AI microprocessor on motherboard computer circuit Black_Kira/iStock via Getty Images

With a trailing 12-month price-to-earnings ratio of over 95, a lot of analysts are reluctant to give Tesla, Inc. (NASDAQ:NASDAQ:TSLA) a buy rating. However, we wonder if investors are taking a thorough look at Tesla and considering the company’s full scope of potential, rather than just its auto manufacturing aspect. We suspect that people may have a hard time assessing Tesla’s full operations with traditional valuation models, as the company has so much activity in a multitude of sectors and either does not consider it or only evaluates the auto aspect.

Therefore, we will look at what these other business activities are, which are worth trillions, and why they may be fully discounted at today’s $700 share price. We will also go over the reasons why Tesla should be considered a strong buy, even at today’s high fundamental valuations, and why we believe it could become the first company ever to be valued at US$10T.

Tesla Is “Just a Car Company” Myth

The company has historically been valued by investors and analysts purely as an automotive company, and has not taken into account the other areas in which they operate. Tesla should rather be viewed more as a conglomerate than a car company. The high fundamentals may also be fueled by the fact that Tesla is working on solving arguably the most meaningful challenges that society is set to face in the future.

The company is gearing up for the bulk of the future challenges it sees. Whether it’s switching all cars to electric, or making the grid completely green by introducing solar power and battery packs to making self-driving cars and automating factories by using vertical integration to its advantage and much more.

About 2 weeks ago, it even came to light that Tesla has submitted proposals for a 24-hour drive-in restaurant and theater that customers can use while charging their electric vehicles (“EVs”). It is unlikely that automakers such as Ford (F) and GM (GM) are developing AI divisions, a solar team, expandable gigafactories with vertical integration, a humanoid robotics team, a team developing batteries, Powerwalls and Powerpacks, and a host of different solutions. Accordingly, comparing car manufacturers to Tesla would not constitute an ideal method for valuation.

The EV Opportunity

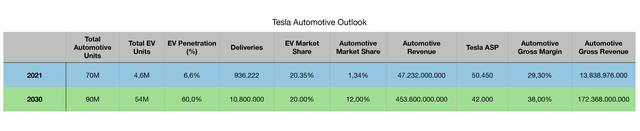

One of Tesla’s largest opportunities, of course, is its EV business, which is currently its main driver. The total EV market saw 4,6M units sold in 2021, representing a 6,6% penetration of EV’s in the total car market, which totaled nearly 70M units sold in 2021.

As the total car market grows at a reasonable 3,5% CAGR between 2020 and 2030, the total car market is expected to reach 90M units per year. The EU has targeted a 50% EV penetration rate by 2030, which is in line with most public forecasts.

Tesla Model Y (Courtesy of Tesla, Inc.)

However, we believe this could be in the neighborhood of 60%, given the immense drop in battery costs resulting from Wright’s Law. Batteries are currently the largest cost component of a vehicle. Wright’s Law states that for every cumulative doubling of the number of units produced, the cost will fall by a constant percentage. In the case of lithium-ion batteries, it appears that costs will decrease by 28% for every cumulative doubling of the number of units produced.

Market Outlook and Scalability

Therefore, we expect EVs to have the same sticker price as regular ICE vehicles by 2023, meaning that the initial purchase cost of an EV will be the same as that of a regular gasoline car. This means that it should be a no-brainer to buy an EV, given the long-term benefit of low cost of ownership, i.e., low maintenance, tax benefits, low charging costs, and currently avoiding sky-high gasoline prices as well. At a 60% EV adoption rate, we could expect that of those 90 million cars, 54 million will be EVs.

Tesla delivered 936.222 vehicles in fiscal year 2021, according to their fourth quarter report, which compared to the total 4,6 million EVs sold in 2021, gives them a 20,35% market share in the overall EV market. Given Tesla’s order backlog and the fact that it cannot yet meet customer demand, their market share could still increase in the future. In this analysis, we assume that Tesla maintains its 20% market share, and does not gain additional market share due to slow but growing competition.

If both criteria are met, i.e., Tesla retains its market share and the EV market is 60% taken, Tesla is expected to sell 10,8 million vehicles by 2030, or an increase of 1.053,58% over FY2021. That would also mean a 12% market share for Tesla in the total car market of 90 million vehicles. Perhaps we are still early to invest in Tesla, given the global transition to EVs.

