jetcityimage/iStock Editorial via Getty Images

One of the more notable laggards over the past few months has been Tesla (NASDAQ:TSLA). The electric vehicle maker has seen its shares lose about a third of their value over the past three months, which is a lot more than we’ve seen the overall market decline. While some of the wounds here may be self-inflicted thanks to CEO Elon Musk’s Twitter purchase, there are other items that need to change for shares to truly bottom.

A year ago, we were talking about Musk selling Tesla shares because he had expiring options and thus needed to pay a large tax bill. This year, the CEO decided to purchase Twitter, resulting in another round of Tesla share sales, the latest of which came with a roughly $4 billion sale last week. Some bulls were hoping that once the Twitter deal closed, Tesla shares would rise with that overhang gone, but that hasn’t been the case just yet.

The craziness surrounding the social media site combined with the uncertainty of how Elon Musk fully funded the purchase has certainly hurt Tesla. If he struck a deal with lenders to borrow some more money to plug any equity shortfall from partners backing out, he might need to sell additional Tesla shares at some point. Investors are waiting for a tweet from the CEO to say “I’m done selling”, but of course, we’ve heard that over the past year and it hasn’t stopped him from disposing of more shares.

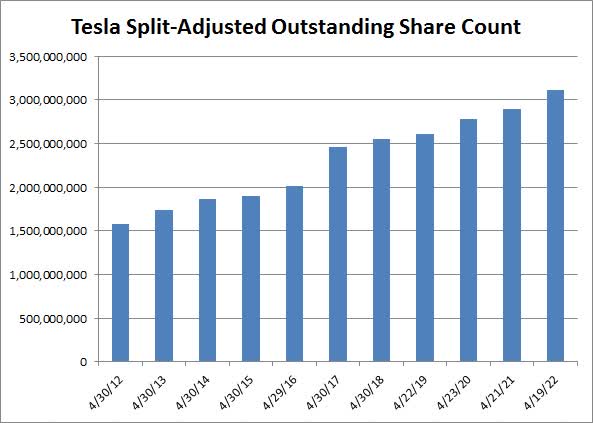

Elon Musk’s stock sales don’t just drive the name down when the trades go through, as they also help to create a larger supply of Tesla shares in the market. If we look at float data from Yahoo! Finance, the EV maker’s float has gone from roughly 2.325 billion shares (split-adjusted) to 2.64 billion in the past 18 months. That’s a more than 13.5% rise in the float in that time period, and in the last three years, the increase is more than 32.3% when you throw in stock-based compensation and other items.

Slowing the rise in the float, whether it be from less CEO share sales or perhaps a stock buyback program that’s been talked about, could improve sentiment over the short to medium term. As the chart below shows, Tesla’s split-adjusted share count has risen significantly over the past decade. If you include the additional 50 million outstanding shares increase that Tesla has reported since the April 2022 update detailed below, the number of shares outstanding has now more than doubled since April 2012.

Tesla Shares Outstanding (Company Filings)

Another item that needs to be cleared up is what’s happening in China. A couple of weeks ago, Tesla cut prices across the board for its Shanghai-produced models sold in their home market. However, there have not been any major changes to delivery estimate timelines since, and another rumor circulated late last week that another round of price cuts could be coming. With the Berlin factory ramp reducing the need for Model Y exports to Europe a bit, Tesla needs more demand in China to sell its Shanghai production runs. Lower prices can certainly boost sales numbers, but it could come at a sizable cost to margins, especially if inflationary pressures continue.

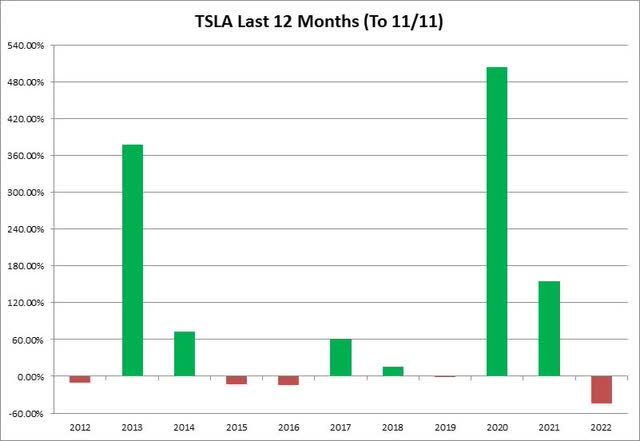

One item that could help the stock may be something investors don’t consider that often, and that is the calendar. We’re less than two months away from the start of a new year, but just changing the date to 2023 isn’t what’s necessarily important here. If you look at the chart below, Tesla shares have lost about 45% over the past year. That’s the worst 12-month performance stopping at November 11th (or the closest trading day) over the last decade, with no other one year period even reaching a 14% decline.

Tesla Performance To 11/11 (Yahoo! Finance)

I bring this up because Tesla may become a tax-loss selling favorite at year’s end, with investors trying to offset capital gains before the new year. Those who have held the stock for less than 12 months and are trying to offset short-term gains may be even more inclined to sell. This is the biggest tax-loss sales opportunity at this time of the year in Tesla’s history, but those that do close out their positions may look to return with a much lower cost basis once the new year starts (or after any potential wash sale dates have passed).

Another thing going against Tesla right now is the technical setup. The stock’s latest leg down, seen in the chart below, has resulted in a rollover of the 50-day moving average (purple line). This key technical trend line is likely to go quite a bit lower in the coming weeks with the stock where it is currently, and that can provide resistance on the upside. You may also notice the down and to the right channel Tesla shares have traded in so far this year, with a series of lower highs and lower lows.

TSLA Last 12 Months (Yahoo! Finance)

It may not help sentiment that one of Tesla’s biggest supporters, ARK Invest, has been mostly absent lately. Cathie Wood and her team only made one small purchase of the stock last week in the three ETFs that hold it. This is despite the fact that Tesla’s implied weight in all of those three funds was below 9% at Friday’s close, with its 7.53% weight in the ARK Innovation ETF (ARKK) being the lowest Tesla has seen this year. On Friday, ARK Invest actually bought some General Motors (GM) in the ARK Autonomous Technology & Robotics ETF (ARKQ) instead of Tesla. Tesla’s weight is lowest in the ARK Next Generation Internet ETF (ARKW), where Friday’s implied finish was just 7.18%.

With the pullback in Tesla shares recently, analysts have become very positive about the name. The average price target on the stock is $280, which implies an almost 43% upside from Friday’s close. Also, three of every five analysts covering the name have either a buy or strong buy rating on the stock, up from less than 20% in the summer of 2020. As a point of reference, the split-adjusted average price target did peak at around $336 in April of this year.

In the end, Tesla investors are looking for shares to find a bottom. For that to occur, the primary catalyst likely needed would be for CEO Elon Musk to stop selling shares and get the Twitter situation under control. A stock buyback might also be a positive item, even if it doesn’t necessarily reduce the number of outstanding shares or float, but just stops them from rising too much more. China remains a wildcard here, as we wait to see if more price cuts are coming, and perhaps a simple change in the calendar could lead to improved sentiment. Last week’s late bounce was certainly nice, but it’s no guarantee that the pop was the start of a trend until the news cycle improves a bit here.

Be the first to comment