin up” TSLA stock. That in turn could imply that he has more sales planned. Musk selling stock in itself is no risk to long-term investors, but it is a risk to those with short, even medium-term time horizons.

Elon Musk owns about 25% of Tesla stock, worth $173 billion. The Twitter deal is for $44 billion. According to Bloomberg, Musk has sold $32 billion worth of Tesla stock since the deal was announced. If financing falls through and other investors bail, he would have to sell another $12 billion in stock to close the deal. That would put appreciable selling pressure on TSLA, likely causing it to fall. $12 billion is about 1.7% of Tesla’s market cap, and 60% of one day’s dollar trading volume. So, there will be some downward pressure on TSLA’s price if Musk has to sell.

None of this is to say that Tesla can’t hit a $4 trillion market cap. Notably, Apple was once 75% of the way to that target. Tesla’s revenue growth is currently 60%, if you slow that down to one third of the current level (20% growth) you still have the makings of a very valuable company. Tesla had $1.05 in earnings per share (“EPS”) in the quarter, growing at 69%. Let’s say, for the sake of conservatism, that growth will slow down to 20% over the next 10 years. $1.05 compounds to $6.5 over 10 years at that rate. On a full year basis, that’s $26. With a 20-times earnings multiple, we get to a $520 stock price. Multiply that by Tesla’s $3.063 billion shares outstanding, and you get to a $1.59 trillion market cap. That’s 39.75% of the way there. This is all based on an assumption of high growth, but the high growth assumed is far lower than Tesla’s historical growth. So, a market cap for Tesla somewhere in the trillions is not unthinkable.

What is Tesla Stock Worth Long-Term?

Having looked at a short-term negative catalyst for Tesla stock, we can now turn to the question of what it’s worth on a long-term basis. In previous articles, I used discounted cash flow models to arrive at fair value estimates for TSLA ranging between $750 and $860. This was before the recent 3-for-1 split. It’s worth revisiting Tesla’s valuation again in light of the recent earnings release and the stock split.

The tricky part in modelling Tesla is growth. A company’s free cash flow is a product of many moving pieces, including revenue, cash operating expenses, working capital investment, and more. In Tesla’s case, these pieces are mostly growing very rapidly. We can come up with a basic model by conservatively assuming where these various elements will go in the future.

Tesla’s revenue growth in the most recent quarter was 55%. It was 60% in the trailing 12-month period. Conservatism requires that we lower this to account for the effects of scale, so I’ll assume that revenue grows at 20% CAGR over 5 years.

Now we have the cash portion of operating costs. These declined by $1.5 billion. It’s nice to see costs coming down, but I wouldn’t expect it to last–a lot of companies are trimming fat this year to cope with the recession, it’s a temporary thing. So I won’t forecast continual declines in costs, but I will assume that they grow slower than revenue, to account for the fact that management is trying to keep them under control. So I’ll assume they grow at 10%.

Finally, we have the other elements of free cash flow: capital expenditure and working capital. Tesla’s CAPEX growth has slowed dramatically while its net working capital has varied between positive and negative, so I will assume that these items collectively remain unchanged from the base period. From this, I get the following model:

|

BASE PERIOD |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

|

Sales |

$67.1 billion |

$80.52 billion |

$96.6 billion |

$115.9 billion |

$139 billion |

$166 billion |

|

COGS + cash operating costs |

$53.09 billion |

$58.39 billion |

$64.23 billion |

$70.66 billion |

$77.72 billion |

$85.50 billion |

|

CAPEX + Working Capital |

$8 billion |

$8 billion |

$8 billion |

$8 billion |

$8 billion |

$8 billion |

|

FCF |

$6.01 billion |

$14.13 billion |

$24.37 billion |

$37.24 billion |

$53.28 |

$72.5 billion |

So, we end up with $72.5 billion in free cash flow. With today’s share count that works out to $23.69 per share. That’s a 59.8% CAGR growth rate starting from today’s $2.26 in FCF per share. If we assume no growth after the five years of growth are up, and use a 6% discount rate, then we end up with a price target of $338. The market cap at that price would be over $1 trillion, but not anywhere near $4 trillion. Musk’s forecast will not be hit in five years based on this model. The model does suggest that Tesla has upside, though, so it may be worthwhile for investors with long time horizons to take a look.

A Big Risk to Keep in Mind

As we’ve seen so far, Tesla stock faces some short-term headwinds but has long-term potential. Whether it’s investable really depends on your time horizon–for my money, it’s just a hold.

If you choose to go long Tesla, the big risk factor you need to keep in mind is the possibility of supply chain disruptions in China. Elon Musk has bet big on China, where he not only manufactures, but also sells, his cars. Tesla’s China operations are very lucrative for the company, but they are also risky. China’s zero COVID policy caused Tesla’s Shanghai factory output to slow down in Q2. Xi Jinping recently signalled at China’s party congress that he would not be ending zero COVID, so this remains a risk to watch out for.

The Bottom Line

The bottom line on Tesla is that it is a real company whose stock has some non-zero value. In fact, even if you assume that Tesla’s revenue growth gets slashed by more than one half, it still ends up being worth more than what it trades for today. As a long-term bet, Tesla has a lot of potential. I’m not sure I see a path to $4 trillion, but I could see it getting to $1.5 trillion.

The short term, however, is less rosy. If Musk proceeds with his Twitter deal, he may sell more stock – whether due to financing falling through, or just wanting to avoid interest payments. Either way it will be a negative catalyst, putting downward pressure on TSLA stock. That’s not the end of the world, but it is something for the more short-term minded to beware.

Be the first to comment