Gross Margins

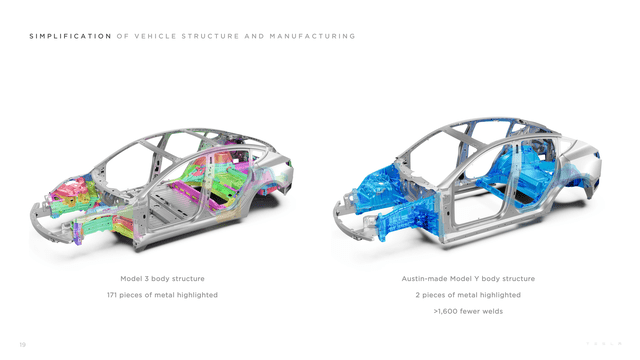

In terms of margins, Tesla was able to achieve an automotive gross margin of 32,9% in the first quarter of 2022, and a total GAAP gross margin of 29,1%. We expect this automotive gross margin to increase over the next 8 years, given cost reductions, while scaling production by 10x between now and 2030 and achieving economies of scale. Tesla increased production by more than 9x between 2017 and 2021.

In the period between 2017 and the first quarter of 2022, Tesla managed to grow car gross margins by about 10%. Given Wright’s Law and the fact that Tesla is expected to produce 10,8 million vehicles per year by 2030, which is a unit increase of about 10-11x, car gross margins are expected to be closer to or above 42,9%. This is, of course, if Tesla could maintain its EV market share, while maintaining its current pricing, which is overly optimistic. In this example, we assume a gross margin of 38%.

Tesla’s Cyber Rodeo (Courtesy of Tesla, Inc.)

Automotive ASP

The last parameter of great importance is Tesla’s average selling price. Currently, Tesla has an average unit selling price of about $52.000 for the fourth quarter of 2021, and about $50.450 for fiscal year 2021. While some analysts believe Tesla’s ASP will rise over time, we think it will fall due to Tesla’s introduction of a super-cheap, likely smaller sedan with a target price of closer to US$25.000-US$35.000 compared to Tesla’s cheapest Model 3 of about US$46.990.

In addition, we also believe that Tesla will lower its ASP to keep up with the competition and maintain its 20% EV market share. In this analysis, we assume Tesla lowers its ASP to US$42.000 to remain competitive in this booming EV market. 10,8 million sales, at an ASP of $42.000, would generate $453,6 billion in automotive revenue. At a 38% gross margin for automobiles, that would equate to $172,37 billion in gross automotive revenue.

OpEx and Scaling Margins

However, we expect the biggest moves to be made in the OpEx portion of the business, as Tesla can scale this up dramatically in the coming years. For example, Tesla’s fully self-driving option currently costs the customer $12.000. This will likely increase dramatically as it moves closer to a level 5, fully self-driving autonomous car. Tesla currently has a fairly high OpEx, which Elon Musk has also admitted, and it should drop dramatically as Tesla scales and variable costs drop closer towards Tesla’s fixed costs.

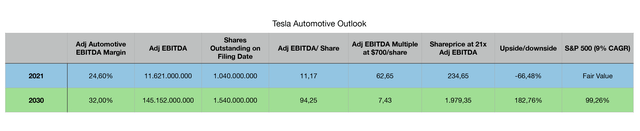

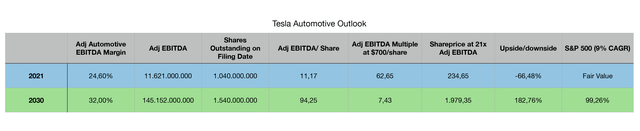

Currently, Tesla is still doubling production almost every year, and expanding into different verticals, hence the high OpEx costs. Tesla had an operating margin of 12,1% in 2021, with operating income of $6,52 billion, while adjusted EBITDA is $11,62 billion, bringing the adjusted EBITDA margin to 21,6%. We believe Tesla can increase this adjusted EBITDA margin to 32% over the next 8 years, driven in part by improvements in gross margins, low fixed costs, Wright’s Law, historical improvement in margins, and expansion of software-based revenues.

Tesla’s Automotive Outlook

If true, Tesla would rake in US$145,15BN in adjusted EBITDA from its automotive business alone. However, we also correct this for share dilution. Between 2017 and 2021, the number of outstanding shares grew at a CAGR of 4,59%. We took a more conservative estimate and applied a CAGR of 5% to the number of shares between now and 2030.

This means that Tesla is currently trading at $700 at an expected 7,43x 2030 Adj EBITDA, according to our estimates. At a more reasonable multiple, given continued growth and looking at multiples of other companies such as $AAPL, we think an optimistic 21x Adj EBITDA is assigned. That would put Tesla’s 2030 share price at roughly US$1.979,35 per share.

Currently, at that multiple, Tesla has a downside of -66,48%. However, by 2030, we think Tesla’s automotive group will have an upside of 182,76% on its own. In contrast, the S&P 500 will have an upside of nearly 100% at a historical CAGR of 9%, meaning that Tesla’s auto segment may outperform the S&P 500 on its own.

The Solar and Battery Opportunity

As mentioned earlier, according to Wright’s Law, each cumulative doubling of the number of units produced represents a constant percentage decrease in price. For Lithium-ion Batteries, this constant percentage is about 28%. Given Tesla’s expertise and scalability in batteries, it is no surprise that they could use this technology to disrupt the energy industry.

Not much light is being shed on Tesla Energy, which launched back in 2015 with the unveiling of its range of Power walls and Power packs. To this day, most analysts do not even know of the existence of Tesla Energy. Analysts are focusing on Tesla’s car segment, while the renewable energy market was worth US$952,16BN last year alone and is growing rapidly. The renewable energy market is expected to grow to approx. US$2T by 2030, at a CAGR of over 8,6%.

Tesla’s Powerwall (Courtesy of Tesla, Inc.)

According to BloombergNEF, the global energy storage market is expected to grow at an astonishing 30% CAGR. That means 58GW/178GWh of energy storage will be deployed annually by 2030. Tesla, on the other hand, has 3,99GWh installed by 2021. Tesla still has a huge potential market share to capture and is poised to do so while lowering costs according to Wright’s Law while ramping up production. The energy storage market is an opportunity of over $435 billion by 2030, and Tesla is in a good position to benefit from a lot of tailwinds from market expansion.

The solar power market is paving the way for the future. The solar electric panel (PV) market is expected to experience a CAGR of 11,9% to US$641,1BN worldwide by 2030. In 2021, Tesla installed 345 MW of solar panels, compared to the projected annual installation of 125 GW of solar panels that would be needed to cover 30% of U.S. energy production by 2030, meaning Tesla still has a ton of market share to capture in that sector.

Tesla’s Solar Roof (Courtesy of Tesla, Inc.)

Tesla could also branch out into other industries that converge with energy generation, such as cryptocurrency and cryptocurrency mining, which Elon Musk has shown great interest in over the past few years if it can be done sustainably. Currently, Tesla owns 43.200 BTC, worth about US$1,29BN at the time of writing this article.

Or, as mentioned earlier, accommodations such as restaurants while charging customers’ EVs. Technically, in the distant future, Tesla could even fully automate these restaurants, as Amazon (AMZN) has done with its Amazon Go stores, requiring little to no staff. Tesla could easily use their “Optimus” robot, which they are now developing to do this work, which I will talk more about soon.

Autonomous Vehicles and RoboTaxis

Since the automotive valuation was based primarily on the fact that Tesla would continue to sell only their regular “fully self-driving” package, and would not receive regulatory approval for a truly autonomous vehicle, the outlook would change radically if it did receive such approval.

In that case, Tesla could drastically lower its ASP to sell/ deploy many autonomous vehicles, and lower the cost of ownership because owners would be able to generate income from their car when they are not using it, provided they are willing to run it on Tesla’s autonomous taxi network.

This cab network would be ultra-cheap because it does not require the most capital-intensive part, the driver, and refueling that is done cheaply via electric charging. Low maintenance costs for EVs are also a huge plus. Another advantage is that the owner of the vehicle would gain several hours per week because he can spend his time productively, rather than driving the car himself.

In this scenario, Tesla would generate a ton of passive income from taking a revenue cut from the platform alone, while also generating income for the vehicle owners, who were already able to buy the car at a very low ASP. No other automaker is as close as Tesla to developing such a level 5 autonomous driving capability, aside from companies like Waymo and Mobileye, although Tesla is arguably ahead in real-world / visual AI.

Almost every other car manufacturer uses LIDAR, which is mostly a very expensive piece of technology that might actually not be needed when solved with visual AI. Companies like Cruise Automation and Apple (AAPL), for example, are also picking up on the opportunity. Because the car also gets so much data from the cameras and the autonomy system already in place, Tesla can also offer more competitive / appropriate insurance prices because it has a data advantage. Tesla is able to generate a safety score based on your driving habits and offer a customized data-driven insurance quote.

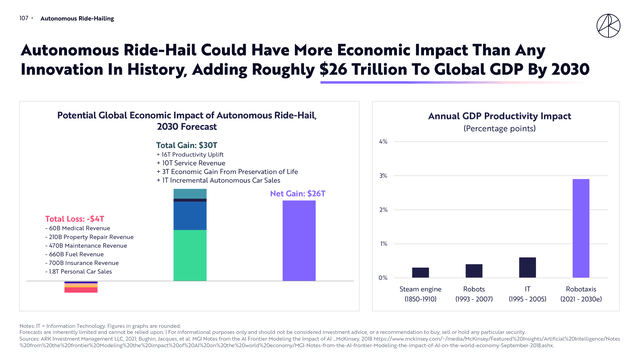

The combination of EVs and autonomy could reduce the cost per mile of cars to 25 cents, or half the cost of a passenger car. If robotic cabs are launched, people might also decide not to own a car themselves, but just use the autonomous cab network, given the low cost. Ark Invest (ARKK) estimates that this could add an additional US$26T (yes, trillion) in value to global GDP, and is expected to be a US$11T market that could be tapped. Elon Musk confirmed on Twitter that this is about right for autonomous vehicles, but said that “Optimus” will greatly exceed this, which I’ll get into in a moment.

Ark Invest BIS2022 (Ark Invest)

AI, Humanoid Robots and Automation

Anyone who has ever used facial recognition to unlock their phone, swiped through YouTube (GOOG) (GOOGL) or TikTok, or perhaps even used GPT3-based writing tools, can attest firsthand to how far artificial intelligence has come. And sometimes it can even be quite frightening.

What not many analysts realize is the fact that Tesla is arguably one of the best, if not the best AI company on earth today. The amount of data that Tesla has been able to collect over the past 7+ years, over billions of miles driven and ridden in tens of thousands of cars, gives them a light-years head start on the competition, which is only now beginning to collect data and explore fully self-driving cars.

Tesla’s Software (Courtesy of Tesla, Inc.)

A study last year also found that the acceptance rate for fully self-driving cars worldwide was only 11%, which means there is a lot of upside potential as Tesla gets closer to level 5 autonomy and continues to raise its prices. Once fully autonomous driving is achieved and regulated, this software alone could generate hundreds of billions of dollars in revenue just for the car portion of the business.

Tesla’s AI/ Data Advantage In Robotics

Not to mention what they could do with this data, and apply it to various products they are in the process of developing. One of those products is Optimus. We’ve all seen the videos of dancing humanoid robots, from Boston Dynamics, that are starting to resemble human movements more and more. Now imagine Tesla being able to couple their immense amount of data, AI, and Machine Learning with robotics, which they have mastered over the past 15 years.

That robot is called “Optimus“, and that is the humanoid robot that Elon Musk referred to when he said that this concept could far exceed the US$26T value that autonomous driving can add to the economy. This is why this company is such an intriguing buy for investors with very long time horizons, like us.

Optimus Humanoid Robot (Courtesy of Tesla, Inc.)

Any repetitive and boring job, such as warehouse picking/ fulfillment and a host of other jobs could simply be replaced by robots working 24/7, at the initial cost of production plus electricity and maintenance. Imagine how low the cost of goods would be if things like warehouse fulfillment at Amazon were done entirely by humanoid robots. It is also worth noting that these robots will not take away jobs, but will lower the cost of goods in a competitive capitalist society and allow people to focus on more meaningful tasks.

For anyone who has yet to experience what AI is capable of, we highly recommend trying out a text autocomplete or other tools that run on GPT3 powered by OpenAI. In fact, few analysts may know that OpenAI was founded in 2015 by Elon Musk and the former chairman of Y Combinator, among others, and together pledged a total of US$1BN. Elon Musk stepped down from the board in 2018, but remained a sponsor.

All of these reasons add up to why Tesla’s auto part may seem negligible 8-10 years from now, looking back at it compared to its robotics and AI, and may be its most important aspect right now. Tesla builds the factory that in turn manufactures the machines.

Taking a Step Back

So, with Tesla’s Adj. EBITDA/share valued at $94,25 in 2030, even at a more conservative 15 times EBITDA Tesla’s automotive manufacturing should be able to match/slightly exceed the S&P 500’s growth, at nearly US$1.400 per share. On average, the S&P 500 also doubles every 7-8 years. Although, that’s only if growth slows significantly after 2030 and Tesla is unable to scale up any of its other businesses worth tens of trillions of dollars.

“Bullish” Tesla Model 3 (Courtesy of Tesla, Inc.)

If Tesla is still experiencing reasonable growth by 2030, and it is trading at a more lofty but acceptable multiple of 21x Adj. EBITDA, then by our calculations on the car side they would be worth an estimated $1.979,35. Again, that’s without regulatory approval for its robot cab / fully self-driving network, without scalability in its power generation and energy storage business, and without expansion in robotics and AI, among other ventures.

At this point, we believe that Tesla would be worth buying for the car portion of the business alone, with the other verticals giving Tesla free exposure to tens of trillions of dollars of upside. If Tesla were able to successfully expand into those niches, the stock price could be a lot higher and Tesla could become the first company with a market capitalization of more than US$10T in the far future.

A More Pessimistic Outlook

The doomsday scenario for Tesla would be that it is either unable to scale up production as quickly as expected, that competitors immediately overtake Tesla’s more than 15 years of experience in EV production, or that margins become more pressured due to lack of demand. So far, analysts have speculated on these factors, despite the fact that Tesla continues to draw very strong demand. That could change in the future, bringing a more speculative downside to buying Tesla stock.

Macroeconomic challenges could also play a role in Tesla’s ability to expand, given the inversion of the yield curve, a possible recession in the coming years, and skyrocketing commodity prices. But Tesla seems well positioned to absorb most of those commodity/ supply chain shocks to date, and demand might not be a problem given the introduction of a cheaper EV and a declining ASP, plus the fact that EVs could reach sticker price parity very soon.

What To Look Out For?

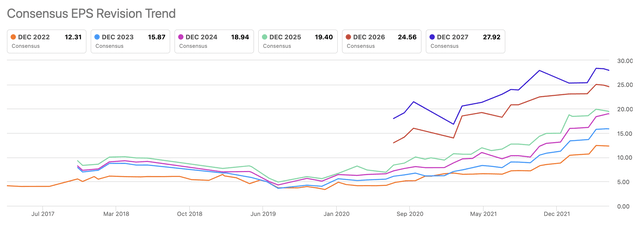

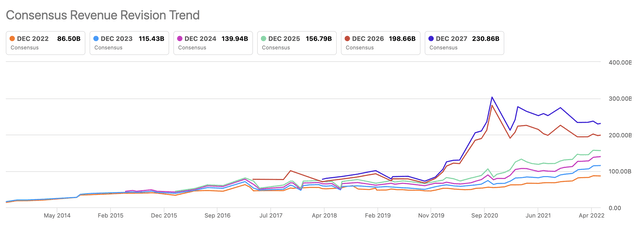

One of the key factors that we are currently looking at is positive earnings revisions. Since the Street currently expects Tesla to grow earnings much more slowly than we do, we expect a continuation of blowout earnings revisions, as we have seen in the past, and especially now in the first quarter of 2022.

Since September 2019, Tesla has always outperformed revenue with a positive revenue surprise. In the last 3 months, Tesla has seen 25 positive EPS revisions, and only 6 negative EPS revisions, despite a decline of about 50% peak to trough.

Concluding Statement

Typically, analysts using classic valuation methods to try to value Tesla and compare it to other car companies, while car manufacturers do not actually cater to the kind of business Tesla is in.

Companies like Ford and GM are unlikely to develop humanoid robots, an advanced AI division to solve autonomous driving (not LIDAR), develop/ scale robotics like Tesla’s gigafactories, develop renewable energy generation/storage, so on and so forth. That doesn’t mean those companies are better or worse than Tesla, they’re just not in the same target sectors.

The downside of Tesla is that it is still currently trading at high fundamental ratios, which some believe is justified because of Tesla’s potential, while others have a more reasoned view of the company’s future. A significant number of analysts have erred in the past about Tesla’s ability to scale and expand, and may continue to do so in the future, as the majority are not sector experts in various domains to conduct a very time-consuming and heavy analysis.

It also appears to us that analysts tend to value Tesla in a linear, purely quantitative way without looking at the actual underlying activities and developments, or taking into account theories such as Wright’s Law that allow for huge cost savings. We suspect that the majority of investors and analysts are giving up on Tesla quickly, given the many uncertain parameters and the challenge of valuing a company that is expanding into sectors that did not exist before or that is disrupting existing sectors at a breakneck pace.

It is our belief that Tesla’s automotive sector will outperform the S&P 500 by a handful over the next 8 years, even if we don’t factor in the trillions of dollars that could be generated by self-driving cars, autonomous cabs, humanoid robots, energy generation and storage, insurance, robotics, automation in general, and more.

Be the first to comment